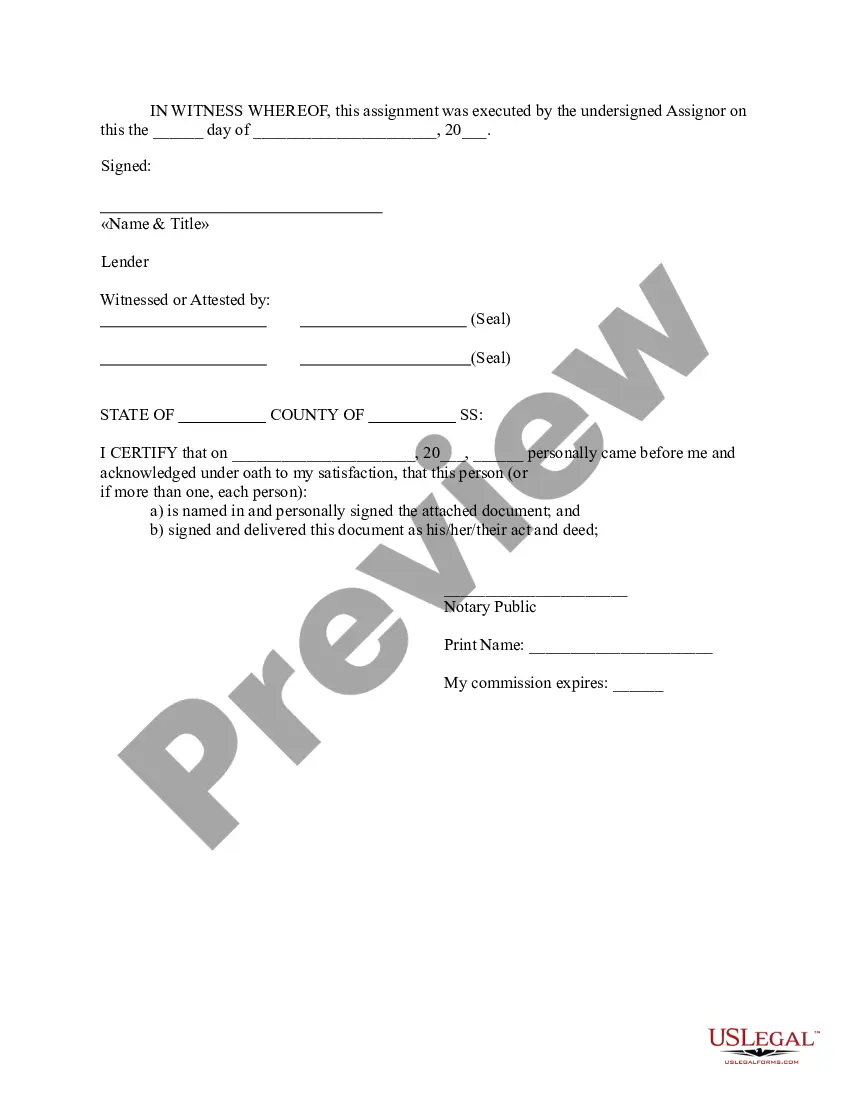

An Assignment of Mortgage is a legal document used to transfer the rights and obligations of a mortgage from one party to another. This document is used when a borrower sells the property securing the loan to a third party, and the original lender must be repaid. It is also used when a lender sells or transfers a loan to another lender. An Assignment of Mortgage is often referred to as a “mortgage transfer” or “mortgage assignment.” The document assigns the mortgage from the current lender to the new lender. It also includes all the terms and conditions of the mortgage loan, such as the interest rate, principal amount, and due date. It also specifies the legal rights and obligations of both parties as they relate to the mortgage loan. There are two types of Assignment of Mortgage: a voluntary assignment and an involuntary assignment. A voluntary assignment of mortgage occurs when the current lender agrees to transfer the loan to a new lender. An involuntary assignment of mortgage occurs when the current lender is forced to transfer the loan to a new lender due to the borrower’s default.

An Assignment of Mortgage is a legal document used to transfer the rights and obligations of a mortgage from one party to another. This document is used when a borrower sells the property securing the loan to a third party, and the original lender must be repaid. It is also used when a lender sells or transfers a loan to another lender. An Assignment of Mortgage is often referred to as a “mortgage transfer” or “mortgage assignment.” The document assigns the mortgage from the current lender to the new lender. It also includes all the terms and conditions of the mortgage loan, such as the interest rate, principal amount, and due date. It also specifies the legal rights and obligations of both parties as they relate to the mortgage loan. There are two types of Assignment of Mortgage: a voluntary assignment and an involuntary assignment. A voluntary assignment of mortgage occurs when the current lender agrees to transfer the loan to a new lender. An involuntary assignment of mortgage occurs when the current lender is forced to transfer the loan to a new lender due to the borrower’s default.