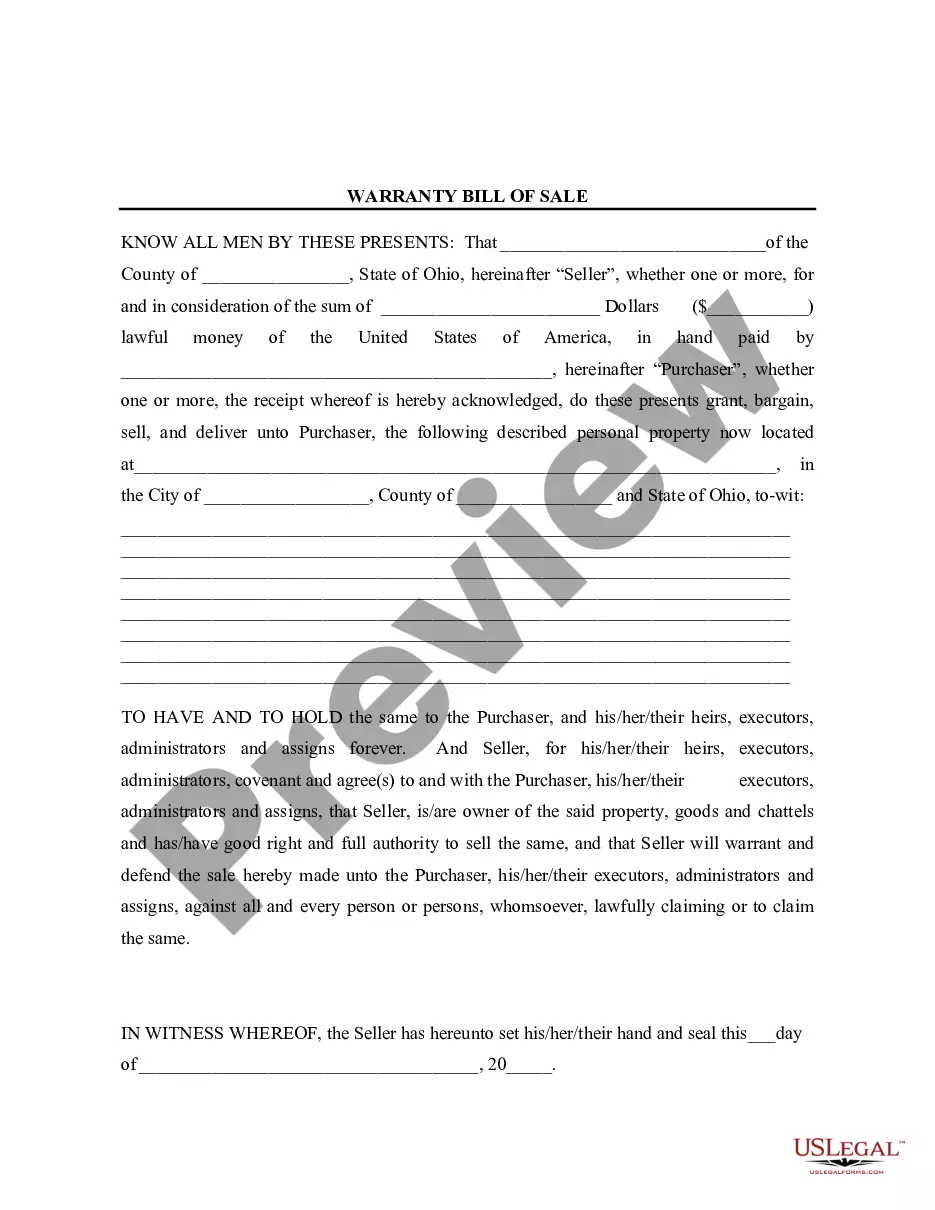

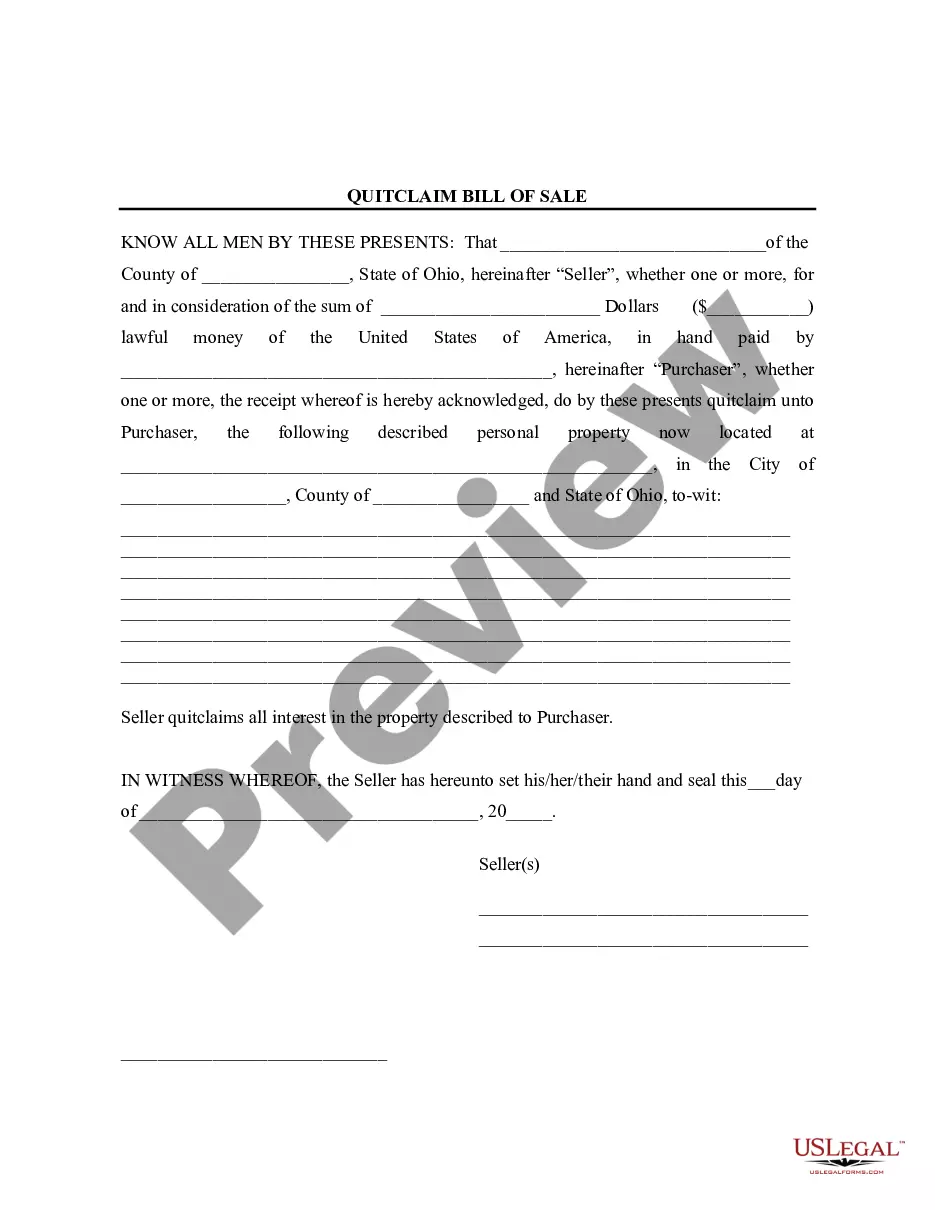

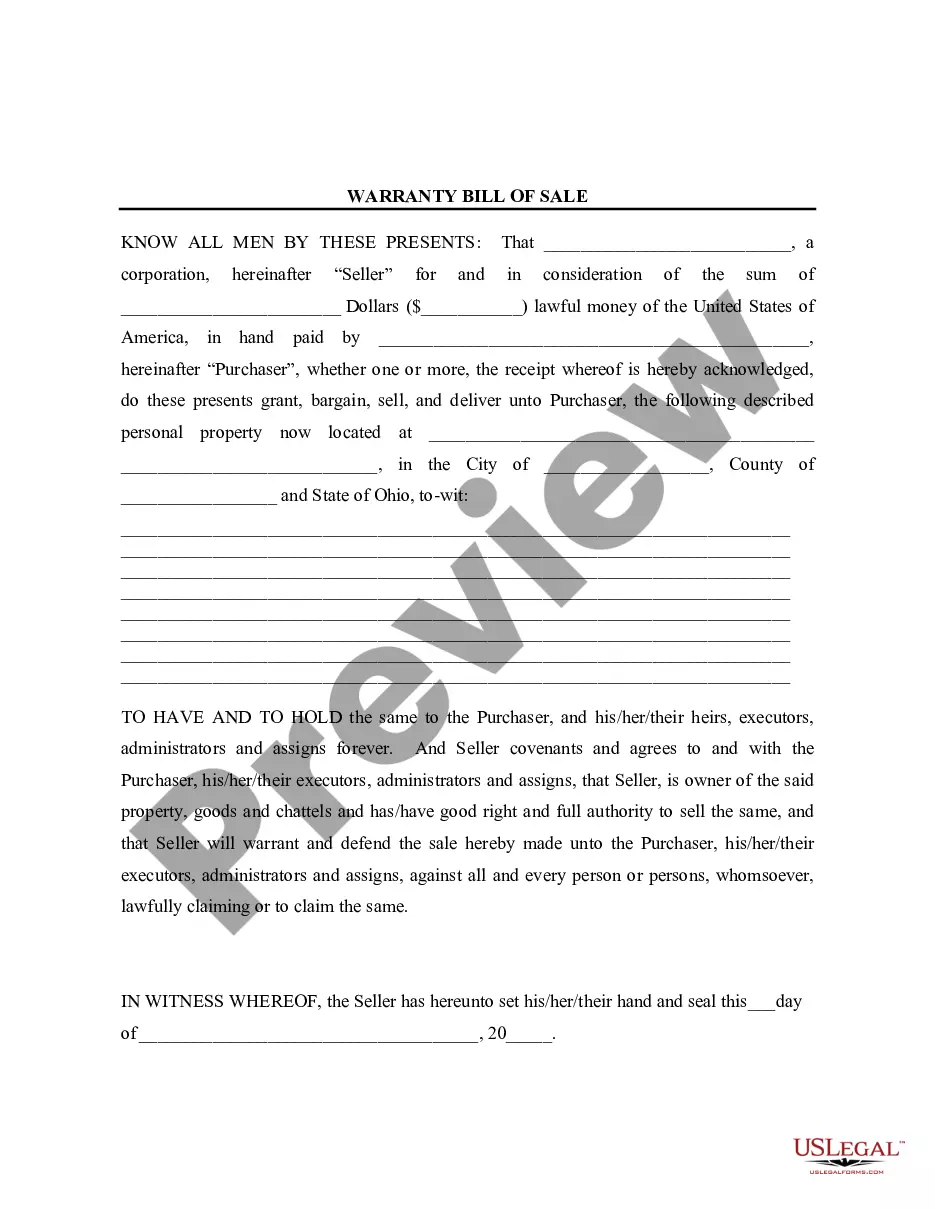

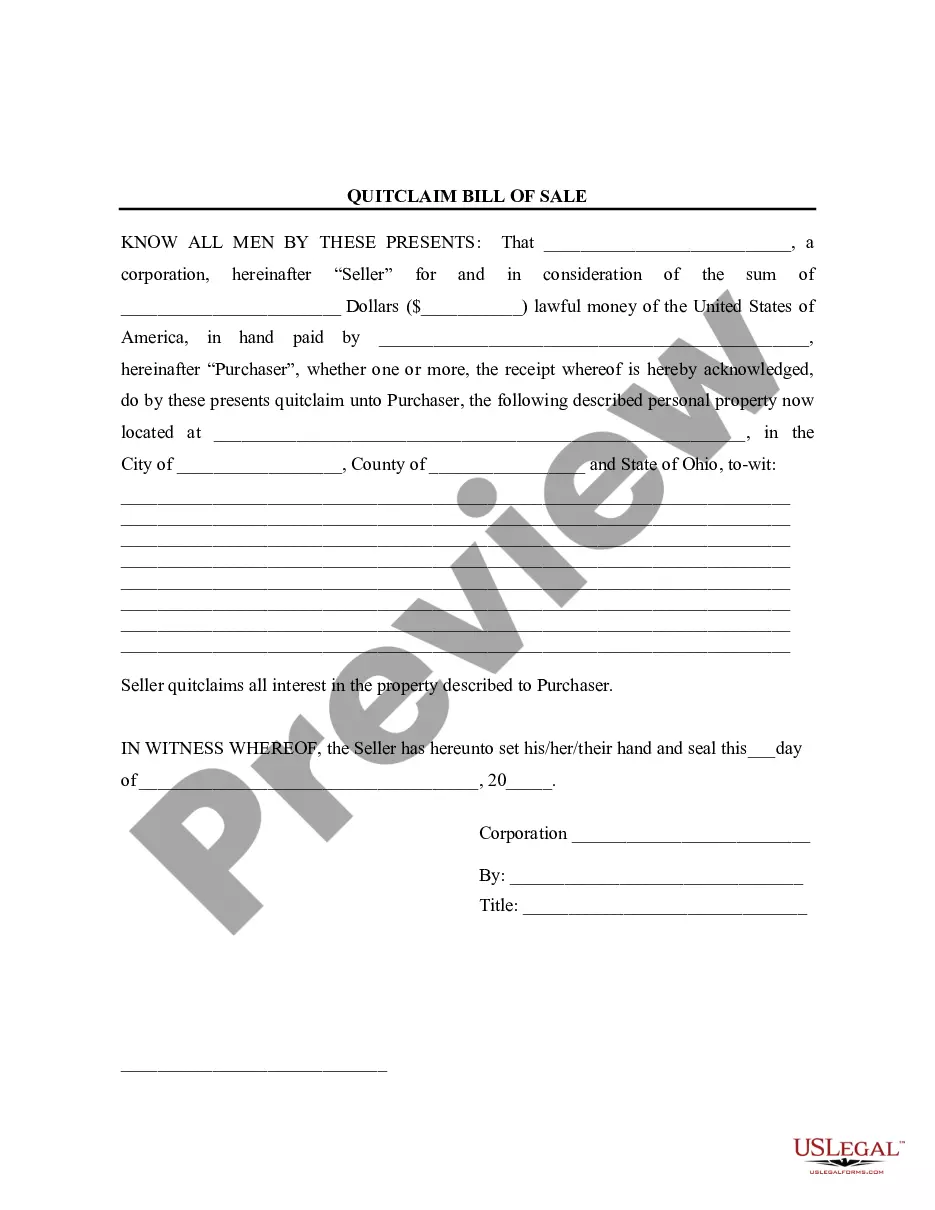

This form provides boilerplate contract clauses that disclaim or limit warranties under the contract. Several different language options are included to suit individual needs and circumstances.

Warranty Provisions

Description

How to fill out Warranty Provisions?

When it comes to drafting a legal document, it is better to delegate it to the professionals. However, that doesn't mean you yourself can not get a template to use. That doesn't mean you yourself can’t get a sample to utilize, nevertheless. Download Warranty Provisions from the US Legal Forms site. It gives you a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. As soon as you are registered with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve provided an 8-step how-to guide for finding and downloading Warranty Provisions quickly:

- Make confident the form meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Press Buy Now.

- Choose the appropriate subscription to suit your needs.

- Make your account.

- Pay via PayPal or by credit/bank card.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

After the Warranty Provisions is downloaded you can fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Warranties that guarantee product performance for a twelve-month period are classified as current liabilities. Conversely, warranties that guarantee product performance for an extended period are classified as non-current liabilities. This type of provision is unlikely to be part of an undertaking's working capital.

Accounting for warranties is quite similar to accounting for bad and doubtful debts. It is based on matching concept, which requires a company to estimate the expected warranty payable (also called warranty liability or provision for warranty expense) and record it at the time of sale.

Provision for Warranty is allowable as Deduction when the assessee has not made provision on a Scientific basis: Karnataka HC Read Judgment The Karnataka High Court held that the provision for warranty is allowable as deduction when the assessee has not made provision on a scientific basis.

Multiply your warranty claim percentage by the amount of your sales in the current year to calculate your warranty reserve liability for the current year. For example, if you generated $100,000 in sales for the current year, multiply $100,000 by 0.02.

It arises when a company sells products which customers are entitled to return for repair or outright replacement.It is based on matching concept, which requires a company to estimate the expected warranty payable (also called warranty liability or provision for warranty expense) and record it at the time of sale.

A business may have a warranty policy, under which it promises customers to repair or replace certain types of damage to its products within a certain number of days following the sale date.The accrual should take place in the same reporting period in which the related product sales are recorded.

Accrue the warranty expense with a debit to the warranty expense account and a credit to the warranty liability account. As actual warranty claims are received, debit the warranty liability account and credit the inventory account for the cost of the replacement parts and products sent to customers.