This is a form of a Partial Release of Judgment Lien.

Partial Release of Judgment Lien

Description Partial Release Form

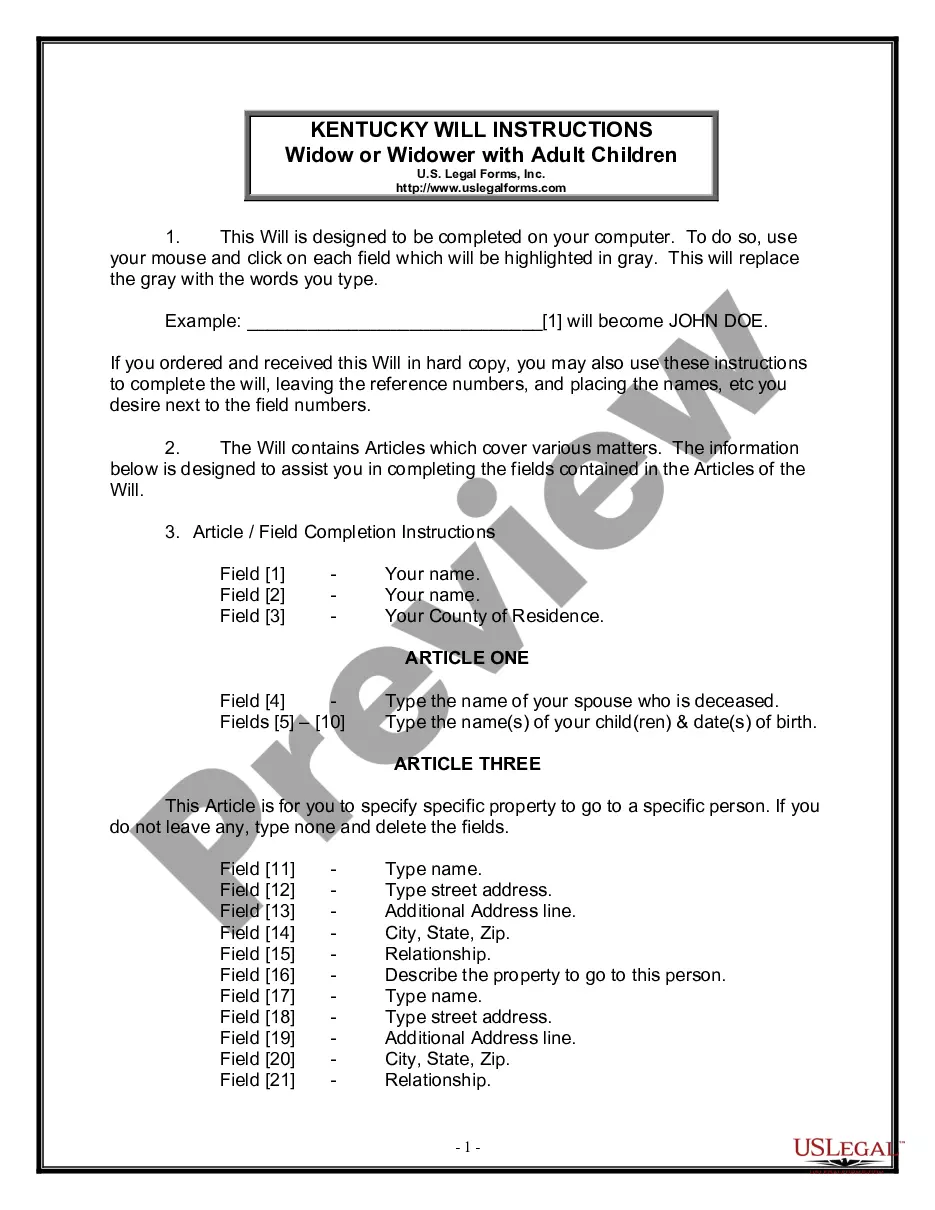

How to fill out Release Of Judgement Letter?

When it comes to drafting a legal form, it’s better to leave it to the experts. However, that doesn't mean you yourself cannot get a sample to use. That doesn't mean you yourself can’t get a sample to use, nevertheless. Download Partial Release of Judgment Lien right from the US Legal Forms website. It offers numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. Once you are registered with an account, log in, search for a particular document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve provided an 8-step how-to guide for finding and downloading Partial Release of Judgment Lien fast:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Click Buy Now.

- Select the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by credit/bank card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

When the Partial Release of Judgment Lien is downloaded you can complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Partial Lien Release Template Form popularity

Partial Release Statement Other Form Names

What Is Lien Release Letter FAQ

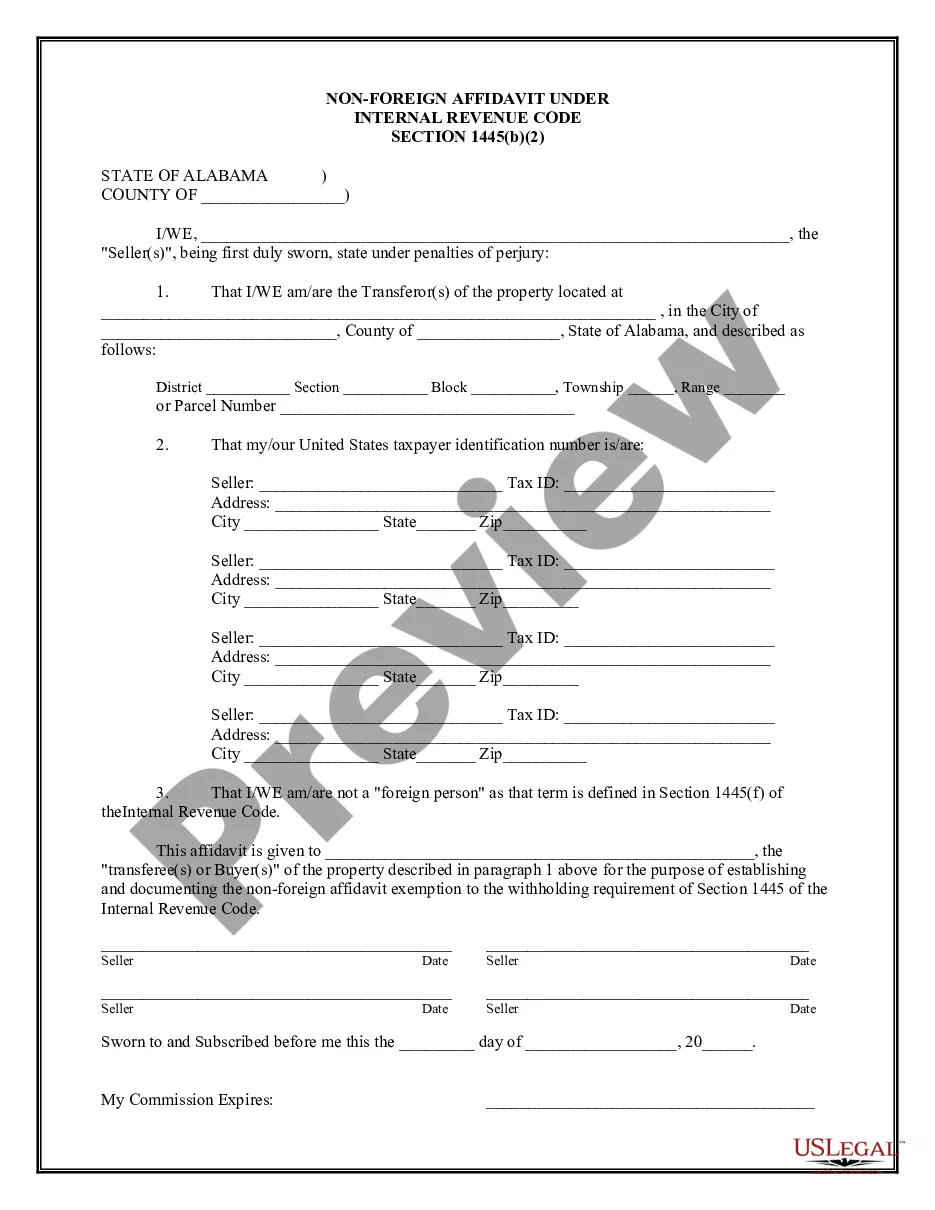

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

The debtor must get a discharge or release of the abstract of judgment to remove the lien from the home. Contact the judgment creditor shown on the abstract. Arrange to pay the debt in full or negotiate payments. Ask the creditor for a discharge if paying in full.

Key Takeaways. A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

There are a few ways you can satisfy or avoid a lien altogether. The firstand most obviousoption is to repay the debt. If you pay off your obligation, the creditor will remove the lien. This is done by filing a release through the same place the lien was recordedthe county or state.