Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

How to fill out Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

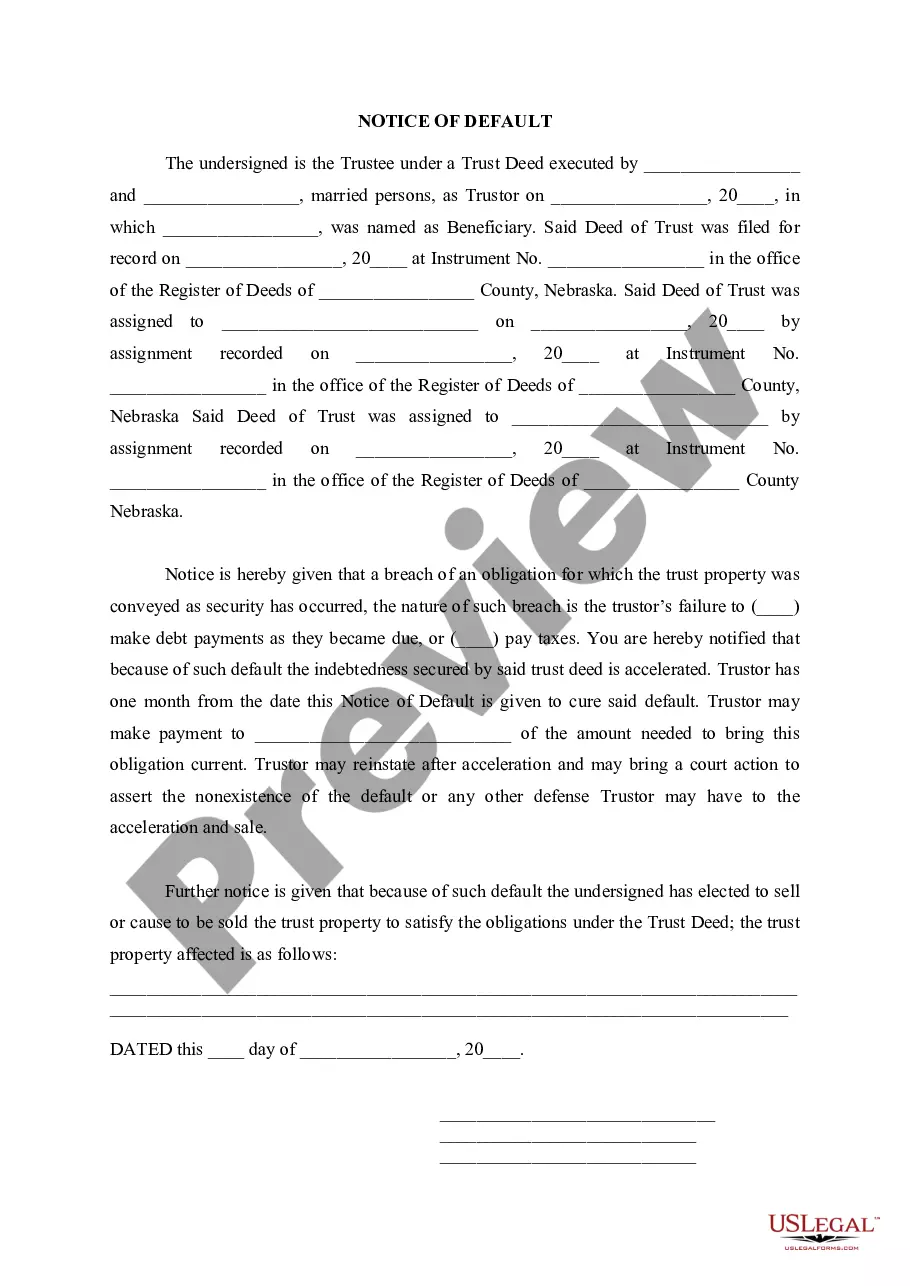

When it comes to drafting a legal document, it is better to delegate it to the specialists. Nevertheless, that doesn't mean you yourself cannot find a sample to use. That doesn't mean you yourself can’t find a sample to use, however. Download Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer right from the US Legal Forms website. It gives you a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. When you are registered with an account, log in, find a specific document template, and save it to My Forms or download it to your device.

To make things easier, we’ve incorporated an 8-step how-to guide for finding and downloading Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer promptly:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the appropriate subscription for your requirements.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

Once the Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer is downloaded you can complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

An owner can separate the mineral rights from his or her land by: Conveying (selling or otherwise transferring) the land but retaining the mineral rights. (This is accomplished by including a statement in the deed conveying the land that reserves all rights to the minerals to the seller.)

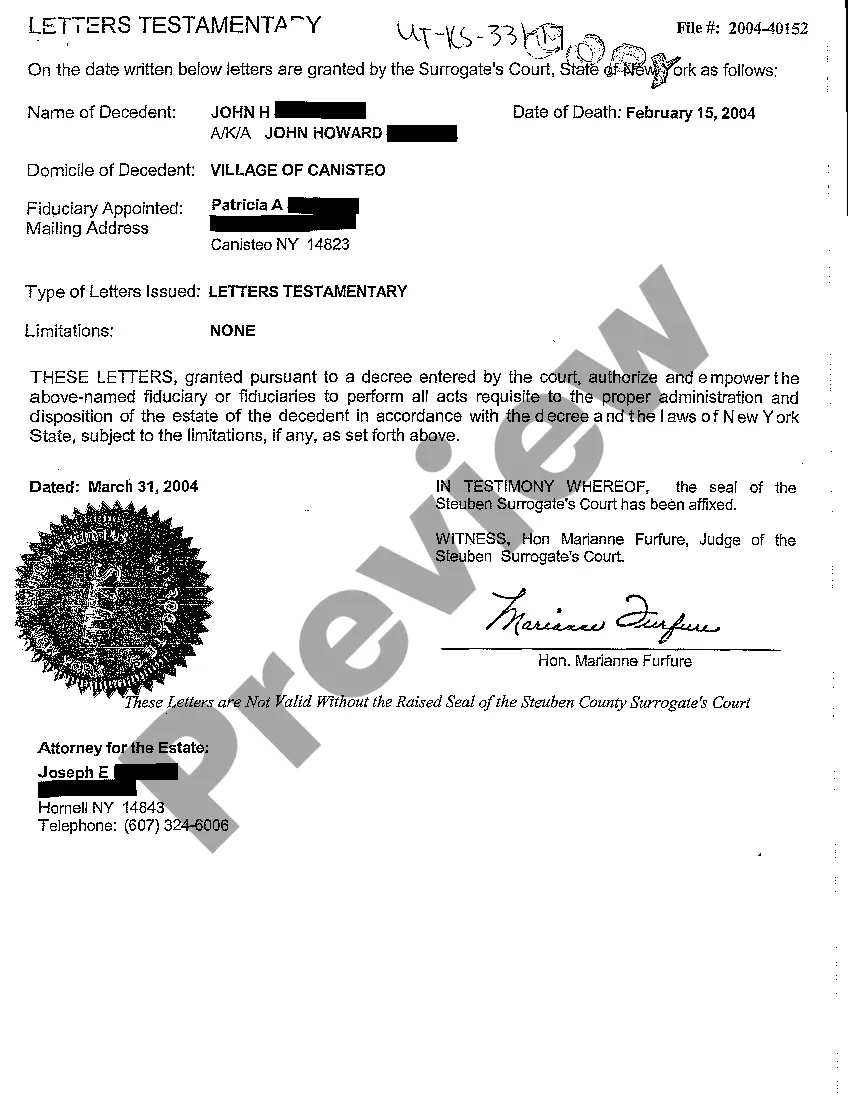

Mineral rights must be transferred to heirs before any transactions related to them can take place. Unlike a home, which can be sold by an estate, mineral rights must be transferred before any sale. Mineral rights can be transferred to rightful heir(s) or to a trust through a mineral deed.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

Surface rights mean that you own the top of the land. Essentially, you'll own the grass, trees and any structures that are part of the land itself. All of the rights to these essential parts of the land will be owned once the title of the land has been transferred to your name.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).