Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out Certificate Of Limited Partnership Of New Private Equity Fund?

Use US Legal Forms to obtain a printable Certificate of Limited Partnership of New Private Equity Fund. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms catalogue on the internet and offers cost-effective and accurate templates for consumers and legal professionals, and SMBs. The documents are categorized into state-based categories and a few of them can be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Press Download next to any template you want and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to easily find and download Certificate of Limited Partnership of New Private Equity Fund:

- Check out to ensure that you get the proper template in relation to the state it’s needed in.

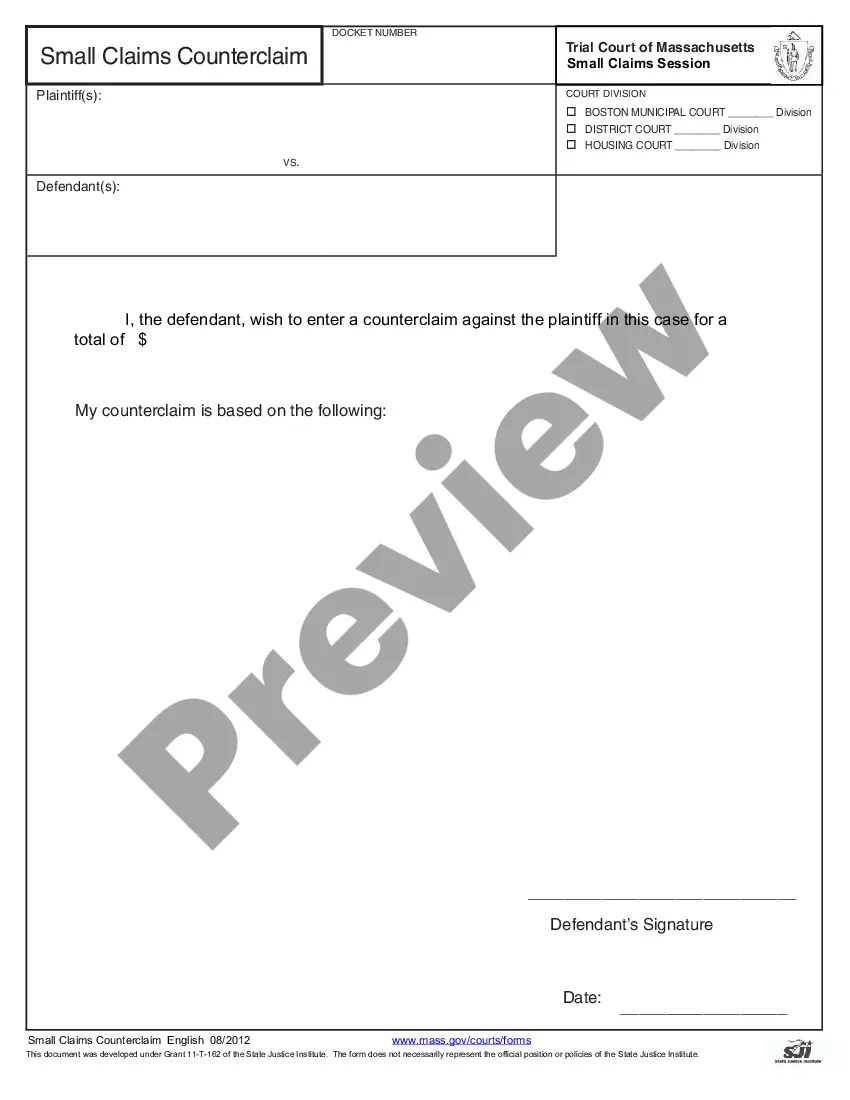

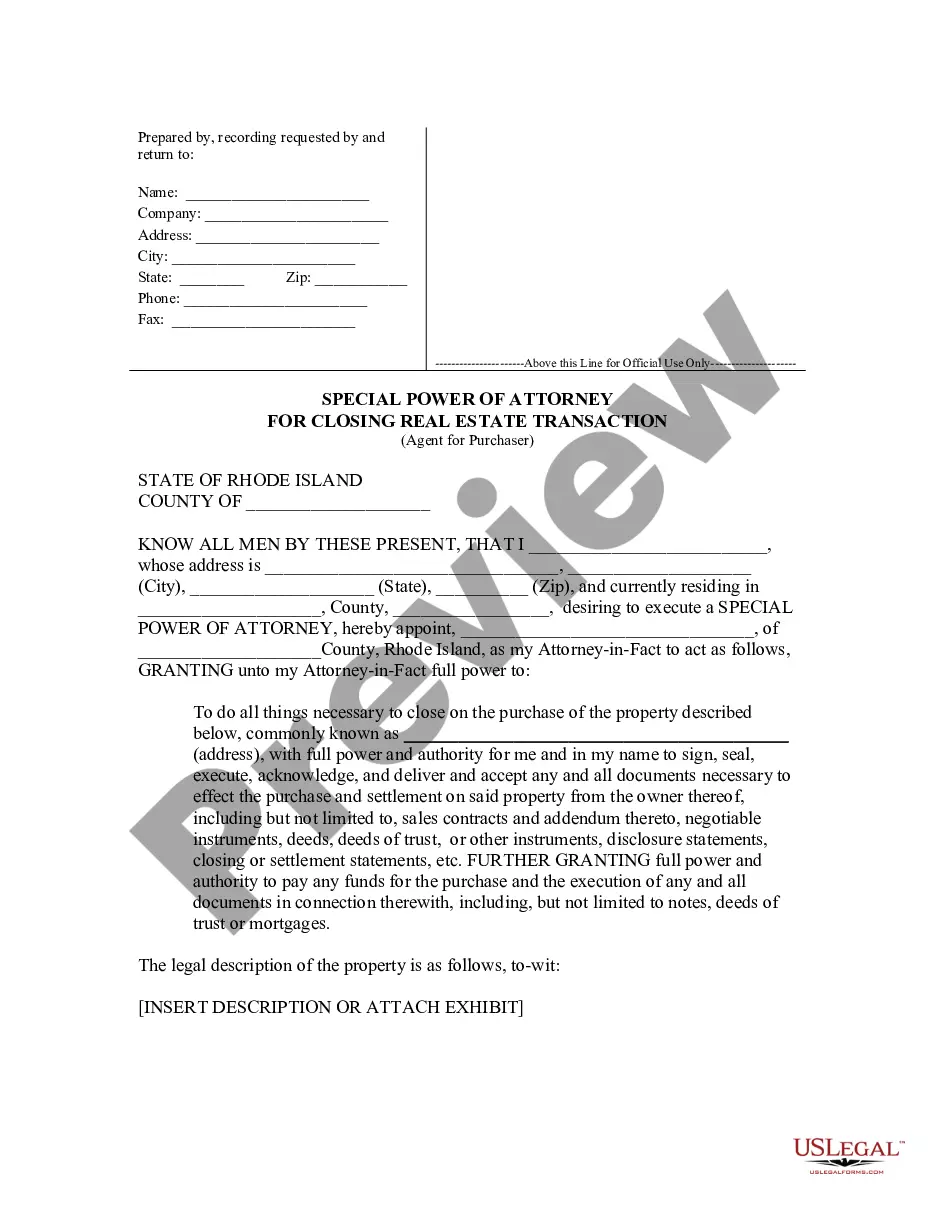

- Review the document by looking through the description and using the Preview feature.

- Click Buy Now if it is the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to get another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Certificate of Limited Partnership of New Private Equity Fund. Above three million users have used our platform successfully. Select your subscription plan and have high-quality documents in a few clicks.

Form popularity

FAQ

Limited partnerships are generally used by hedge funds and investment partnerships as they offer the ability to raise capital without giving up control. Limited partners invest in an LP and have little to no control over the management of the entity, but their liability is limited to their personal investment.

A private equity firm is called a general partner (GP) and its investors that commit capital are called limited partners (LPs). Limited partners generally consist of pension funds, institutional accounts and wealthy individuals.General partners generally charge both a management fee and a performance fee.

A limited partnership is usually a type of investment partnership, often used as investment vehicles for investing in such assets as real estate. LPs differ from other partnerships in that partners can have limited liability, meaning they are not liable for business debts that exceed their initial investment.

Your Limited Partnership Agreement can include details like: the name, address, and purpose of forming the partnership; whether limited partners have any voting rights regarding the day-to-day business decisions; how decisions will be made (by unanimous vote, majority vote, or majority vote based on percent ownership);

It is a partnership in which only one partner is required to be a general partner.LPs have limited liabilitythey are only liable on debts incurred by the firm to the extent of their registered investment and have restricted management authority.

A long-form limited partnership agreement to be used in connection with the formation of a private equity fund structured as a limited partnership. This Standard Document can be adapted for other investment structures or other purposes where formation of limited partnerships is desired.

Limited Partners (LP) are the ones who have arranged and invested the capital for venture capital fund but are not really concerned about the daily maintenance of a venture capital fund whereas General Partners (GP) are investment professionals who are vested with the responsibility of making decisions with respect to

A standard Model Limited Partnership Agreement (LPA) has been a persistent need in the private equity asset class given the cost, time and complexity of negotiating the terms of investment.