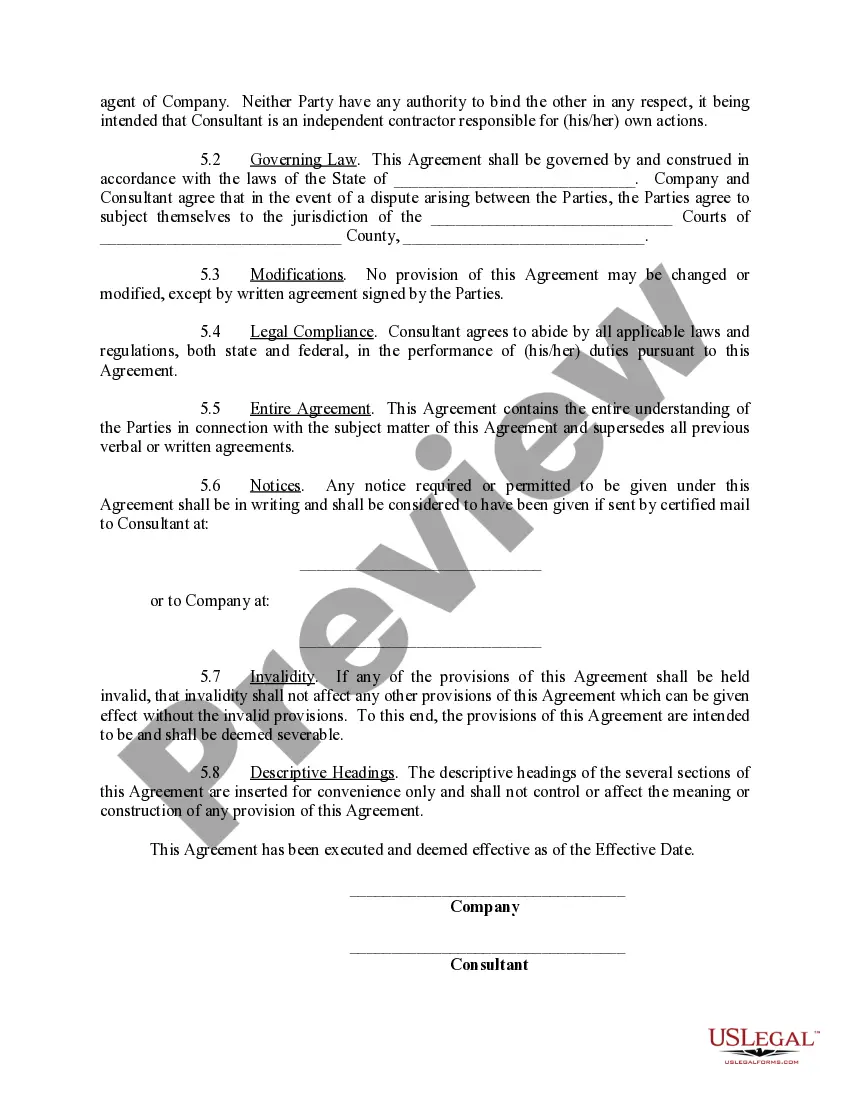

This forms is an agreement between a company and a former employee. Included in this agreement are terms, services and compensation information.

Consulting Agreement with Former Employee

Description Agreement Employee Document

How to fill out Agreement Employee?

When it comes to drafting a legal form, it’s easier to leave it to the professionals. However, that doesn't mean you yourself can’t find a template to utilize. That doesn't mean you yourself can’t find a sample to use, however. Download Consulting Agreement with Former Employee right from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. When you are registered with an account, log in, look for a certain document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Consulting Agreement with Former Employee quickly:

- Make confident the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the file.

After the Consulting Agreement with Former Employee is downloaded you can complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!

Agreement Former Blank Form popularity

Former Employee Statement Other Form Names

Agreement Employee Form FAQ

Consultant agreements are important because they outline what work will be done, as well as the terms of the agreement between the client and the consultant. A consultant agreement should be detailed and include compensation terms, contract termination, intellectual property ownership and confidentiality agreements.

Before You Make The Decision To Leave Your Employer, Do Your Research. Make Your Employer Your Client. Beware Of Burning Bridges. Address Your Non-Compete. Go Solo, But Not Alone. Nurture Your Network.

Allowing independent contractors or consultants to manage company employees is not a recommended practice.Managing employees, on the other hand, typically involves overseeing and enforcing the organization's personnel policies and procedures.

In the United States, if the IRS determines that a consultant's relationship to a client qualifies as an employer-employee relationship, the client will not only have to pay the employer portion of Social Security and Medicare taxes for the period the consultant was engaged (currently 7.65% of qualifying wages), but

Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly. Project objectives. Detailed description of the project. List of responsibilities. Fees. Timeline. Page numbers.