Release of Surface Damages For Pipeline Easement

Description

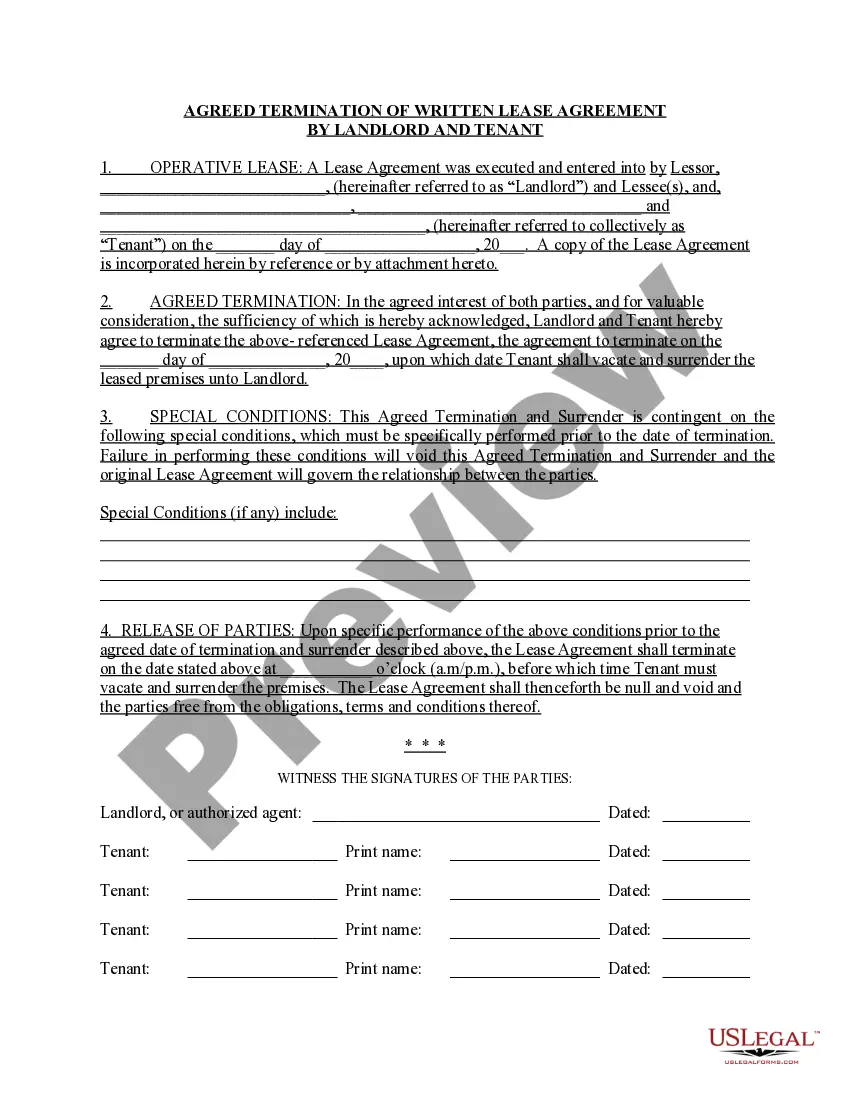

How to fill out Release Of Surface Damages For Pipeline Easement?

When it comes to drafting a legal document, it is easier to leave it to the experts. However, that doesn't mean you yourself can not find a template to use. That doesn't mean you yourself can not find a template to utilize, however. Download Release of Surface Damages For Pipeline Easement from the US Legal Forms website. It gives you numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. After you are signed up with an account, log in, search for a specific document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Release of Surface Damages For Pipeline Easement promptly:

- Make sure the form meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Hit Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by debit/visa or mastercard.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

As soon as the Release of Surface Damages For Pipeline Easement is downloaded you may complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Background on perpetual easementsEasements are treated as a recovery of the basis of the property first, with any excess proceeds treated as capital gain, which is taxed at a lower rate than ordinary income. The basis of property that offsets an easement is limited to the basis of the affected acres or square footage.

You don't usually report payment for an easement or damages. You only reduce your cost basis in the remaining property, by the amount you received, for when the property is sold in the future. But,if you got the 1099-S, it must be reported on your tax return, but it is most likely not taxable.

Easements and right-of-way payments, even if they are labeled as a lease, do receive sales treatment. Keep in mind: Easements are treated as a recovery of the basis of the property first, with any excess proceeds treated as capital gain, which is taxed at a lower rate than ordinary income.

How much money should landowners get when an oil or gas pipeline crosses their land? As it stands, landowners receive a one-time payment roughly based on the length of the pipeline, with rates varying from $5 to $50 per foot or more for a Marcellus or Utica shale pipeline right-of-way agreement.

How much money should landowners get when an oil or gas pipeline crosses their land? As it stands, landowners receive a one-time payment roughly based on the length of the pipeline, with rates varying from $5 to $50 per foot or more for a Marcellus or Utica shale pipeline right-of-way agreement.

Pipelines can reduce property values by 5 to 40 percent, according to Realtors.Pipelines can reduce property values by 5 to 40 percent by making them less attractive to potential buyers, according to local Realtors.

No, your compensation and damages settlement payment or award is not taxable.

If an easement is 50 rods long, that is almost an acre. In a recent case, a pipeline company paid some owners $180 per rod and others $767 per rod for the same project.