Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries

Description Testamentary Trust Example

How to fill out Trust Documents Example?

When it comes to drafting a legal form, it’s easier to delegate it to the experts. However, that doesn't mean you yourself can not find a template to utilize. That doesn't mean you yourself cannot get a template to utilize, however. Download Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries from the US Legal Forms web site. It offers a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. After you are registered with an account, log in, find a certain document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries quickly:

- Make sure the form meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the appropriate subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/bank card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

After the Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries is downloaded you may fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Example Of Trustee Form popularity

Assignment Of Deed Of Trust Other Form Names

Example Of A Testamentary Trust FAQ

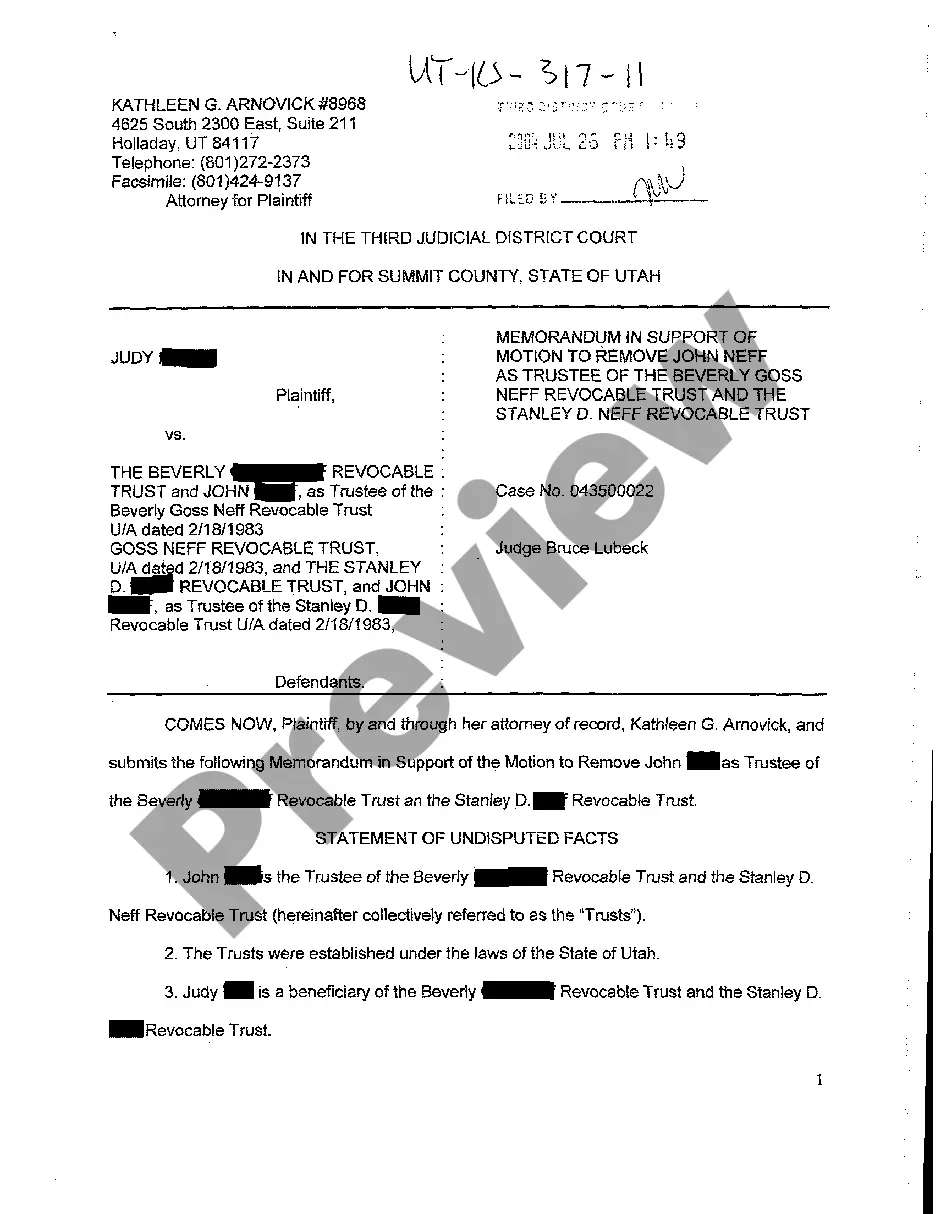

Some use deeds of trust instead, which are similar documents, but they have some fundamental differences.With a deed of trust, however, the lender must act through a go-between called the trustee. The beneficiary and the trustee can't be the same person or entity.

Distribution of trust funds after death The Trustee simply transfers all assets to the beneficiary. Distribution is also fairly easy if the trust document identifies all assets and specific amounts to be paid to each beneficiary.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

Two documents are needed to transfer California real property from a trust to beneficiaries of the trust; a deed and an 'affidavit of death of trustee. ' An 'affidavit death of trustee' is a declaration, under oath, by the successor trustee.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.