Subordination Agreement (Deed of Trust to Storage Agreement)

Description

How to fill out Subordination Agreement (Deed Of Trust To Storage Agreement)?

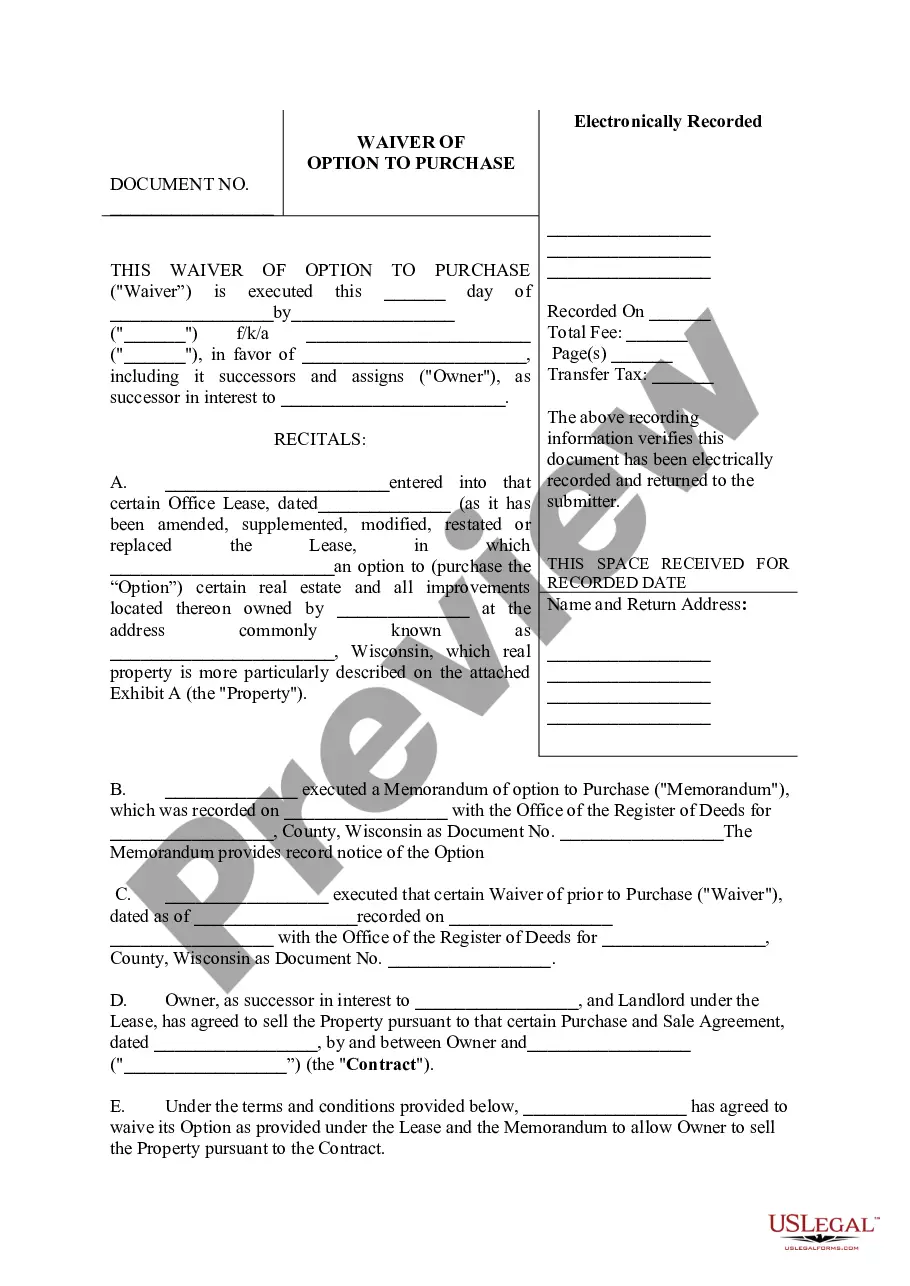

When it comes to drafting a legal document, it’s easier to leave it to the experts. Nevertheless, that doesn't mean you yourself can not find a sample to use. That doesn't mean you yourself can not find a sample to use, nevertheless. Download Subordination Agreement (Deed of Trust to Storage Agreement) from the US Legal Forms web site. It provides numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. When you’re signed up with an account, log in, find a specific document template, and save it to My Forms or download it to your device.

To make things easier, we’ve incorporated an 8-step how-to guide for finding and downloading Subordination Agreement (Deed of Trust to Storage Agreement) promptly:

- Be sure the document meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Hit Buy Now.

- Choose the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/visa or mastercard.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

When the Subordination Agreement (Deed of Trust to Storage Agreement) is downloaded you can complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

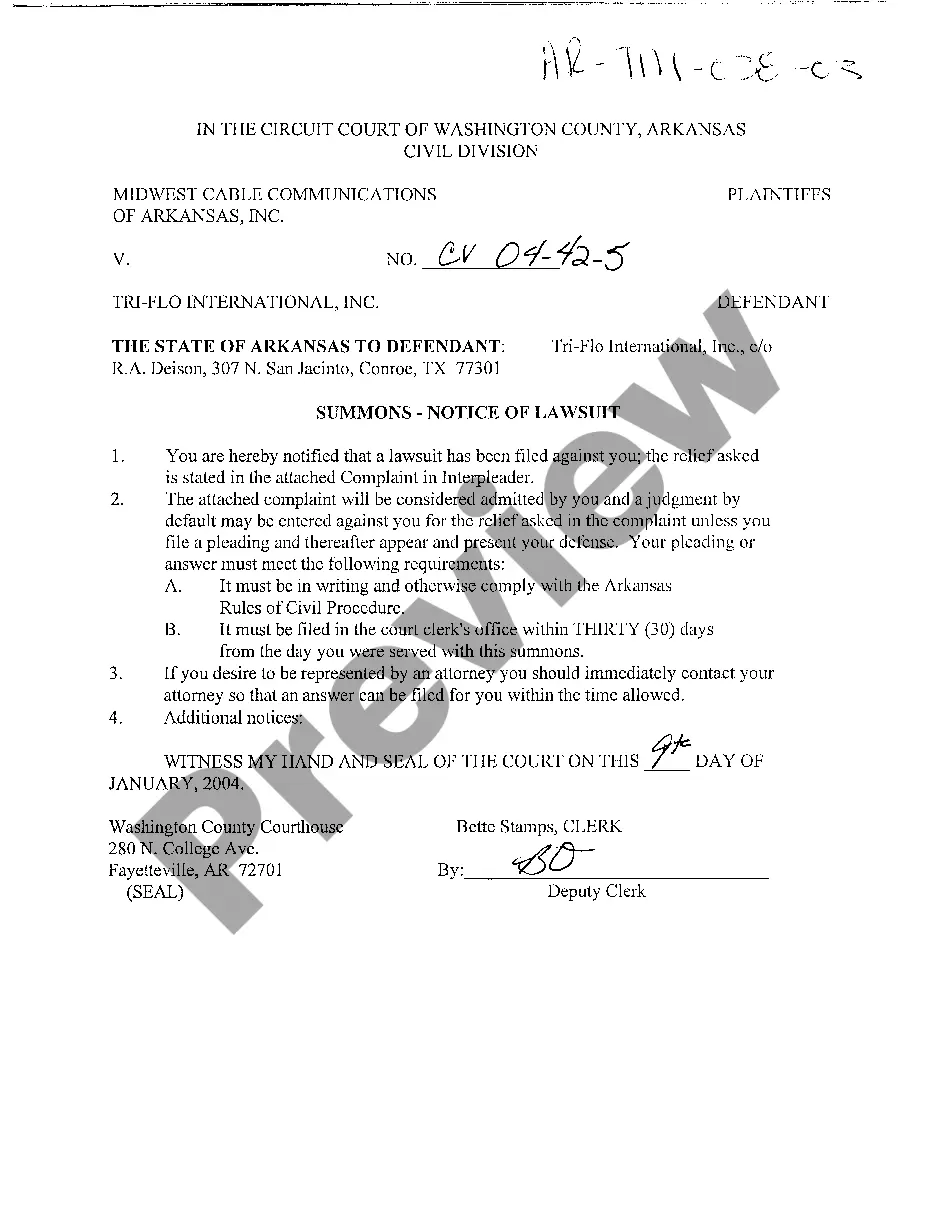

A subordination clause or subordination agreement is used to lower the priority of a first recorded deed of trust or mortgage in favor of a later or junior recorded deed of trust or mortgage.

A subordination agreement often comes up when a home has a first and a second mortgage, and the borrower wants to refinance the first mortgage. If you have two mortgages on your home and refinance the first loan, the refinancing lender might require a subordination agreement.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.

The borrower (trustor) benefits the most from a subordination clause since this makes it easier to obtain an additional loan on their property. For example, the buyer of vacant land can obtain a construction loan more easily if the loan against the land will be subordinated to the construction loan.

The signed agreement must be acknowledged by a notary and recorded in the official records of the county to be enforceable.

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

Subordination clauses are most commonly found in mortgage refinancing agreements. Consider a homeowner with a primary mortgage and a second mortgage. If the homeowner refinances his primary mortgage, this in effect means canceling the first mortgage and reissuing a new one.

A subordinate deed of trust occurs in a situation where a person has two deeds on a single property.This trustee holds the legal title to the property as security for a loan between a lender and a borrower.