Release of Judgment Lien - By Creditor

Description

How to fill out Release Of Judgment Lien - By Creditor?

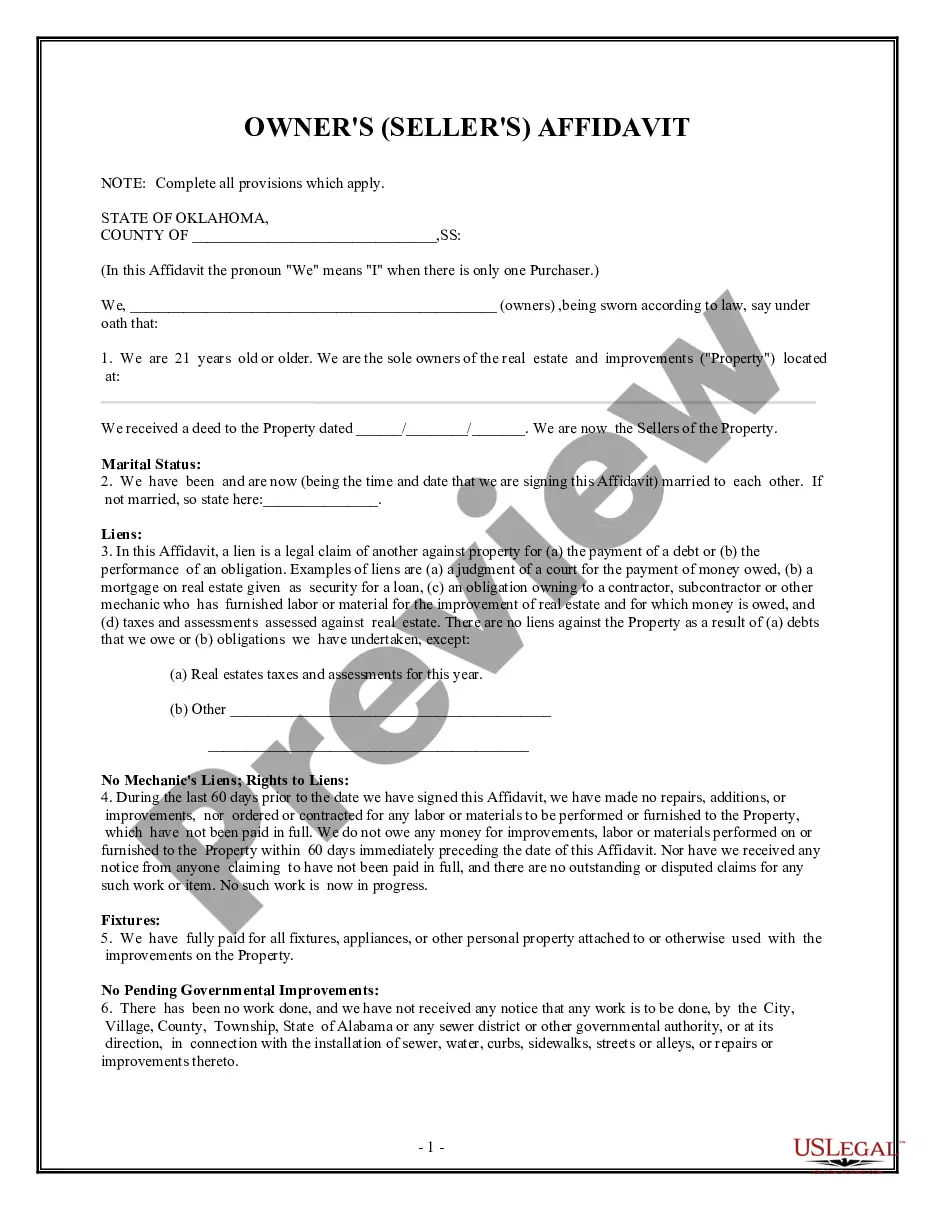

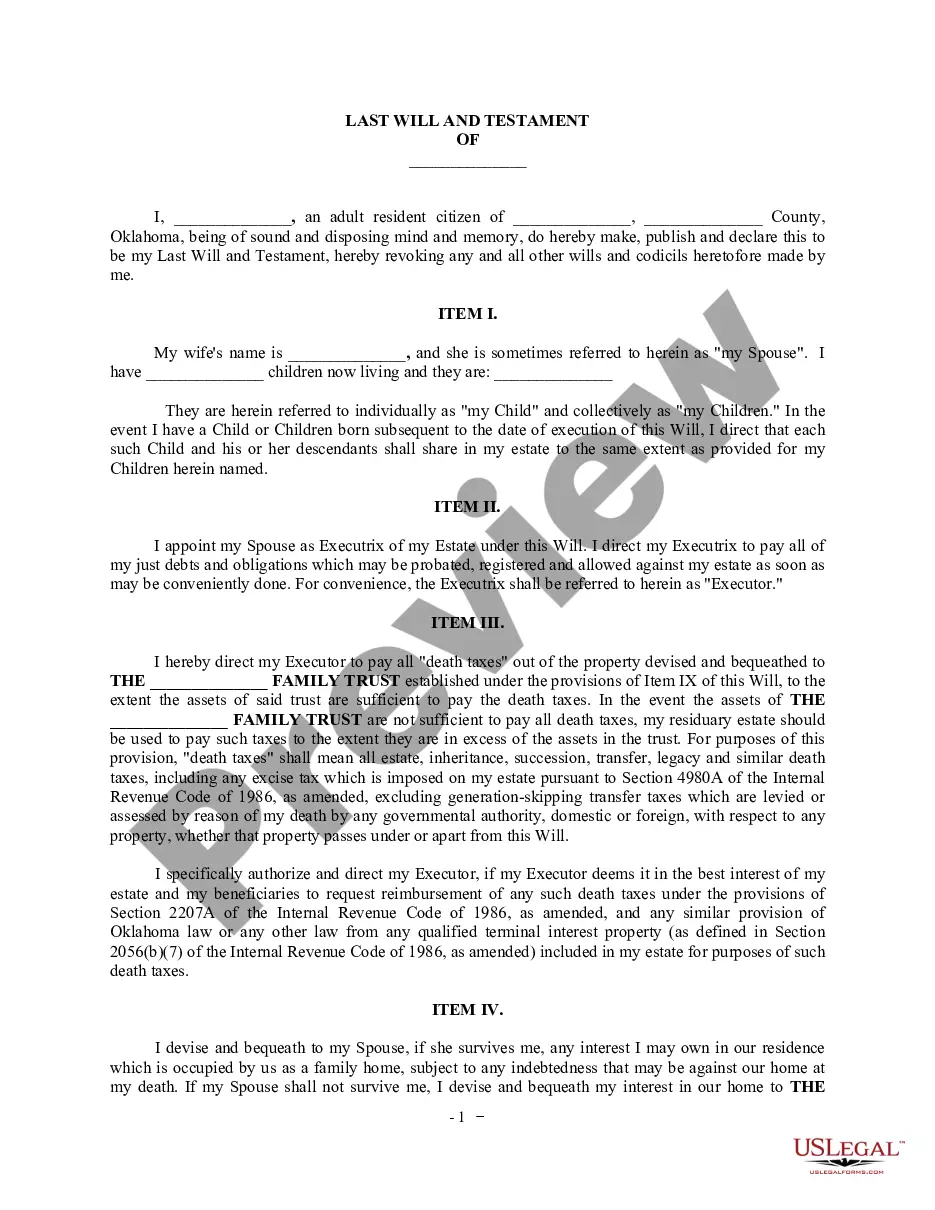

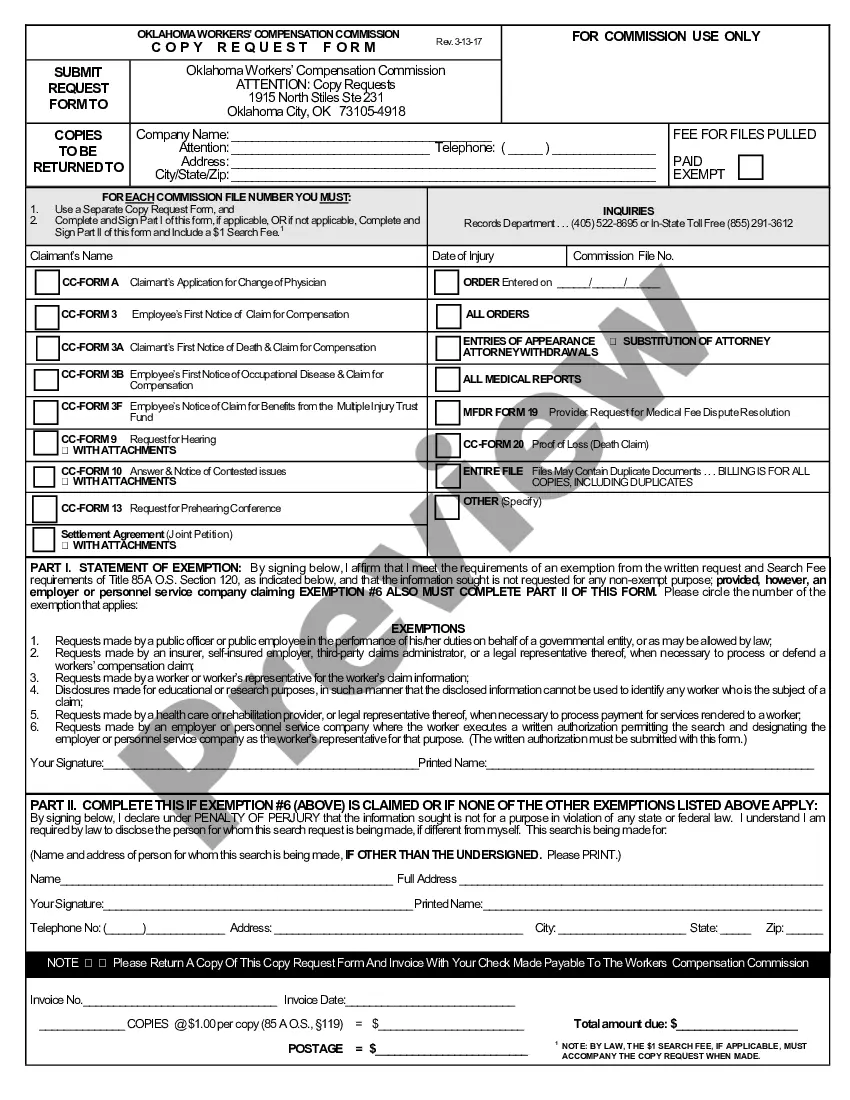

When it comes to drafting a legal form, it’s easier to delegate it to the experts. Nevertheless, that doesn't mean you yourself can not get a sample to utilize. That doesn't mean you yourself cannot find a sample to utilize, however. Download Release of Judgment Lien - By Creditor straight from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. Once you’re registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Release of Judgment Lien - By Creditor promptly:

- Make sure the document meets all the necessary state requirements.

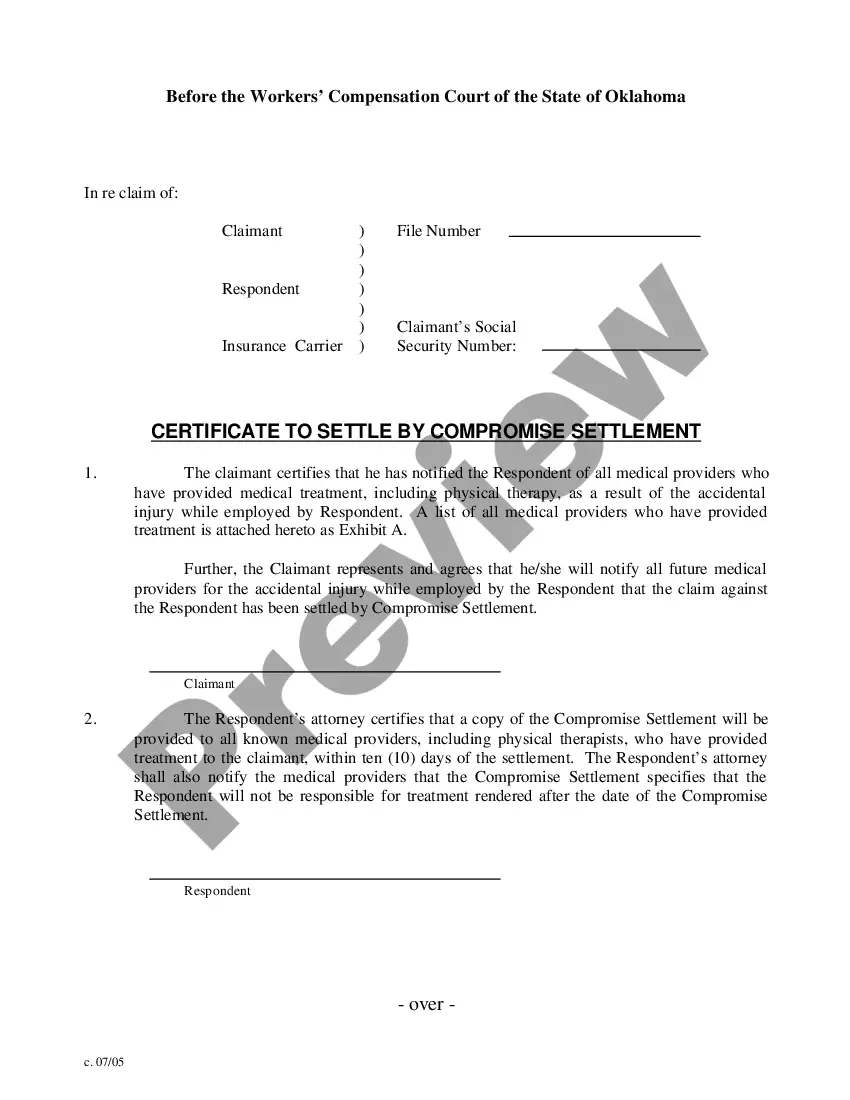

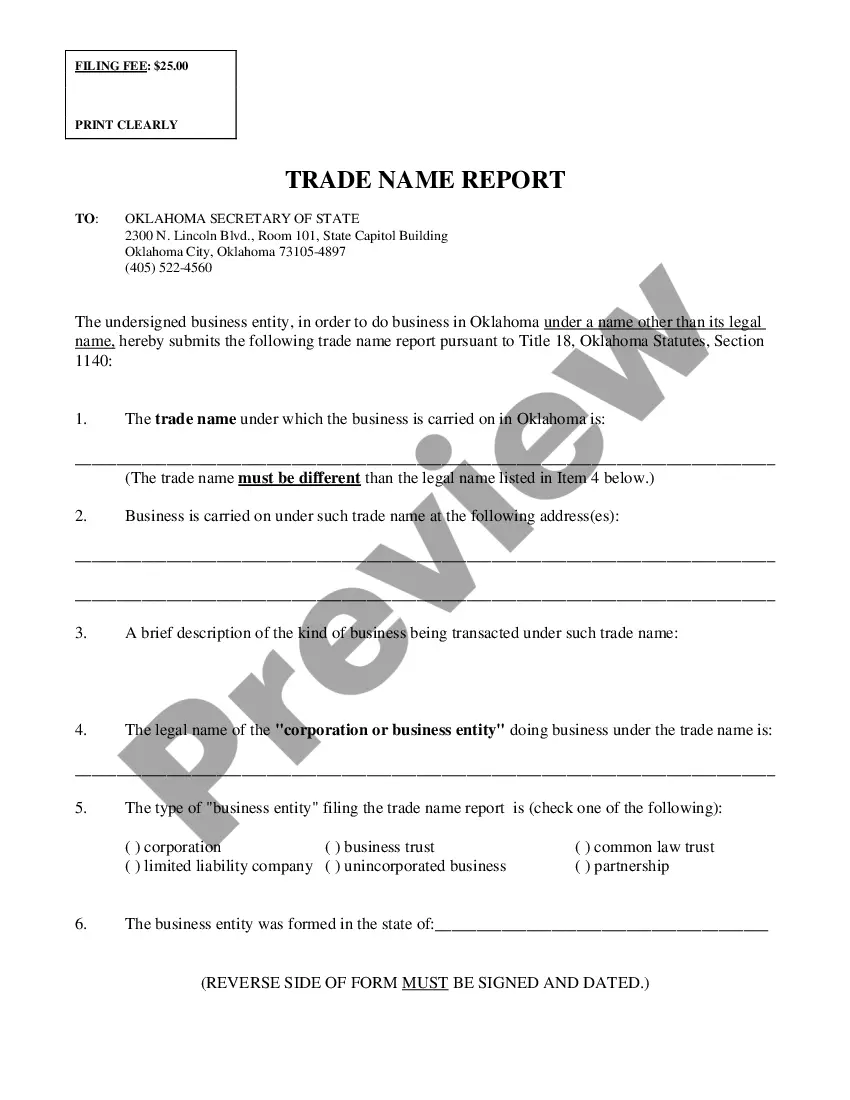

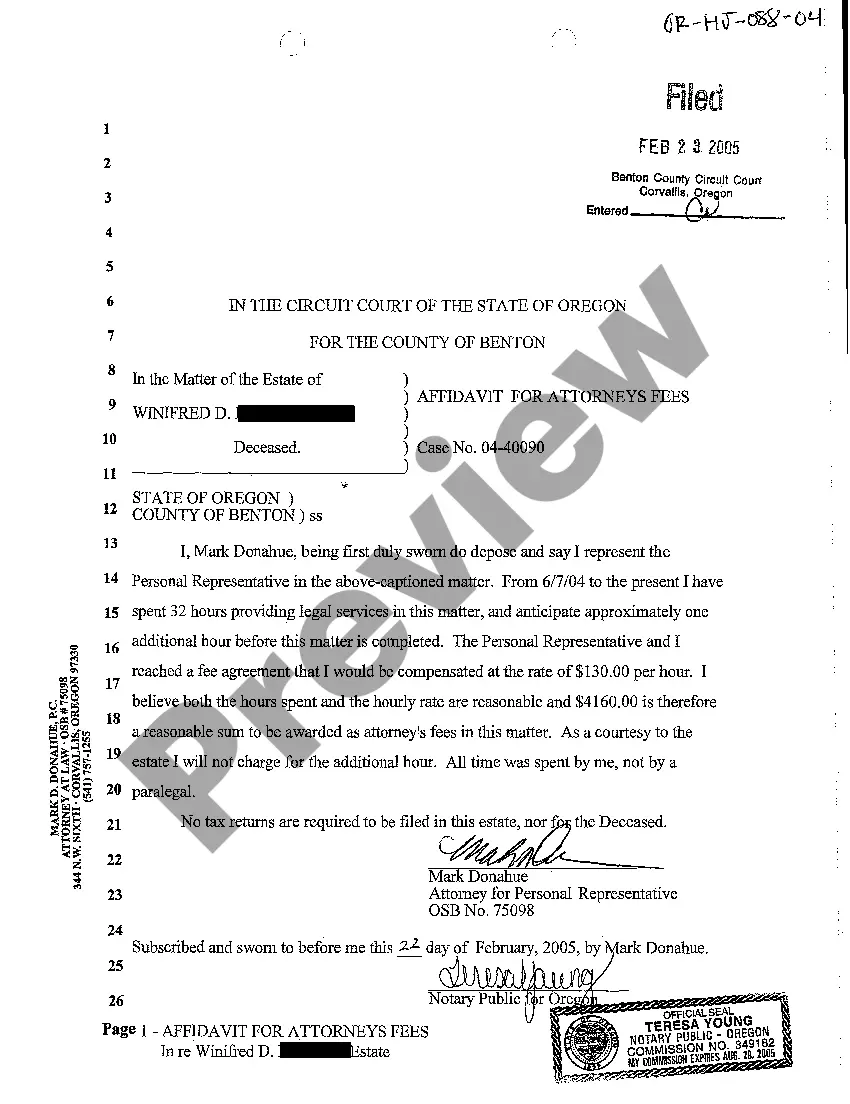

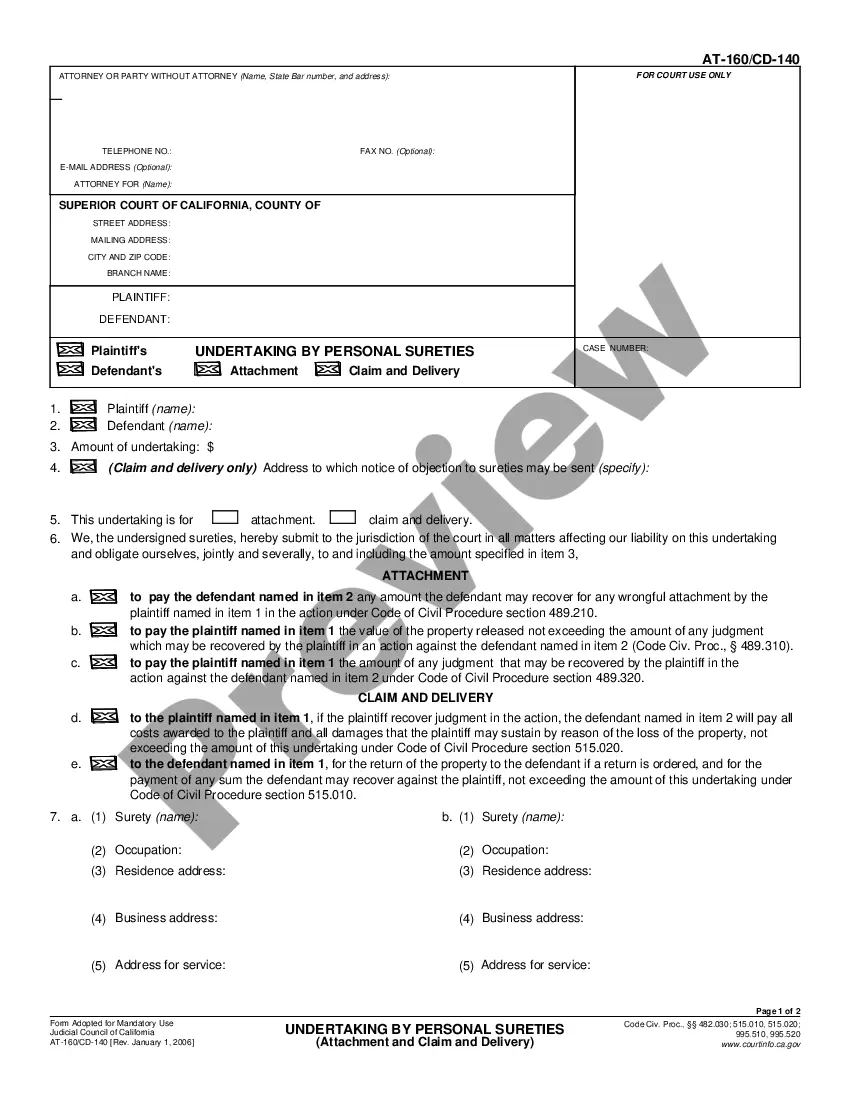

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the appropriate subscription to suit your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the document.

As soon as the Release of Judgment Lien - By Creditor is downloaded you are able to fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

To fight a creditor's attempts to gain a judgement against you, you'll need to respond to the Summons and Complaint by providing an Answer to the court within the appropriate amount of time. Your Answer should include a request for the creditor to prove the validity of the debt.

Just as there are two ways for a creditor to get a judgment against you, there are two ways to have the judgment vacated. They are: Appeal the judgment and have the appeals court render the original judgment void; or. Ask the original court to vacate a default judgment so that you can fight the lawsuit.

How Long Does a Judgment Stay on My Credit Report? In most cases, judgments can stay on your credit reports for up to seven years. This means that the judgment will continue to have a negative effect on your credit score for a period of seven years.

California allows the judgment to last ten years and it can be renewed for an additional ten years if the creditor files the required forms in a timely fashion.

Contact the creditor that filed the lien. Make payment arrangements if you cannot pay in full. Pay the lien amount in full or as agreed. Request a satisfaction of lien. File the satisfaction of lien if mailed to you. Consult a bankruptcy attorney.

In most cases, after your lien has been filed your customer resolves their account and you need to remove a lien. Once you have received payment in full, or a settlement amount, and the funds have cleared then you are obligated to remove the lien, You can contact Lien-Pro directly to remove liens.

A judgment is sometimes removed if you pay it. Some state laws require judgments to be removed from your credit report when they are paid. Some states also allow debt collectors and creditors to re-file the judgment if it is unpaid, also known as an unsatisfied judgment.

Contact the creditor that filed the lien. Make payment arrangements if you cannot pay in full. Pay the lien amount in full or as agreed. Request a satisfaction of lien. File the satisfaction of lien if mailed to you. Consult a bankruptcy attorney.

You Can Appeal for a Vacated Judgment A vacated judgment is essentially declared void, which means the credit bureaus are legally required to remove it from your credit reports.Paying off a judgment should automatically change its status to Satisfied, both in the public record and on your credit reports.