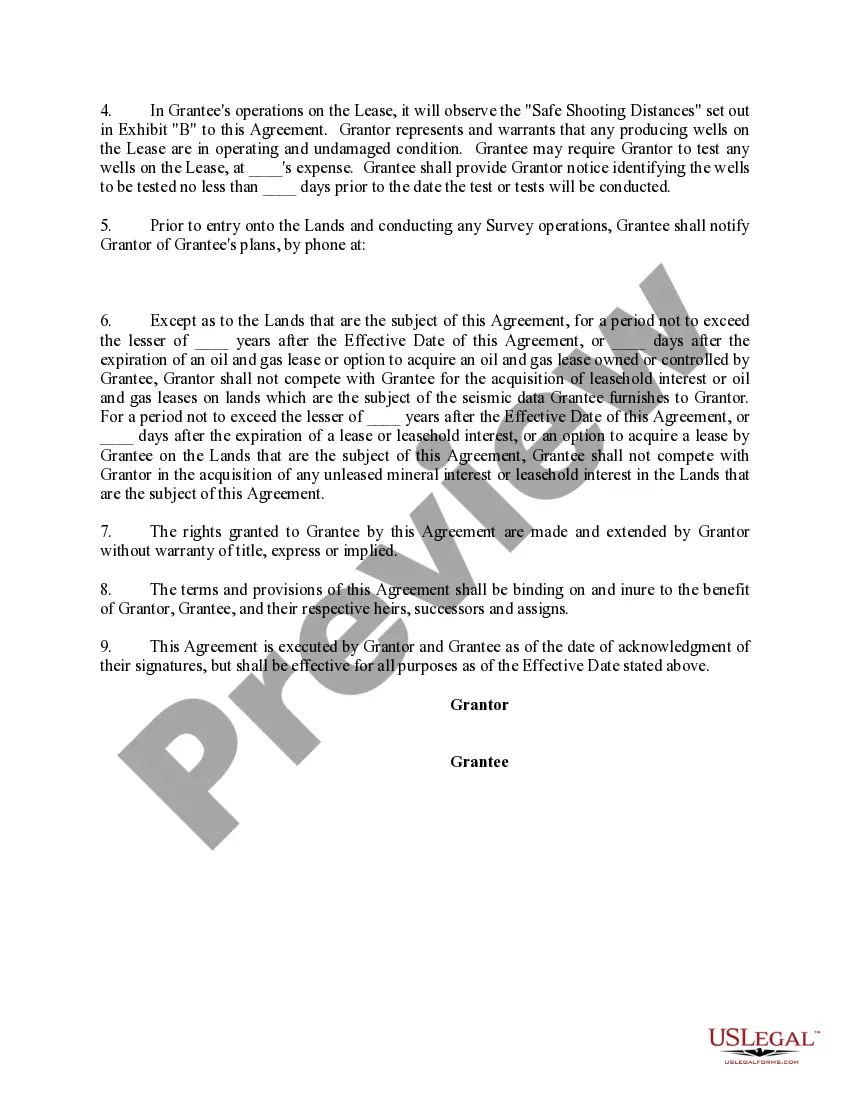

Seismic Agreement Allowing Third Party to Conduct Seismic Operation on Grantor's Lease

Description

How to fill out Seismic Agreement Allowing Third Party To Conduct Seismic Operation On Grantor's Lease?

When it comes to drafting a legal form, it is better to leave it to the experts. Nevertheless, that doesn't mean you yourself cannot find a template to utilize. That doesn't mean you yourself can’t get a template to utilize, nevertheless. Download Seismic Agreement Allowing Third Party to Conduct Seismic Operation on Grantor's Lease from the US Legal Forms website. It offers numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. As soon as you are signed up with an account, log in, look for a certain document template, and save it to My Forms or download it to your gadget.

To make things easier, we’ve included an 8-step how-to guide for finding and downloading Seismic Agreement Allowing Third Party to Conduct Seismic Operation on Grantor's Lease quickly:

- Make sure the document meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the suitable subscription to suit your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

Once the Seismic Agreement Allowing Third Party to Conduct Seismic Operation on Grantor's Lease is downloaded you can complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

In real estate, the grantor is the property seller who conveys property to a buyer, or grantee. If there is more than one seller on the deed, then the sellers are co-grantors. In estate planning, the term grantor is most often used with regards to trusts.

The Grantor is any person conveying or encumbering, whom any Lis Pendens, Judgments, Writ of Attachment, or Claims of Separate or Community Property shall be placed on record. The Grantor is the seller (on deeds), or borrower (on mortgages). The Grantor is usually the one who signed the document.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

A grantor trust is a trust in which the individual who creates the trust is the owner of the assets and property for income and estate tax purposes. Grantor trust rules are the rules that apply to different types of trusts. All grantor trusts are revocable living trusts, while the grantor is alive.

Unlike a grantor trust, which is taxed to the grantor, a nongrantor trust is taxed as its own separate taxpaying entity. The trustee of the trust has the trust file its own tax return, Form 1041. On that return goes all the trust's items of income and expense.

A grantor is an individual or other entity that creates a trust (i.e., the individual whose assets are put into the trust) regardless of whether the grantor also functions as the trustee. The grantor may also be referred to as the settlor, trustmaker, or trustor.

Grantors the party who transfers title in real property (seller, giver) to another (buyer, recipient, donee) by grant deed or quitclaim deed. Guarantors a person or entity that agrees to be responsible for another's debt or performance under a contract if the other fails to pay or perform.

A grantor trust is a trust in which the individual who creates the trust is the owner of the assets and property for income and estate tax purposes. Grantor trust rules are the rules that apply to different types of trusts. All grantor trusts are revocable living trusts, while the grantor is alive.