Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files

Description

How to fill out Liens, Mortgages/Deeds Of Trust, UCC Statements, Bankruptcies, And Lawsuits Identified In Seller's Files?

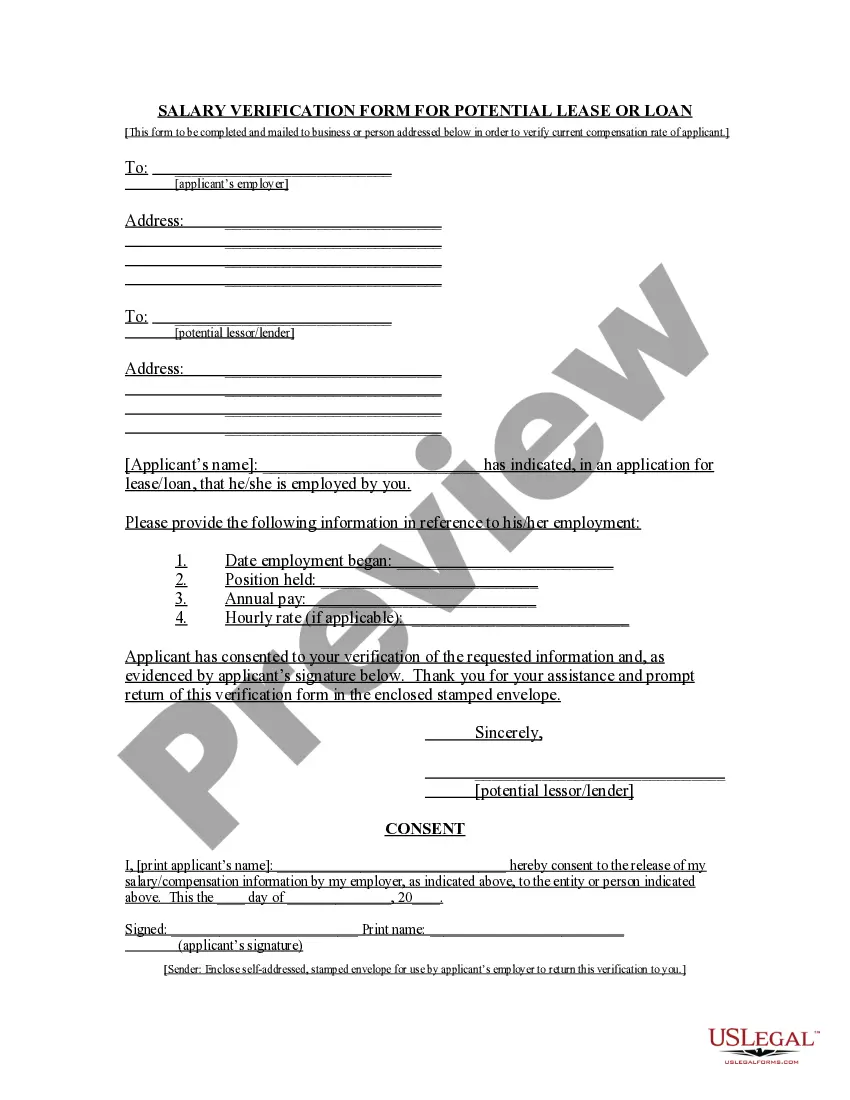

When it comes to drafting a legal document, it’s easier to leave it to the experts. However, that doesn't mean you yourself can’t find a sample to use. That doesn't mean you yourself can’t find a template to utilize, nevertheless. Download Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files right from the US Legal Forms web site. It provides numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. Once you are signed up with an account, log in, look for a particular document template, and save it to My Forms or download it to your device.

To make things easier, we’ve provided an 8-step how-to guide for finding and downloading Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files promptly:

- Make sure the document meets all the necessary state requirements.

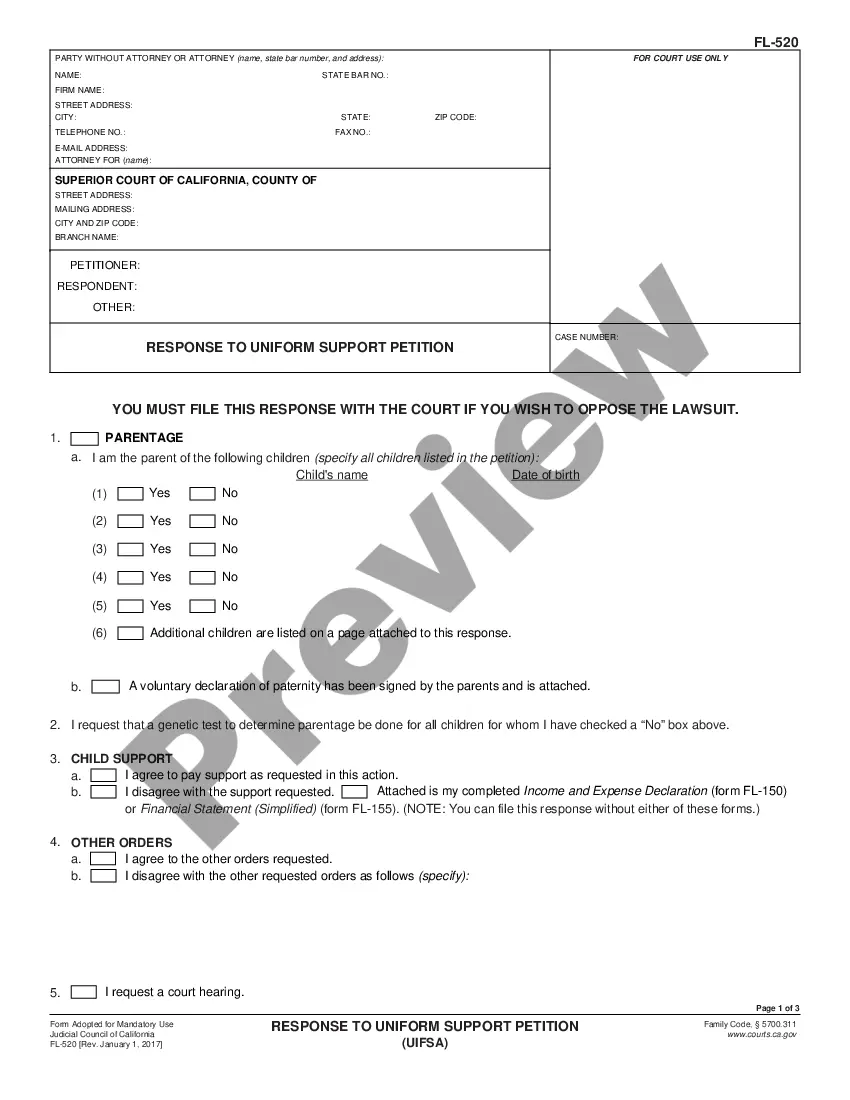

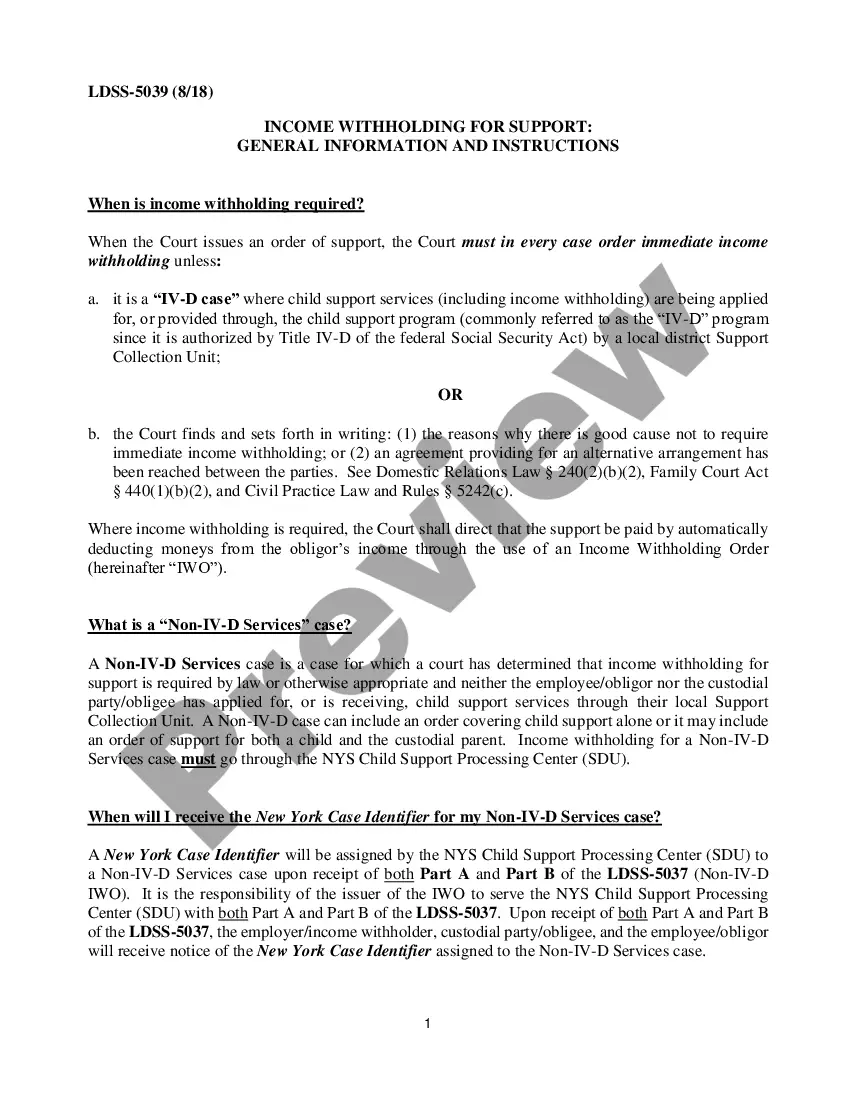

- If available preview it and read the description prior to buying it.

- Press Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/bank card.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the file.

Once the Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files is downloaded you are able to complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

By filing a financing statement with the appropriate public office. by possessing the collateral. by controlling the collateral; or. it's done automatically upon attachment of the security interest.

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

UCC filings or liens are legal forms that a creditor files to give notice that it has an interest in the personal or business property of a debtor. Essentially, UCC lien filings allow a lender to formally lay claim to collateral that a debtor pledges to secure their financing.

If a creditor gets a judgment against you and the debt is dischargeable in a Chapter 7 bankruptcy, filing for bankruptcy will wipe out a creditor's ability to collect.And liens don't go away in bankruptcy automatically. So it's possible to wipe out a judgment in bankruptcy and remain obligated to pay the lien.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

A UCC-1 financing statementalso sometimes referred to as a 'UCC-1 filing,' a 'UCC lien,' or simply a 'UCC-1'is a form that creditors use to create a lien against a debtor's property.