Assignment of After Payout Interest

Description

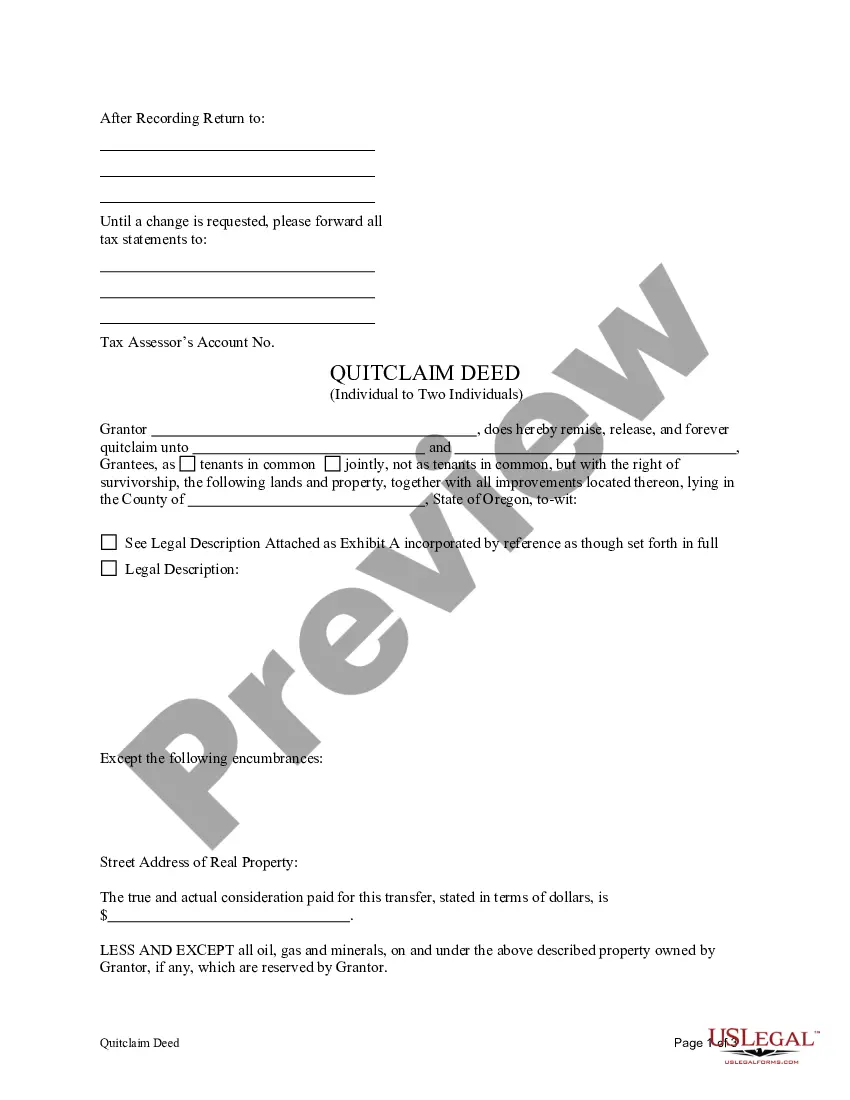

How to fill out Assignment Of After Payout Interest?

When it comes to drafting a legal document, it’s better to delegate it to the experts. Nevertheless, that doesn't mean you yourself can’t find a template to use. That doesn't mean you yourself cannot get a template to use, nevertheless. Download Assignment of After Payout Interest right from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. After you’re signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your device.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Assignment of After Payout Interest fast:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Select the suitable subscription to suit your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the Assignment of After Payout Interest is downloaded you may fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment of interest is a transfer of a limited liability company (LLC) owner's interest in the LLC. The most common reasons for an LLC owner to transfer their interest in an LLC are to leave the LLC, to pay off a debt, or to secure a loan.

The two types of assignment are Collateral (partial), and Absolute (entire face amount).

The assignor normally remains liable unless there is an agreement to the contrary by the other party to the contract.No specific language is required to create an assignment so long as the assignor makes clear his/her intent to assign identified contractual rights to the assignee.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

An absolute assignment is typically intended to transfer all your interests, rights and ownership in the policy to an assignee. A collateral assignment is a more limited type of transfer.

A corrective assignment corrects or amends a defect or mistake in the original assignment.When the lender assigns a mortgage to MERS, MERS does not actually receive ownership of the note or mortgage agreement. Instead, MERS tracks the mortgage as the mortgage is assigned from bank to bank.

Definition of "Assignment of Mortgage" The act of transferring a mortgage from one party to another is called assignment of mortgage.