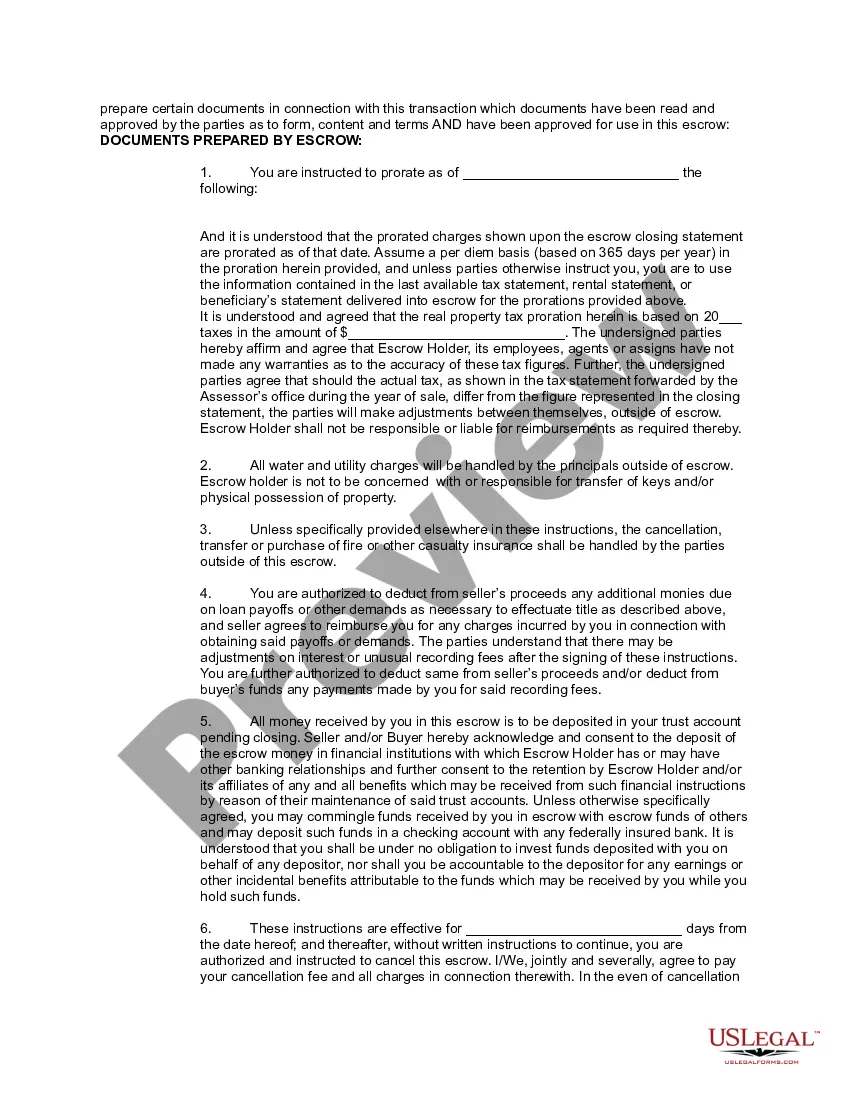

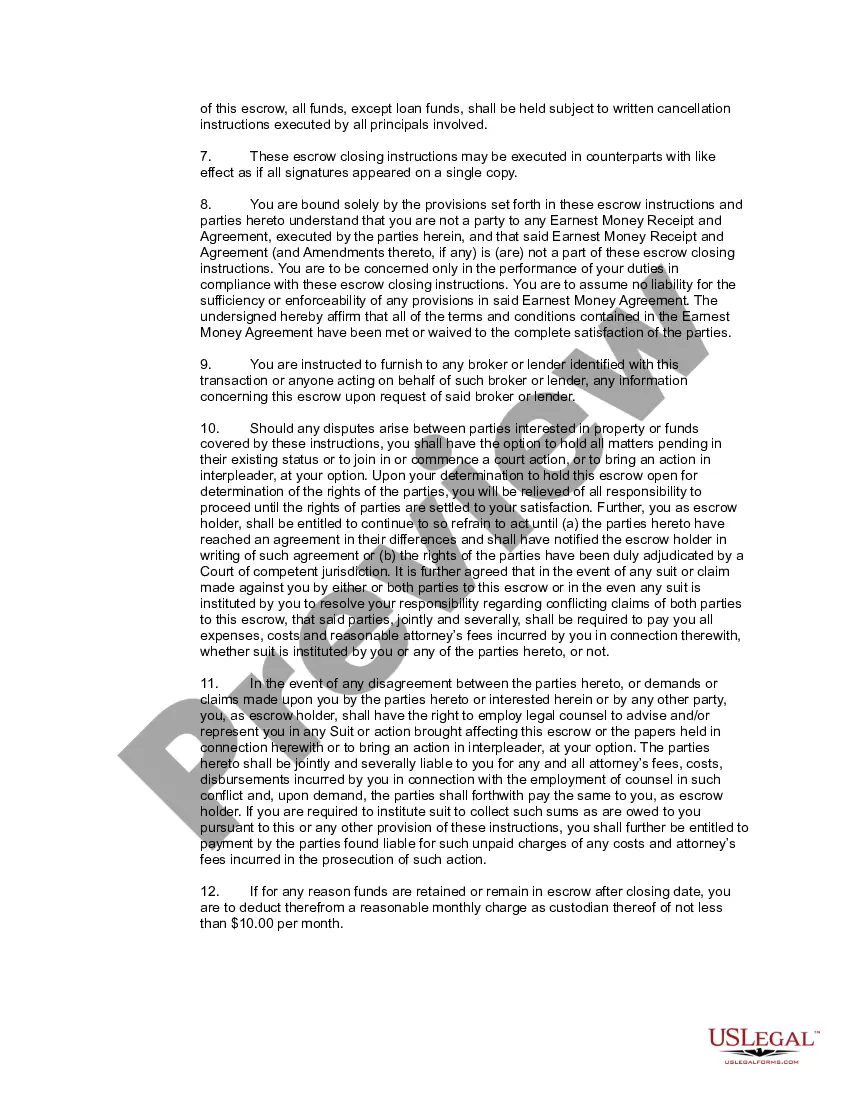

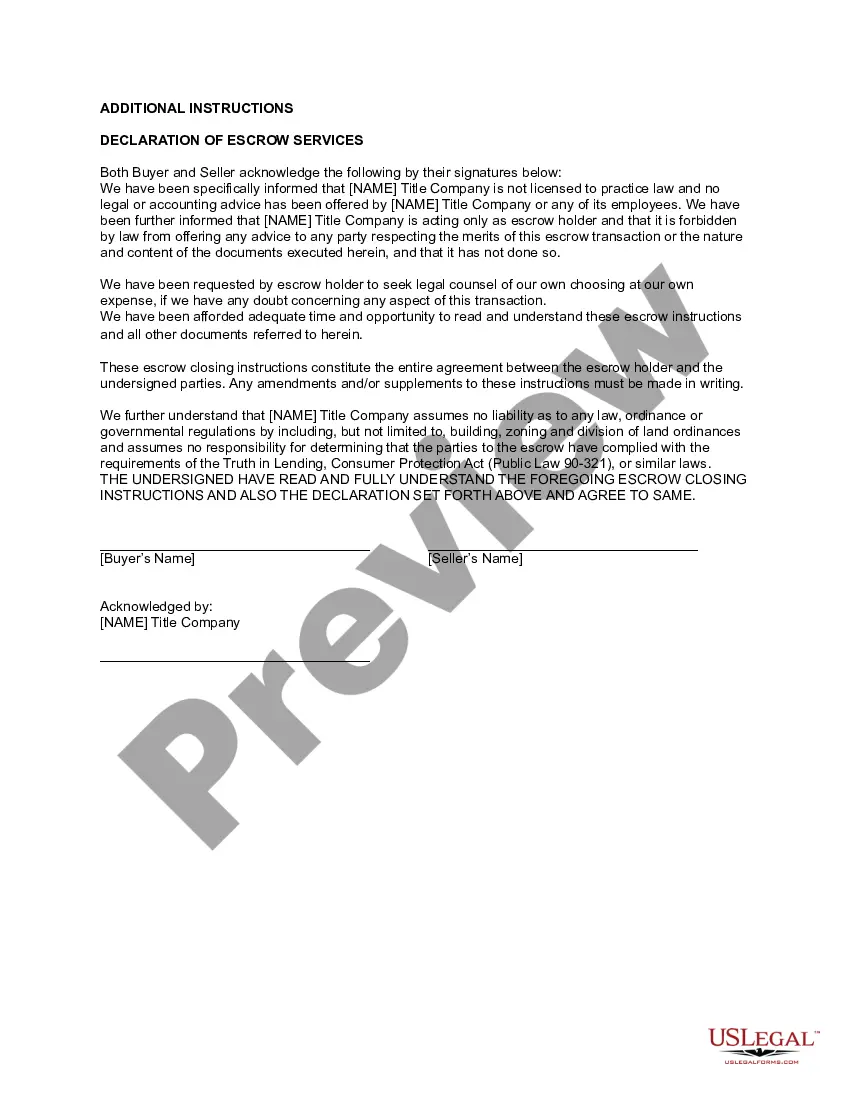

Escrow Closing Instructions are a set of instructions provided by a lender or title company to a borrower, seller, and escrow agent involved in a real estate transaction. The instructions specify the document requirements, fees, and other details needed to ensure a successful closing. There are two types of Escrow Closing Instructions: initial escrow instructions and closing instructions. Initial escrow instructions include information such as the type of loan, loan term, loan amount, loan interest rate, escrow account requirements, and title insurance requirements. Closing instructions detail the actual closing process, including the closing date, the number of days to closing, the closing documents to be provided, the fees to be paid, the payment methods, and any other instructions for the closing.

Escrow Closing Instructions are a set of instructions provided by a lender or title company to a borrower, seller, and escrow agent involved in a real estate transaction. The instructions specify the document requirements, fees, and other details needed to ensure a successful closing. There are two types of Escrow Closing Instructions: initial escrow instructions and closing instructions. Initial escrow instructions include information such as the type of loan, loan term, loan amount, loan interest rate, escrow account requirements, and title insurance requirements. Closing instructions detail the actual closing process, including the closing date, the number of days to closing, the closing documents to be provided, the fees to be paid, the payment methods, and any other instructions for the closing.