Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman

Description Quit Claim Deed With Life Estate

How to fill out Quitclaim Deed Of Life Estate Interest Created Under A Will, To The Remainderman?

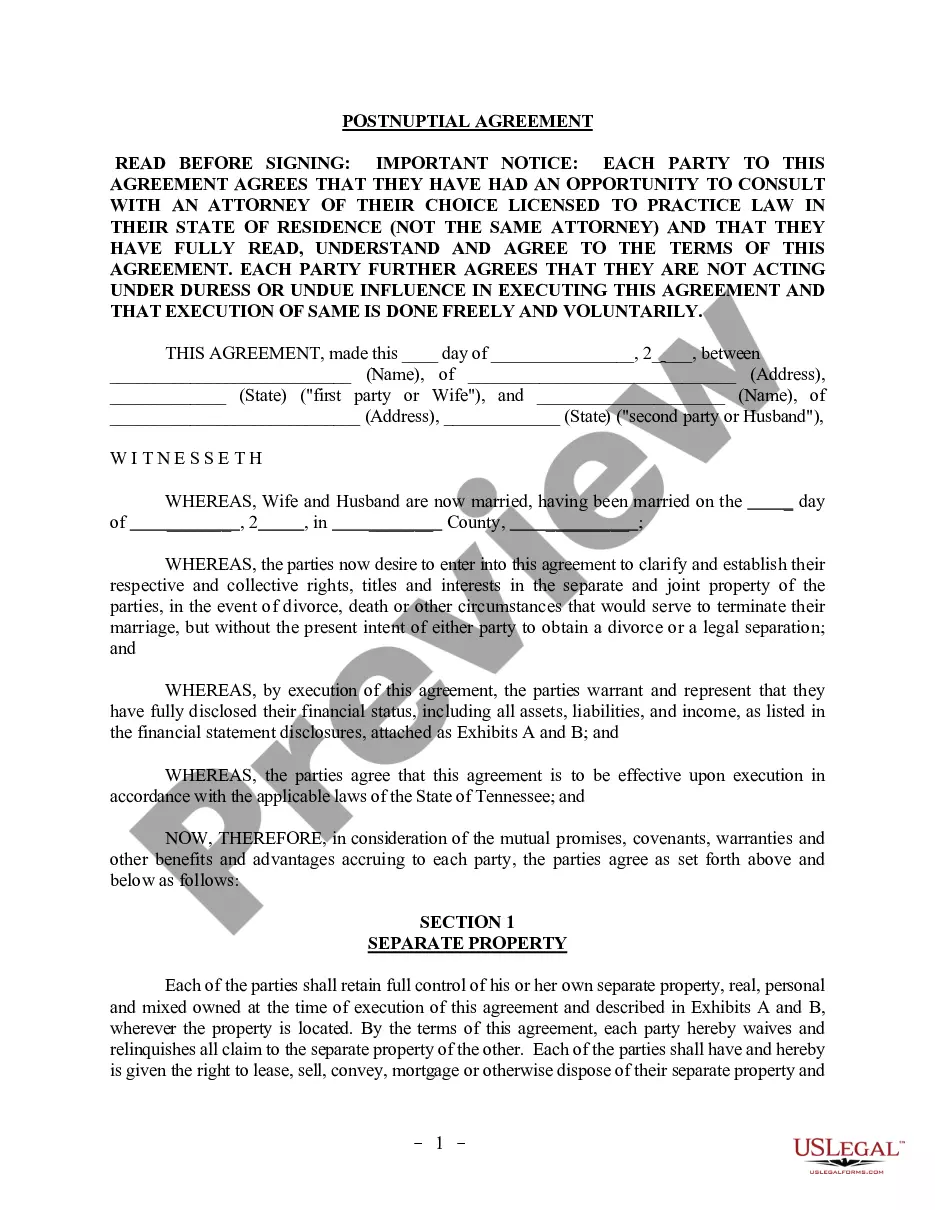

When it comes to drafting a legal form, it is easier to leave it to the professionals. Nevertheless, that doesn't mean you yourself can not get a sample to use. That doesn't mean you yourself can not get a sample to utilize, however. Download Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman right from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. Once you are signed up with an account, log in, look for a specific document template, and save it to My Forms or download it to your gadget.

To make things much easier, we have included an 8-step how-to guide for finding and downloading Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman fast:

- Make sure the form meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Press Buy Now.

- Select the appropriate subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/bank card.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

When the Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman is downloaded you may complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!

Remainderman Deed Form Form popularity

FAQ

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

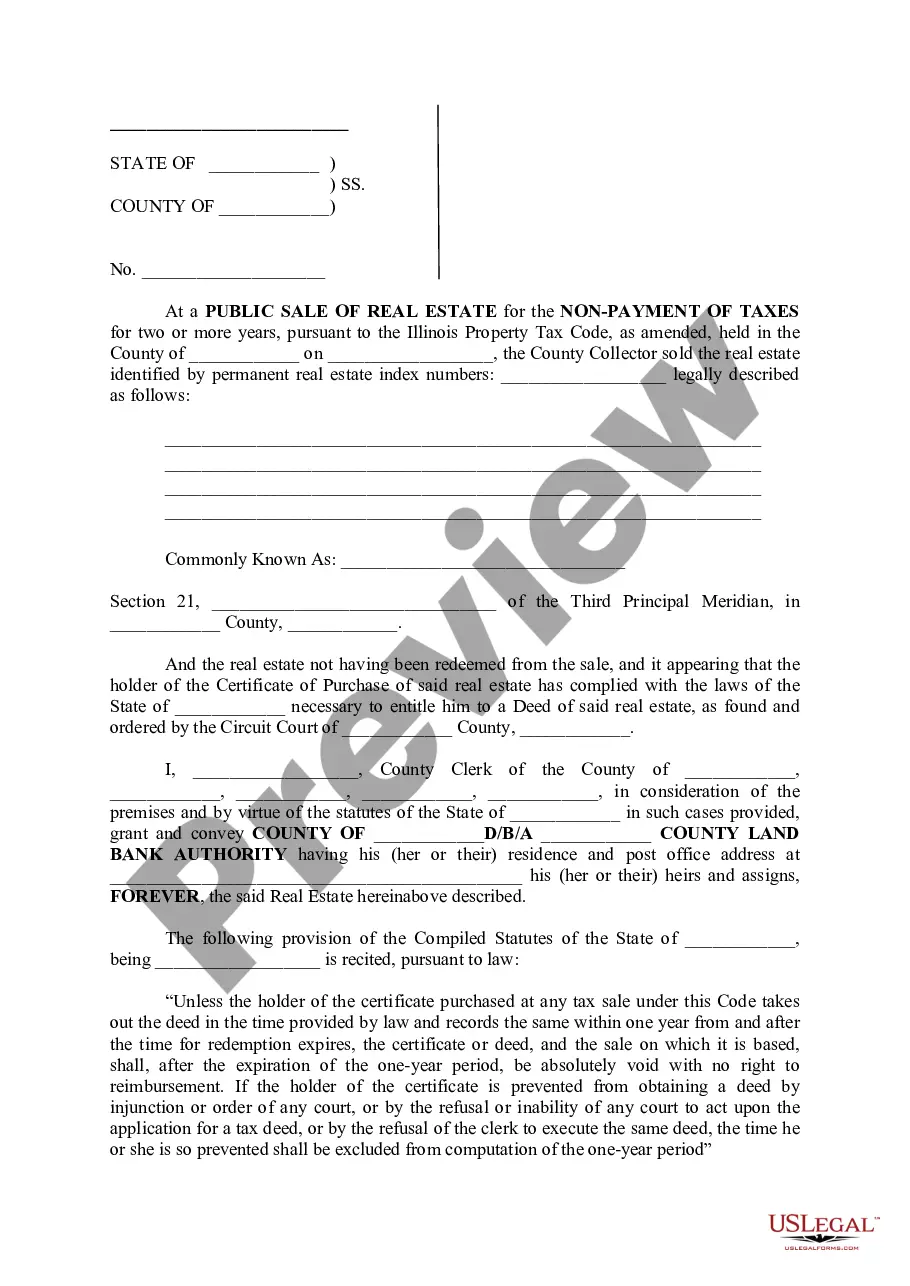

A properly written, signed and filed Enhanced Life Estate Deed does supersede the terms of the owner's Will, so long as the grantor has not exercised the retained right to reclaim ownership while living.When the owner later dies, transfer of title to the property may require probate of the Will.

A signed quit claim deed overrides a will, because the property covered by the deed is not part of the estate at your mother's death.The deed needed to be notarized to be valid.

No a will does not override a deed. A will only acts on death. The deed must be signed during the life of the owner. The only assets that pass through the will are assets that are in the name of the decedent only.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

A life estate helps avoid the probate process upon the life tenant's death. The property will automatically transfer to the remainderman, making the process simple and easy a will isn't needed for the transfer to happen.

Once the quitclaim deed is signed and notarized, it is a valid legal document. But the grantee must also have the quitclaim deed recorded in the county recorder's office, or with the county clerk -- whoever has the authority to record deeds and property transfers.