Limited Liability Company LLC Agreement for New General Partner

Description

How to fill out Limited Liability Company LLC Agreement For New General Partner?

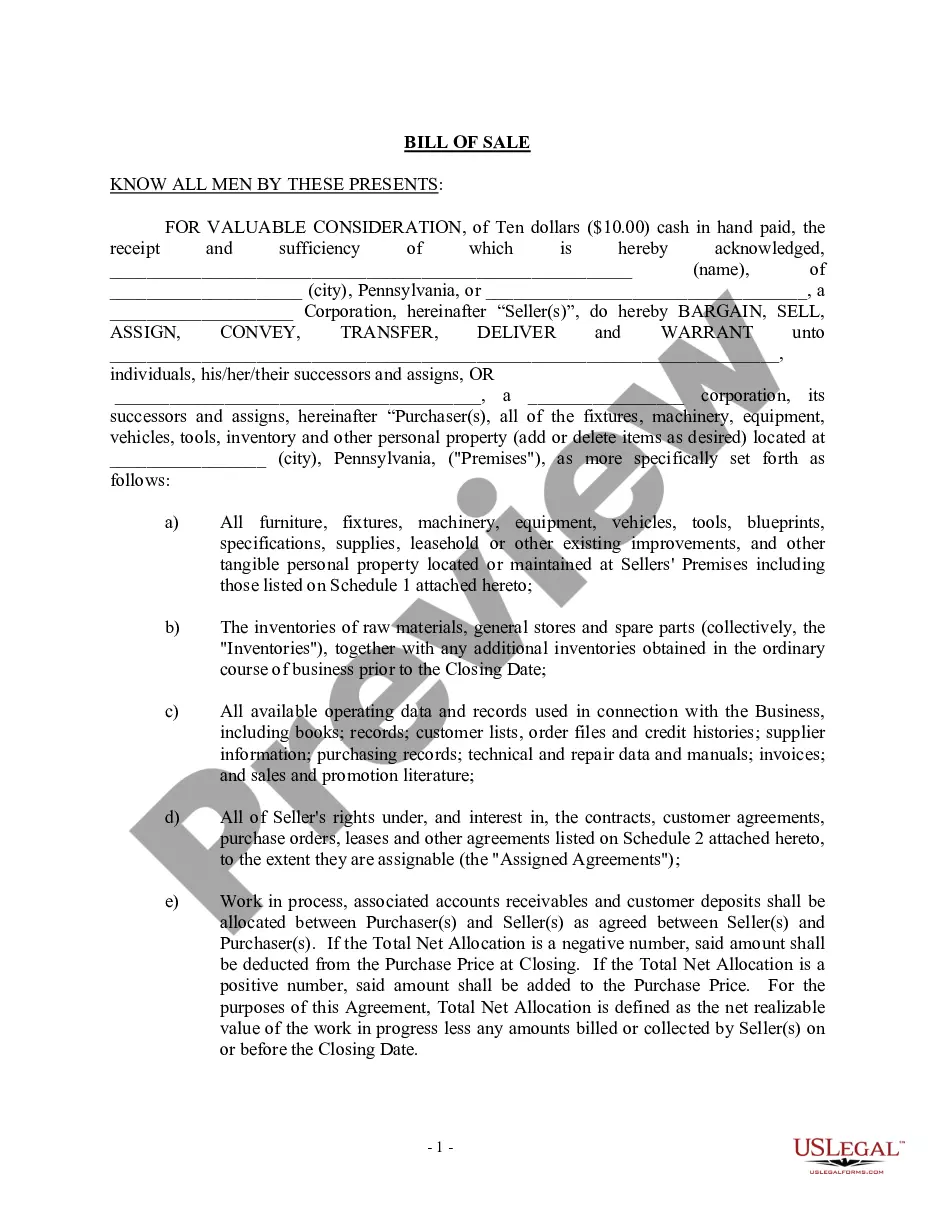

Use US Legal Forms to get a printable Limited Liability Company LLC Agreement for New General Partner. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most complete Forms catalogue on the web and provides cost-effective and accurate templates for customers and legal professionals, and SMBs. The templates are grouped into state-based categories and some of them can be previewed before being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For those who don’t have a subscription, follow the following guidelines to quickly find and download Limited Liability Company LLC Agreement for New General Partner:

- Check out to make sure you have the proper form with regards to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Hit Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Limited Liability Company LLC Agreement for New General Partner. Above three million users have already utilized our platform successfully. Select your subscription plan and get high-quality documents in a few clicks.

Form popularity

FAQ

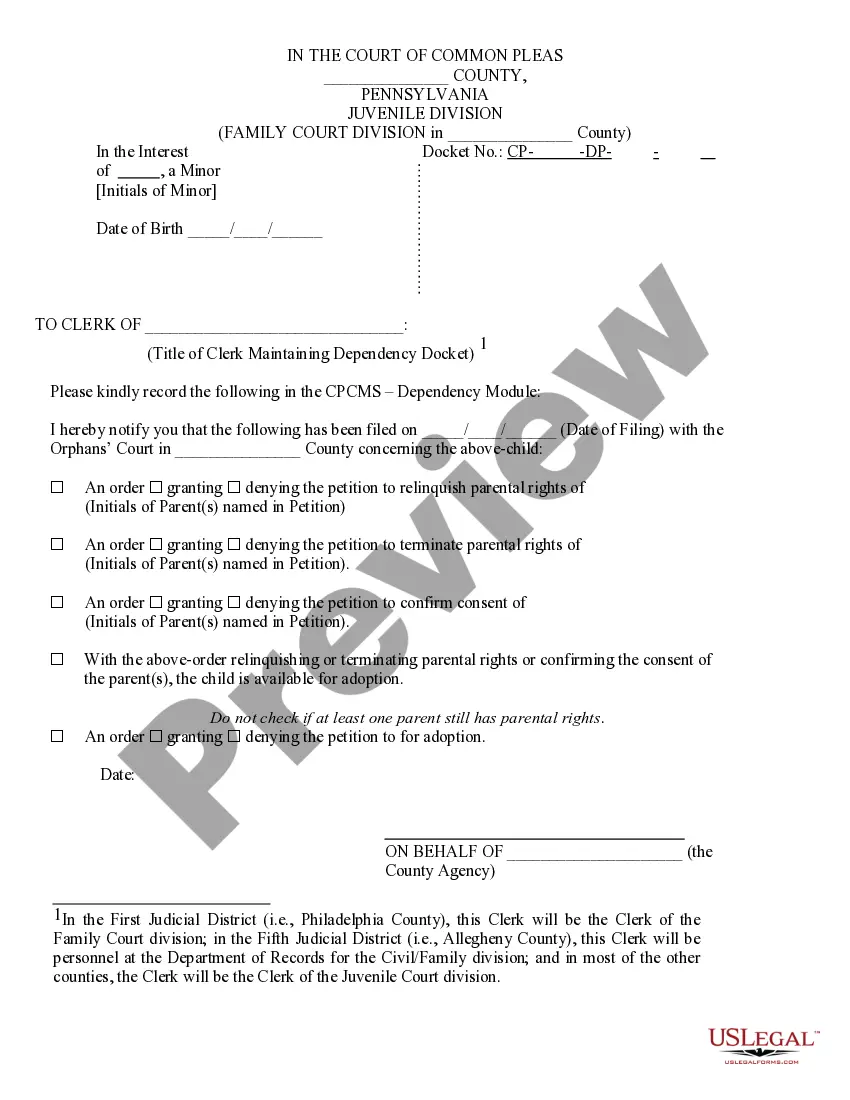

Owners are exposed to liability as a partner, so they form an LLC and conduct their partnership business as an LLC. The LLC takes the full liability but shields the owners from personal liability. An LLC can choose to be taxed as a corporation if it does not want to be taxed as a partnership.

There is no general partner in an LLC. There is a general partner in a Limited Partnership. There are members of an LLC and maybe a Manager of the LLC.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity.

If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally. The agreement outlines the rights, responsibilities, and duties each partner has to the company and to each other.

Step 1: Consult Your Operating Agreement Follow the rules outlined in your business's operating agreement, assuming you have one. Without an operating agreement, most states require that all current LLC members must agree to add a new member, and the new member becomes an automatic equal partner.

LLCs aren't usually required by states to have an LLC partnership agreement; however, it's something to considerespecially when an LLC will have multiple owners (a multi-member LLC).

In general, a partnership is a business agreement between two or more people who are called partners.Typically, the terms general partner and limited partner in all types of partnerships will refer to liability, with general partners pledging their own personal assets while limited partners having limited liabilities.

Partnerships are unique business relationships that don't require a written agreement.Because partners share profits equally in the absence of a written agreement, you could run into situations where you feel that you're doing all of the work, but your partner is still getting half of the profits.

Whats the difference in a limited partner and a general partner in an LLC.A limited partner is not liable for any amount greater than his or her original investment in the partnership, while a general partner is liable for all of the partnership's liabilities.