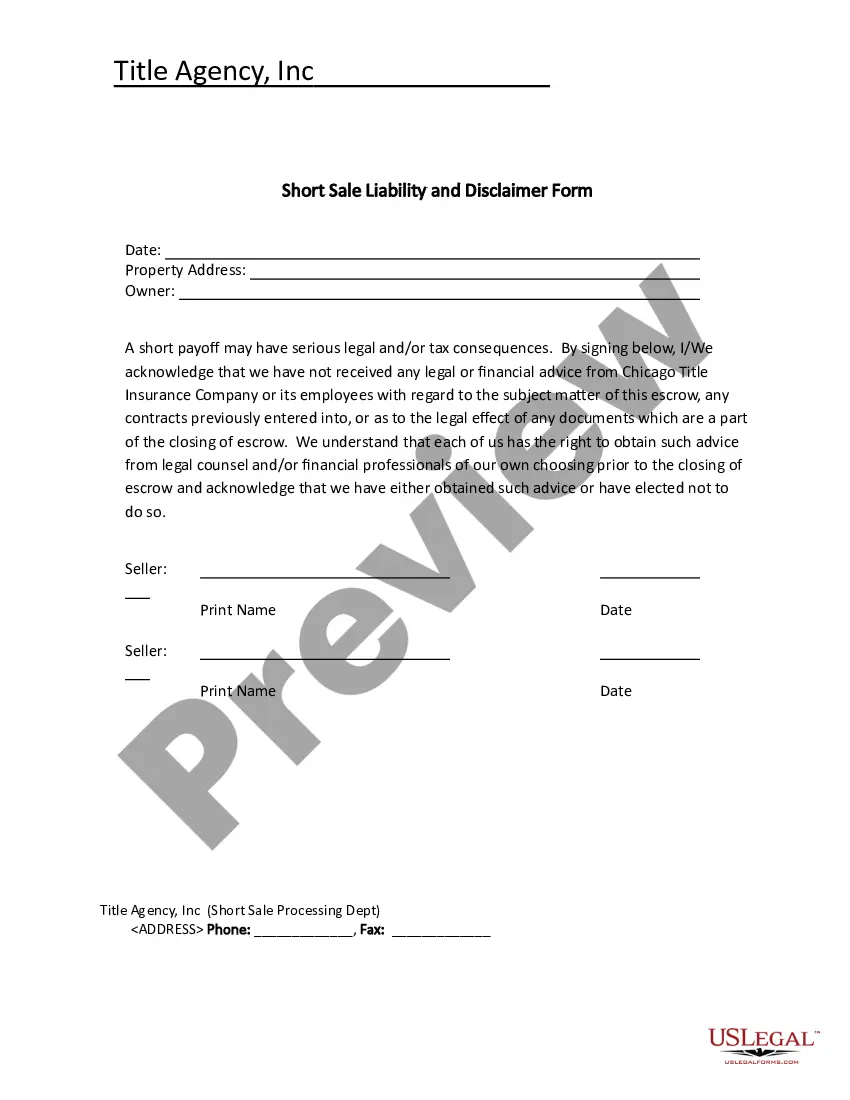

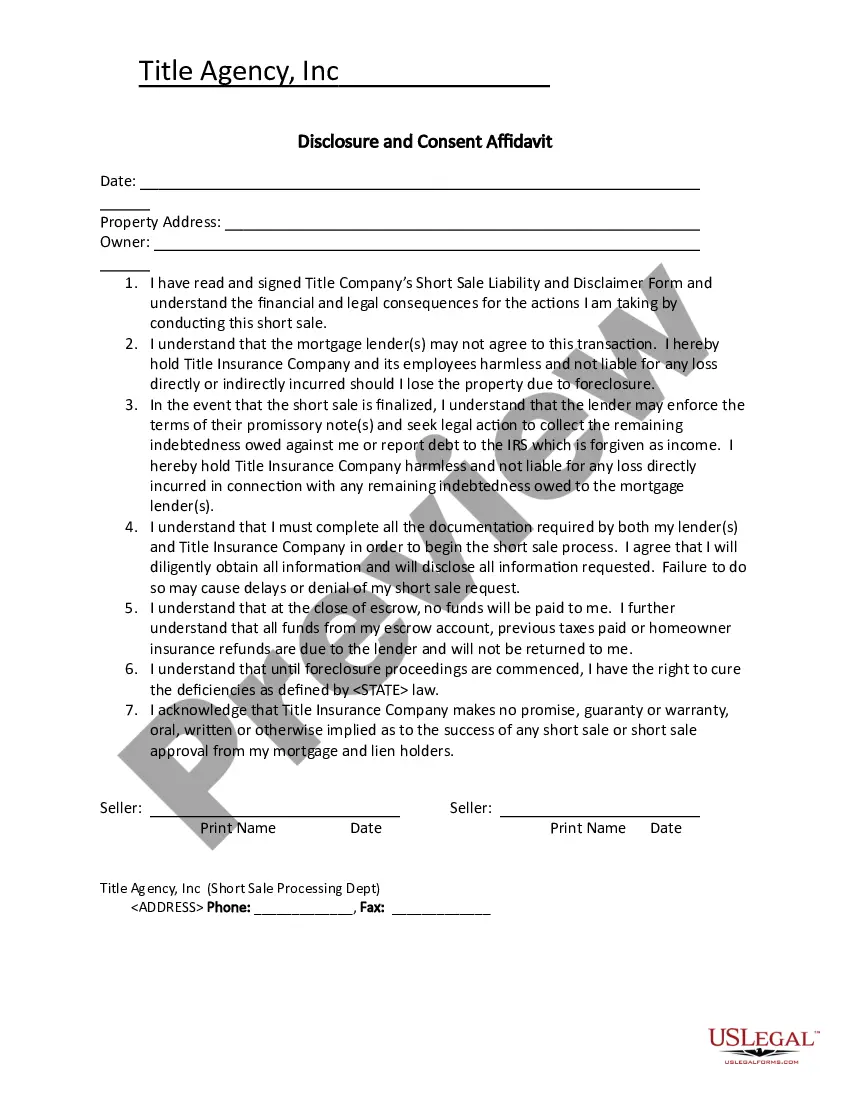

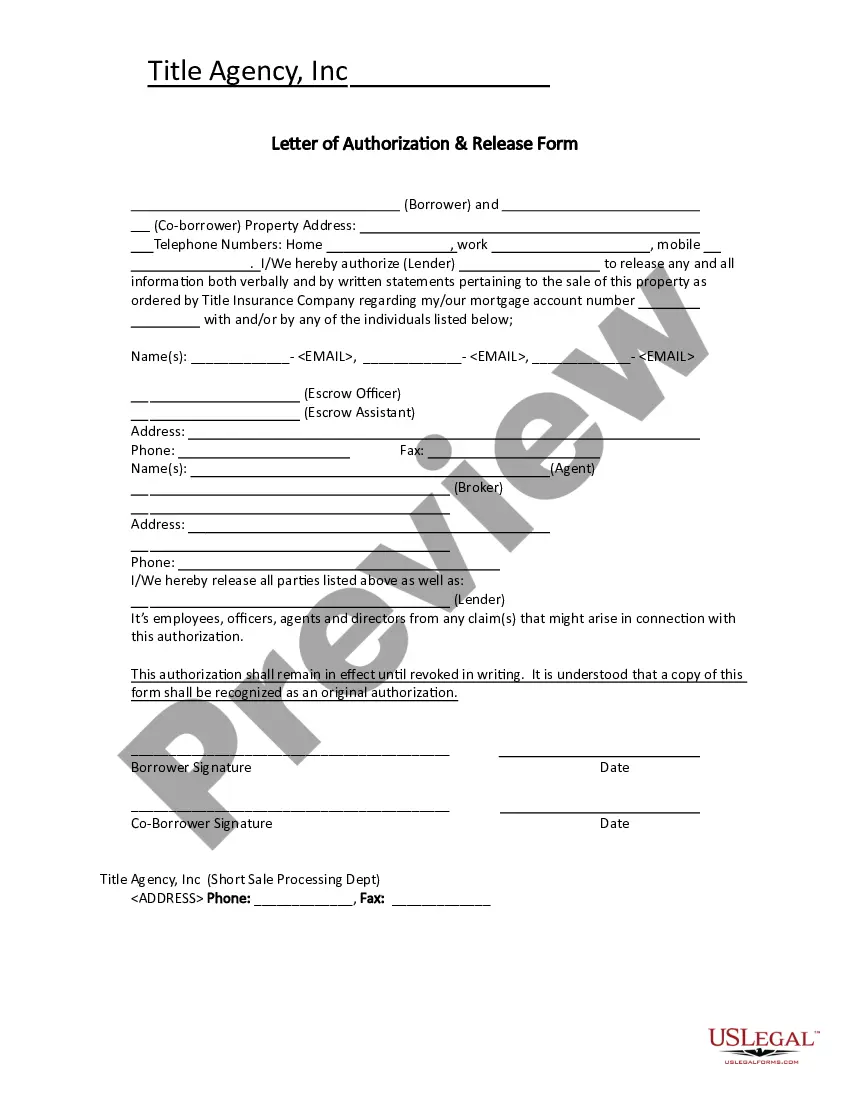

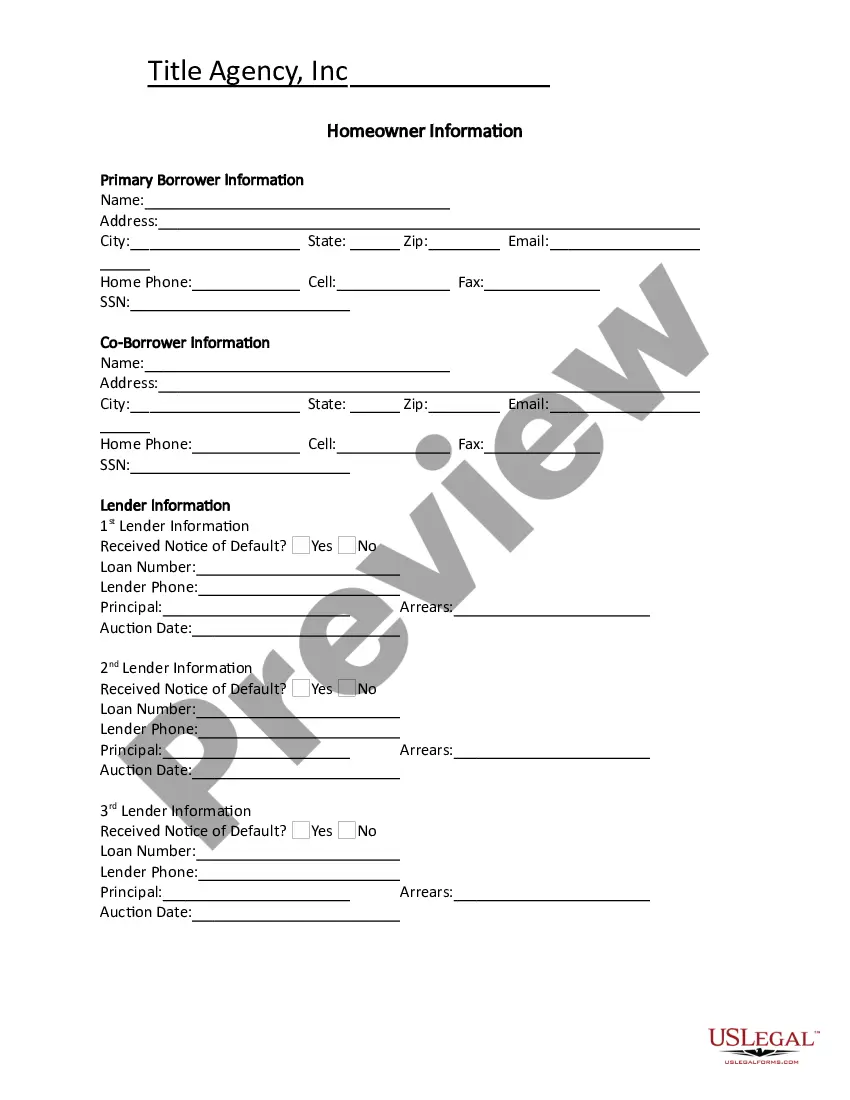

A Short Sale Processing Document and Agreement is an agreement between a borrower, lender, and a third party such as a real estate agent or attorney that outlines the terms of a short sale transaction. This document is used when a homeowner is unable to pay their mortgage and is selling their home for less than the amount they owe on the mortgage. The agreement outlines the responsibilities of each party involved and the process for completing the sale. There are a few different types of Short Sale Processing Document and Agreement, including a Purchase and Sale Agreement, an Agreement to List, a Short Sale Authorization and Request Form, and a Short Sale Addendum. The Purchase and Sale Agreement sets forth the terms of the sale, such as the purchase price, closing date, and other details of the sale. The Agreement to List is a document between the homeowner and the real estate agent that outlines the agent's commission and the process of listing and selling the home. The Short Sale Authorization and Request Form is a document that authorizes the lender to approve or deny a short sale transaction. Lastly, the Short Sale Addendum outlines additional terms and conditions between the buyer and seller, such as the buyer's responsibility for closing costs and other fees.

Short Sale Processing Document and Agreement

Description

How to fill out Short Sale Processing Document And Agreement?

How much time and resources do you usually spend on composing formal documentation? There’s a greater opportunity to get such forms than hiring legal experts or wasting hours searching the web for a proper template. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, such as the Short Sale Processing Document and Agreement.

To obtain and prepare an appropriate Short Sale Processing Document and Agreement template, adhere to these easy steps:

- Look through the form content to ensure it complies with your state requirements. To do so, check the form description or utilize the Preview option.

- If your legal template doesn’t meet your requirements, locate another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Short Sale Processing Document and Agreement. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely secure for that.

- Download your Short Sale Processing Document and Agreement on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most reliable web services. Join us now!

Form popularity

FAQ

How To Get A Short Sale Home: The Process For Buyers In 6 Steps Step 1: Get Approved For Financing. As with any home purchase, the first step is getting approved.Step 2: Get A Real Estate Agent And Find A Home.Step 3: Do Your Research.Step 4: Make An Offer.Step 5: Have The Home Inspected.Step 6: Close On The Property.

Short selling involves borrowing a security whose price you think is going to fall from your brokerage and selling it on the open market. Your plan is to then buy the same stock back later, hopefully for a lower price than you initially sold it for, and pocket the difference after repaying the initial loan.

The listing agreement should state that the seller's acceptance of any offer will be subject to the lender's approval of the offer without requiring that the seller bring cash to close escrow, and an agreement by the listing broker to accept the commission as approved by the lender.

Key Takeaways. A short sale usually indicates a homeowner in financial distress, a real estate market in the doldrums, or both. The short sale must be approved in advance by the mortgage lender.

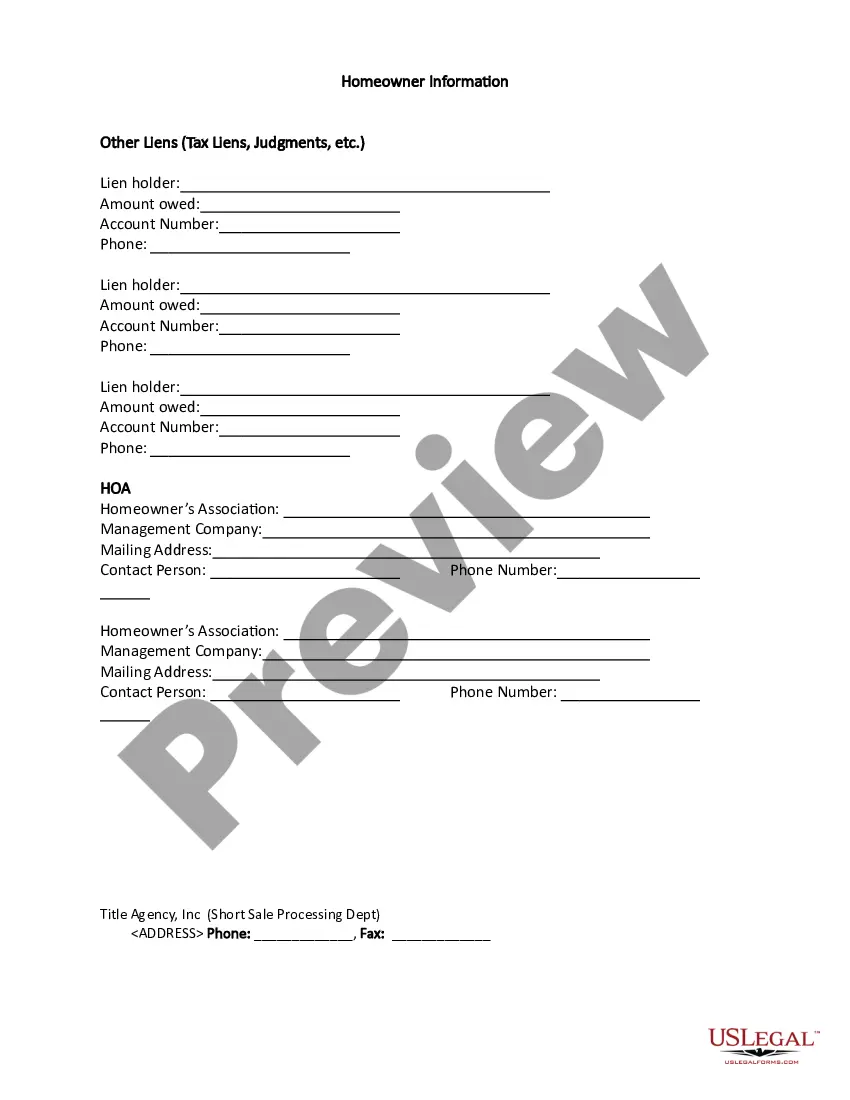

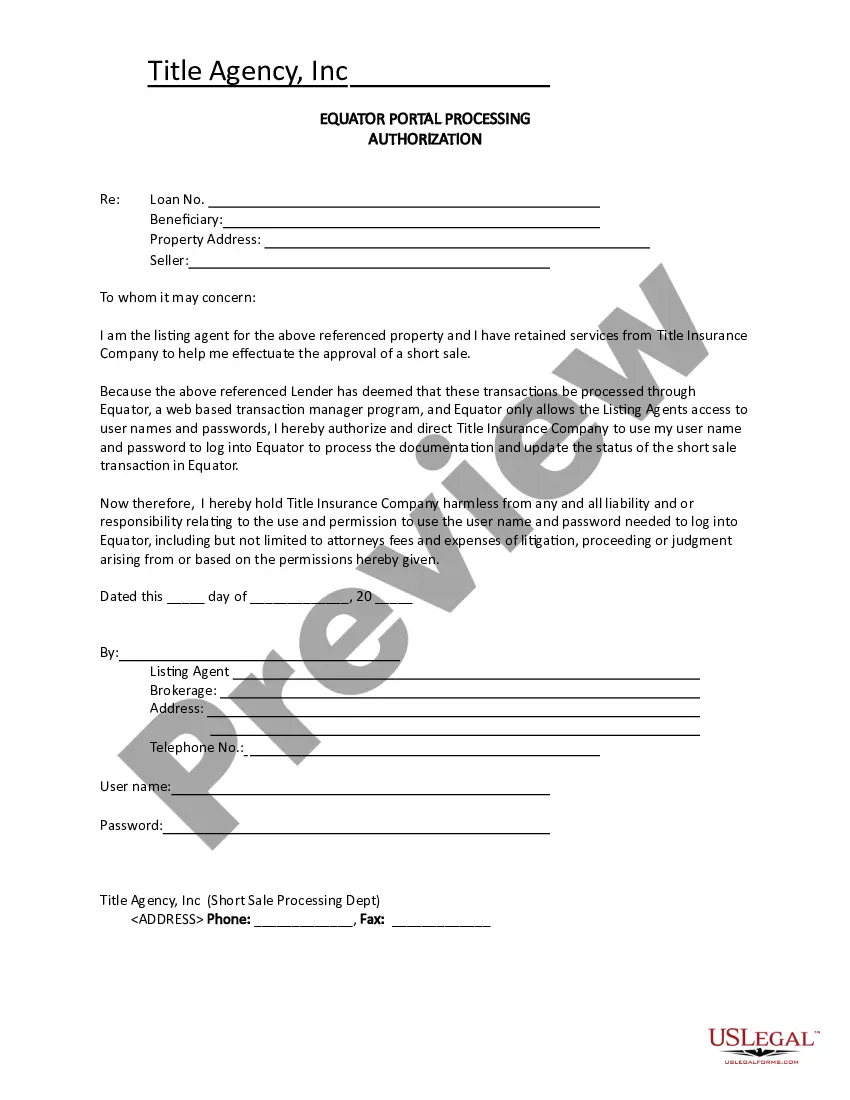

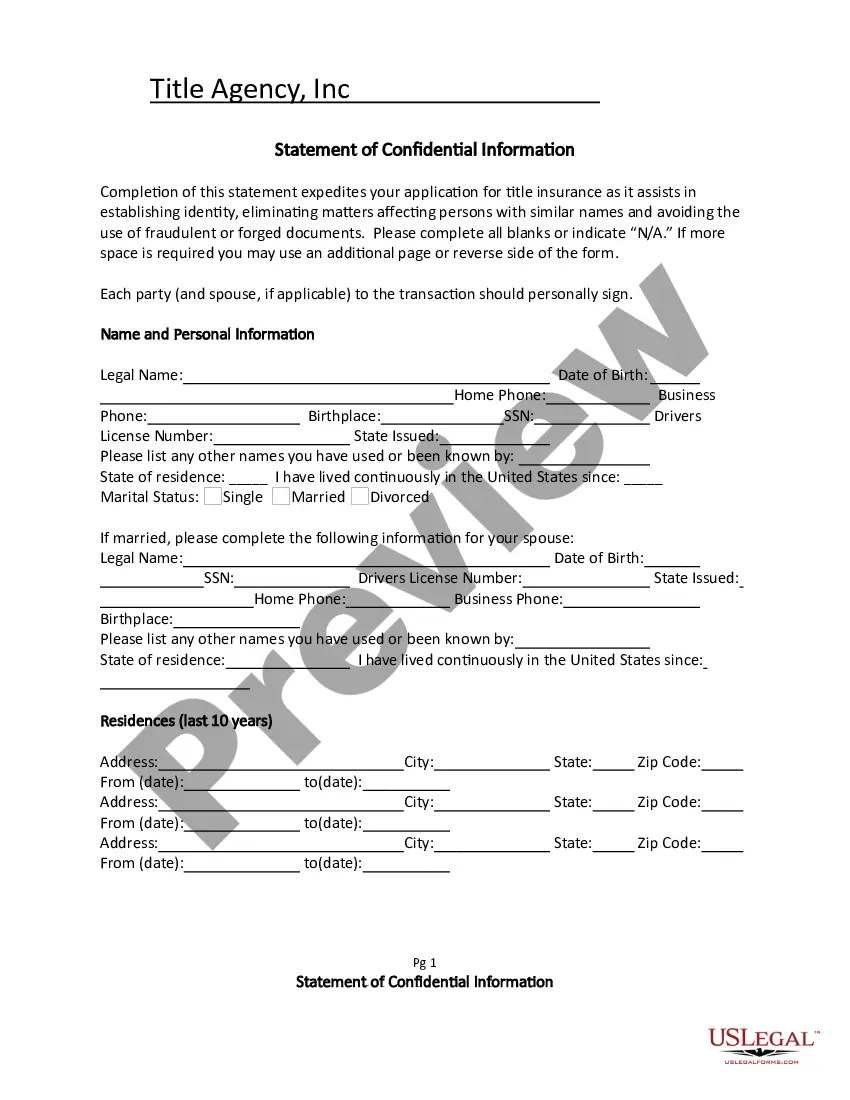

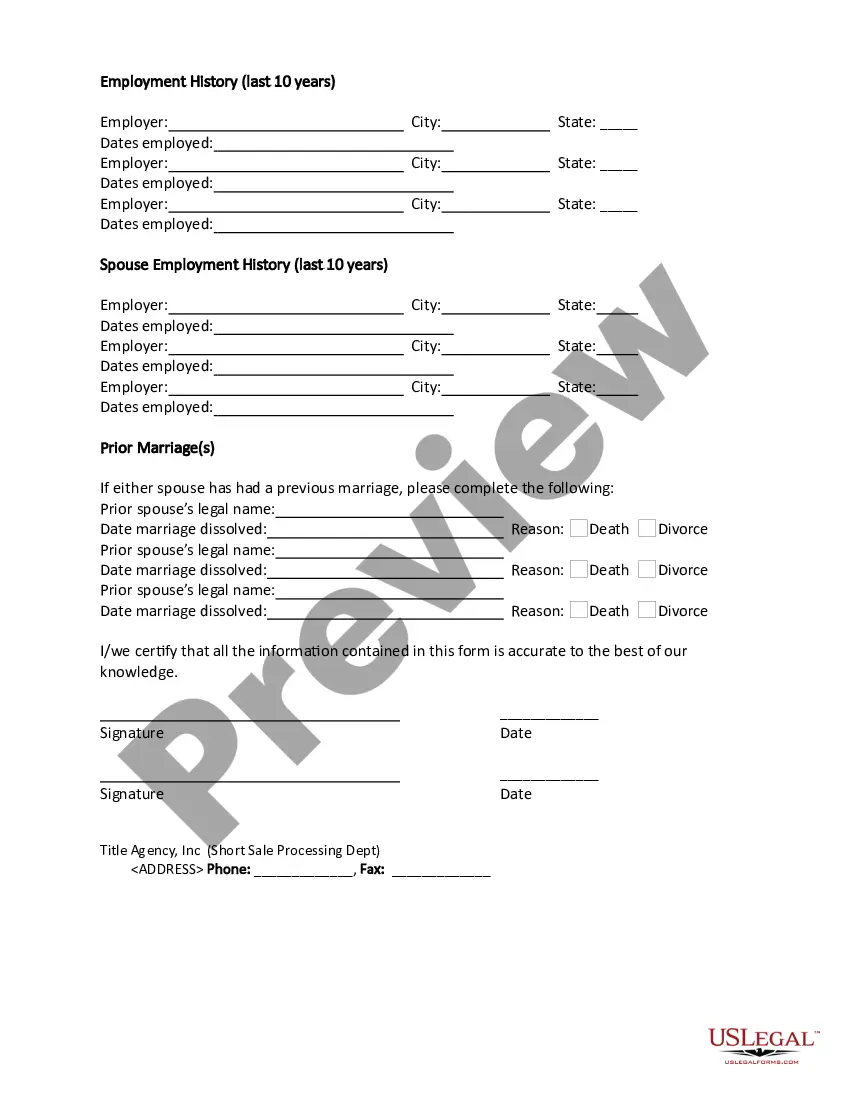

Documents Required for a Short Sale Package An Executed Listing Agreement. Fully Executed Purchase Contract. Seller's Hardship Letter. Authorization Letter. Last Two Bank Statements. Tax Returns and Wage Documentation. A Closing Disclosure.