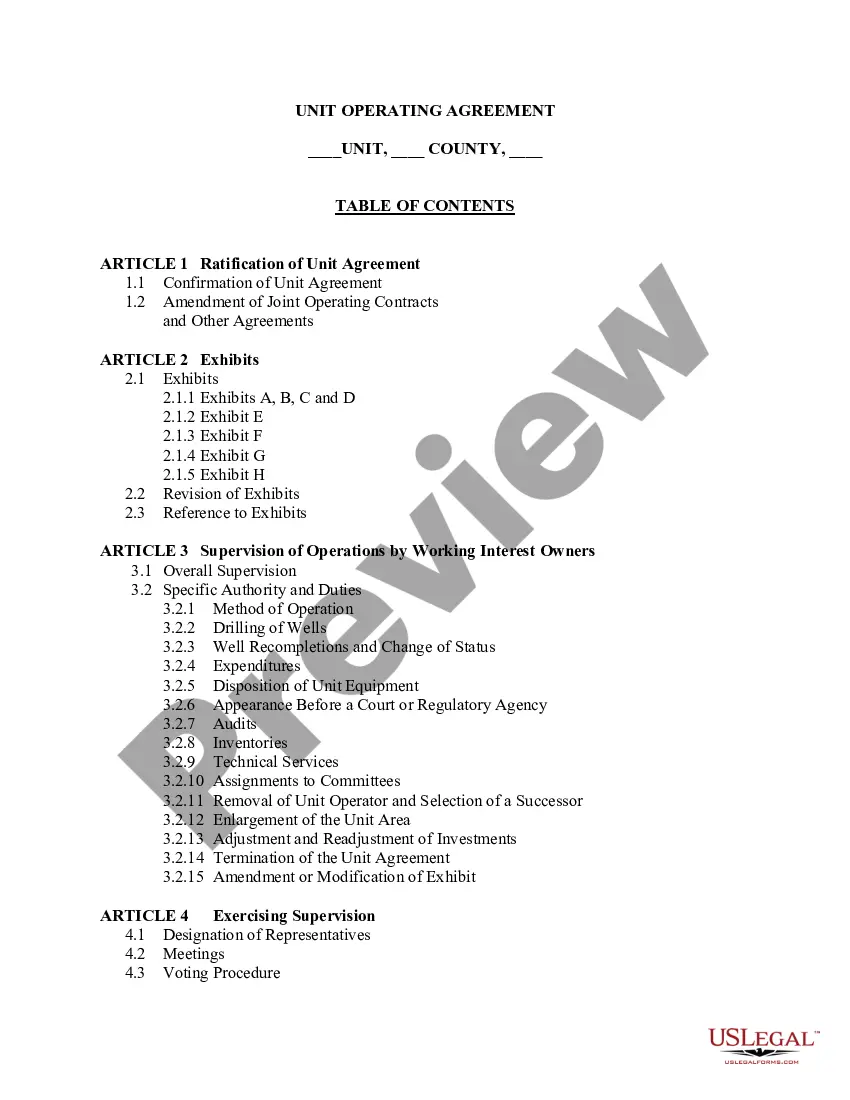

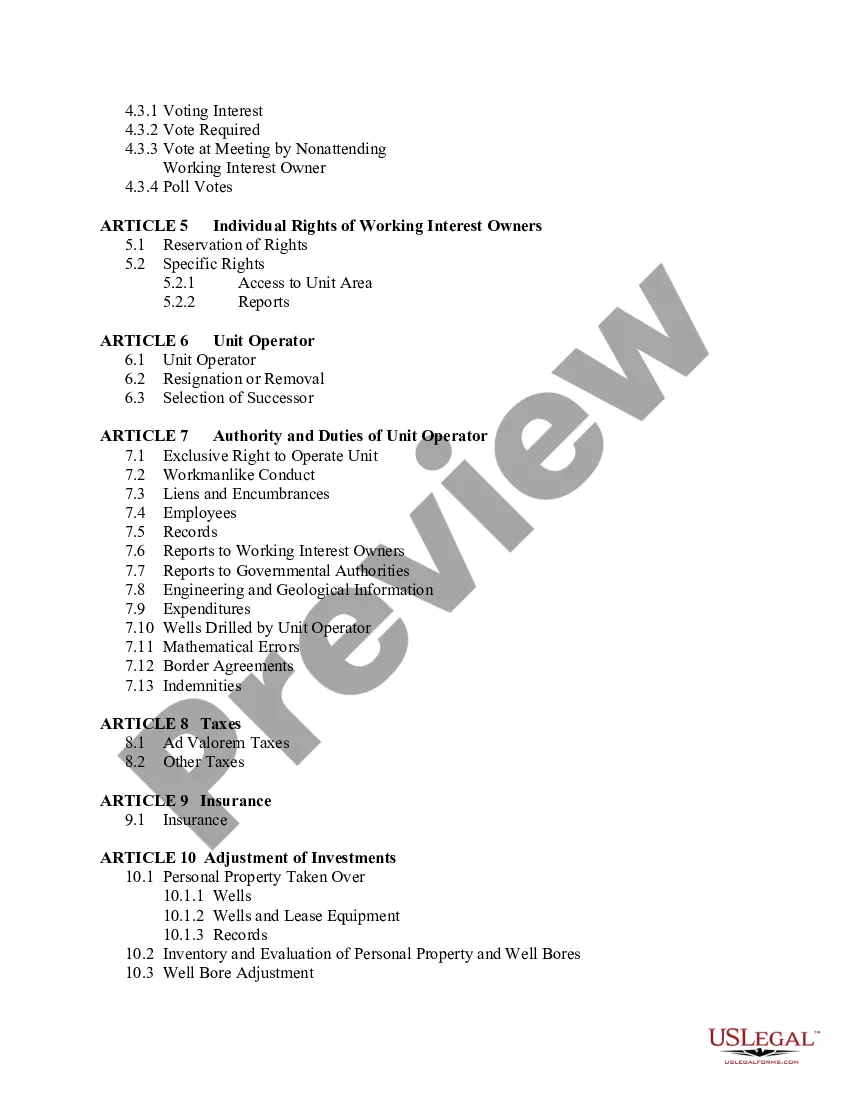

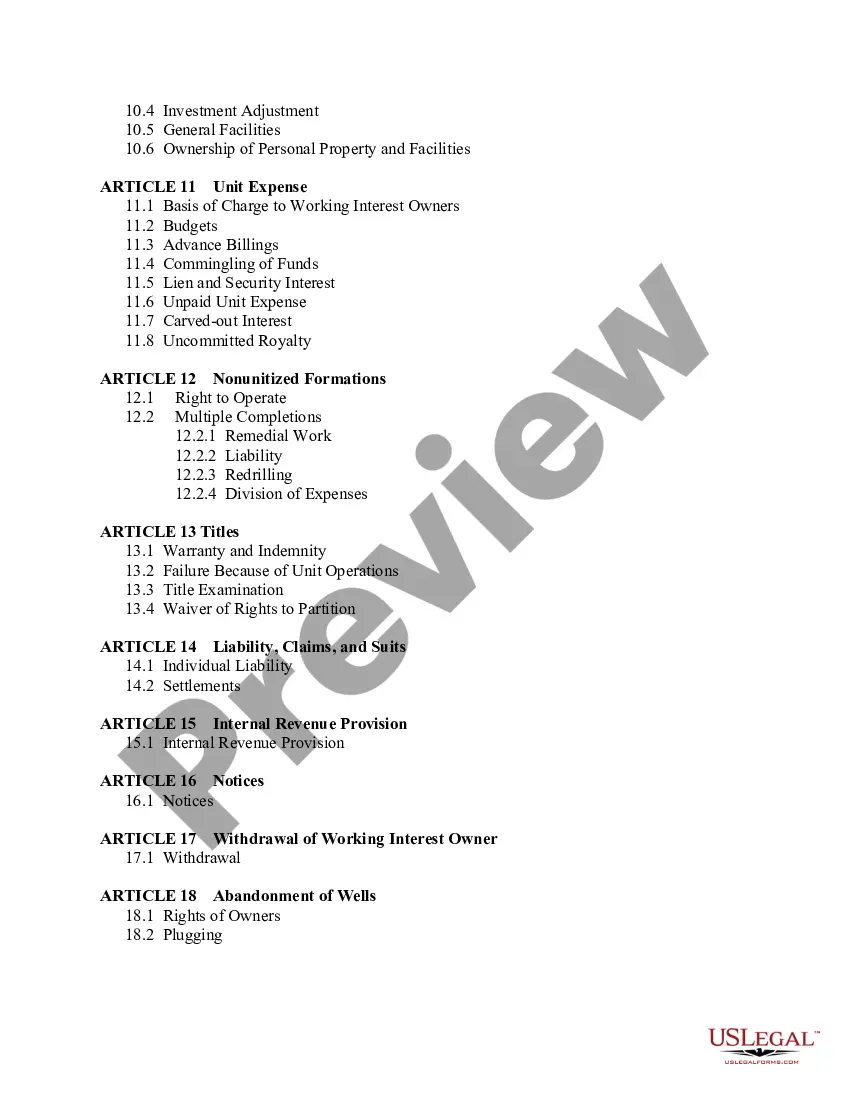

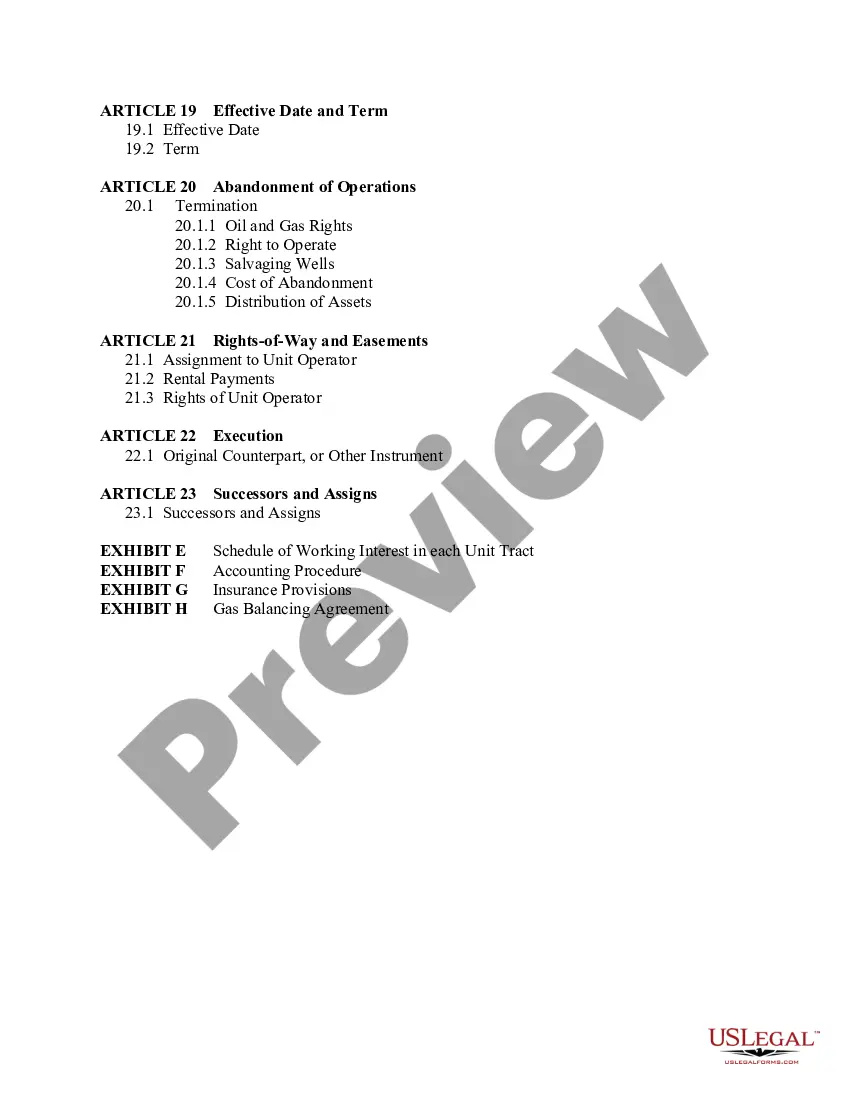

Unit Operating Agreement

Description

How to fill out Unit Operating Agreement?

When it comes to drafting a legal document, it is better to leave it to the professionals. However, that doesn't mean you yourself cannot find a template to utilize. That doesn't mean you yourself cannot get a sample to use, nevertheless. Download Unit Operating Agreement straight from the US Legal Forms web site. It offers numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. When you’re registered with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things less difficult, we have incorporated an 8-step how-to guide for finding and downloading Unit Operating Agreement promptly:

- Be sure the document meets all the necessary state requirements.

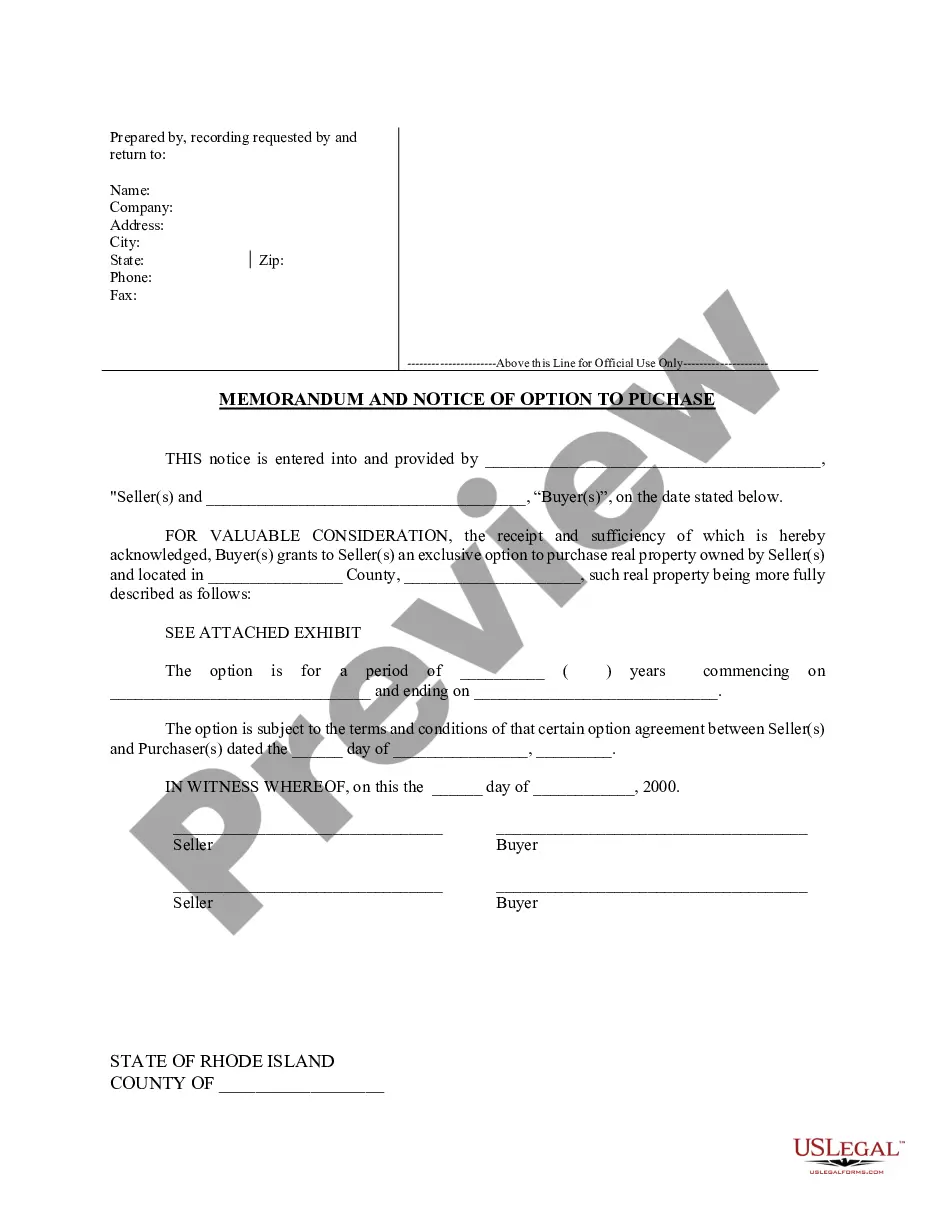

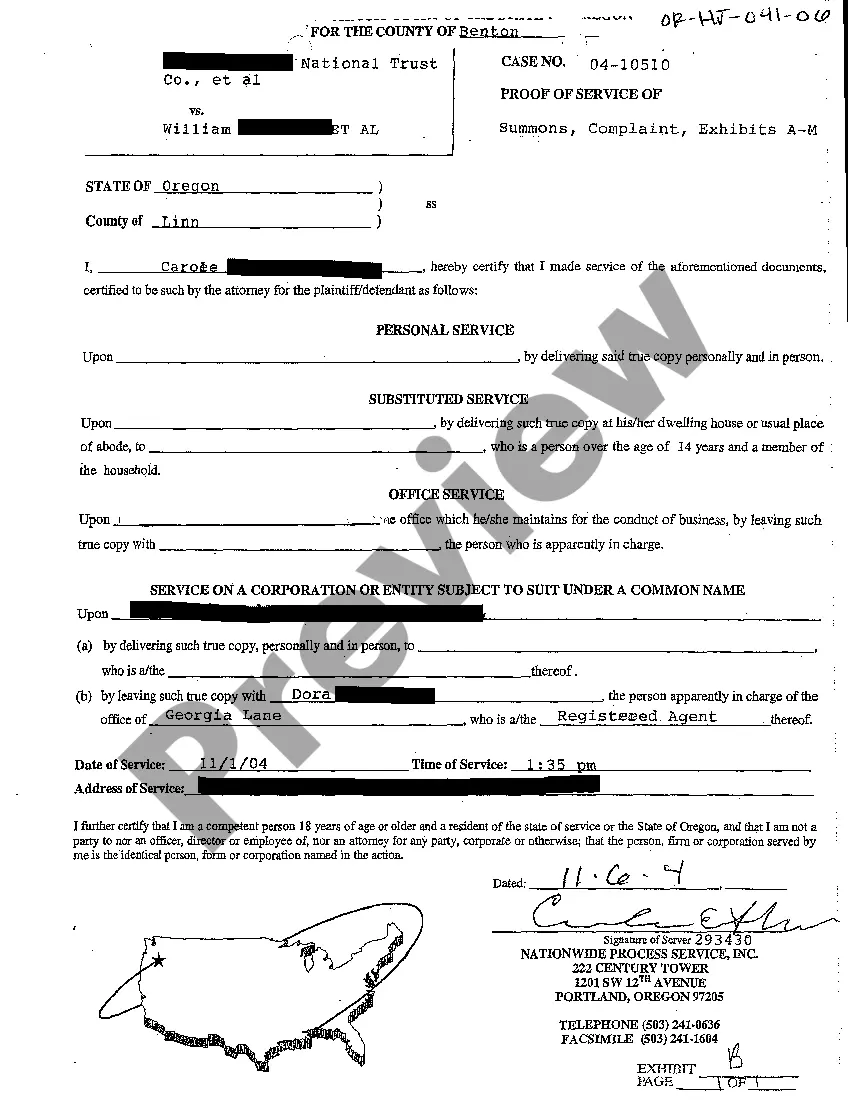

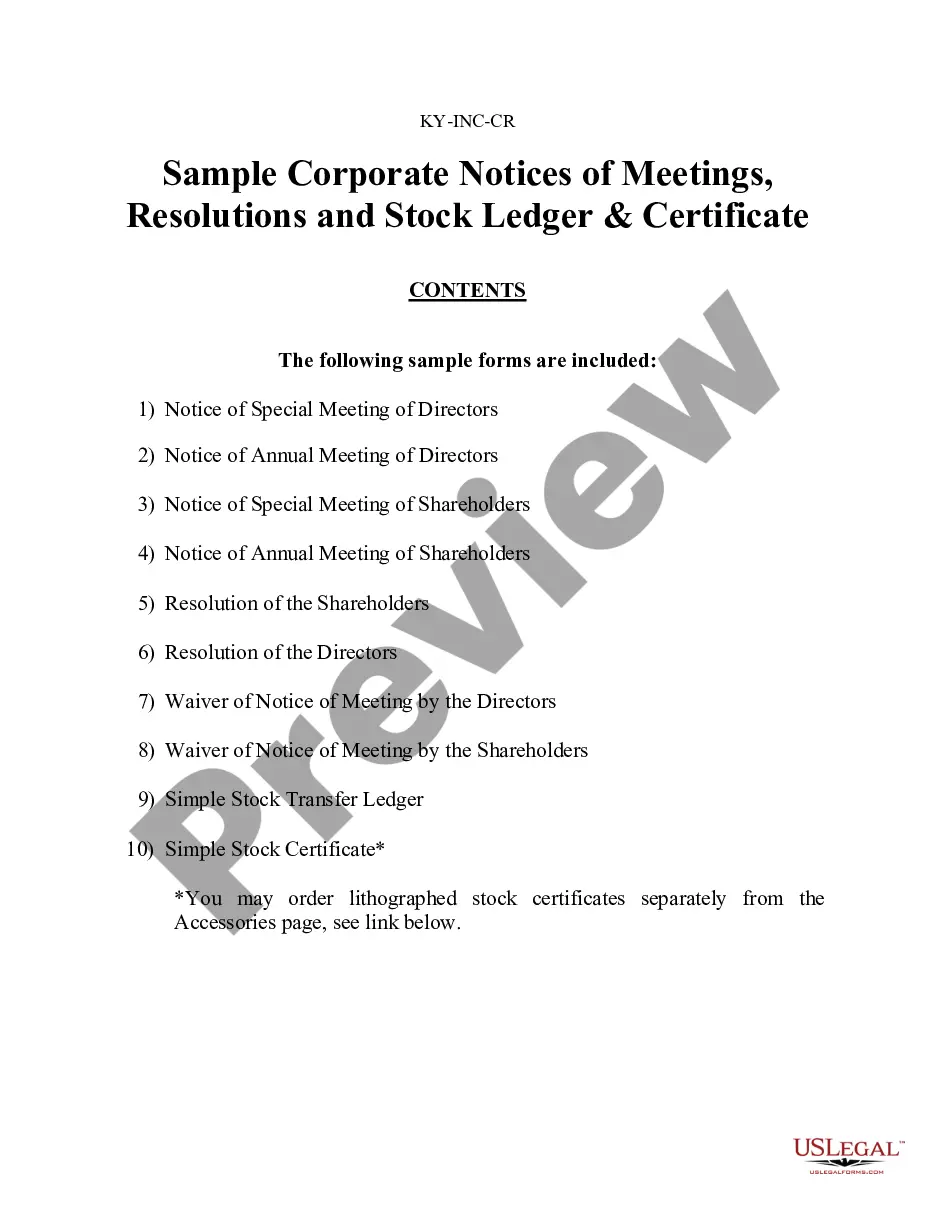

- If available preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the suitable subscription to suit your needs.

- Make your account.

- Pay via PayPal or by debit/visa or mastercard.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

Once the Unit Operating Agreement is downloaded it is possible to complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.However, a written operating agreement defines in writing how the LLC is run.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

You can use online services to create an operating agreement, but you are better served by getting the help of an attorney. Your attorney can make sure all the relevant clauses are included, and he or she can tailor the document to the requirements of your state.

No. Though California law requires you to have an Operating Agreement for your LLC, it doesn't require you to file it anywhere. Your California Operating Agreement is an internal document.This means that your business address will be posted on the California Secretary of State's website, exposing your privacy.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

The operating agreement outlines who owns the LLC and what percentage of ownership each party has. Most of the time the members of an LLC will own a percentage relative to the contribution they made to the formation of the business, such as cash investments, but you can divide up ownership however you like.