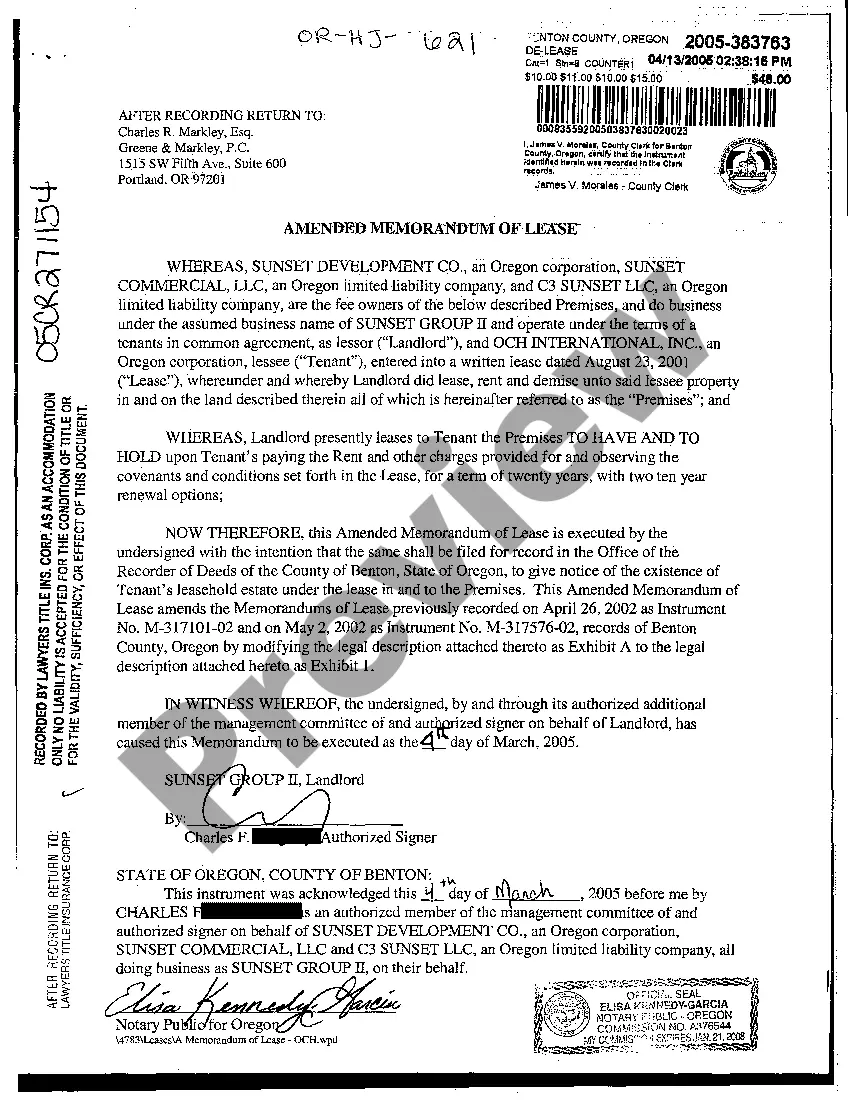

This office lease provision states that it is an unpermitted assignment for partners to have a change in their share of partnership ownership and thus a default under the lease. Generally, this type of change in ownership is couched in those provisions dealing with changes in share ownerships of corporations.

Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership

Description

How to fill out Provision Dealing With Changes In Share Ownership Of Corporations And Changes In Share Ownership Of Partnership?

When it comes to drafting a legal form, it is easier to delegate it to the professionals. However, that doesn't mean you yourself can not find a sample to use. That doesn't mean you yourself cannot find a sample to utilize, nevertheless. Download Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership straight from the US Legal Forms website. It gives you a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. When you are registered with an account, log in, find a certain document template, and save it to My Forms or download it to your device.

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership quickly:

- Make sure the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the appropriate subscription for your requirements.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the document.

When the Provision Dealing with Changes in Share Ownership of Corporations and Changes in Share Ownership of Partnership is downloaded you may fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Normally an agreement can only be changed by unanimous agreement among the shareholders or partners. A deed of variation, or an entirely new agreement, will need to be drawn up and signed by all the shareholders or partners.

Because the corporation has a legal life separate from the lives of its owners, it can (at least in theory) exist forever. Transferring ownership of a corporation is easy: shareholders simply sell their stock to others.

Changes in the ownership of a corporation are made in accordance with the corporation's governing statute (Texas Business Organizations Code), and its governing documents, such as its bylaws. There is no filing requirement with the secretary of state when there is an ownership change.

Follow the corporation's explicit stock transfer processes. Draft an agreement for the stock transfer. Execute the agreement then attain consideration. Record the transfer in the stock ledger of the corporation. Prepare to consent to an S corporation election.

Review the LLC's formation documents. Most LLC operating agreements or articles of organization include the required voting procedure for adding or removing members to the company. Download and fill out a Statement of Information form. Update other documents and accounts as needed.

Trade Shares between Shareholders One way for an individual shareholder to change her ownership percentage in an S-corporation is to buy shares from, or sell shares to, other shareholders. Since the S-corporation can only have at 100 shareholders, the pool of available trade partners is limited.

Stock determine ownership in a corporation.Voting rights allow the owner to control a portion of the company through ownership. By transferring stock ownership from one individual to another individual, you will successful transfer ownership in the corporation.

1Obtain a transfer of business name form. You can find this at your secretary of state's office.2Determine the transfer/registration fee via the website.3Complete the form correctly.4Sign and date the form.5Mail the completed form and payment to the secretary of state's office.