Assumption and Amendment of Loan Documents

Definition and meaning

The Assumption and Amendment of Loan Documents is a legal agreement that allows a new borrower to assume an existing loan secured by a property, while also amending certain terms of the original loan. This document formalizes the transfer of responsibility for the loan from the initial borrower to the new borrower and details any changes to the loan agreement or related documents.

Who should use this form

This form is intended for borrowers who are taking over an existing loan associated with a property, as well as lenders who need to document the transfer of loan obligations. It is suitable for cases where real estate ownership is changing hands while the existing financing remains in place, typically in real estate transactions such as purchases, refinancing, or partnerships.

Key components of the form

The Assumption and Amendment of Loan Documents usually includes the following key components:

- The effective date of the agreement.

- The names and details of the new borrower and the lender.

- A description of the property in question.

- The original loan amount and any amendments to the loan terms.

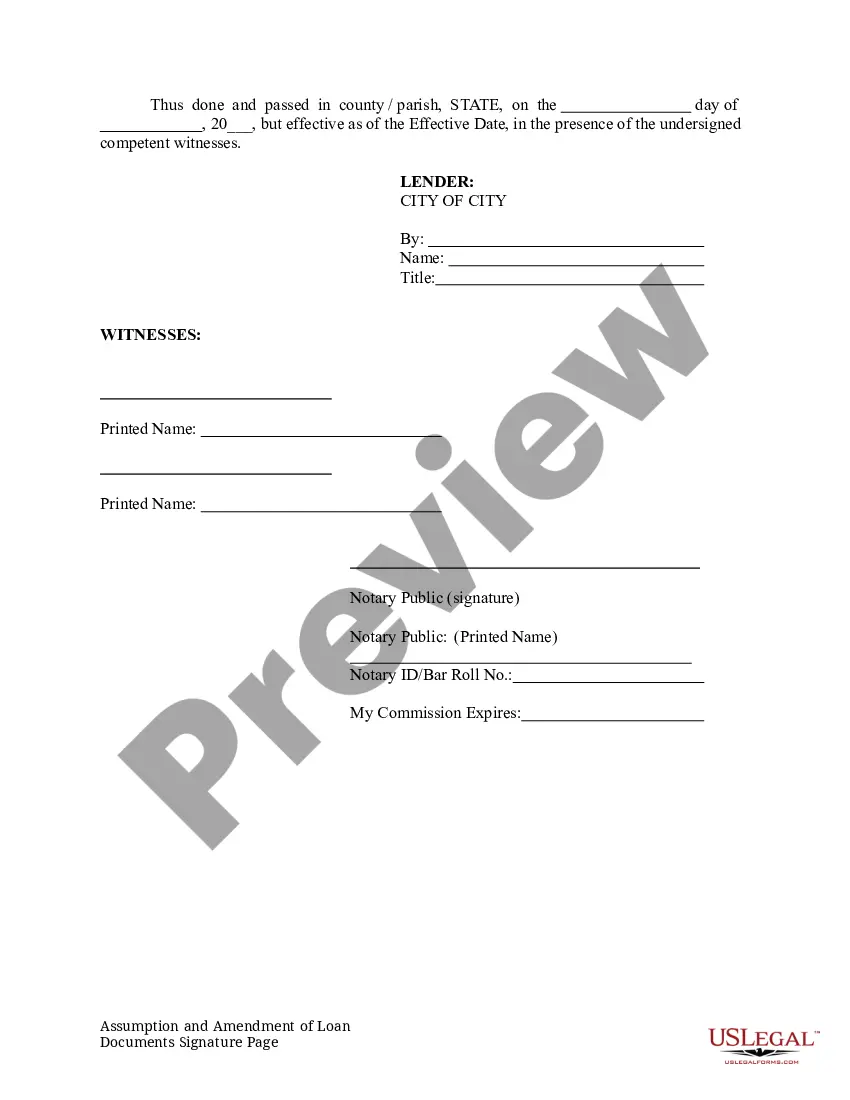

- Signatures of all parties involved, including witnesses and notaries.

Legal use and context

This agreement is often used in real estate transactions where a buyer assumes an existing mortgage from a seller. Formally documenting the assumption of loan obligations helps clarify the responsibilities and legal rights of the parties involved. This legal context ensures that all parties are aware of their commitments and protects the lender's interests in overseeing the loan agreement.

Common mistakes to avoid when using this form

When completing the Assumption and Amendment of Loan Documents, avoid these common mistakes:

- Failing to include accurate and complete information about all parties involved.

- Not aligning the details of the assumed loan with the original loan documents.

- Ignoring state-specific statutory requirements or lender conditions.

- Neglecting to secure required signatures, especially from witnesses and notaries.

What to expect during notarization or witnessing

During the notarization process, the notary public will verify the identities of all signatories and confirm their willingness to sign the Assumption and Amendment of Loan Documents. Signers must provide valid identification and, in some cases, may need to sign the document in the presence of the notary. The notary will then affix their signature and seal to properly document the signing, which ensures the legality of the agreement.

Form popularity

FAQ

A mortgage loan assumption allows you to buy a home by taking over (or "assuming") the owner's mortgage instead of getting a new mortgage. This has advantages for homebuyers and sellers. Homebuyers can get a mortgage with a lower interest rate than may be currently available on the market.

An assumable mortgage allows a homebuyer to assume the current principal balance, interest rate, repayment period, and any other contractual terms of the seller's mortgage. Rather than going through the rigorous process of obtaining a home loan from the bank, a buyer can take over an existing mortgage.

Buyer shall receive a credit at Closing in an amount equal to the sum of the unpaid principal balance of the Loan, and any interest, default interest, or other sum that is accrued, due and/or payable to Existing Lender on the Closing Date.

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

What is a Loan Amendment? A loan amendment is a legally bound modification to the terms and conditions of an already-existing loan agreement. If a lender or a borrower needs changes made to the original loan agreement, they will use a loan amendment to outline the terms and conditions of those modifications.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.