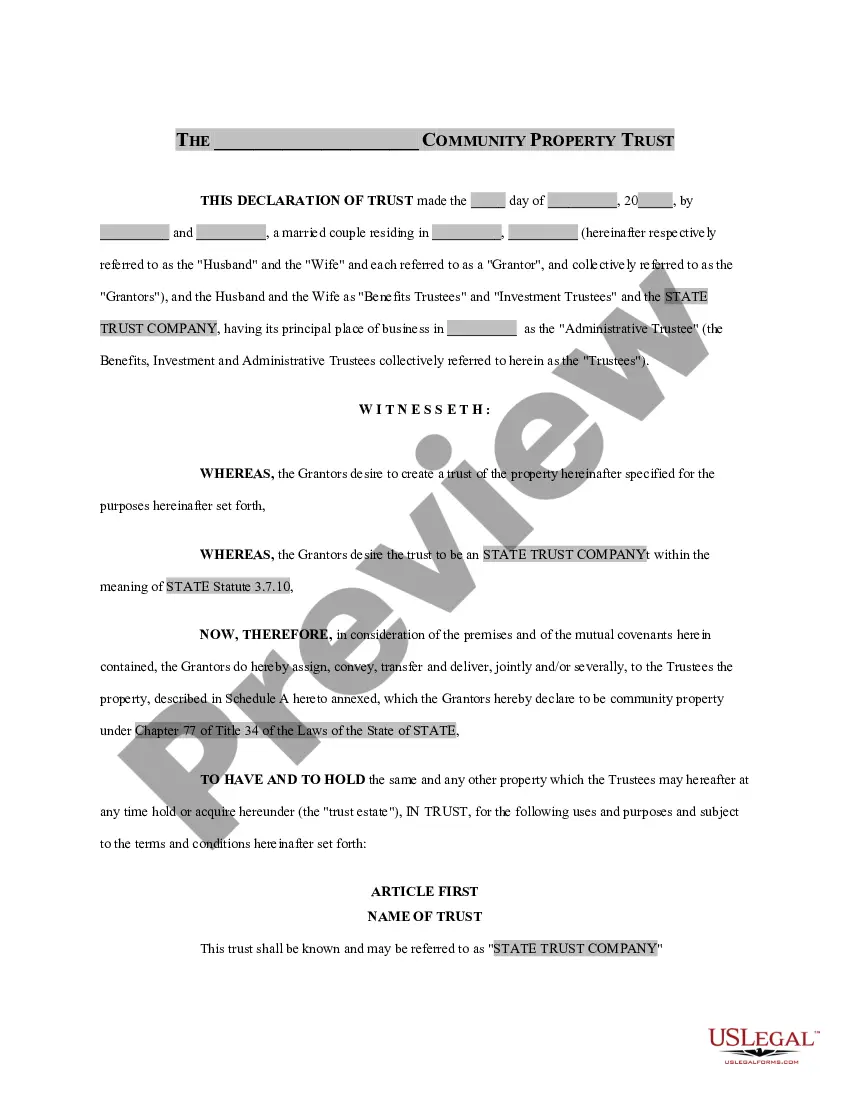

A Community Property Trust (CPT) is a type of irrevocable trust that is used to manage the separate property of married couples. This type of trust is used to protect the assets of both spouses in the event of death, divorce, or other unforeseen circumstances. It is also used to ensure that the assets of one spouse are not used to satisfy the debts of the other. The CPT is often used in states that recognize community property, which is property acquired during the marriage and deemed to be equally owned by both spouses. There are two main types of Community Property Trusts: the Qualified Terminable Interest Property (TIP) Trust and the Revocable Living Trust. A TIP Trust is a trust that is designed to protect the surviving spouse’s rights to the community property, while allowing the deceased spouse to designate who will receive the trust assets upon death. A Revocable Living Trust is an irrevocable trust that allows the couple to determine who will receive the trust assets and when they will receive them. This type of trust is often used to provide for a surviving spouse in the event of death or divorce.

Community Property Trust

Description

How to fill out Community Property Trust?

If you’re searching for a way to properly prepare the Community Property Trust without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every personal and business scenario. Every piece of paperwork you find on our web service is created in accordance with federal and state regulations, so you can be certain that your documents are in order.

Adhere to these simple instructions on how to obtain the ready-to-use Community Property Trust:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and select your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Community Property Trust and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Benefits of Community Property Trusts A community property trust holds assets a married couple jointly owns. Each spouse has equal interests in the property and can use them during their lifetime. When one spouse dies, the property gets a new basis equal to the fair market value at the time of the death.

California is a community property state, so any property acquired during the marriage is generally subject to equal distribution between the spouses in the event of divorce. In California, trusts established before marriage are generally considered separate property.

A Florida Community Property Trust (FLCPT) is a joint trust that holds the assets of a married couple, and, while both spouses are alive, the assets generally may be used for their benefit.

California is a community property state. This means everything you earn or acquire during your marriage belongs to each spouse equally. Attempts to put more assets than are rightfully yours into a trust will not override the community property law.

How to Protect Assets from Divorce. In many states, including California, property owned by a spouse before he or she is married is considered separate property and is not divided between spouses when they divorce. Trusts, if established before the marriage, are also considered separate property.

Property you didn't earn, like a gift or inheritance one of you received while married, is not community property. Generally, a loan to pay for one spouse's education or training (student debt) is treated like that spouse's separate property. After you divorce, that spouse will be responsible for their student debt.

In California, trusts established before marriage are considered separate property. Other trusts ? including domestic or foreign asset protection trusts, revocable trusts and irrevocable trusts ? also protect assets in the event of divorce.

What happens to a Living Trust after a divorce? All trusts require three things: a Creator (Trustor or Grantor), a Trustee, and trust property. Once the court orders a property division between the two former spouses, the trust no longer has assets in it and it evaporates as a matter of law.