Royalty Owner's Statement of Ownership

Description Statement Of Ownership Template

How to fill out Royalty Statement?

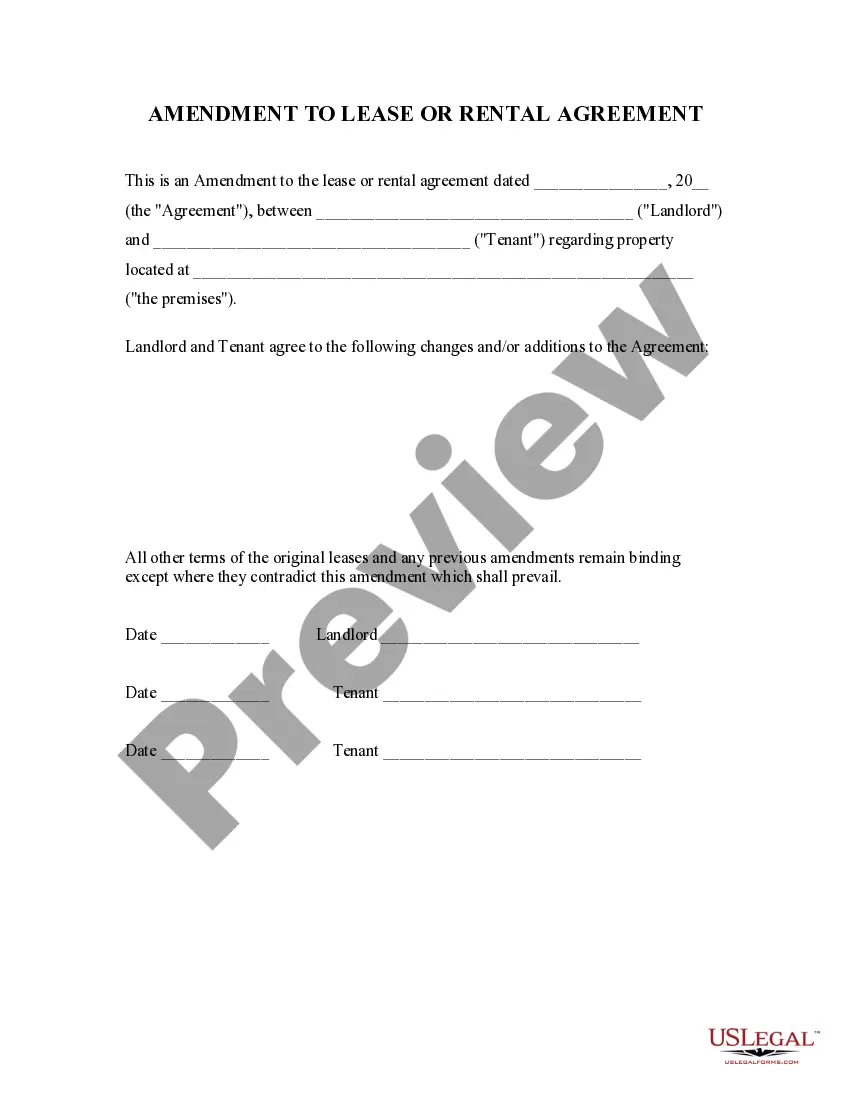

When it comes to drafting a legal document, it’s better to delegate it to the professionals. Nevertheless, that doesn't mean you yourself can not find a template to utilize. That doesn't mean you yourself cannot find a sample to use, nevertheless. Download Royalty Owner's Statement of Ownership straight from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. When you are registered with an account, log in, look for a specific document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Royalty Owner's Statement of Ownership quickly:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Press Buy Now.

- Choose the suitable subscription to suit your needs.

- Create your account.

- Pay via PayPal or by credit/bank card.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the file.

As soon as the Royalty Owner's Statement of Ownership is downloaded you can fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Equinor Owner Relations Login Form popularity

Chevron Royalty Owner Relations Other Form Names

Equinor Login FAQ

Mineral interests and royalty interests both involve ownership of the minerals under the ground. The main difference between the two is that the owner of a mineral interest has the right to execute leases and collect bonus payments and the owner of royalty interests does not execute leases or collect bonus payments.

For many years, almost all oil and gas leases reserved a 1/8th royalty. Today, the royalty fraction is negotiable, and is usually between 1/8th and 1/4th. Bonus. The bonus is the amount paid to the Lessor as consideration for his/her execution of the lease.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

Royalty income is reported on Form 1099-MISC, Box 2, Royalties. The oil and gas company will generally also report related expenses, including production tax. The person will continue to receive these royalty payments while the well is still producing.

The definition of an Oil or Gas Royalty interest, as stated by MineralWise.com is, Royalty interest is an oil and natural gas lease that gives the owner of the interest the right to receive a portion of the production from the leased acreage (or of the proceeds of the sale thereof), but generally does not require the

Royalty Exchange is an online marketplace and auction platform where you can buy and sell intellectual property. SongVest bills itself as The Stock Market of Music. Cypress Growth Capital specializes in royalties related to venture capital and business startups.

Traditionally 12.5%, but more recently around 18% 25%. The percentage varies upon how well the landowner negotiated and how expensive the oil company expects the extraction of oil and gas to be.

A royalty owner means any owner of oil or gas who is entitled to oil and gas rights. A royalty owner also means any owner of an interest in an oil or gas lease which entitles him to a share in the production of the oil or gas under such lease.

In the event oil and gas were found and the wells produce, then the royalties kick in. So if the oil well produce 100 barrels a day, and the price of oil is $80 per barrel that month, then the cash flow is 100x$80 = $8,000/day The royalty owner, who agreed to 15% royalty, would receive $8,000 x 0.15 = $1,200/day.