Sub-Operating Agreement

Description

How to fill out Sub-Operating Agreement?

When it comes to drafting a legal document, it’s better to delegate it to the experts. However, that doesn't mean you yourself cannot get a sample to utilize. That doesn't mean you yourself can not get a sample to use, however. Download Sub-Operating Agreement straight from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. When you are registered with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things easier, we’ve included an 8-step how-to guide for finding and downloading Sub-Operating Agreement promptly:

- Make confident the form meets all the necessary state requirements.

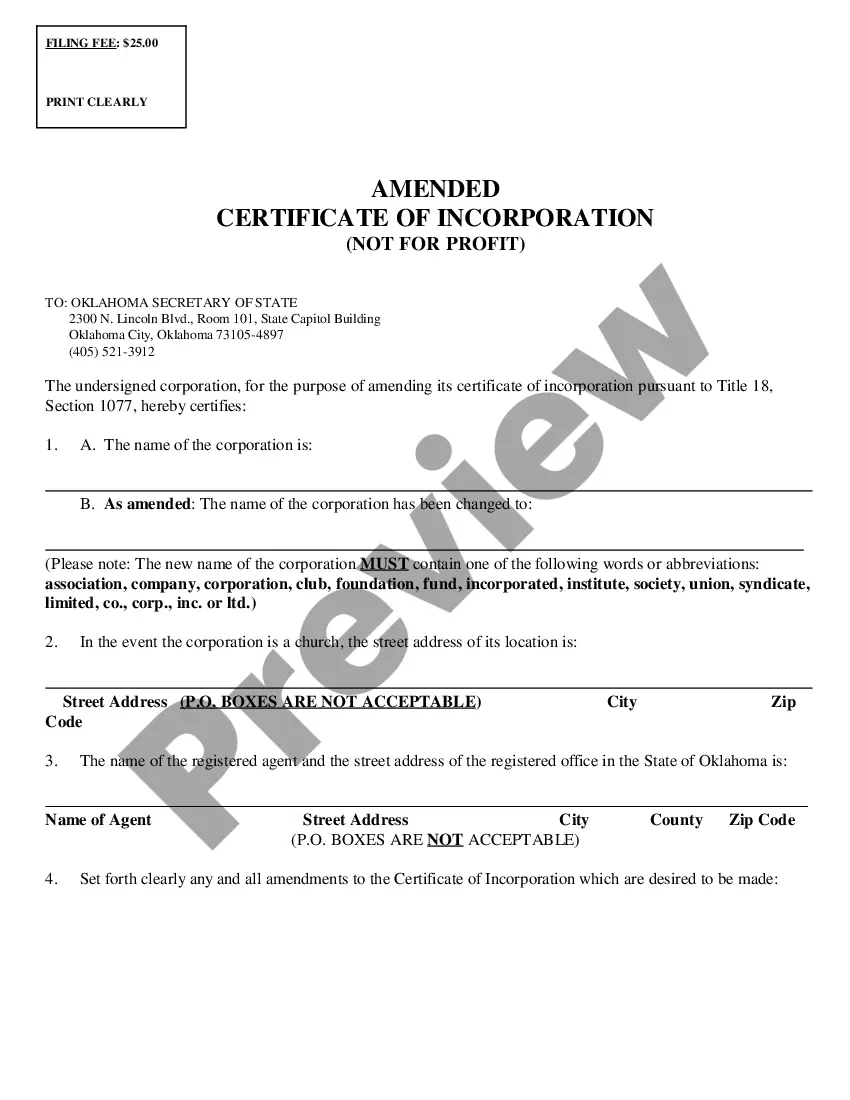

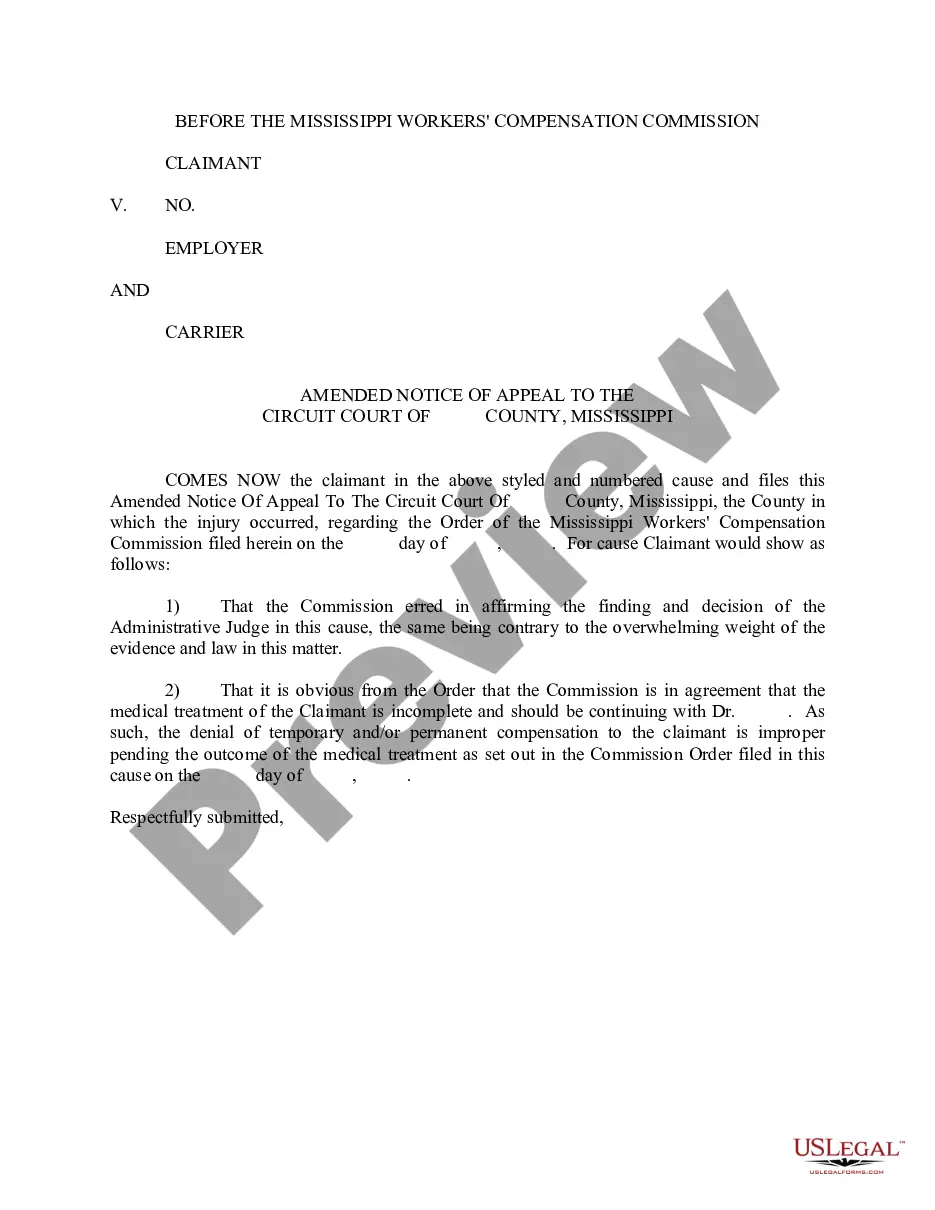

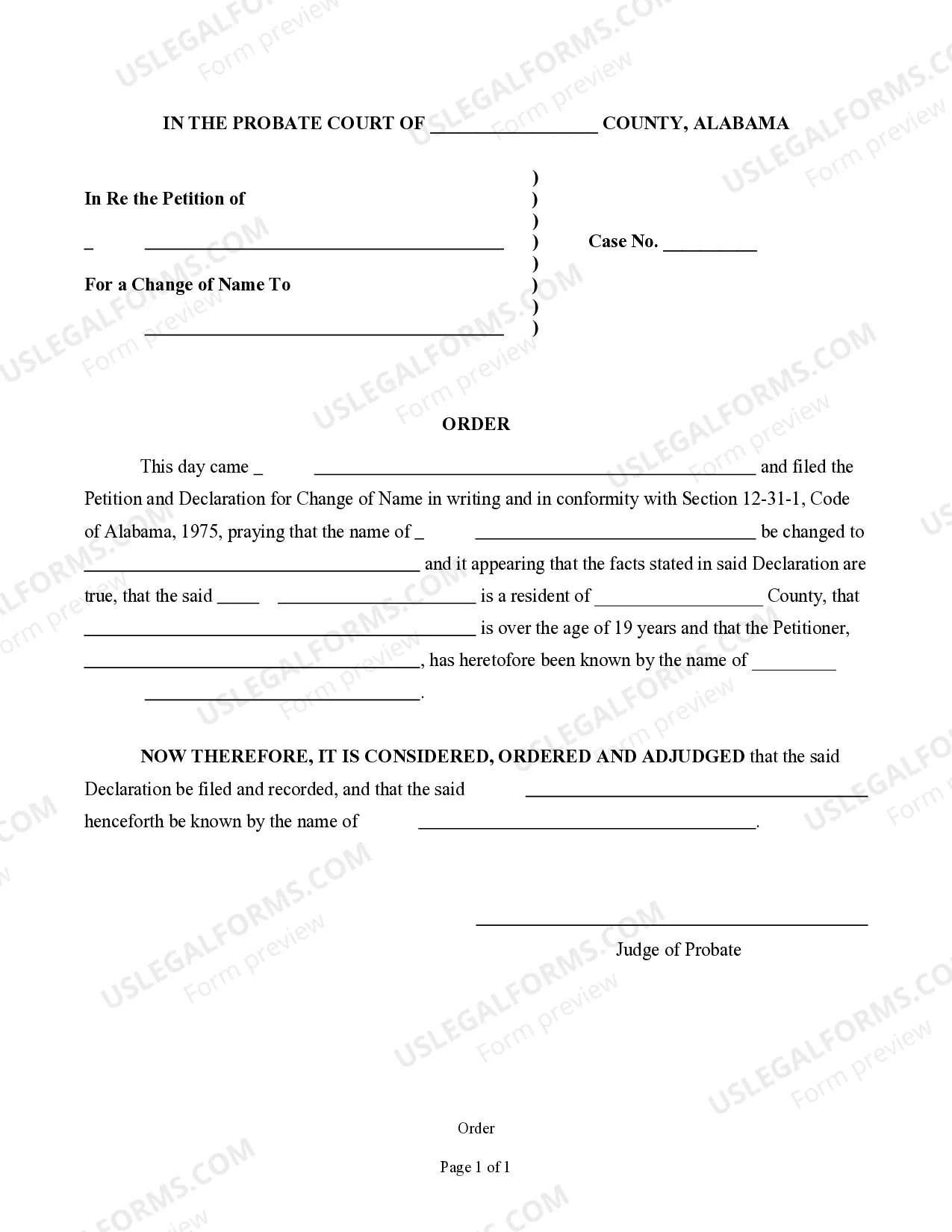

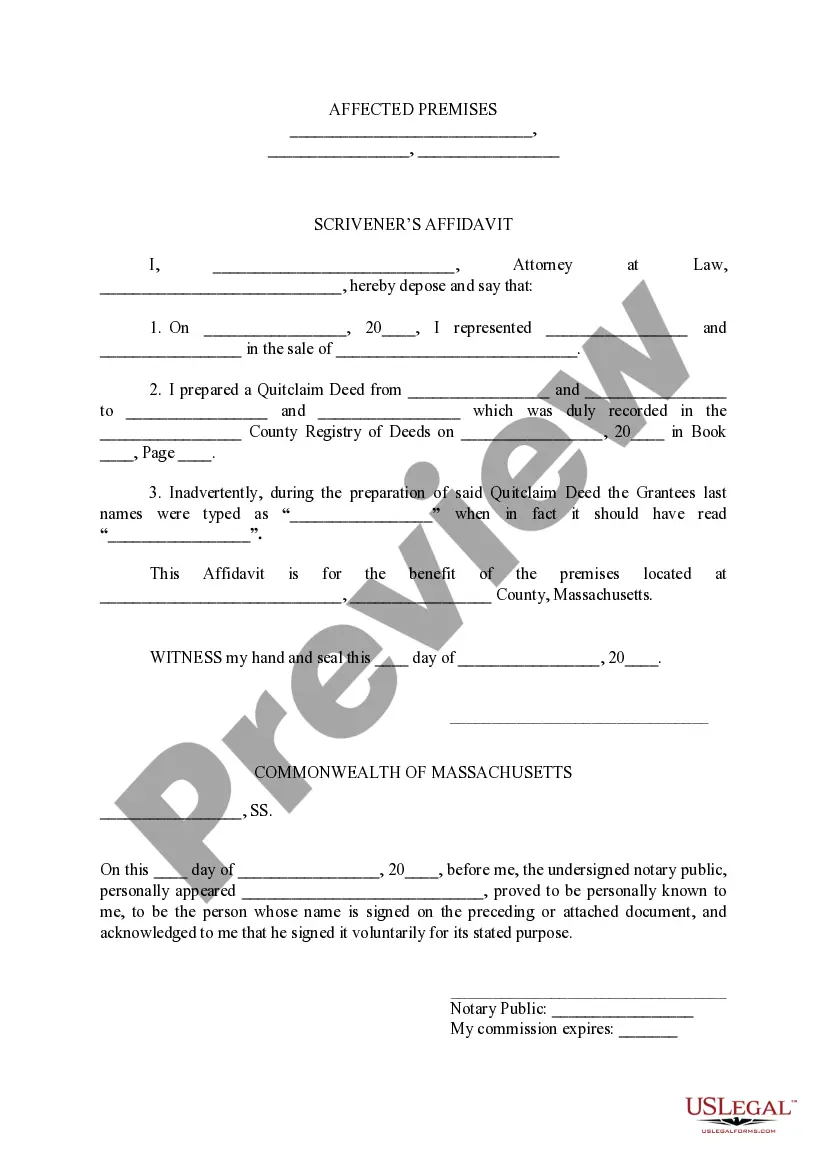

- If available preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the suitable subscription to suit your needs.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

Once the Sub-Operating Agreement is downloaded you are able to fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

If the single-member LLC is owned by a corporation or partnership, the LLC should be reflected on its owner's federal tax return as a division of the corporation or partnership.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

An LLC is a special entity recognized under state law that is neither a sole proprietorship nor a partnership nor a corporation.A subsidiary is a company owned by another company, the parent LLC. The parent LLC owns at least 50% of the voting stock of the subsidiary.

An operating agreement (bylaws) is an internal document that defines how the business owners professionally relate to each other, whereas the articles of incorporation (certificate of formation) is a public document that legally establishes a business as a corporation.

What's the difference in bylaws vs operating agreement? Bylaws are internal governing documents for corporations, while an operating agreement lays out internal operating procedures for an LLC.

Are you wondering, can an LLC have subsidiaries? An LLC can have subsidiaries. Parent companies (also known as holding companies or umbrella companies) are usually formed as corporations. They own a large (controlling) amount of interest in a different company, which is called its subsidiary.

Yes. There are two ways in which an LLC may own another LLC: An LLC may own multiple, single-member LLCsthis is called a holding company structure; or. An LLC may serve as the master entity and own a series of LLC cells, should state statute offer this option.

A limited liability company (LLC) is not required to have bylaws. Bylaws, which are only relevant to businesses structured as corporations, include rules and regulations that govern a corporation's internal management.Alternatively, LLCs create operating agreements to provide a framework for their businesses.

Single-member LLC are changes in ownership of the interests transferred, unless the transfers are excluded under a specific statutory provision.