Clauses Relating to Capital Withdrawals, Interest on Capital

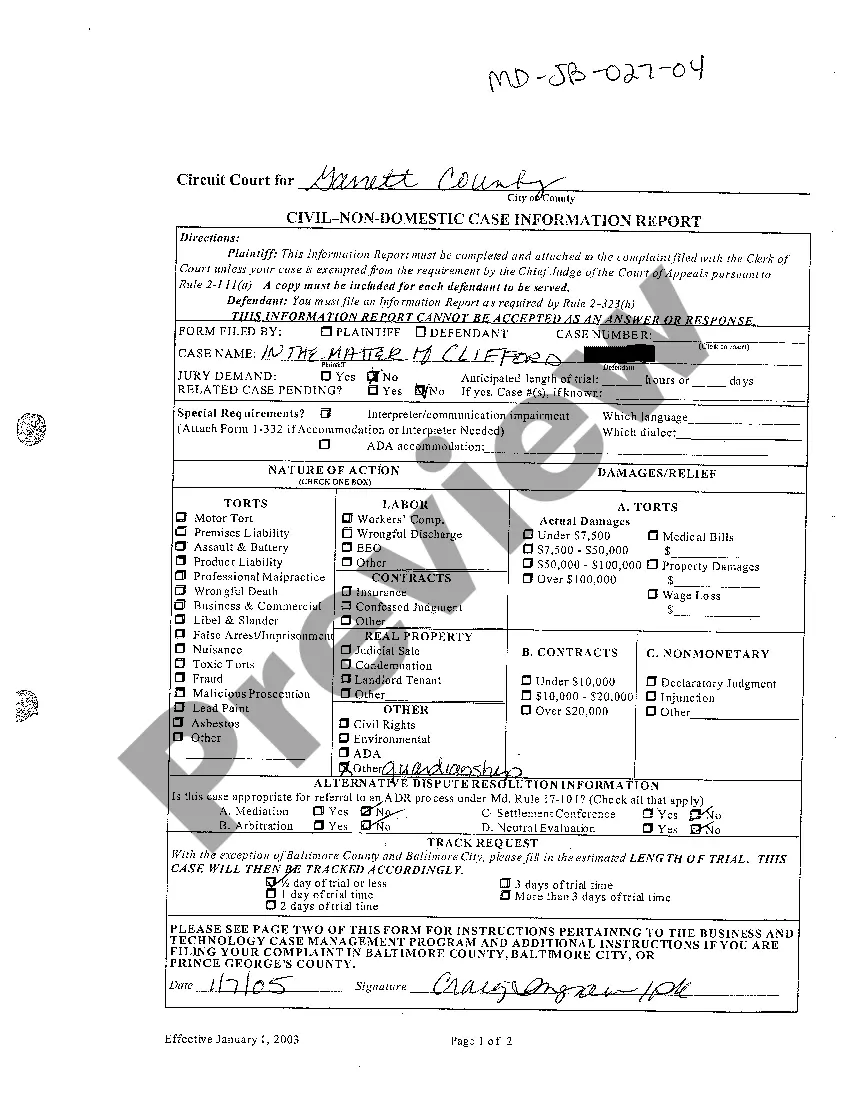

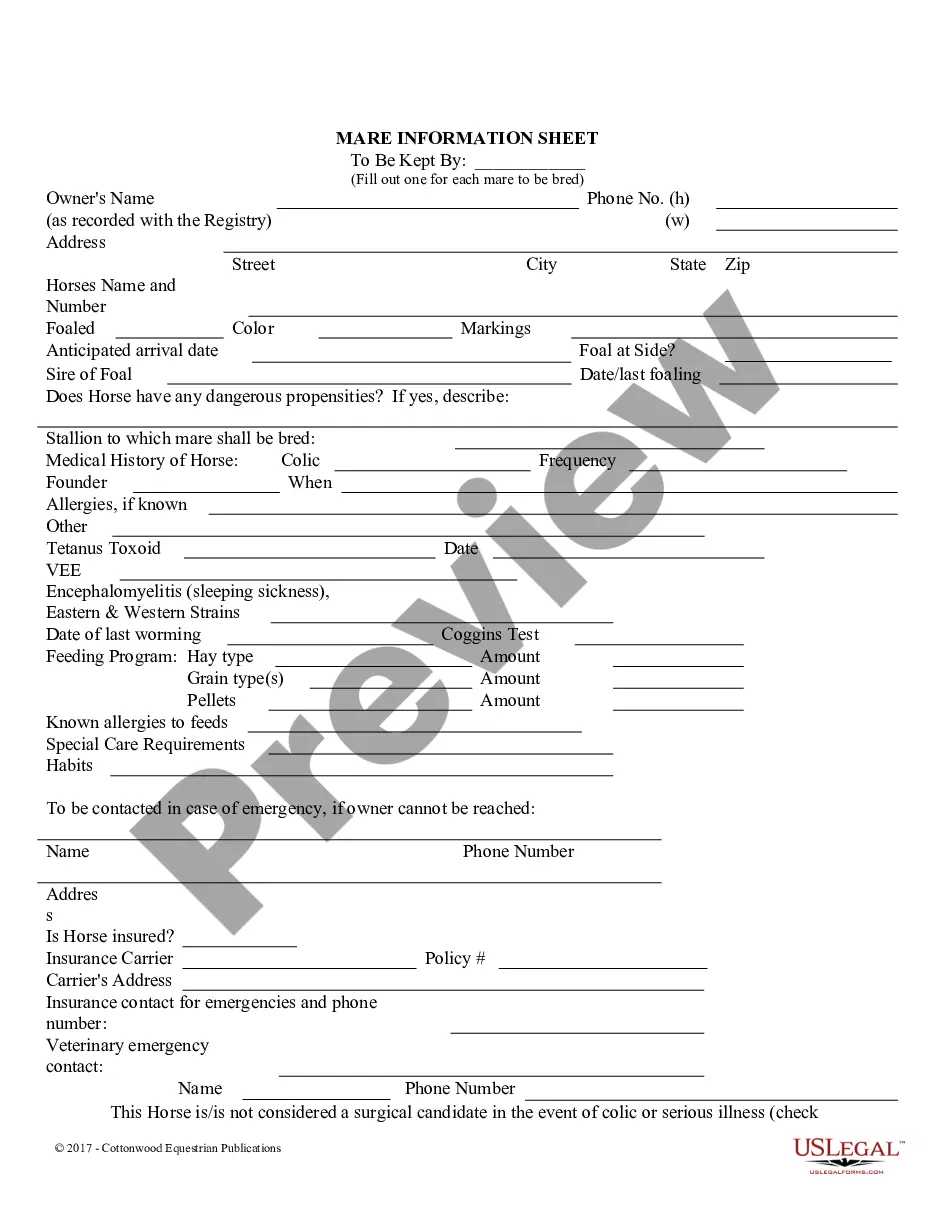

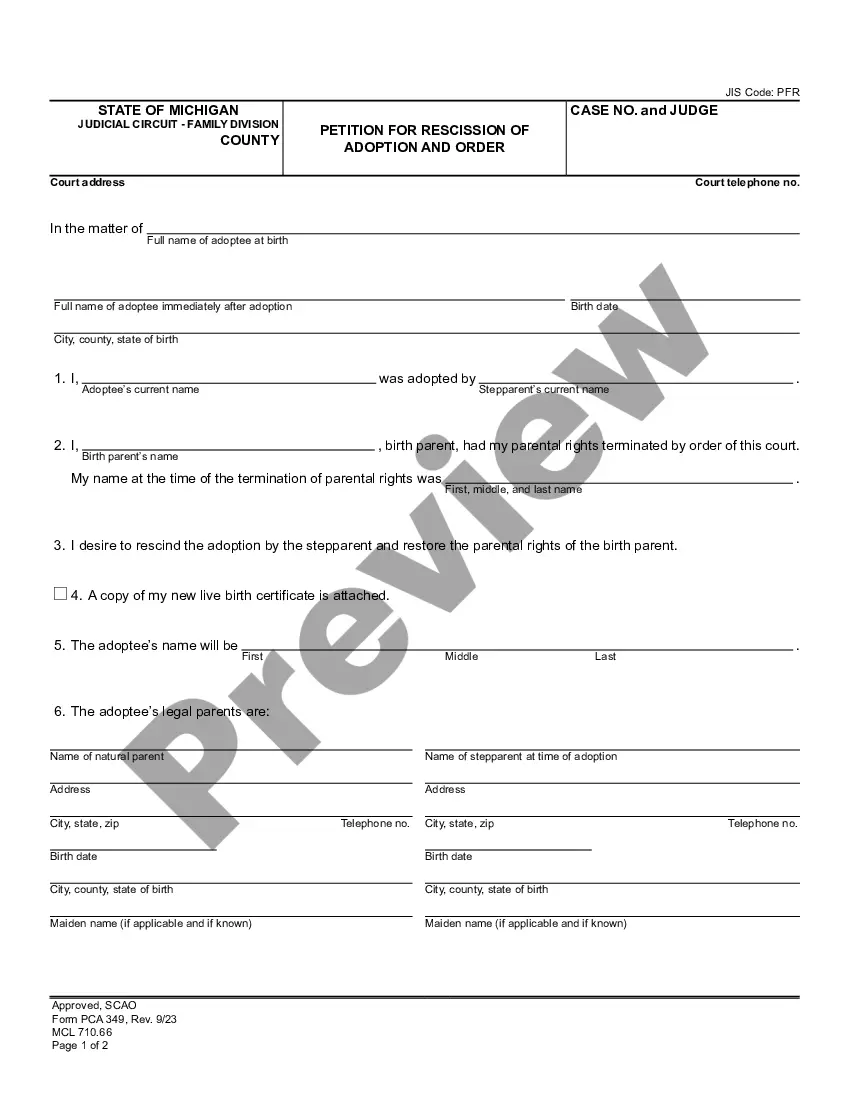

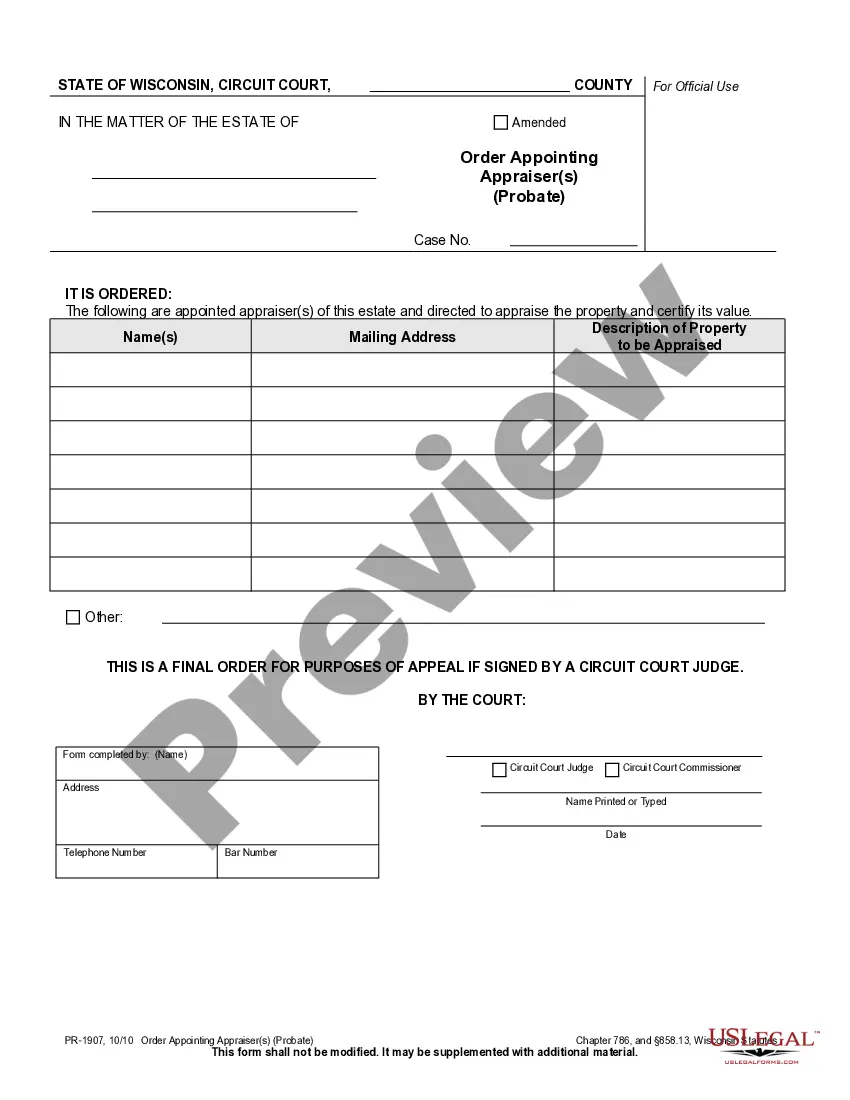

Description

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

Use US Legal Forms to get a printable Clauses Relating to Capital Withdrawals, Interest on Capital. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms catalogue online and offers reasonably priced and accurate samples for consumers and lawyers, and SMBs. The documents are grouped into state-based categories and a number of them can be previewed before being downloaded.

To download samples, customers must have a subscription and to log in to their account. Click Download next to any template you need and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to quickly find and download Clauses Relating to Capital Withdrawals, Interest on Capital:

- Check out to ensure that you get the right form in relation to the state it is needed in.

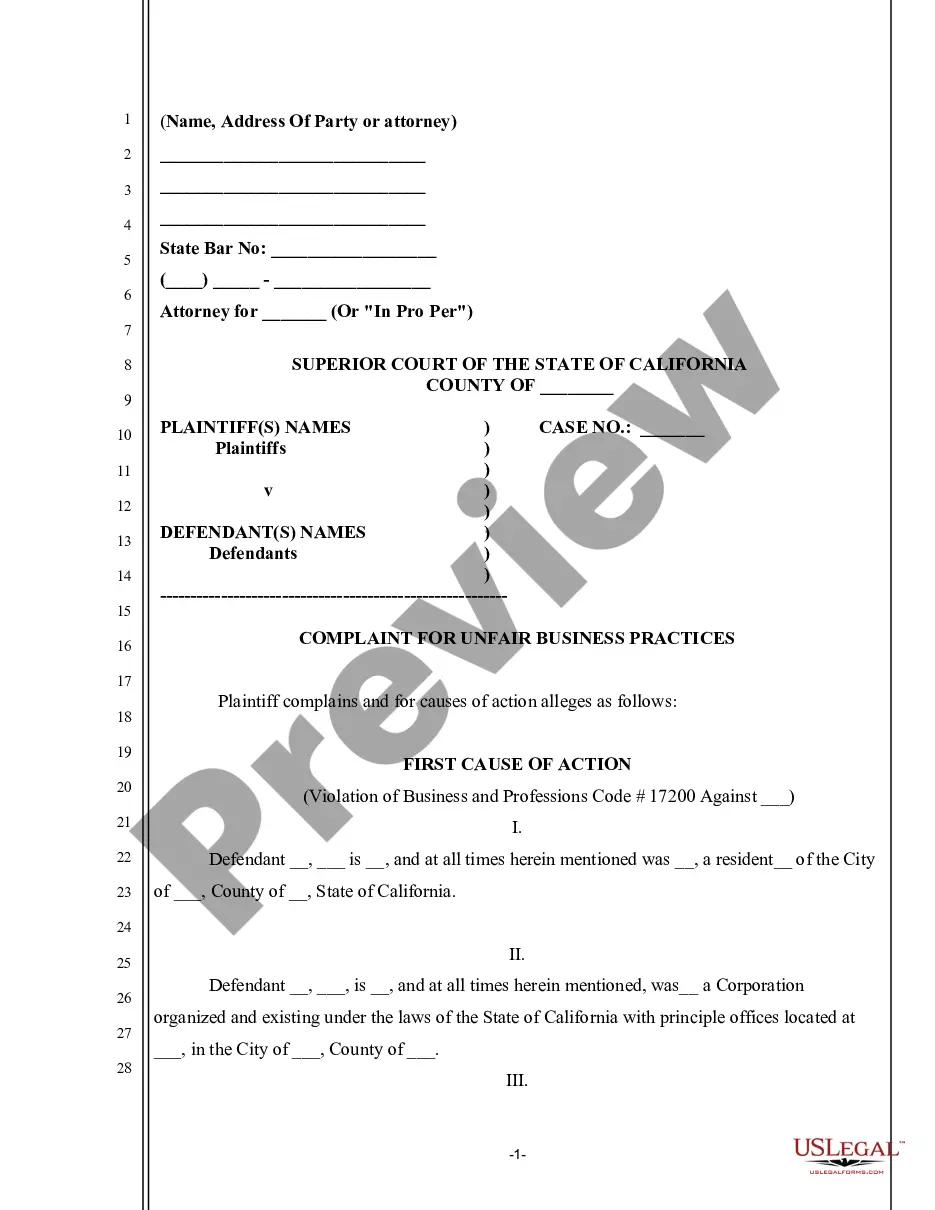

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it’s the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search field if you want to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Clauses Relating to Capital Withdrawals, Interest on Capital. Above three million users already have used our platform successfully. Select your subscription plan and obtain high-quality documents in just a few clicks.

Form popularity

FAQ

Interest on Capital is paid for the reason that proprietor has invested funds in the business and the business is using the funds to sustain.Accordingly, interest on capital is paid on the balance in partner's capital account.

You can calculate Interest on your loans and investments by using the following formula for calculating simple interest: Simple Interest= P x R x T ÷ 100, where P = Principal, R = Rate of Interest and T = Time Period of the Loan/Deposit in years.

Tax Consequences of a Profits Interest The profits interest will be treated as having a $0 basis, and no capital account.

In other words, interest on capital is the interest paid to owners for providing a firm with the required capital to start a business.It is similar to obtaining a loan from any financial institution. The partners are paid interest on the capital that remains outstanding.

What Is a Profits Interest? Profits interest refers to an equity right based on the future value of a partnership awarded to an individual for their service to the partnership. The award consists of receiving a percentage of profits from a partnership without having to contribute capital.

Interest on capital = Amount of capital x Rate of interest per annum x Period of interest.

A profits interest is an interest only in the income of the partnership.A capital interest on the other hand is an interest in the assets of the partnership. Upon sale or liquidation of the partnership assets, the holder of a capital interest would share in such distribution of assets or proceeds.

Divide the amount financed by the finance charge per year to receive the interest rate percentage of the capital lease. In the example, $2,000 divided by 200 gives you an interest rate of 10 percent.