Acquisition Checklist

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Acquisition Checklist?

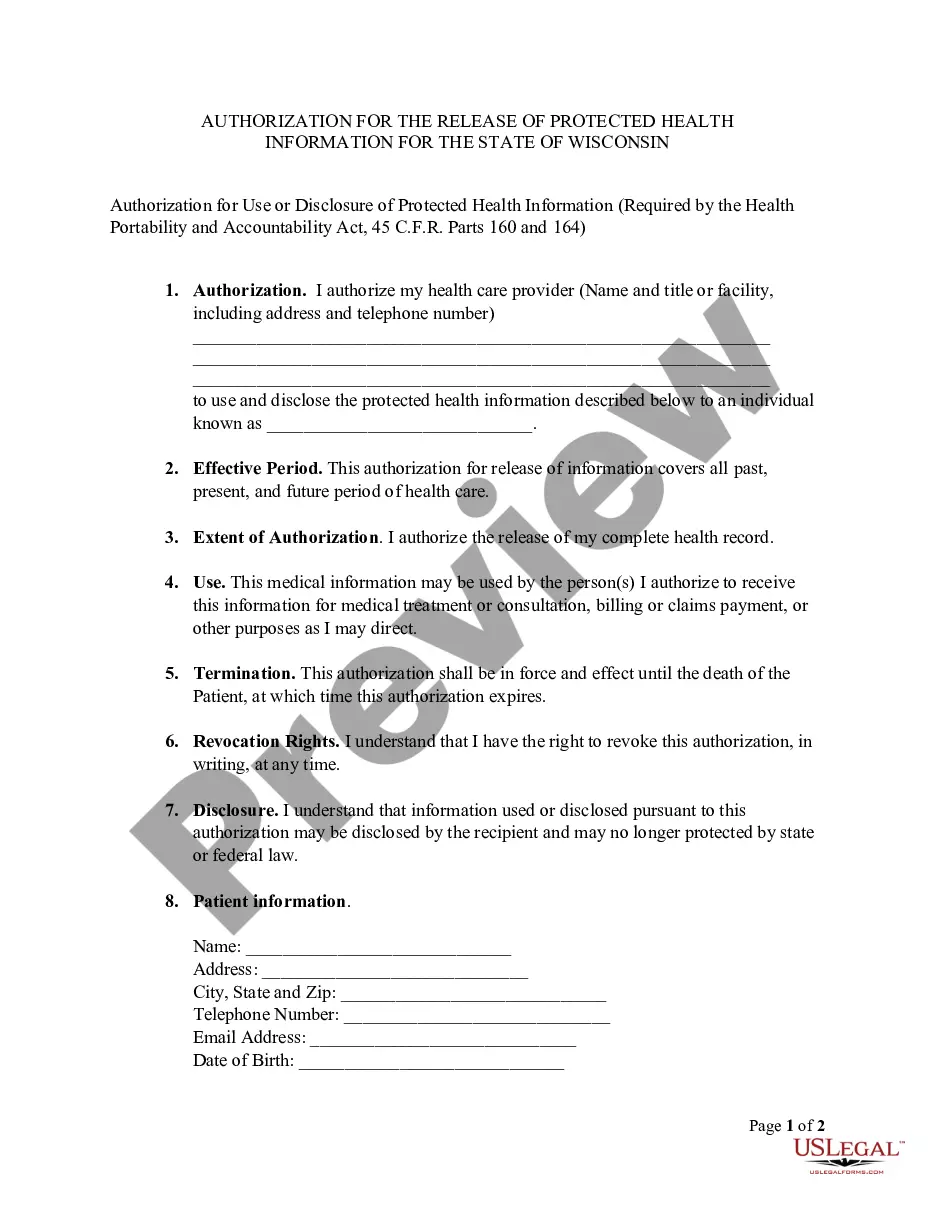

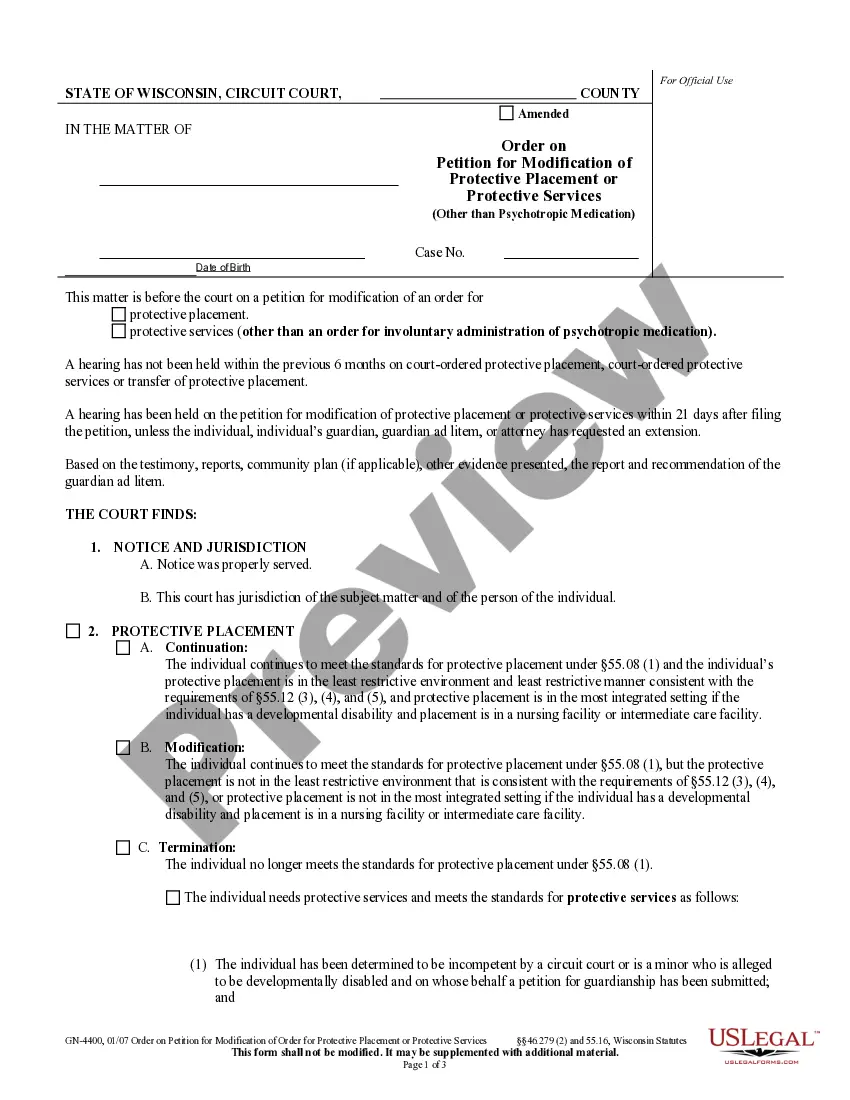

When it comes to drafting a legal form, it is better to delegate it to the experts. However, that doesn't mean you yourself can’t get a template to utilize. That doesn't mean you yourself cannot find a sample to use, nevertheless. Download Acquisition Checklist from the US Legal Forms site. It offers numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. As soon as you are signed up with an account, log in, search for a certain document template, and save it to My Forms or download it to your gadget.

To make things easier, we’ve included an 8-step how-to guide for finding and downloading Acquisition Checklist fast:

- Be sure the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Press Buy Now.

- Select the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the document.

Once the Acquisition Checklist is downloaded you are able to fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

A due diligence checklist is an organized way to analyze a company that you are acquiring through sale, merger, or another method. By following this checklist, you can learn about a company's assets, liabilities, contracts, benefits, and potential problems.

Look at the rationale behind the acquisition. Study what you're acquiring. Have a third party as a mediator. Manage expectations well. Get to know the team management. Have a proper integration plan. Focus on human capital. Impact on financials.

Even though each M&A deal is usually unique, they all consist of a single or combination of the three rudimentary acquisition structures: asset purchase, the merger of companies, or stock sale. Stock sale transactions consist of purchasing the whole business entity, including future loans, liabilities, and receivables.

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

A merger or acquisition transaction is the combination of two companies into one resulting in either one corporate entity or a parent-holding and subsidiary company structure.In a reverse merger or a reverse triangular merger, the target company shareholders and management gain control of the acquiring company.

Definitive acquisition agreement It will include definition, structure of the transaction, the price and other financial terms, details of stock issue and closing conditions. It will also include the general obligation to sell, as well as any conditions related to continuation of employment.

Communication. As in most aspects of business, communication is a vital key to ensuring your merger or acquisition goes smoothly and is the right move for both companies. Win-Win. The merger or acquisition needs to be a win-win for both companies. Shared Vision/New Identity. Well-Planned. Integration.

Target Company Overview. Understanding why the owners of the company are selling the business Financials. Technology/Patents. Strategic Fit. Target Base. Management/Workforce. Legal Issues. Information Technology.

1 The business can survive despite itself. 2 It's a cash flow business. 3 It provides a consumer staple product or service. 4 It has terrible or no sales and marketing expertise. 5 A competent manager is in charge. 6 There is potential upside that can be realised quickly. 7 It's a bargain.