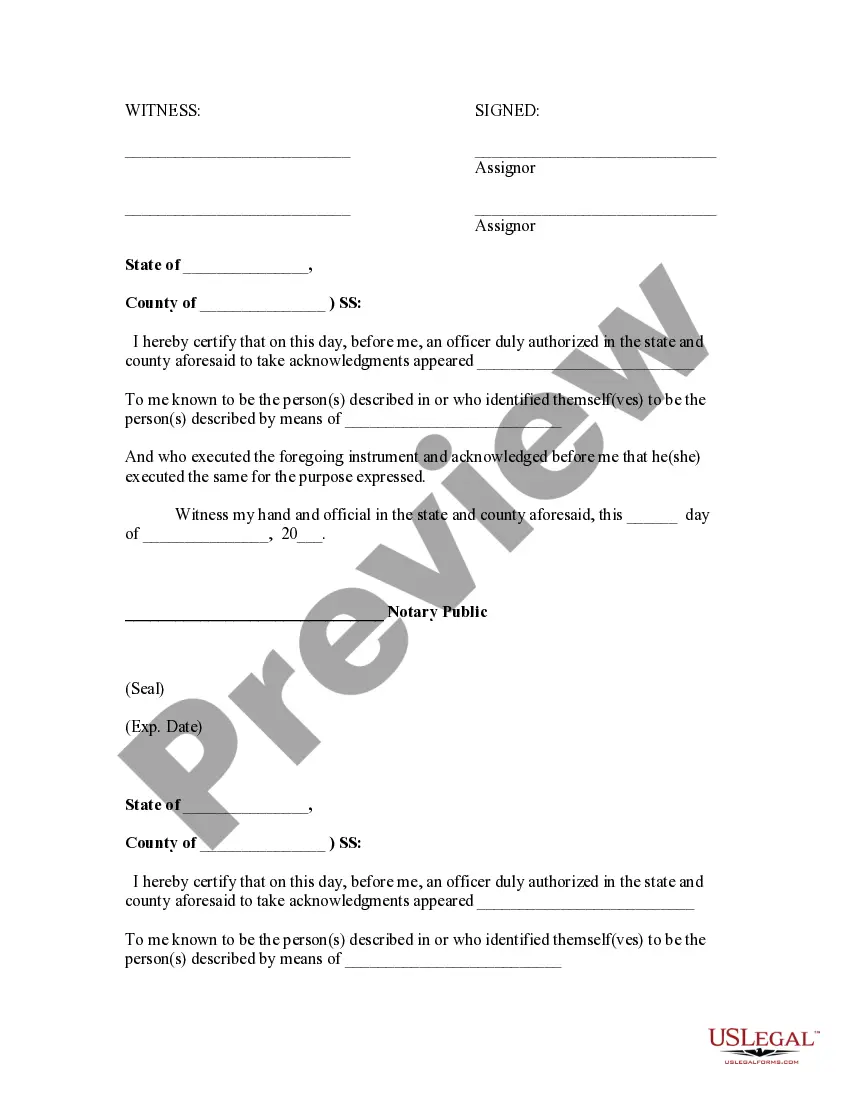

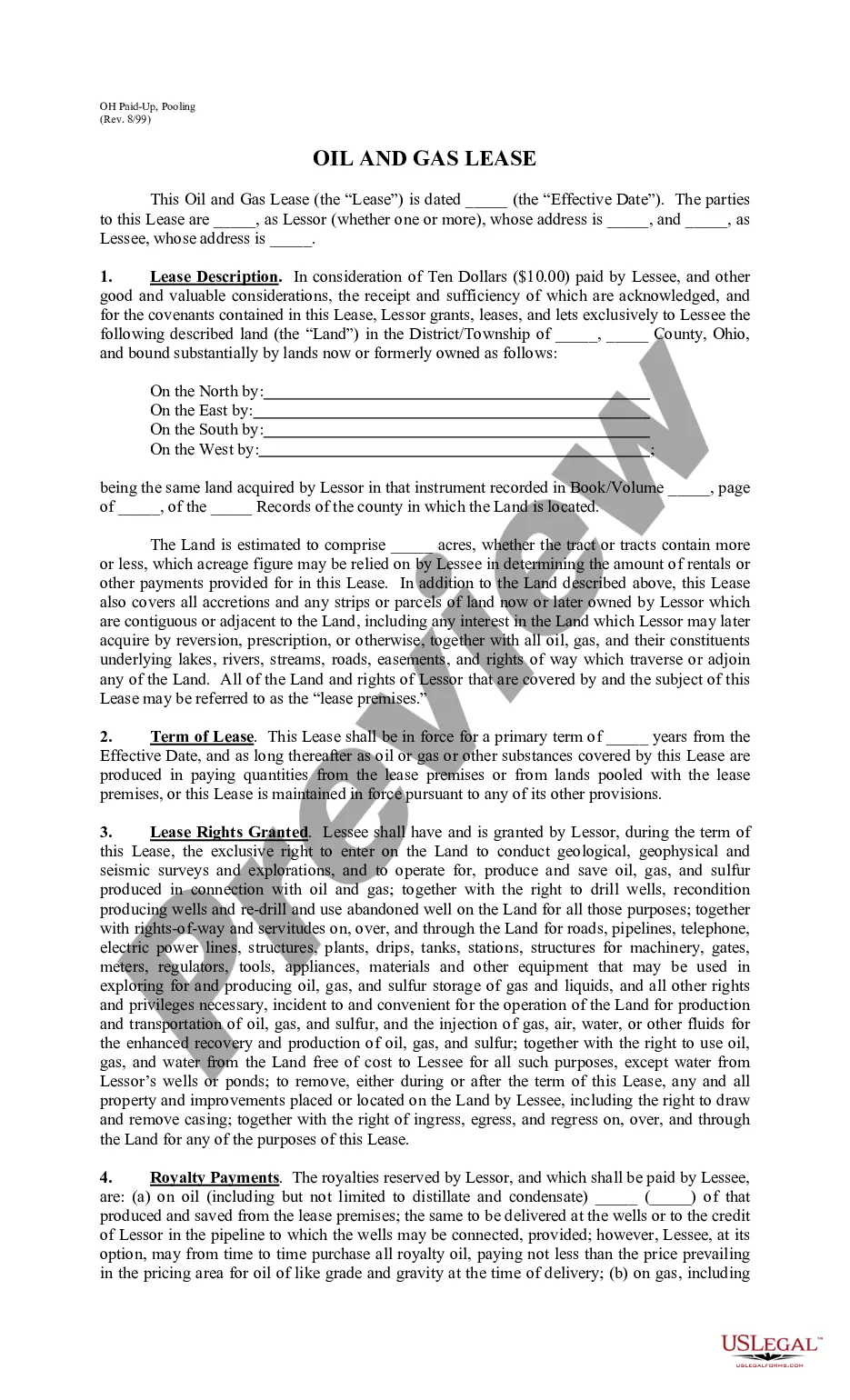

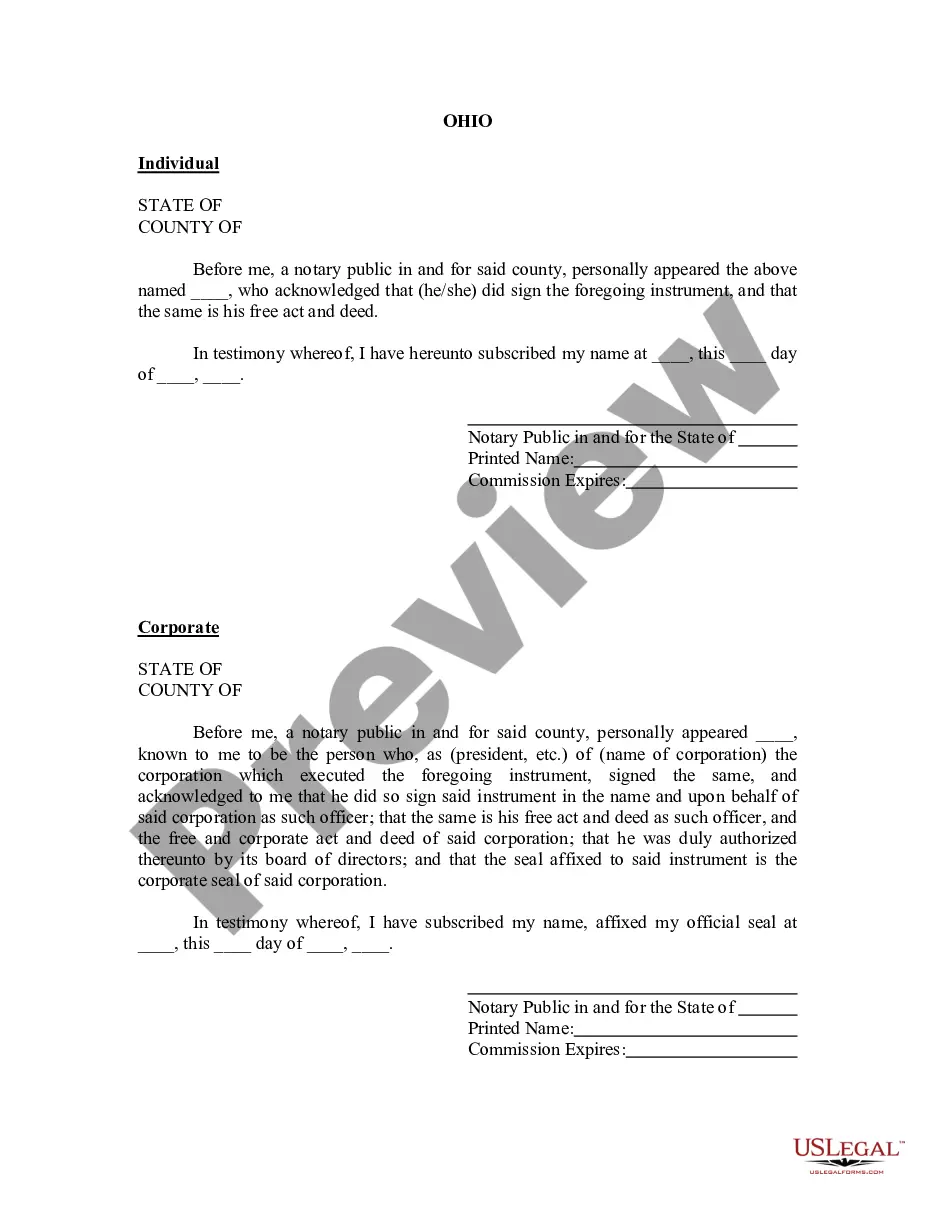

Partial Assignment of Note and Mortgage is an arrangement between two parties whereby a borrower (the mortgagor) assigns a portion of their interest in a note and mortgage to a third party (the assignee). This arrangement allows the assignee to receive a portion of the payments due on the note and mortgage, while the mortgagor remains responsible for the remaining payments. There are two types of Partial Assignment of Note and Mortgage: 1. Partial Assignment of Note: This type of partial assignment involves the assignment of a portion of the interest in a note to a third party. This allows the assignee to receive a portion of the payments due on the note, while the mortgagor remains responsible for the remaining payments. 2. Partial Assignment of Mortgage: This type of partial assignment involves the assignment of a portion of the interest in a mortgage to a third party. This allows the assignee to receive a portion of the payments due on the mortgage, while the mortgagor remains responsible for the remaining payments.

Partial Assignment of Note and Mortgage is an arrangement between two parties whereby a borrower (the mortgagor) assigns a portion of their interest in a note and mortgage to a third party (the assignee). This arrangement allows the assignee to receive a portion of the payments due on the note and mortgage, while the mortgagor remains responsible for the remaining payments. There are two types of Partial Assignment of Note and Mortgage: 1. Partial Assignment of Note: This type of partial assignment involves the assignment of a portion of the interest in a note to a third party. This allows the assignee to receive a portion of the payments due on the note, while the mortgagor remains responsible for the remaining payments. 2. Partial Assignment of Mortgage: This type of partial assignment involves the assignment of a portion of the interest in a mortgage to a third party. This allows the assignee to receive a portion of the payments due on the mortgage, while the mortgagor remains responsible for the remaining payments.