Partial Release of Pipeline Easement

Description

How to fill out Partial Release Of Pipeline Easement?

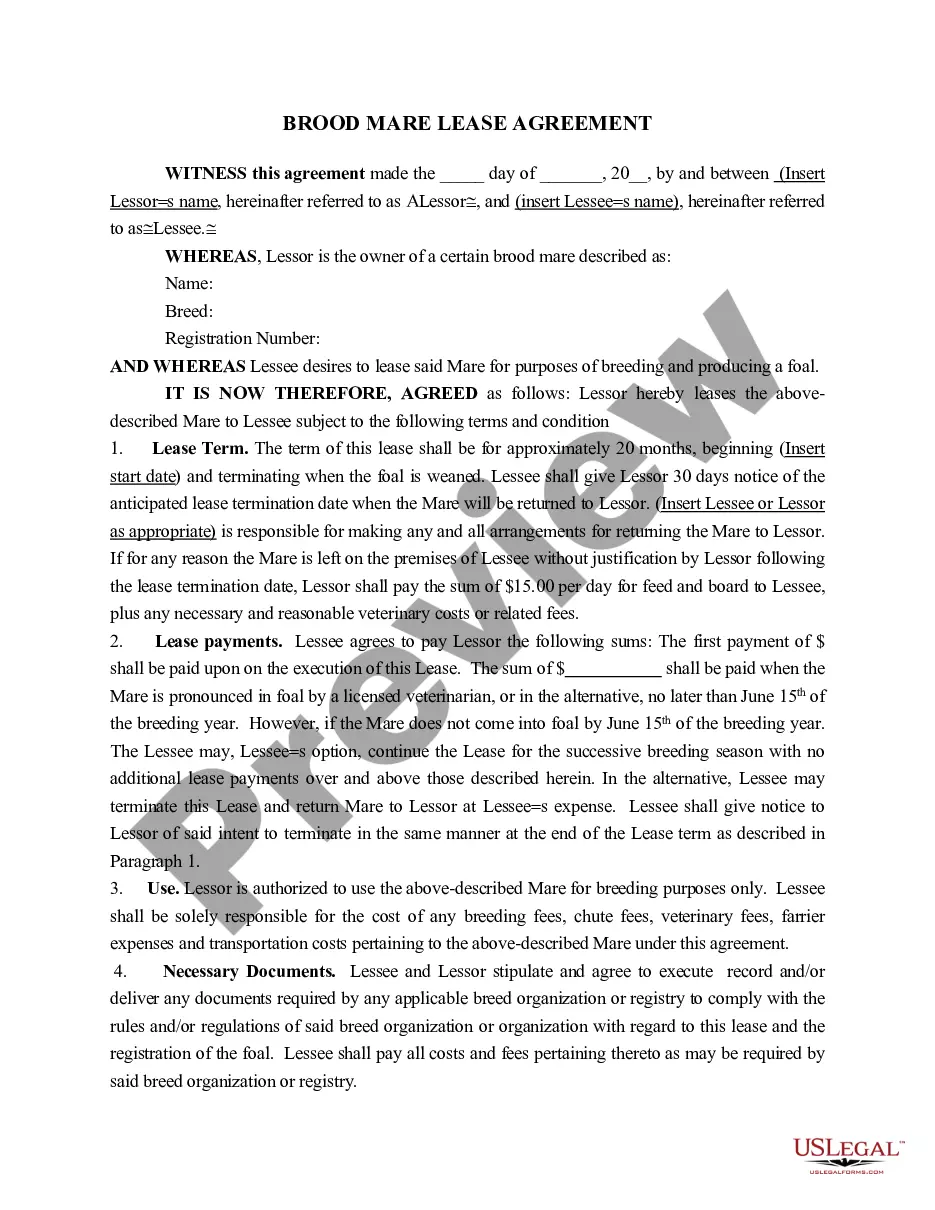

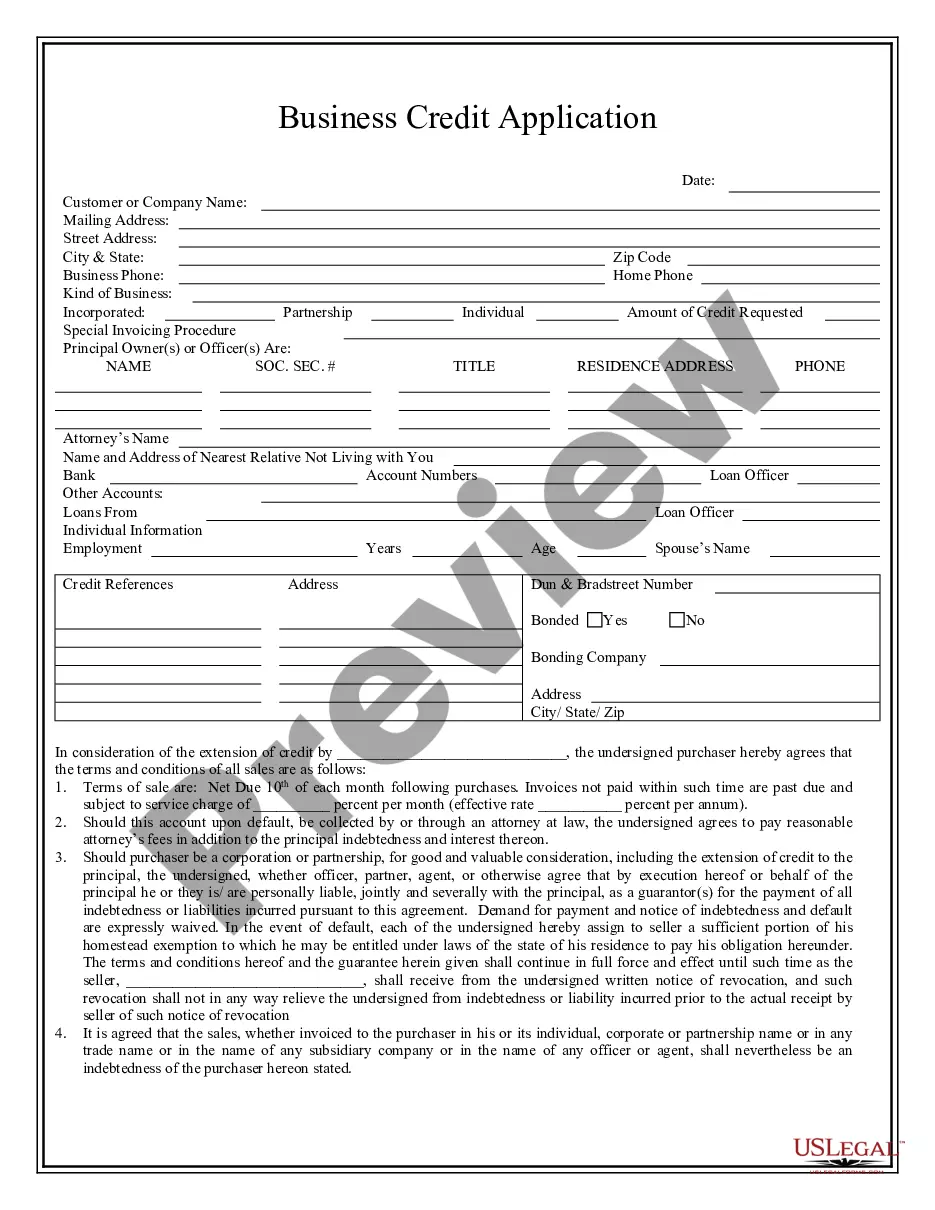

When it comes to drafting a legal form, it is easier to delegate it to the experts. Nevertheless, that doesn't mean you yourself can not find a template to use. That doesn't mean you yourself can’t find a template to utilize, however. Download Partial Release of Pipeline Easement from the US Legal Forms web site. It offers numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. After you’re signed up with an account, log in, look for a particular document template, and save it to My Forms or download it to your gadget.

To make things much easier, we have incorporated an 8-step how-to guide for finding and downloading Partial Release of Pipeline Easement promptly:

- Be sure the form meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Select the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Partial Release of Pipeline Easement is downloaded it is possible to complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Background on perpetual easementsEasements are treated as a recovery of the basis of the property first, with any excess proceeds treated as capital gain, which is taxed at a lower rate than ordinary income. The basis of property that offsets an easement is limited to the basis of the affected acres or square footage.

Easement: An intangible capital asset that reflects the purchased right to use land without ownership. This right is considered permanent and inexhaustible.

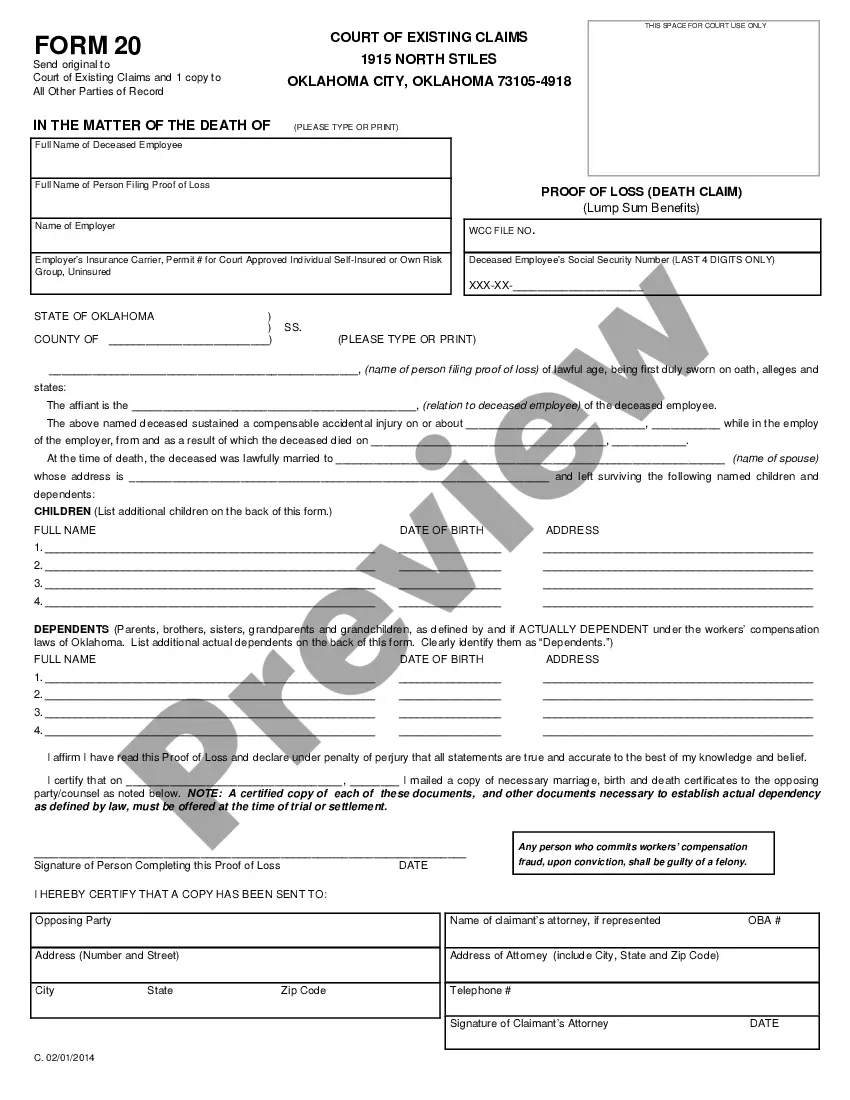

Tax Reporting Whoever is paying for the easement will send you a Form 1099 at the end of the year. If you get a 1099-MISC for rental payments, you report the income on Schedule E. For a permanent easement, you get a 1099-S and use Schedule D to report capital gains.

A property easement is generally written and recorded with the local assessor's office. The documented easement will show up when a title search is conducted and it stays there indefinitely, unless both parties agree to remove it.

While an unrecorded easement may still be enforceable, the easement may be nullified by a "bona fide purchaser" of the property if the property is sold for value and the subsequent purchaser has no notice (constructive or otherwise) of the unrecorded easement.

Key Takeaways. A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

How much money should landowners get when an oil or gas pipeline crosses their land? As it stands, landowners receive a one-time payment roughly based on the length of the pipeline, with rates varying from $5 to $50 per foot or more for a Marcellus or Utica shale pipeline right-of-way agreement.

Background on perpetual easements Easements are treated as a recovery of the basis of the property first, with any excess proceeds treated as capital gain, which is taxed at a lower rate than ordinary income. The basis of property that offsets an easement is limited to the basis of the affected acres or square footage.