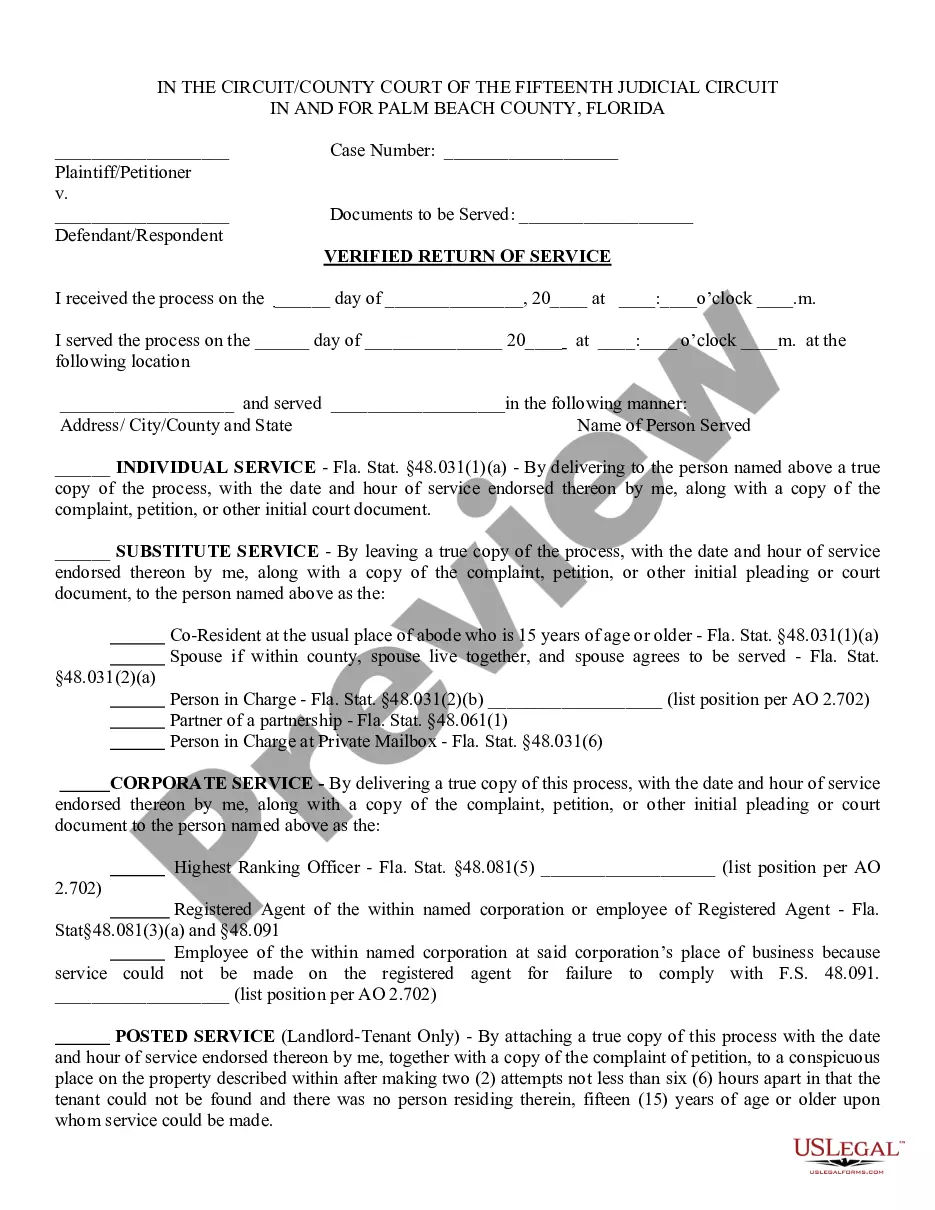

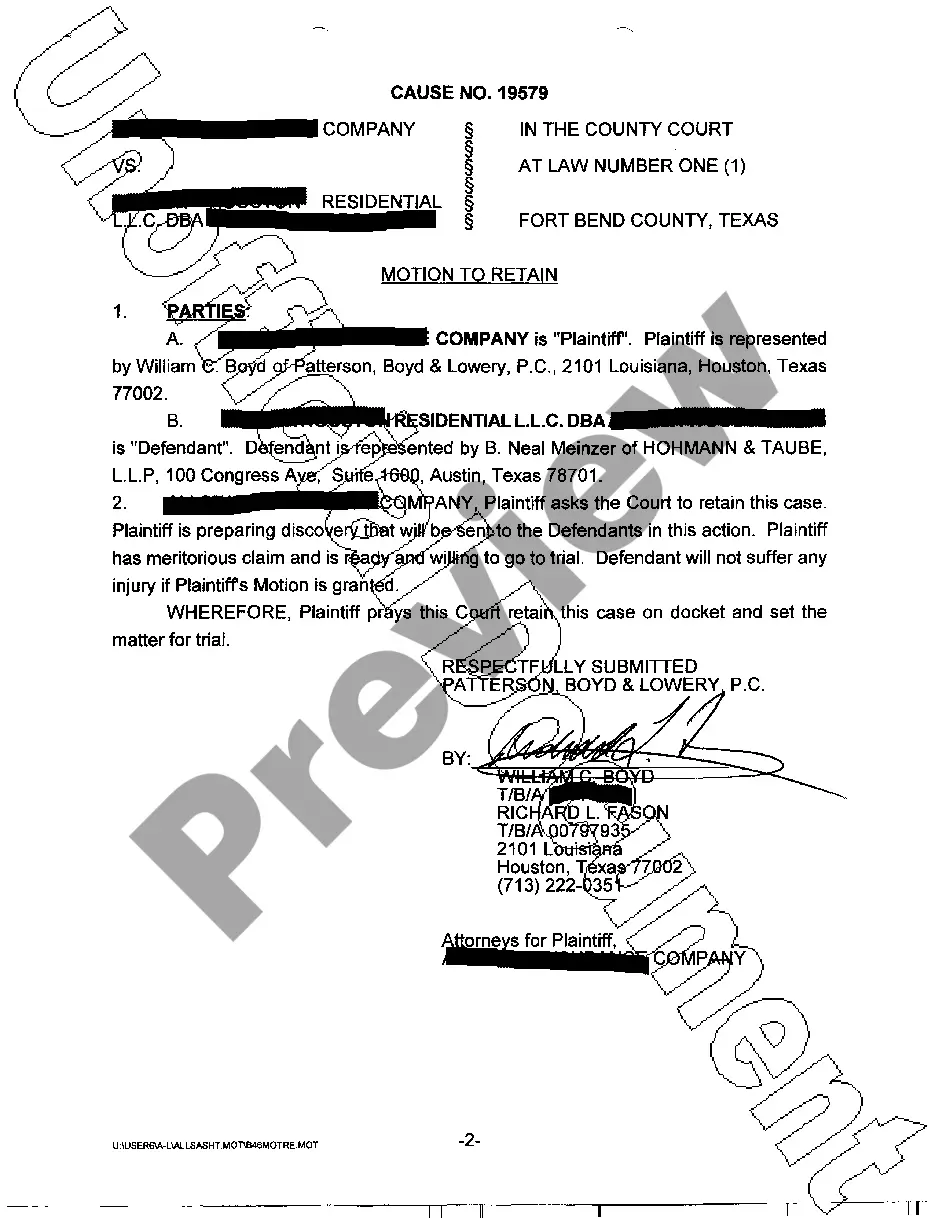

An Assumption Endorsement — Issued by Underwriter is a document that allows a new owner or lender to take over an existing insurance policy from a prior owner or lender. The endorsement is issued by the underwriter and specifies the terms and conditions of the policy transfer. It also serves as a record that the underwriter has approved the policy transfer. There are two types of Assumption Endorsement-Issued by Underwriter: Subordination Endorsement and Nonsubordination Endorsement. A Subordination Endorsement is used when the new owner or lender will have a higher priority than the prior owner or lender. A Nonsubordination Endorsement is used when the new owner or lender will have the same priority as the prior owner or lender.

Assumption Endorsement - Issued by Underwriter

Description

How to fill out Assumption Endorsement - Issued By Underwriter?

If you’re looking for a way to appropriately complete the Assumption Endorsement - Issued by Underwriter without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business scenario. Every piece of documentation you find on our web service is drafted in accordance with federal and state laws, so you can be sure that your documents are in order.

Adhere to these straightforward instructions on how to get the ready-to-use Assumption Endorsement - Issued by Underwriter:

- Make sure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and choose your state from the dropdown to locate another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Assumption Endorsement - Issued by Underwriter and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Types Of Insurance Endorsements Scheduled Personal Property Endorsement.Water/Sewer Backup Endorsement.Flood Endorsement.Earthquake Endorsement.Identity Theft Endorsement.Canine Liability Exclusion Endorsement.Additional Insured Endorsement.Home Business Endorsement.

A common endorsement is scheduled personal property coverage, which you can buy as extra coverage for specific types of belongings. For example, you might have an insurance endorsement to add coverage for a valuable piece of jewelry, like an engagement ring, or expensive artwork.

Endorsements can be broadly classified into two, financial and non-financial. Financial endorsements are those which affect the premium, whereas non-financial endorsements are those which do not affect the premium amount.

An insurance endorsement/rider is an amendment to an existing insurance contract that changes the terms of the original policy. An endorsement/rider can be issued at the time of purchase, mid-term or at renewal time. Insurance premiums may be affected and adjusted as a result.

This endorsement insures the lender against loss or damage sustained by the Insured by reason of: (a) the invalidity or unenforceability of the lien of the Insured Mortgage upon the Title as a result of the Modification; (b) the lack of priority of the lien of the Insured Mortgage over defects in or liens or

An endorsement allows you to operate a certain type of commercial motor vehicle and transport specific items.

An endorser is someone who agrees to repay a Direct PLUS Loan if the borrower doesn't repay the loan, much like a cosigner does for other types of loans. If the borrower is a parent, the endorser may not be the student on whose behalf the parent is borrowing.

A signature is an endorsement. For example, when an employer issues a payroll check, it authorizes or endorses the transfer of money from the business account to the employee. The act of signing the check is considered an endorsement, which serves as proof of the payer's intent to transfer funds to the payee.