Employee Agreement Incentive Compensation and Stock Bonus

Description

How to fill out Employee Agreement Incentive Compensation And Stock Bonus?

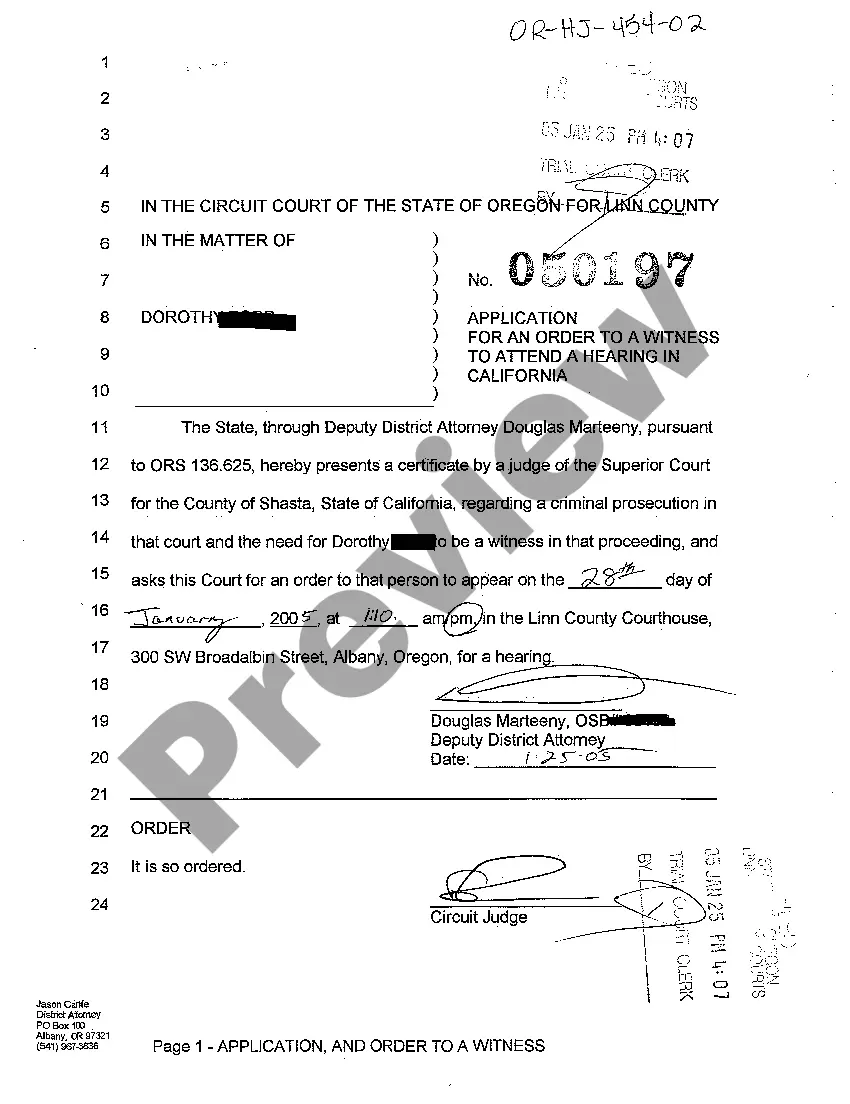

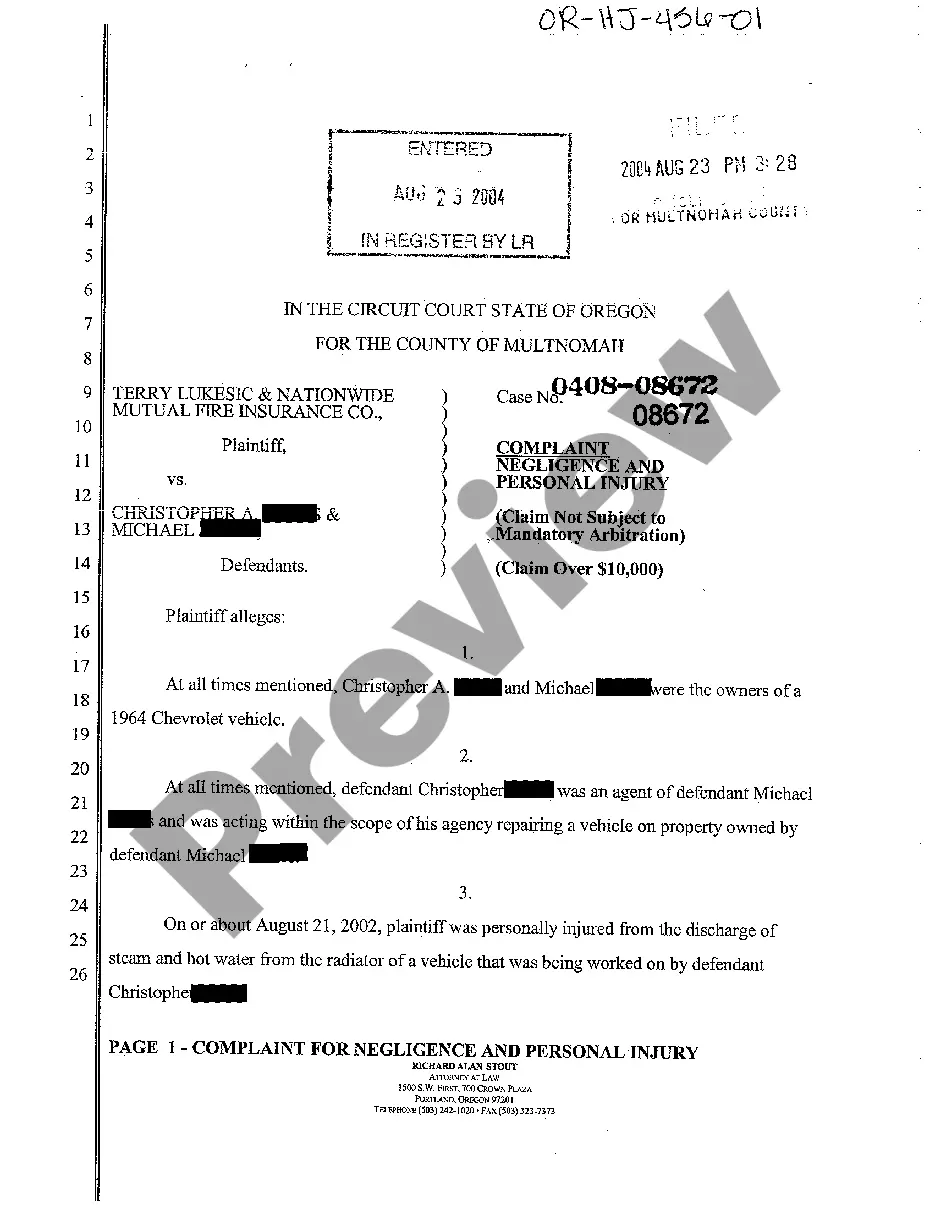

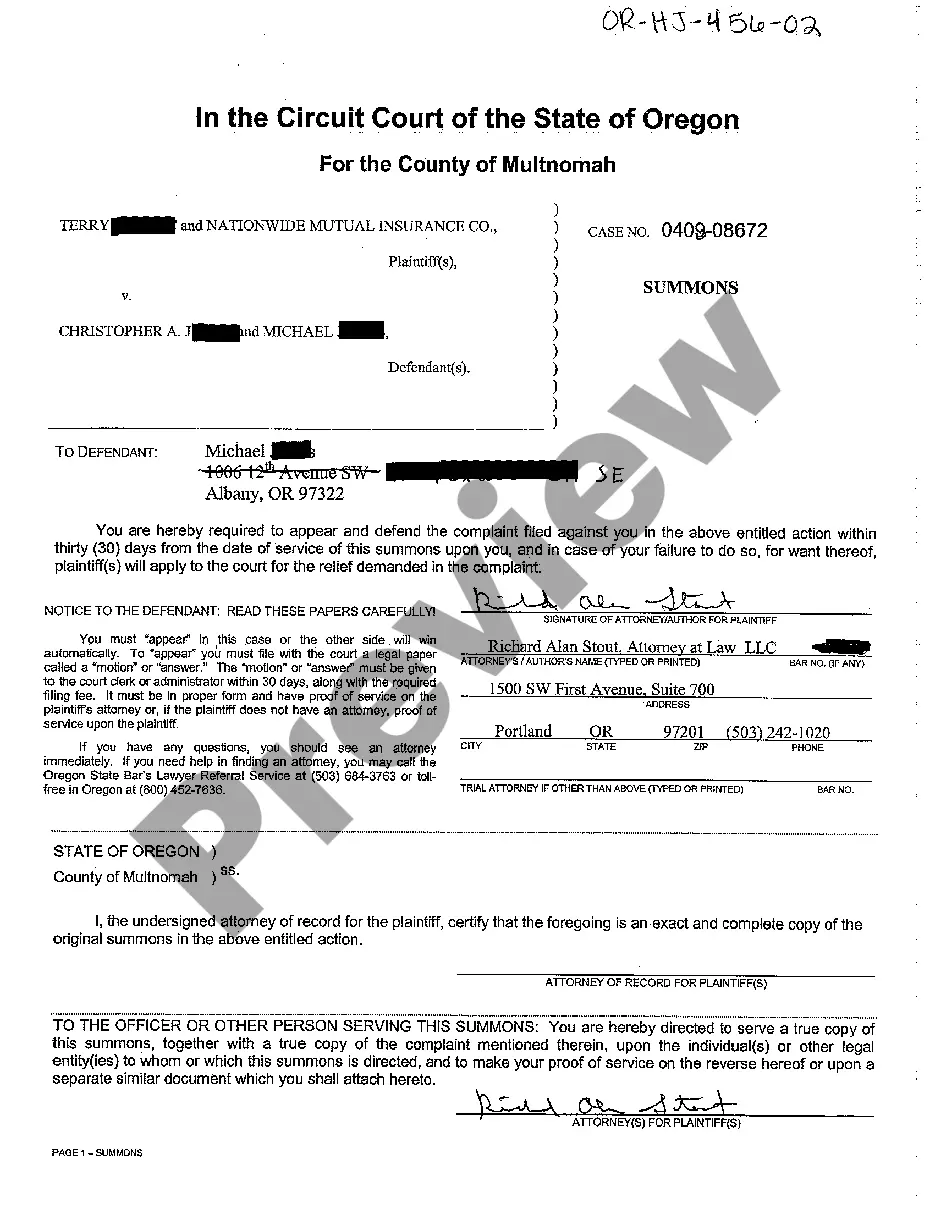

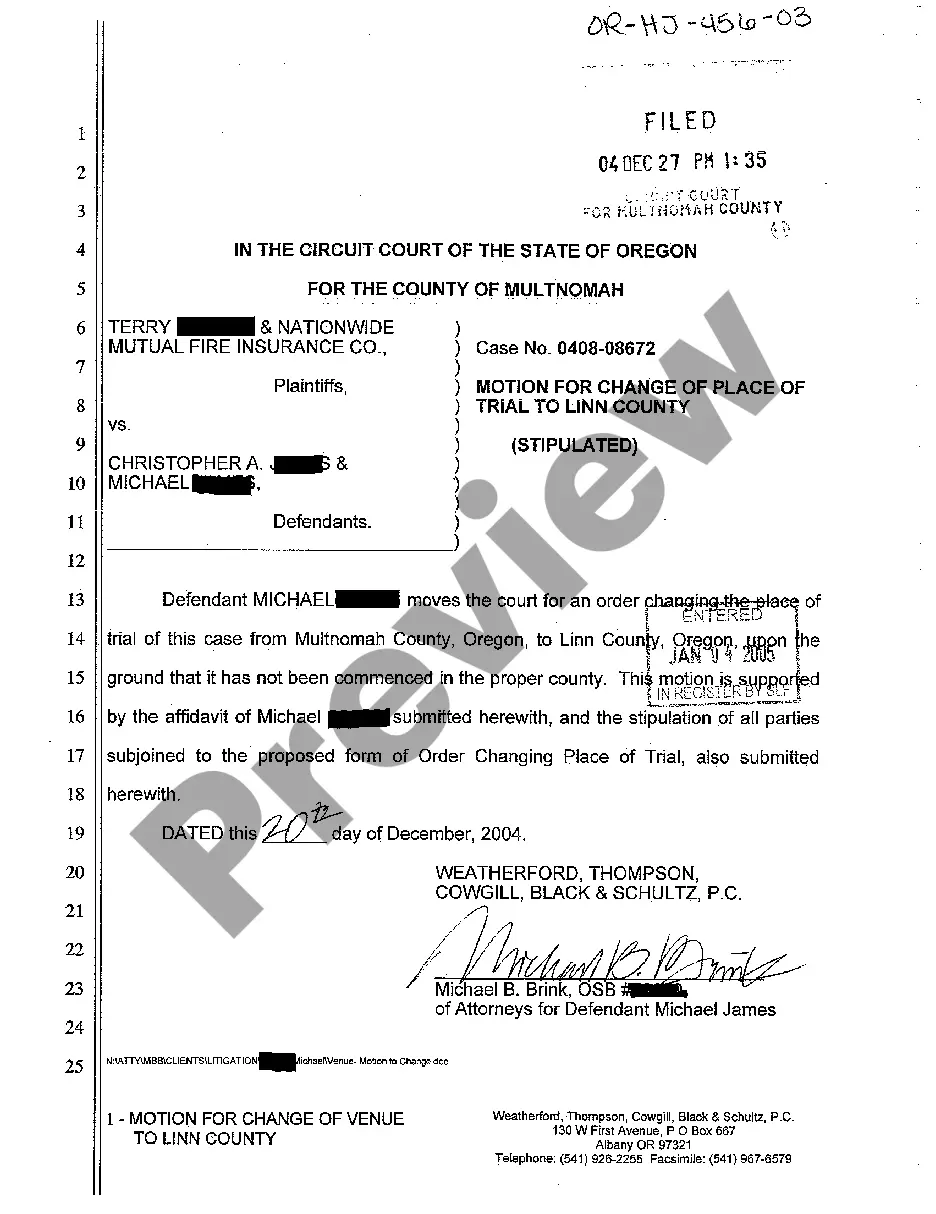

When it comes to drafting a legal form, it’s better to delegate it to the professionals. Nevertheless, that doesn't mean you yourself cannot find a sample to utilize. That doesn't mean you yourself can not get a sample to utilize, nevertheless. Download Employee Agreement Incentive Compensation and Stock Bonus right from the US Legal Forms site. It gives you numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. After you’re registered with an account, log in, search for a specific document template, and save it to My Forms or download it to your device.

To make things easier, we’ve incorporated an 8-step how-to guide for finding and downloading Employee Agreement Incentive Compensation and Stock Bonus fast:

- Make sure the form meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Press Buy Now.

- Select the suitable subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

As soon as the Employee Agreement Incentive Compensation and Stock Bonus is downloaded you are able to complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

A company sets aside a predetermined amount; a typical bonus percentage would be 2.5 and 7.5 percent of payroll but sometimes as high as 15 percent, as a bonus on top of base salary. Such bonuses depend on company profits, either the entire company's profitability or from a given line of business.

An example of incentive is extra money offered to those employees who work extra hours on a project. Incentive is defined as something that encourages someone to do something or work harder. An example of incentive is an ice cold beer at the end of a long bike ride.

Incentive plans are methods in which employees of an organization are kept motivated for the work that they do, and are given incentives on reaching or accomplishing certain organization goals.It usually comprises of incentives like profit sharing, project bonuses, stock options, sales commission etc.

Incentive: Additional pay (above and beyond the base salary or wage) awarded to an employee, such as stock options or a contingent bonus plan, that is 'forward looking'. Bonus: Plans that award cash or other items of value, such as stock (or stock options), based on accomplishments achieved.

Know how much money you have available for the bonus plan. Base the plan on quantifiable, measurable results. Consider setting tiered goals so that employees can reach different bonus levels by achieving more difficult goals. Put your bonus plan in writing.

A good bonus percentage for an office position is 10-20% of the base salary. Some Manager and Executive positions may offer a higher cash bonus, however this is less common. Some employers will not offer a cash bonus, and will offer a higher salary or other compensation like stock options instead.

What is a Good Bonus Percentage? A good bonus percentage for an office position is 10-20% of the base salary. Some Manager and Executive positions may offer a higher cash bonus, however this is less common.

You can try to skirt the question with a broad answer, such as, My salary expectations are in line with my experience and qualifications. Or, If this is the right job for me, I'm sure we can come to an agreement on salary. This will show that you're willing to negotiate. Offer a range.

Target the Audience. Similar to a marketing plan or a training plan, your incentive plan needs to be targeted to a specific audience. Establish SMART Goals. Offer Appealing Rewards. Align with Your Culture. Incorporate Training. Communicate, Track, Report, Communicate.