Heirship or Descent Affidavit Questionnaire

Overview of this form

The Heirship or Descent Affidavit Questionnaire is a legal document designed to help individuals gather relevant information regarding heirship matters. This form assists in identifying the rights and obligations of parties involved in a decedent's estate without going through lengthy legal processes. Unlike other estate planning documents, this questionnaire focuses on the specifics of heirship and descent, making it a valuable tool for both individuals seeking legal assistance and attorneys preparing for cases.

What’s included in this form

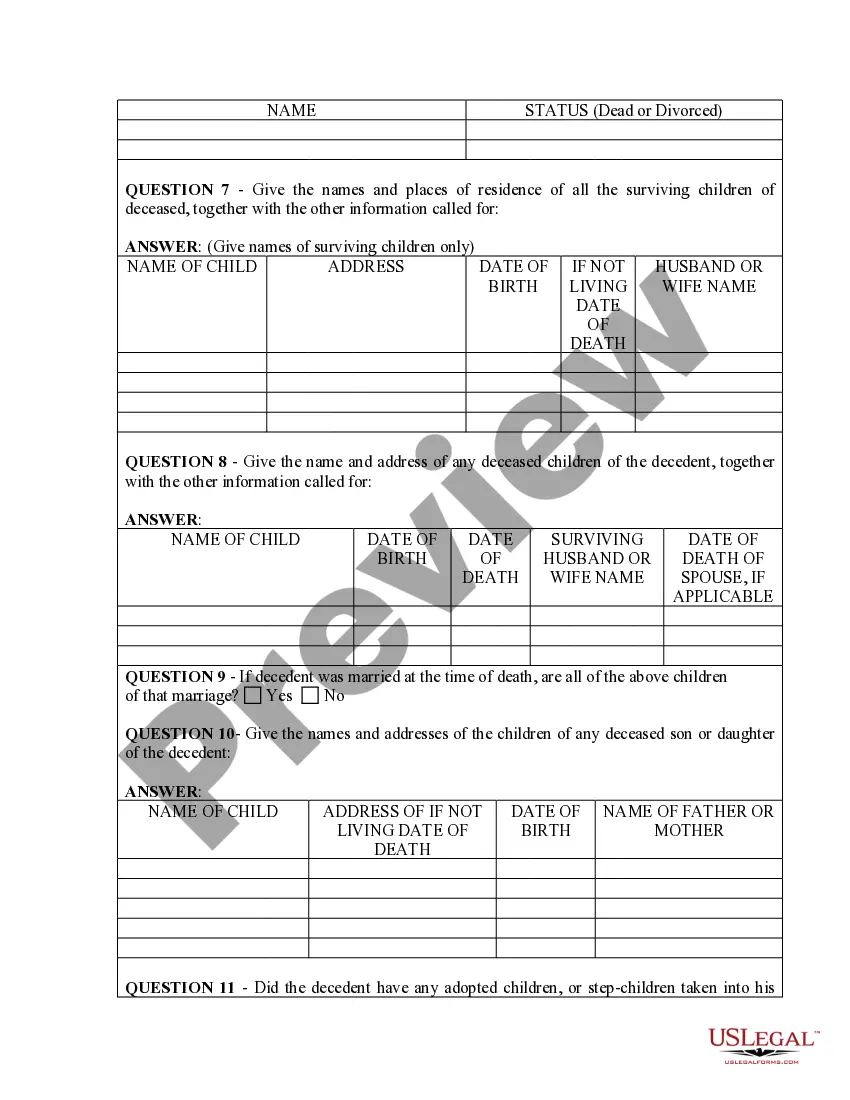

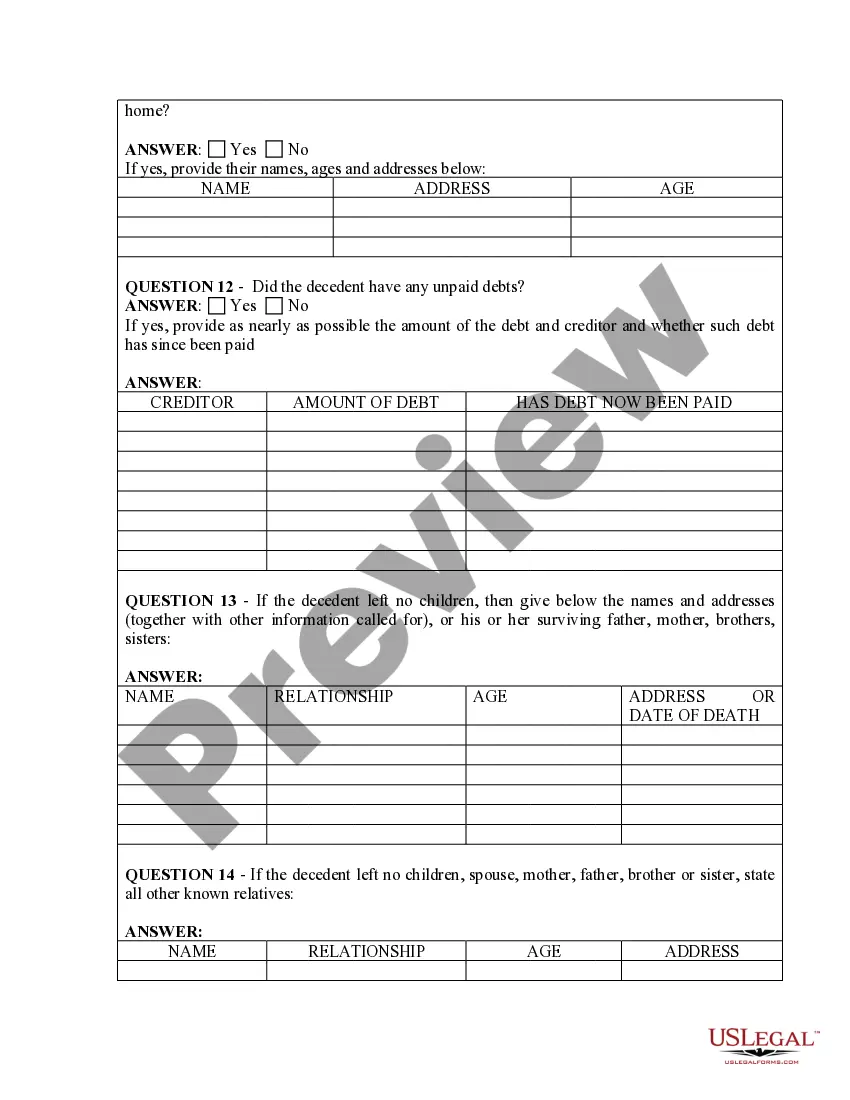

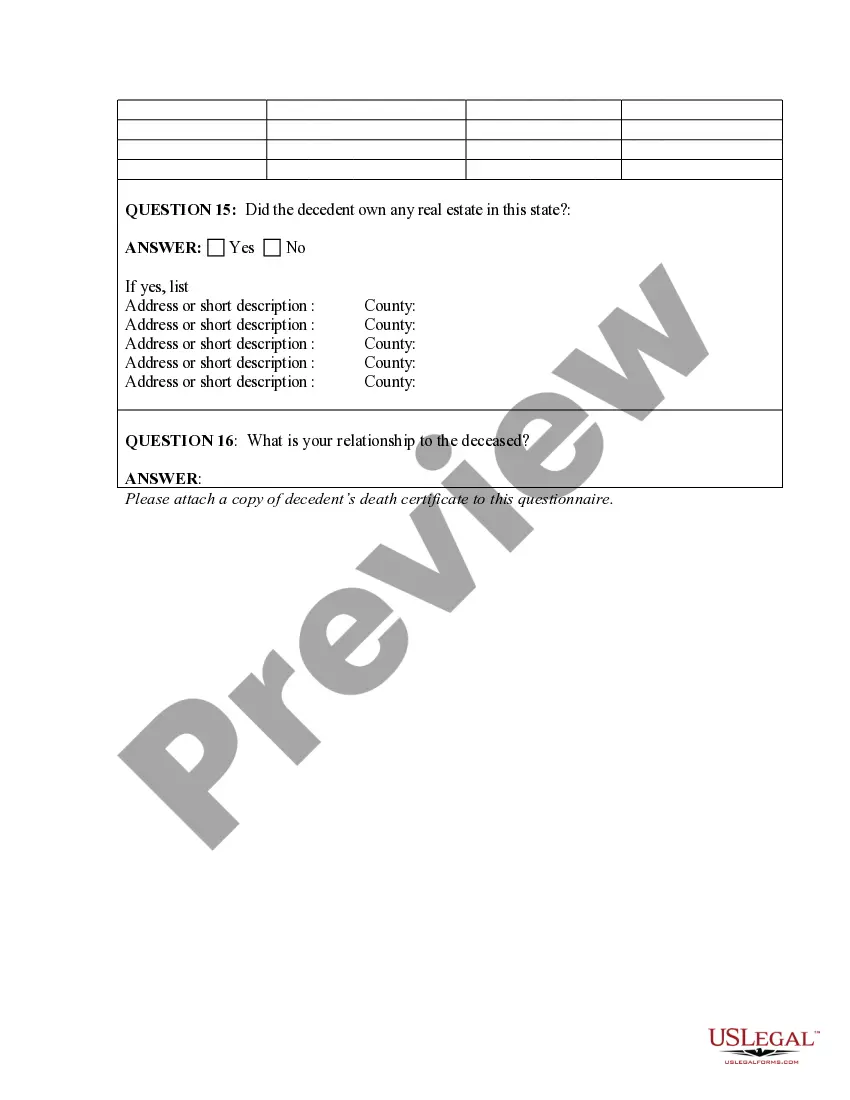

- Identification of the decedent and their estate details.

- Questions regarding the existence of a will and its probate status.

- Sections for detailing potential heirs and their respective relationships to the decedent.

- Information on any previous inheritance disputes or claims.

- Space for additional pertinent facts that may affect the heirship determination.

When to use this form

This form should be used in scenarios where an individual needs to establish legal heirship, particularly after a loved one has passed away without clear documentation about their heirs. It is essential when navigating probate processes or when multiple parties may claim rights to the estate. Additionally, it can help streamline an attorney-client consultation by providing a comprehensive overview of the necessary details upfront.

Intended users of this form

- Individuals seeking to clarify their rights as heirs to an estate.

- Family members or beneficiaries of a decedent.

- Attorneys representing clients in heirship matters.

- Personal representatives of an estate preparing for probate.

Completing this form step by step

- Start by identifying the decedent, including their full name and date of death.

- Determine if a will exists and if it has been admitted to probate; provide details if applicable.

- List all potential heirs and their relationship to the decedent.

- Answer questions regarding any disputes or claims related to the estate.

- Provide additional information that may impact the heirship determination.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Avoid these common issues

- Failing to include all potential heirs, which can lead to legal disputes.

- Not verifying the status of a will and its probate process.

- Providing incomplete information about the decedent's assets.

- Overlooking details that may affect the determination of legal heirs.

Benefits of using this form online

- Convenient access to download and complete the form from anywhere.

- Easy to edit and customize the document as needed before finalizing.

- Reliability and assurance that the form is prepared by licensed attorneys.

Form popularity

FAQ

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor). Create the new deed. Sign and notarize the deed. File the deed in the county land records.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.