Surface Use Agreement Establishing Amounts Lessee Will Pay For Road and Location Damages

Description

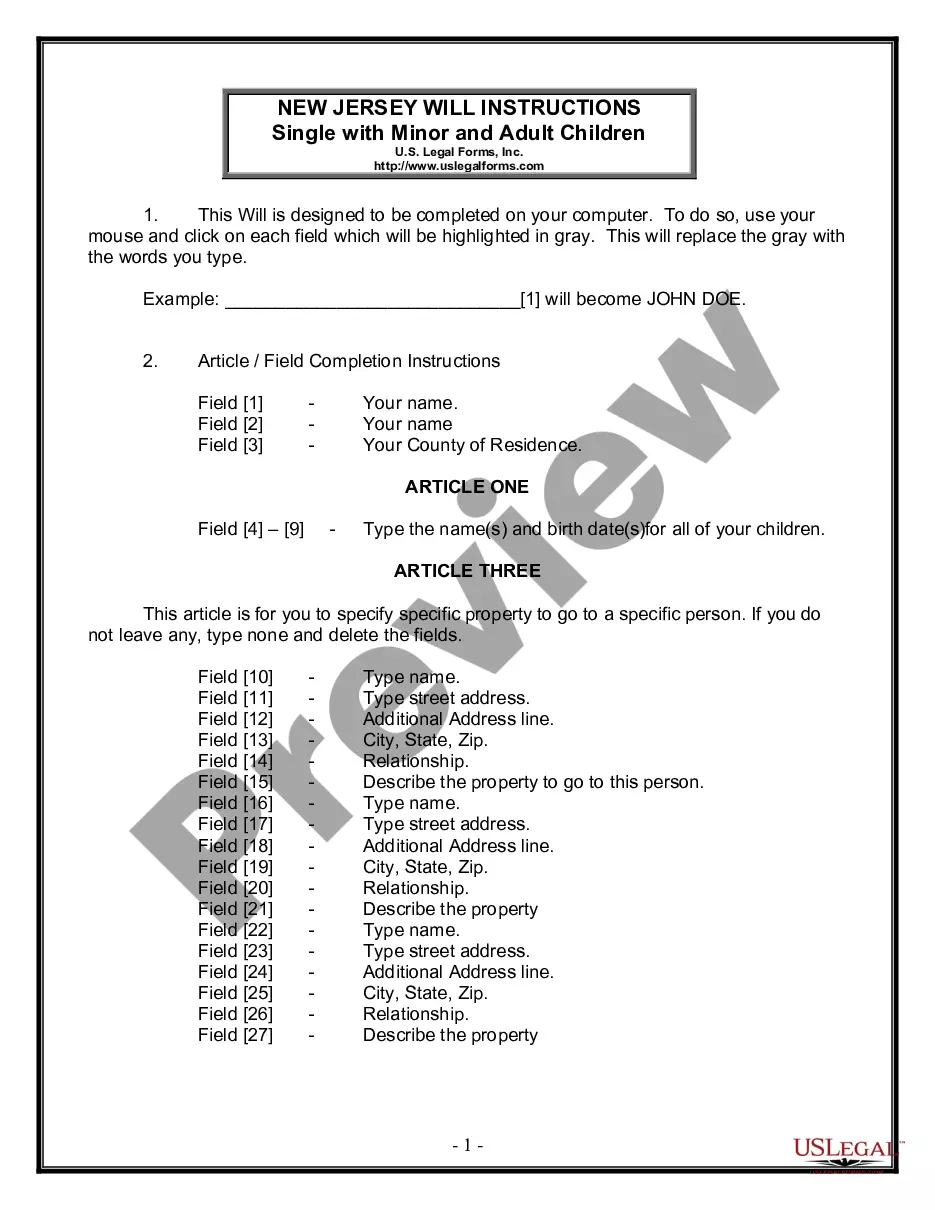

How to fill out Surface Use Agreement Establishing Amounts Lessee Will Pay For Road And Location Damages?

When it comes to drafting a legal form, it’s easier to delegate it to the experts. Nevertheless, that doesn't mean you yourself can not get a sample to utilize. That doesn't mean you yourself can not get a sample to utilize, nevertheless. Download Surface Use Agreement Establishing Amounts Lessee Will Pay For Road and Location Damages right from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. As soon as you’re signed up with an account, log in, find a particular document template, and save it to My Forms or download it to your gadget.

To make things easier, we have incorporated an 8-step how-to guide for finding and downloading Surface Use Agreement Establishing Amounts Lessee Will Pay For Road and Location Damages quickly:

- Make sure the form meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the suitable subscription for your requirements.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

When the Surface Use Agreement Establishing Amounts Lessee Will Pay For Road and Location Damages is downloaded you can fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Make a List of All Your Debts. Rank Your Debts. Find Extra Money to Pay Your Debts. Focus on One Debt at a Time. Move Onto the Next Debt on Your List. Build Up Your Savings. Other Tips.

Be polite, but firm, in your tone. For example, if you are writing with regard to a personal loan, you could begin by saying: "As you are aware, on date you contacted me for help regarding your delinquent car payment. I lent you the sum of dollar amount and you promised to pay back the money within time period."

Contact information for both parties. Location/state whose laws apply to the agreement. Terms and conditions of the business relationship. Terms of payment. Start date of the agreement. End date of the agreement.

The legal name of both the promisor and the payee. The total amount of the loan. The terms of the repayment. What the payments are for. When the payments are due. How the payments will be made. When the last payment should be made.

A payment plan can be understood as an extension of the invoice due date. Typically an invoice has payment terms, such as NET 7.Once your customer approves the payment plan they will be charged automatically for the installments on the date each payment is due.

Look for a sample template online which you can use as a guide for when you are drafting your document. Open a word processing software and start formatting your document. Identify the parties who are involved in the loan. Write your consideration to make your loan valid.

I, FULL NAME, borrowed $500 from FULL NAME on DATE. The money is to be repaid in one lump sum. I, FULL NAME, promise to repay the full amount, $500, with a personal check on DATE. I agree to pay a late fee of $5 per day until the loan is paid in full if I am not able to make the payment on the agreed date.

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.