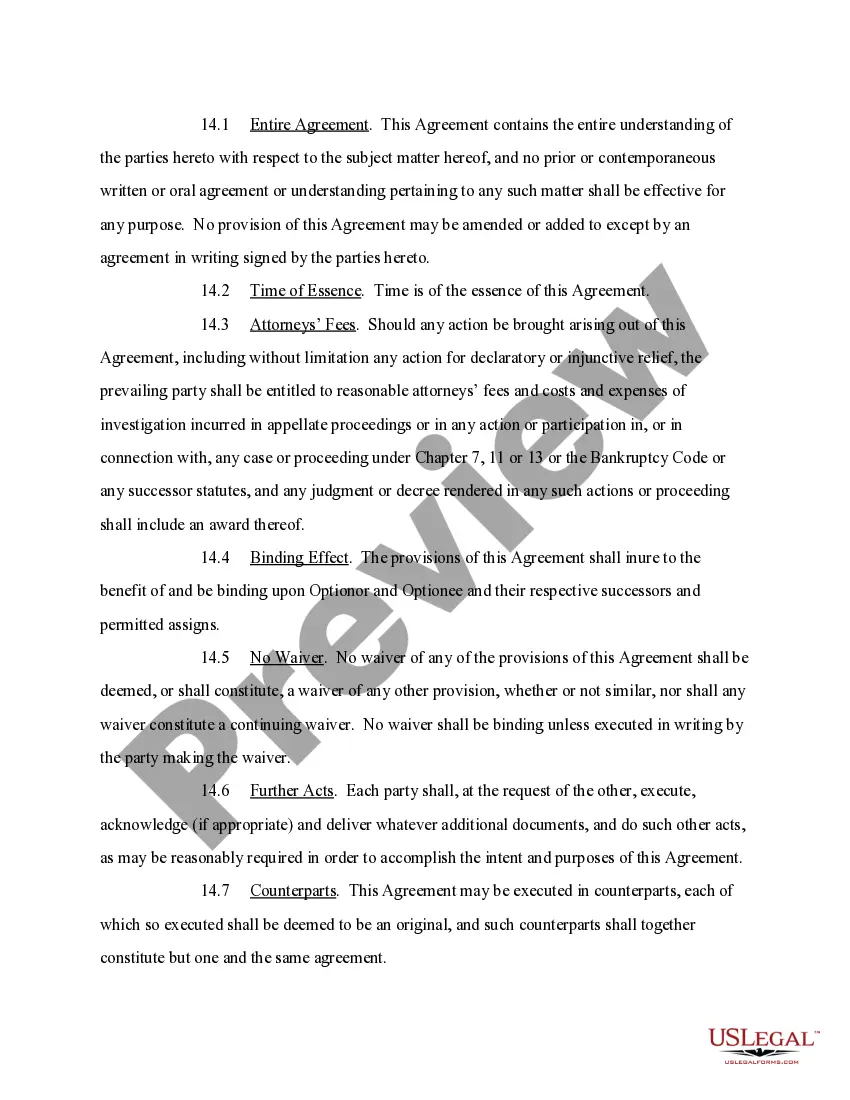

An Option Agreement is a legally binding contract that grants one party (the optioned) the right, but not the obligation, to purchase or lease certain assets from another party (the option or) at a predetermined price and within a specified period of time. It is commonly used in real estate, finance, and other business contexts. There are two types of Option Agreements: call options and put options. A call option gives the optioned the right to purchase the assets from the option or at the predetermined price; a put option gives the optioned the right to sell the assets to the option or at the predetermined price. Both types of Option Agreements require the optioned to pay an option fee for the right to purchase or sell the assets. The option fee is typically non-refundable.

Option Agreement

Description

How to fill out Option Agreement?

How much time and resources do you typically spend on drafting official paperwork? There’s a better opportunity to get such forms than hiring legal experts or spending hours searching the web for an appropriate blank. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, including the Option Agreement.

To obtain and prepare a suitable Option Agreement blank, follow these simple instructions:

- Look through the form content to make sure it complies with your state regulations. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t satisfy your needs, locate a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Option Agreement. If not, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally reliable for that.

- Download your Option Agreement on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you safely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trusted web services. Join us now!

Form popularity

FAQ

An option to purchase agreement gives a home buyer the exclusive right to purchase a property within a specified time period and for a fixed or sometimes variable price. This, in turn, prevents sellers from providing other parties with offers or selling to them within this time period.

The seller of a call option receives a premium when they assume the obligation to sell their shares at the strike price. The buyer benefits by getting the option to purchase the asset at the strike price, no matter if the value of the asset increases above that price in the period of time covered by the contract.

The difference between a lease option and a lease purchase agreement is that the lease option only obligates the seller to sell. A lease purchase agreement commits both parties to the sale barring breach of contract or the buyer's inability to secure a mortgage.

A real estate purchase option is a contract on a specific piece of real estate that allows the buyer the exclusive right to purchase the property. Once a buyer has an option to buy a property, the seller cannot sell the property to anyone else. The buyer pays for the option to make this real estate purchase.

A call option writer makes money from the premium they received for writing the contract and entering into the position. This premium is the price the buyer paid to enter into the agreement. A call option buyer makes money if the price of the security remains above the strike price of the option.

Options explained for dummies Part - 2 Option Contract - YouTube YouTube Start of suggested clip End of suggested clip Price over a certain period of time. However options are not the same thing as stocks. Because theyMorePrice over a certain period of time. However options are not the same thing as stocks. Because they do not represent ownership in a company.

An option is a contract giving the buyer the right?but not the obligation?to buy (in the case of a call) or sell (in the case of a put) the underlying asset at a specific price on or before a certain date. People use options for income, to speculate, and to hedge risk.

Disadvantages of option agreements for landowners The main disadvantage of option agreements for sellers is that there is no guarantee of sale, seeing as the buyer only has the option to buy. In addition, the property will not be put on the open market for third parties to make offers.