Certificate of Merger of Two Delaware Limited Partnerships

Description

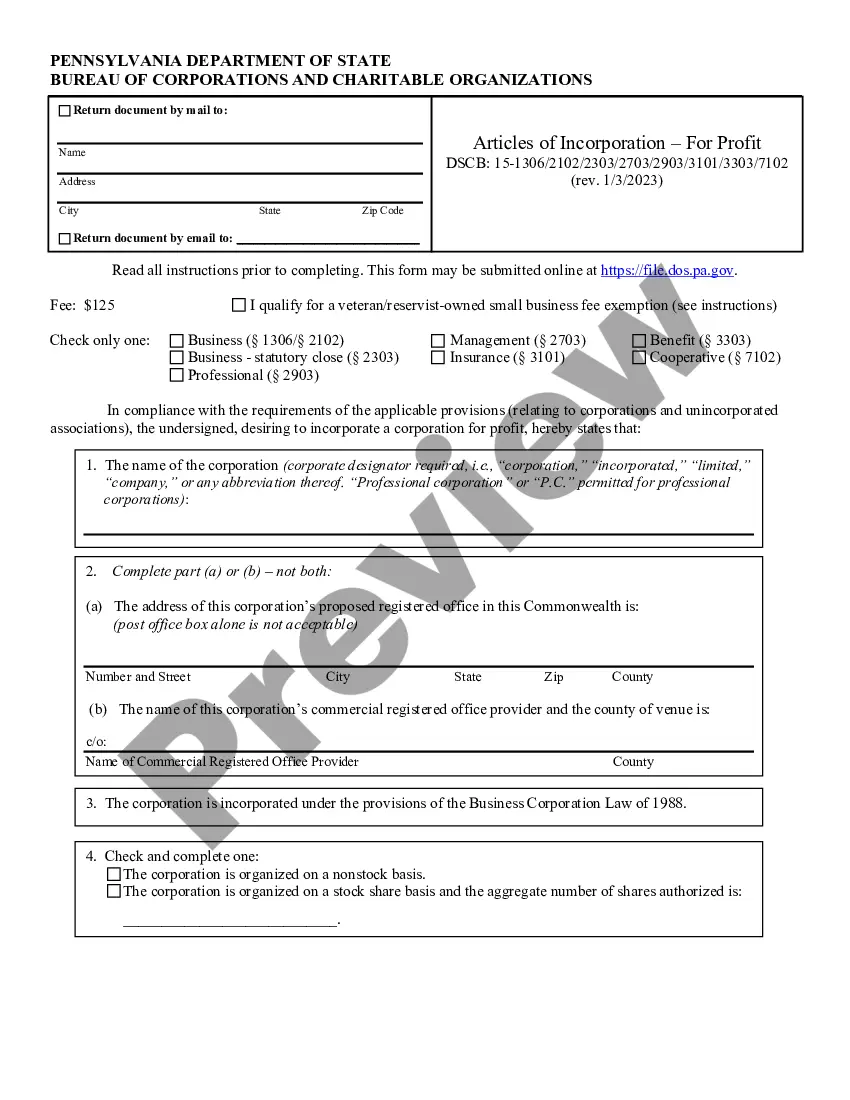

How to fill out Certificate Of Merger Of Two Delaware Limited Partnerships?

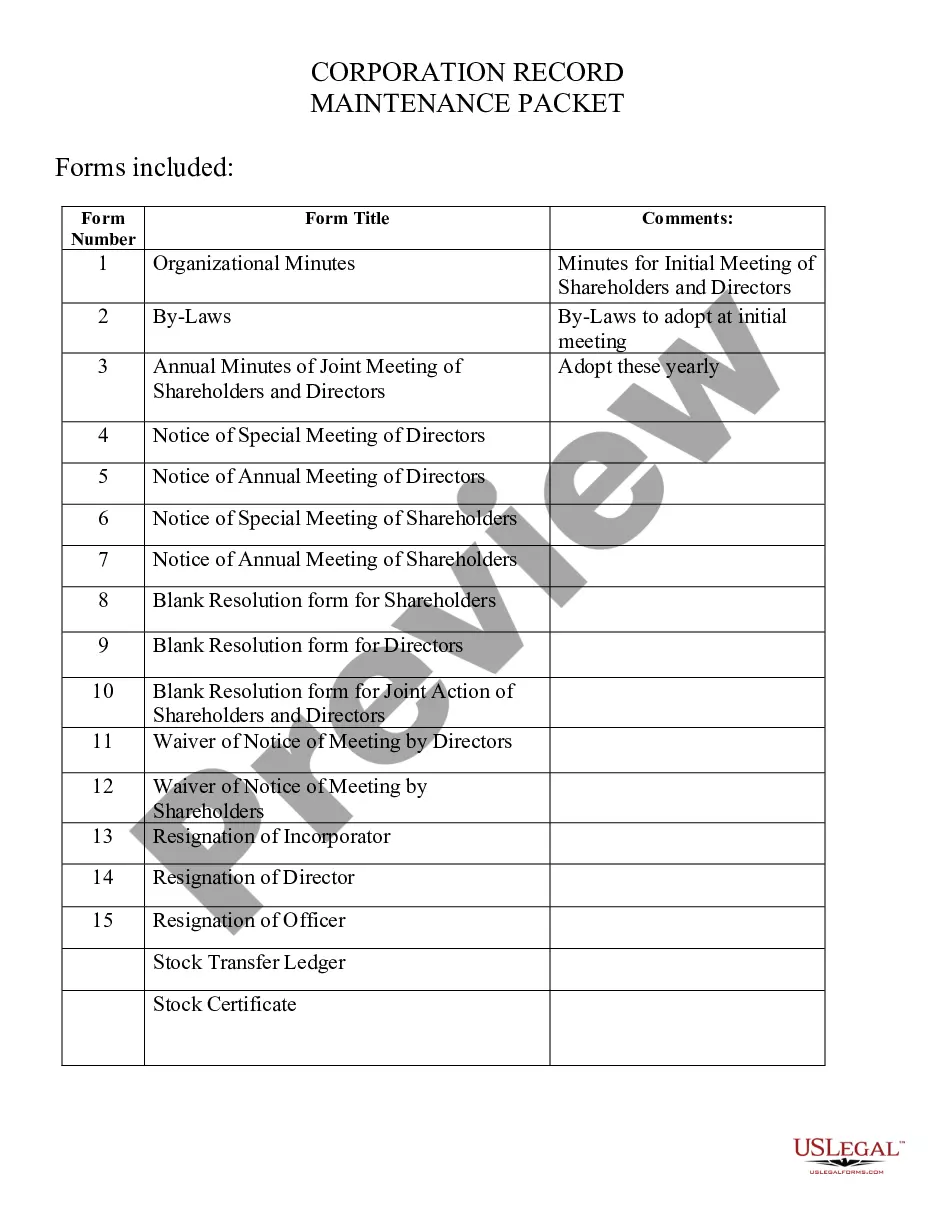

Use US Legal Forms to get a printable Certificate of Merger of Two Delaware Limited Partnerships. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms library on the internet and offers cost-effective and accurate templates for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and some of them can be previewed before being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to easily find and download Certificate of Merger of Two Delaware Limited Partnerships:

- Check to make sure you have the correct form in relation to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it’s the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search field if you want to get another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Certificate of Merger of Two Delaware Limited Partnerships. More than three million users have utilized our platform successfully. Select your subscription plan and obtain high-quality forms in a few clicks.

Form popularity

FAQ

What is an entity status letter? It verifies whether or not an entity is in good standing with us and provides certification for: Legal status in court proceedings. An outstanding liability that could have an effect on an entity's credit rating (e.g., the closing of escrow).

Limited partnerships are generally used by hedge funds and investment partnerships as they offer the ability to raise capital without giving up control. Limited partners invest in an LP and have little to no control over the management of the entity, but their liability is limited to their personal investment.

The most important difference between the LLC and LP relates to the personal liability of the participants.A limited partner typically does not have personal liability for partnership obligations, but is not permitted to participate in the day-to-day management of the limited partnership.

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

The filing fees for a merger are $300 ($50 for nonprofit corporations and cooperatives) plus the filing fee for any new Texas filing entity created by the merger. For example: The filing fee for the merger of a Texas corporation that creates a new Texas limited partnership is $300 plus $750 for a total of $1050.

An LLC must go through a state agency to merge with another LLC. Once the merger takes effect, one of the LLCs ceases to exist. Property previously owned by each LLC vests in the surviving LLC, and the financial obligations of both LLCs become the obligations of the surviving LLC.

A Delaware Limited Partnership refers to a business entity in the state of Delaware that consists of at least one general partner and at least one limited partner. The general partner can be either an individual or an entity, such as a corporation.

The ownership of a Delaware LLC is not on public record, so to show ownership in a Delaware LLC it is shown via an Operating Agreement. This Operating Agreement is typically kept on file internally within the company and not required to be disclosed to the State of Delaware nor to the Registered Agent.

Pros of a Limited Partnership. Capital Amount is Quite Generous. Limited Partner Faces Limited Liability for Losses. Shared Responsibility of Work. Cons of a Limited Partnership. Breach in Agreement. General Partners Bear Maximum Risk in Case of Debts.