Deed and Assignment from individual to A Trust

Description

How to fill out Deed And Assignment From Individual To A Trust?

When it comes to drafting a legal document, it’s easier to leave it to the specialists. However, that doesn't mean you yourself can not find a template to use. That doesn't mean you yourself can not find a sample to utilize, nevertheless. Download Deed and Assignment from individual to A Trust from the US Legal Forms site. It gives you numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. When you’re signed up with an account, log in, look for a particular document template, and save it to My Forms or download it to your device.

To make things easier, we’ve incorporated an 8-step how-to guide for finding and downloading Deed and Assignment from individual to A Trust promptly:

- Make confident the form meets all the necessary state requirements.

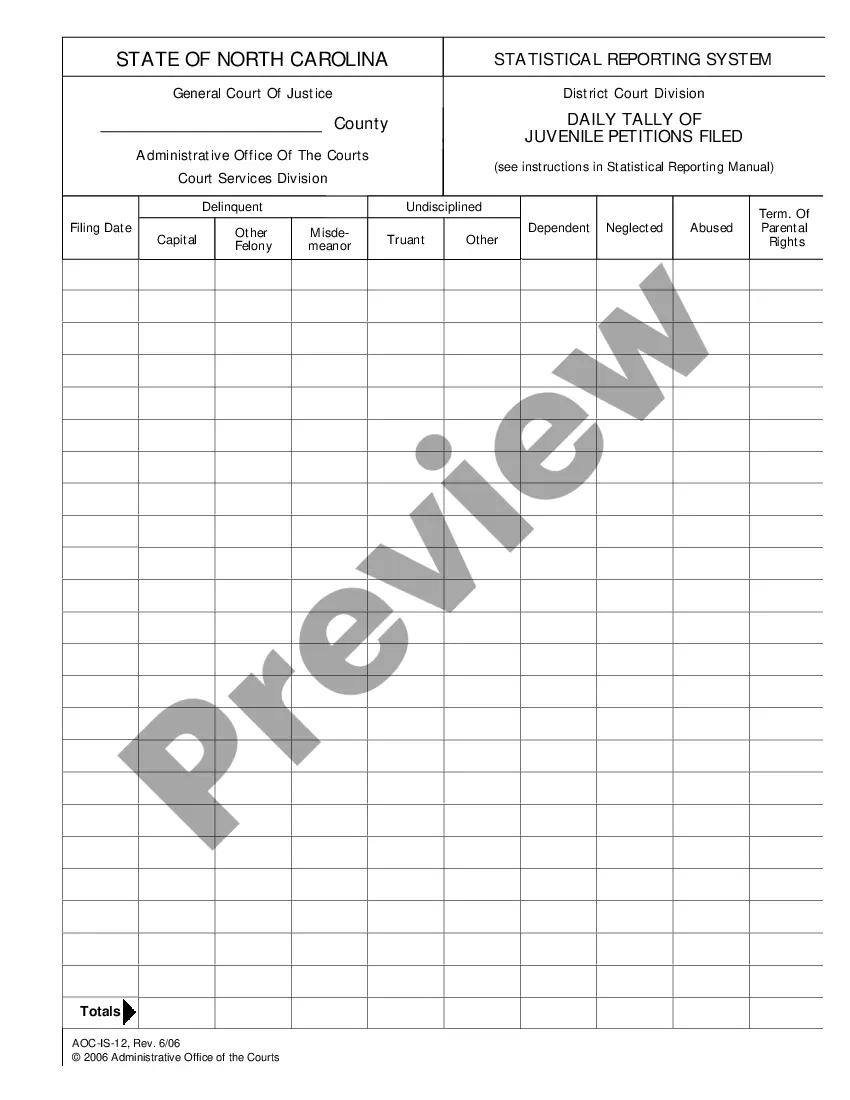

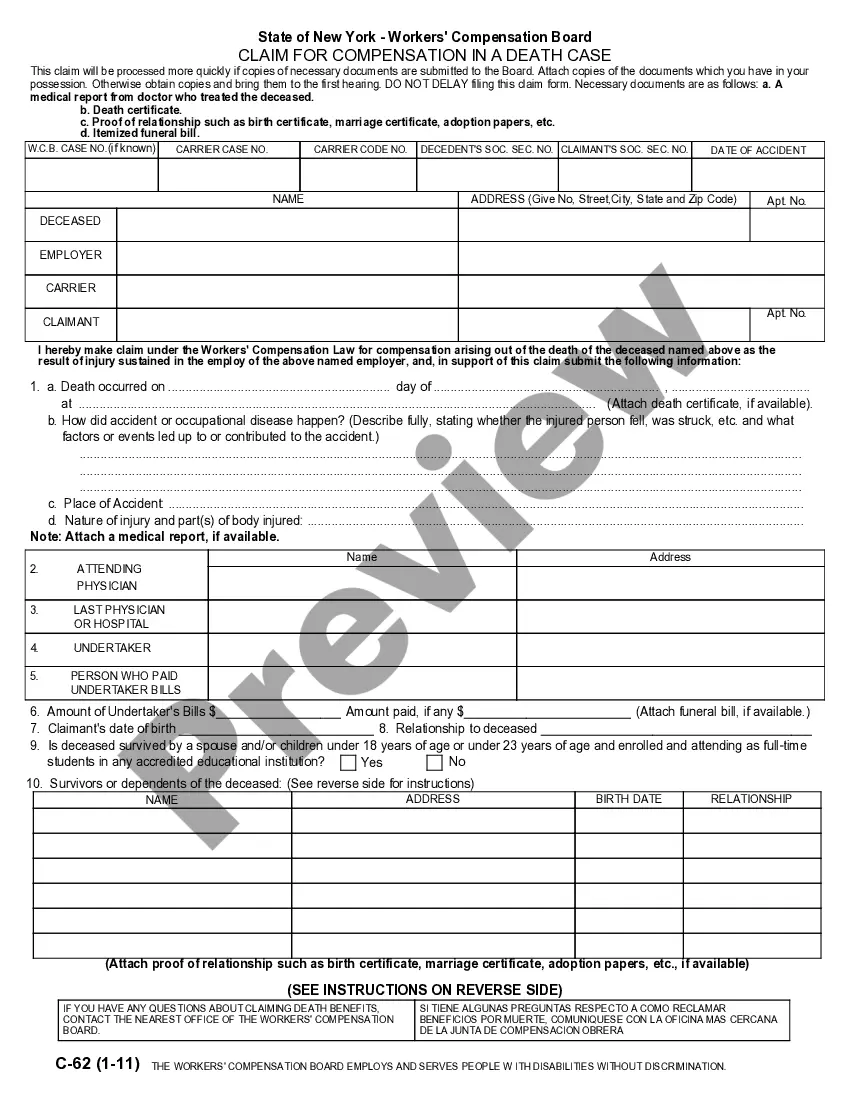

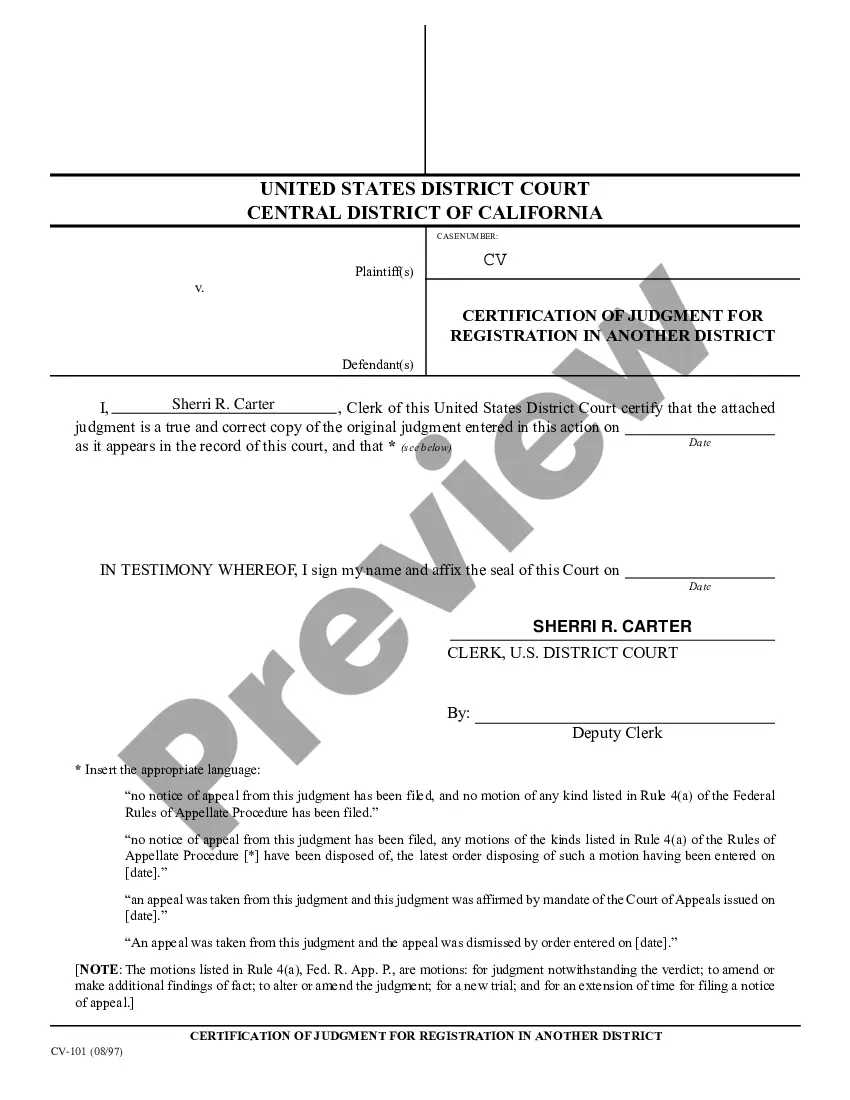

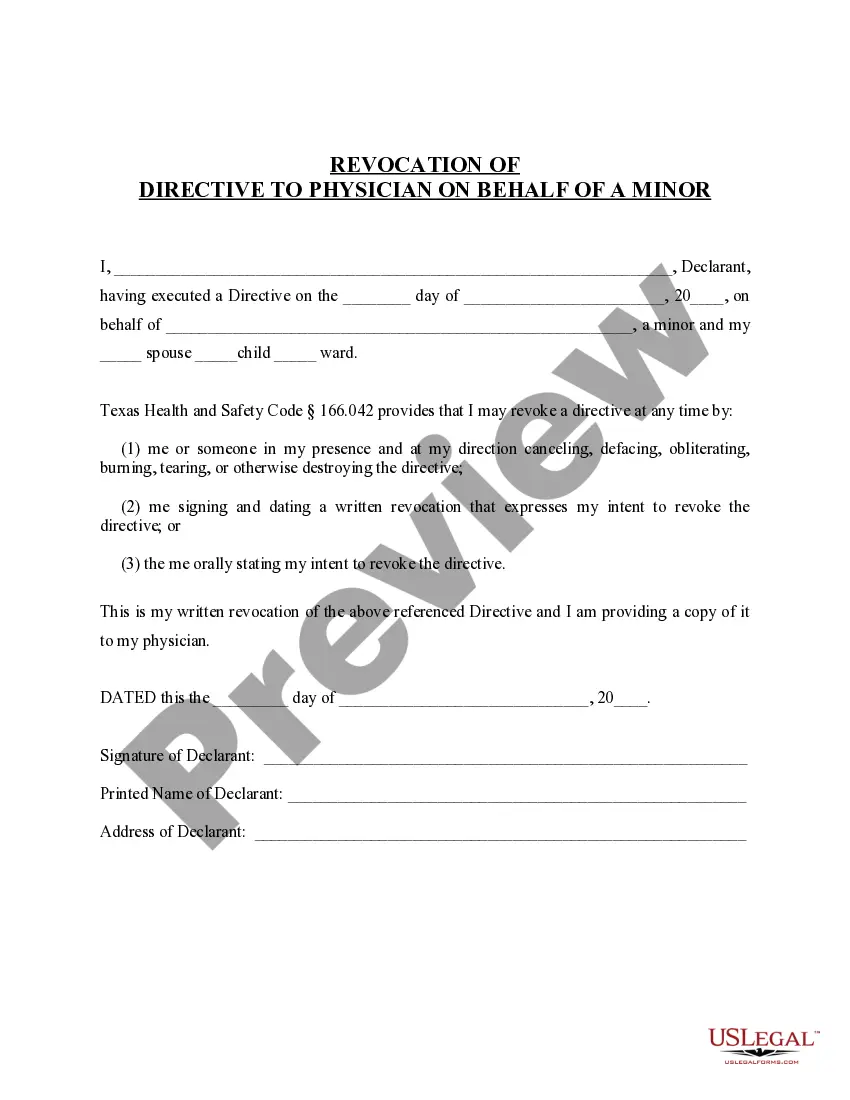

- If available preview it and read the description prior to buying it.

- Press Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the document.

As soon as the Deed and Assignment from individual to A Trust is downloaded you are able to fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

Based on these rules, upon creation of a trust, title to trust property is split between the trustee and the beneficiaries. The trustee holds legal title to the property and the beneficiaries hold equitable title. Because the trustee holds legal title to the property, that property must be held in the trustee's name.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Obtain a California grant deed from a local office supply store or your county recorder's office. Complete the top line of the deed. Indicate the grantee on the second line. Enter the trustees' names and addresses.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...