Clauses Relating to Preferred Returns

Description

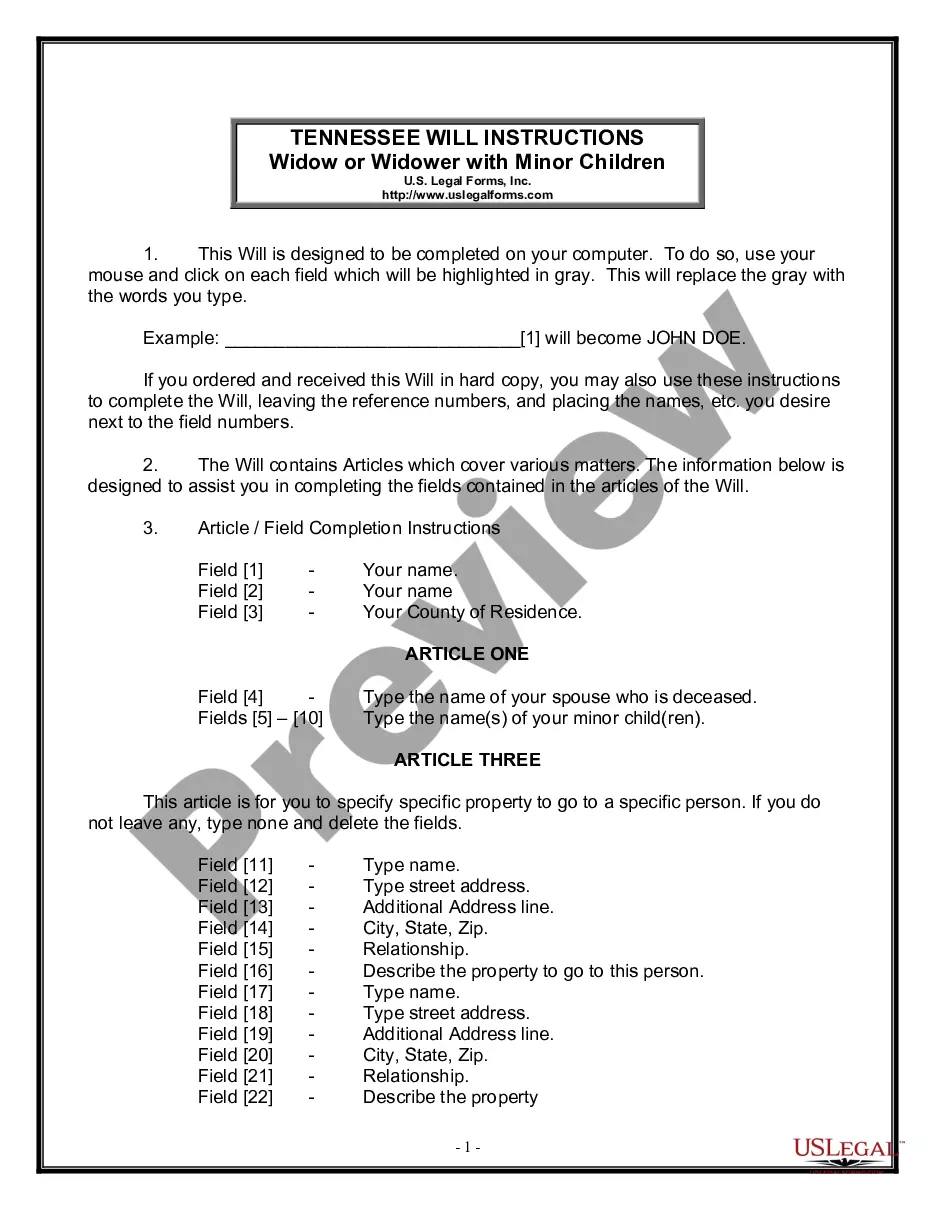

How to fill out Clauses Relating To Preferred Returns?

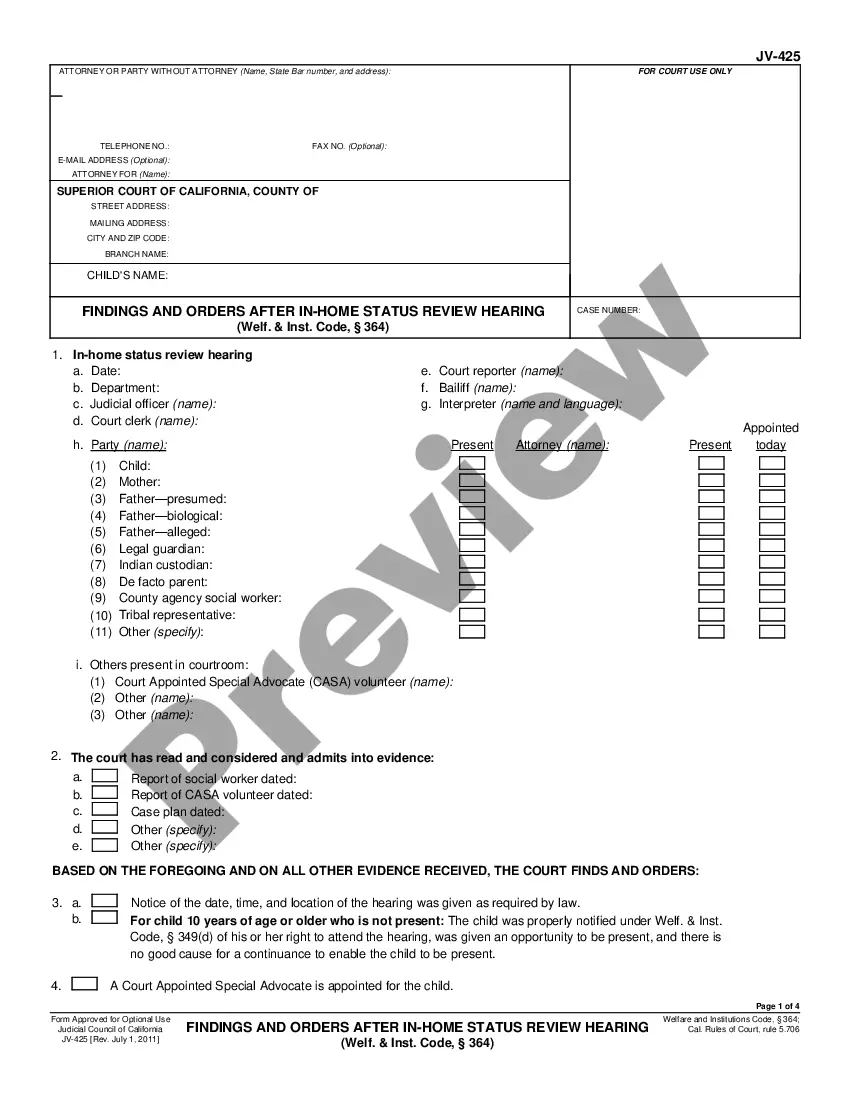

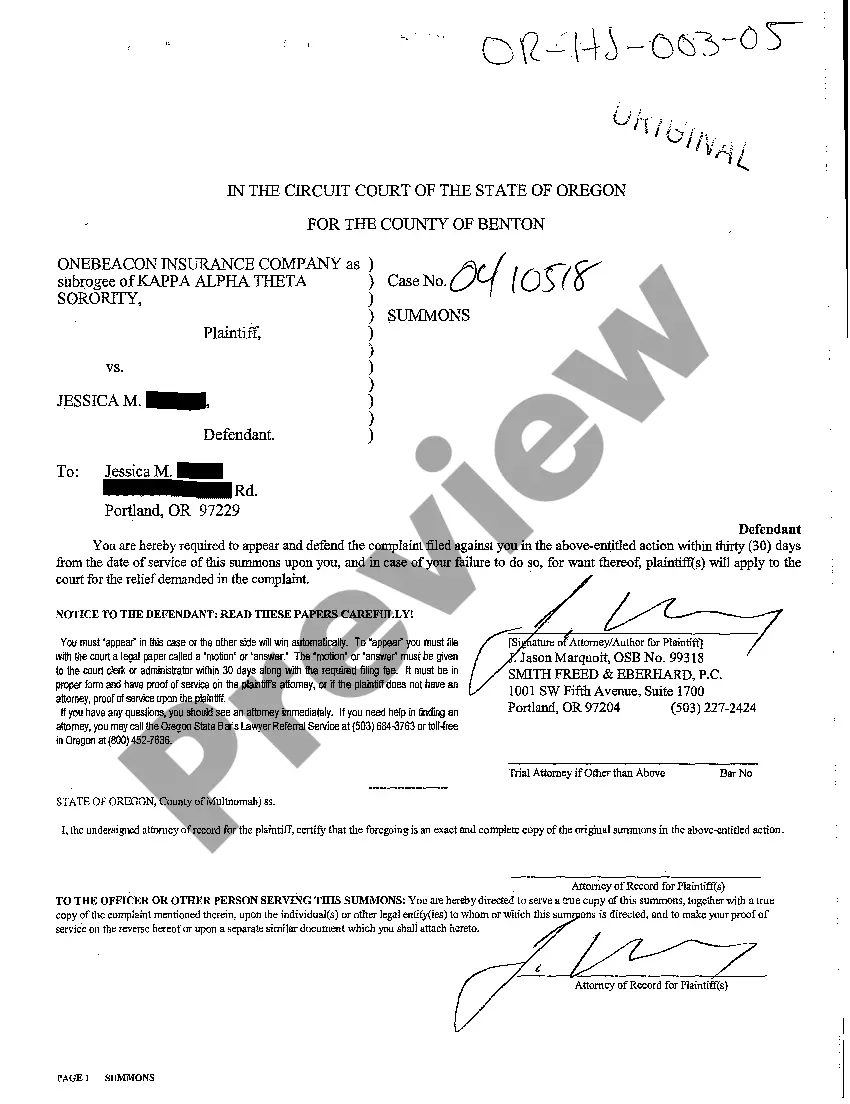

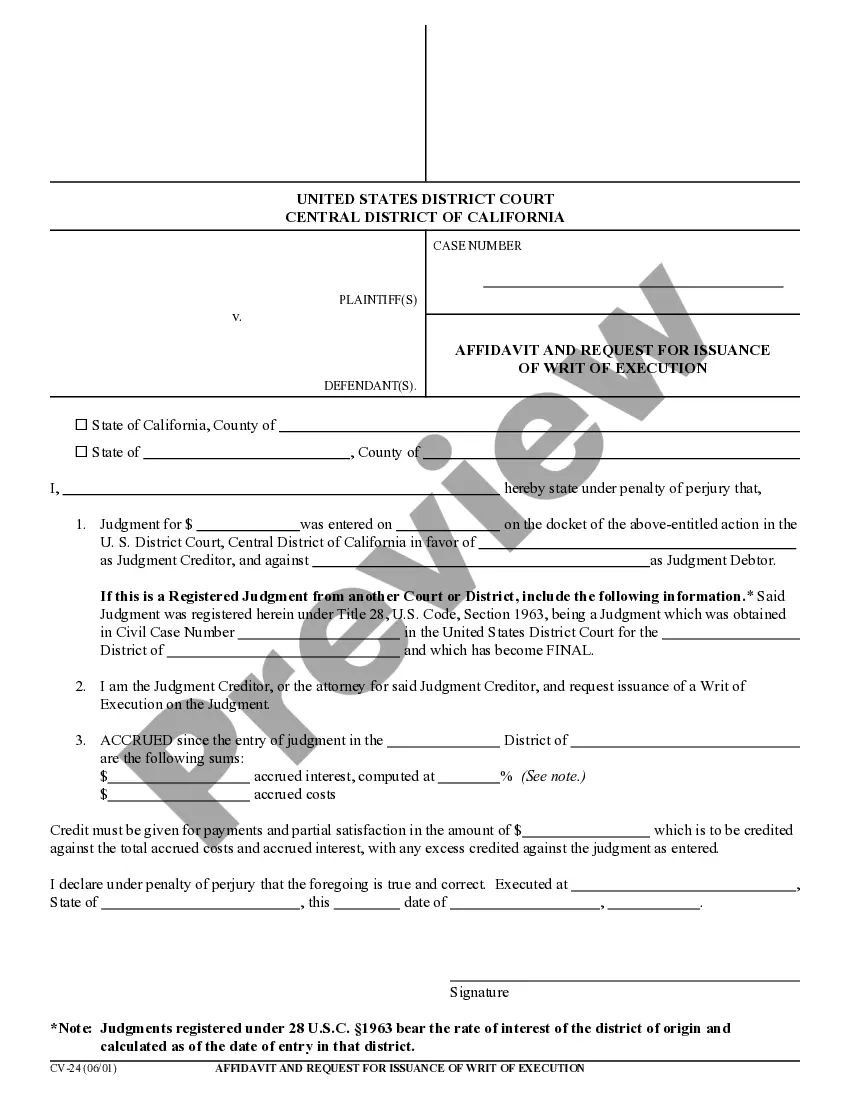

Use US Legal Forms to obtain a printable Clauses Relating to Preferred Returns. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most comprehensive Forms library on the internet and provides cost-effective and accurate samples for customers and legal professionals, and SMBs. The templates are grouped into state-based categories and some of them can be previewed before being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Clauses Relating to Preferred Returns:

- Check to ensure that you get the right form in relation to the state it’s needed in.

- Review the document by reading the description and by using the Preview feature.

- Click Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to get another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Clauses Relating to Preferred Returns. Over three million users already have utilized our platform successfully. Select your subscription plan and get high-quality documents within a few clicks.

Form popularity

FAQ

If the preferred return is cumulative it means that the investor will receive the first X% (the preferred return) for that year as well as a make-up for prior years' shortfalls (the preferred return minus the actual return).

Compounded means that the calculation of a preferred return periodic growth amount comes from the amount of invested capital plus all previously earned but unpaid amounts.

Preferred return indicates a contractual entitlement to distributions of profit. The priority of this distribution is maintained until a predetermined threshold rate of return has been met. Once met, profit distributions are made to any other subordinate stakeholders in the project.

To calculate the preferred return amount, multiply the total equity investment from limited partners by the preferred return percentage. If the preferred return is 8% and limited partners invested $1 million, the annual preferred return is $80,000 (0.08 $1,000,000).

Economic accruals of preferred return are guaranteed payments as of the time of accrual.

Preferred equity is a special financing structure that is common among large commercial real estate investments or private equity funds which can provide participating investors with additional security on their investment while providing the active investors leverage to more capital for an investment.

A distribution of profits to a class of preferred equity Investors that is made before distributions are made to common equity Investors. Preferred returns can relate to the return of invested capital and/or a percentage-based annual rate paid by the Issuer on the invested capital.

To calculate the preferred return amount, multiply the total equity investment from limited partners by the preferred return percentage. If the preferred return is 8% and limited partners invested $1 million, the annual preferred return is $80,000 (0.08 $1,000,000).

A preferred returnsimply called prefdescribes the claim on profits given to preferred investors in a project. The preferred investors will be the first to receive returns up to a certain percentage, generally 8 to 10 percent.