Memorandum of Trust Agreement

Description Memorandum Of Trust Example

How to fill out Memorandum Of Trust Agreement?

When it comes to drafting a legal document, it is better to leave it to the specialists. However, that doesn't mean you yourself can not find a template to utilize. That doesn't mean you yourself can’t get a sample to utilize, however. Download Memorandum of Trust Agreement from the US Legal Forms website. It provides a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. As soon as you’re signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve included an 8-step how-to guide for finding and downloading Memorandum of Trust Agreement promptly:

- Be sure the form meets all the necessary state requirements.

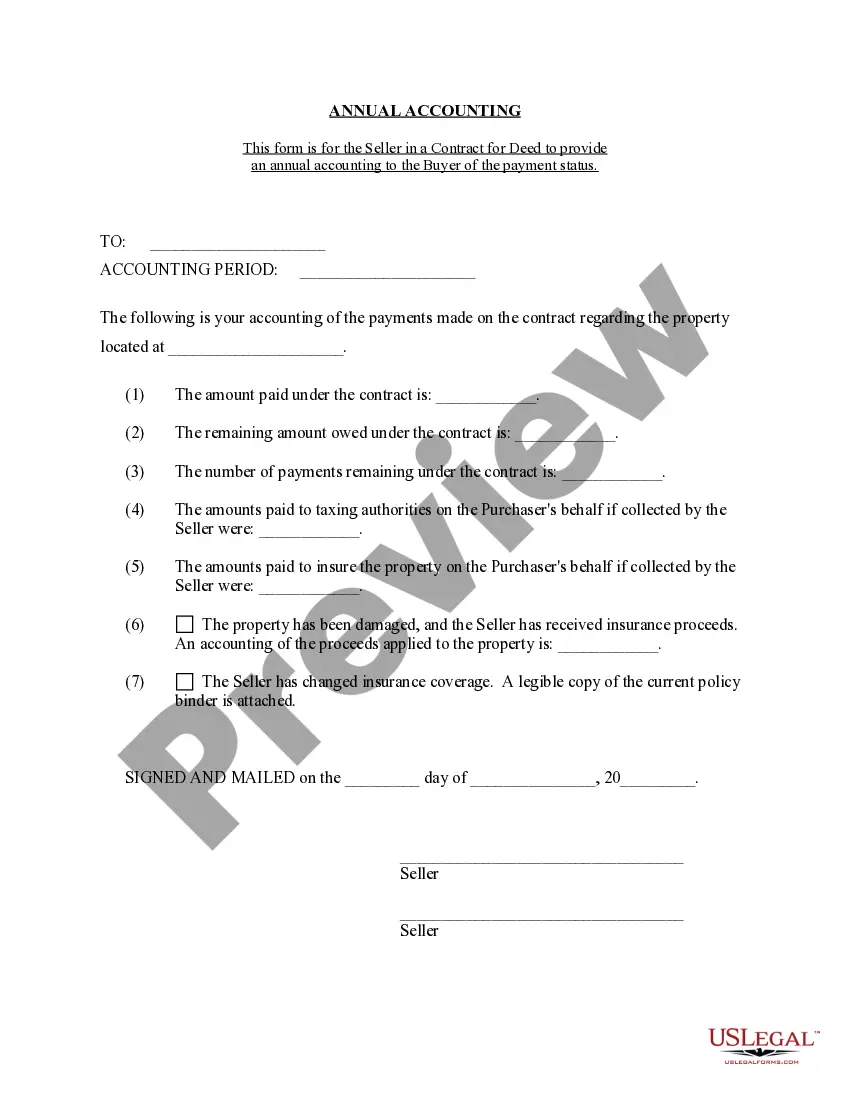

- If available preview it and read the description before buying it.

- Hit Buy Now.

- Select the suitable subscription for your needs.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the file.

Once the Memorandum of Trust Agreement is downloaded you can complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!

Memorandum Of Trust Sample Form popularity

FAQ

When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

Under O.R.C. 5301.255, the memorandum of trust is a document that certifies a trustee has the authority to act on behalf of an existing trust. The trustee is the person or entity who holds title to a trust's assets on behalf of a settlor.

A Memorandum of Trust is a synopsis of a trust that is used when transferring real property into a trust. It's then recorded in county in which the property is owned. The Memorandum of Trust is used in place of the actual trust to identify the grantor and trustees as well as the basic details of the trust.

An estate plan that includes a trust costs $1,000 to $3,000, versus $300 or less for a simple will. What a living-trust promoter may not tell you: You don't need a trust to protect assets from probate. You can arrange for most of your valuable assets to go to your heirs outside of probate.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

List Your Assets and Decide Which You'll Include in the Trust. Gather the Paperwork. Decide Whether You Will Be the Sole Grantor. Choose Beneficiaries. Choose a Successor Trustee. Choose Someone to Manage Property for Minor Children. Prepare the Trust Document. Sign and Notarize.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.