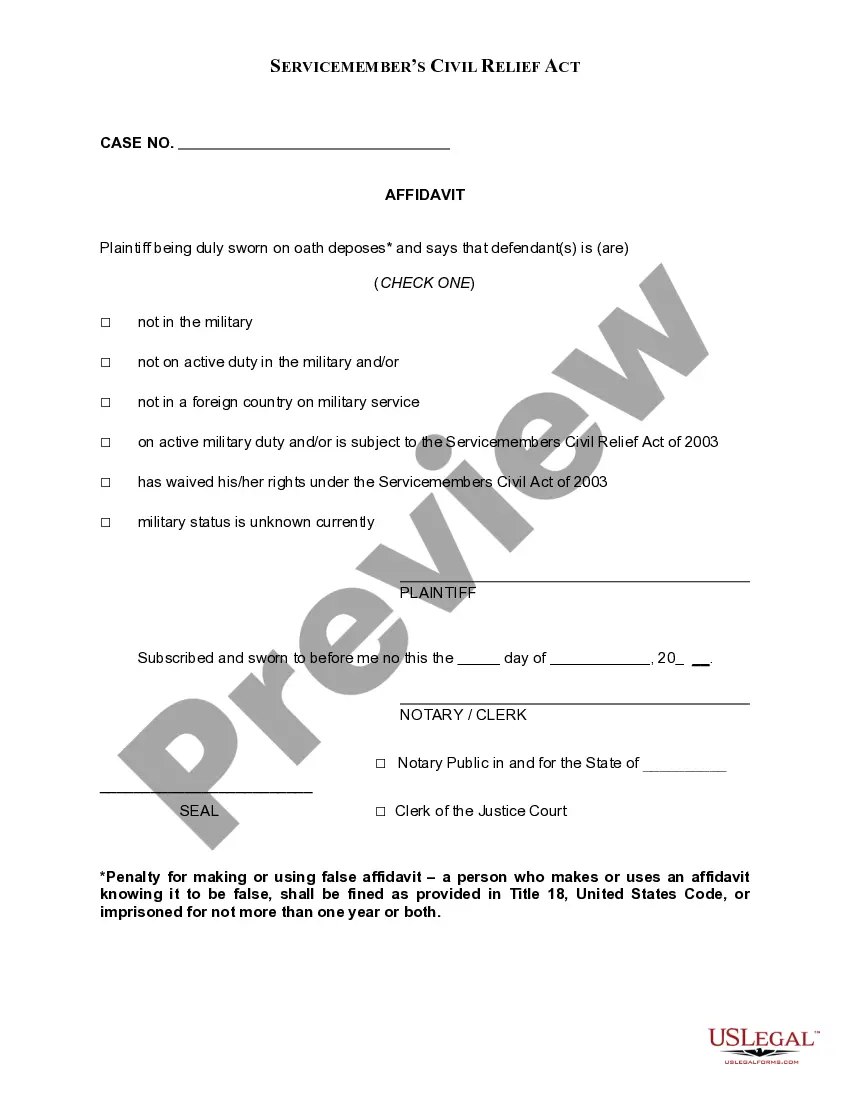

The Service member's Civil Relief Act (SCRA) is a federal law that provides financial and legal protections to military members who are facing financial obligations while on active duty. This law applies to all military personnel in the United States Armed Forces, including members of the National Guard and Reserves. The SCRA provides protections for service members who are facing eviction, foreclosure, repossession of a vehicle, loss of professional licenses, and other financial obligations. It also provides a cap on the interest rate that creditors may charge service members on existing debts, and a stay of proceedings in civil actions. The SCRA is made up of three main types of protections: the Soldiers' and Sailors' Civil Relief Act, the Military Spouses Residency Relief Act, and the Uniformed Services Employment and Reemployment Rights Act. The Soldiers' and Sailors' Civil Relief Act (SACRA) provides financial relief to service members on active duty by capping the interest rate on existing debts at 6%, and staying the proceedings of any civil actions against service members. The Military Spouses Residency Relief Act (MARRY) is designed to provide residency and tax relief to military spouses who are relocating due to their spouse's military service. The Uniformed Services Employment and Reemployment Rights Act (SERRA) protects the rights of service members to return to their job or a similar position after serving in the military. The SCRA is an important federal law that provides financial and legal protection to military members who are facing financial obligations while on active duty. It provides protections for service members facing eviction, foreclosure, repossession, and other financial obligations, as well as a cap on the interest rate charged by creditors on existing debts, and a stay of proceedings in civil actions.

Service member's Civil Relief Act

Description

How to fill out Service Member's Civil Relief Act?

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state laws and are checked by our experts. So if you need to complete Service member's Civil Relief Act, our service is the perfect place to download it.

Obtaining your Service member's Civil Relief Act from our library is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they locate the proper template. Later, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance verification. You should attentively review the content of the form you want and ensure whether it satisfies your needs and fulfills your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find a suitable template, and click Buy Now when you see the one you want.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Service member's Civil Relief Act and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Under the Servicemembers Civil Relief Act (SCRA), the maximum interest rate that may be charged on an eligible Direct Loan or FFEL Program loan is 6% during the period of the servicemember's qualifying military service.

Those who work in the auto lending industry should be aware of the following rules and regulations: Interest rates ? The SCRA caps interest rate for active-duty servicemembers at 6 percent. Thus, lenders must often adjust interest rates on scra car loan taken out before servicemembers go on active duty.

SCRA and MLA are two different laws that serve to provide financial protection for servicemembers and their families during times of need. The SCRA provides additional protections for those who are already members of the military, while the MLA expands the scope of financial products covered by federal law.

The SCRA permits servicemembers to terminate motor vehicle leases early, and without penalty, after entering military service or receiving qualifying military orders for a permanent change of station or deployment. This protection also applies to the servicemember's dependents who are joint lessees.

Active duty Soldiers are eligible for the Servicemembers' Civil Relief Act starting on the date active duty orders are received and, in limited situations, a Soldier's dependents may also be eligible. Protection generally terminates one year after the date of discharge of active duty.

New loans or debt: Contracts entered into during your service are not protected by the SCRA. This act applies specifically to loans taken out prior to active service.

You can request an interest rate reduction from your lender at any time while you are serving on active duty and up to 180 days after release from active duty. A lender can't revoke your loan or credit account, change the terms of your credit, or refuse to grant you credit just because you exercised your SCRA rights.

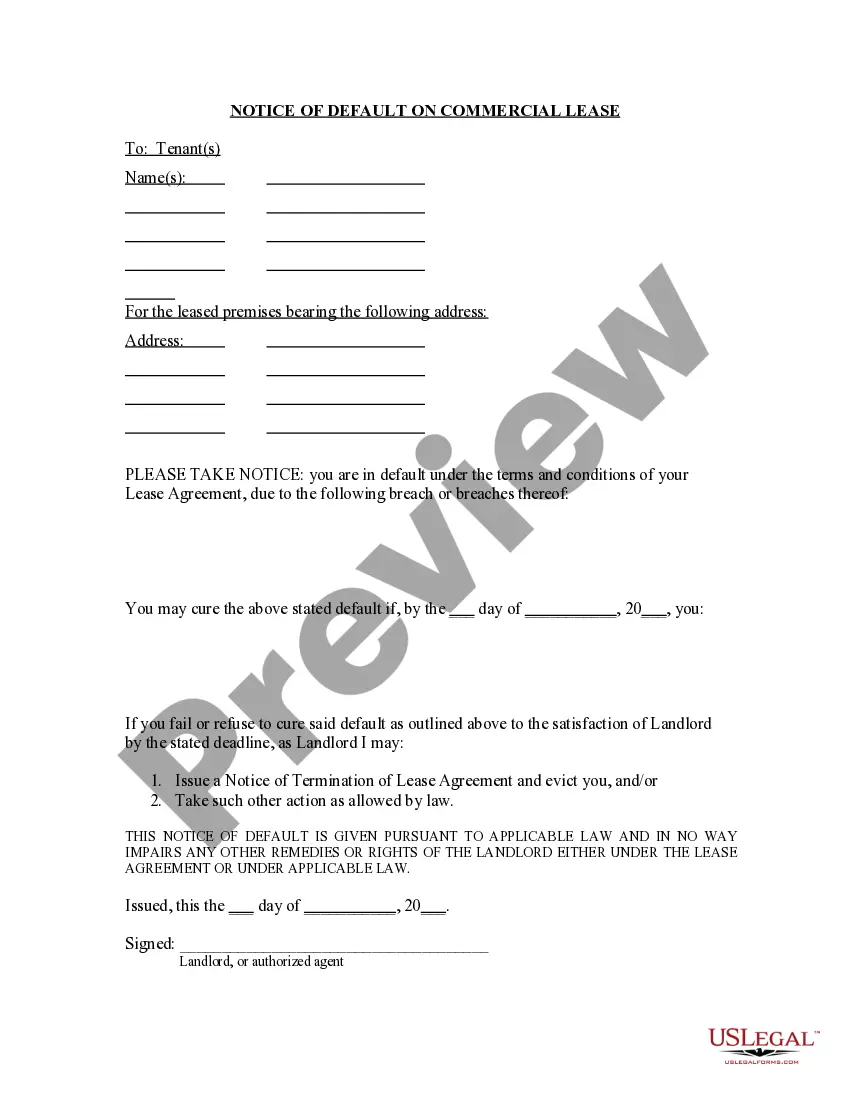

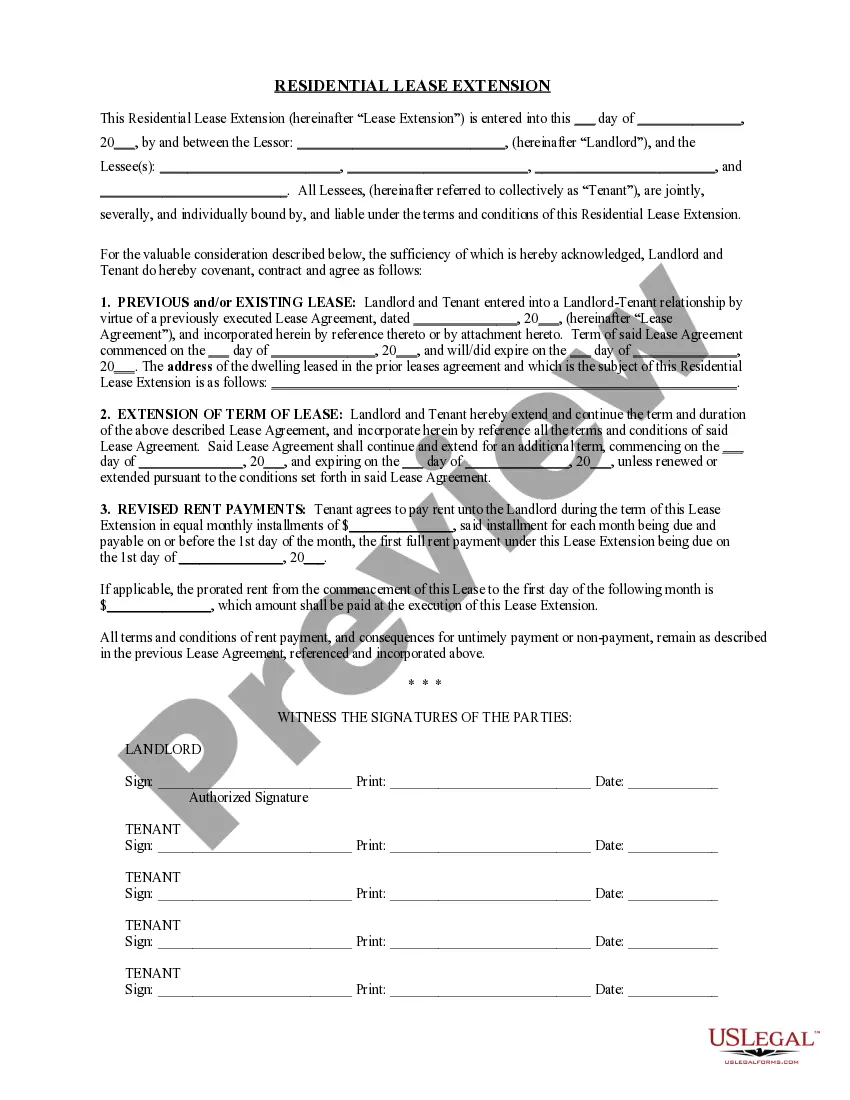

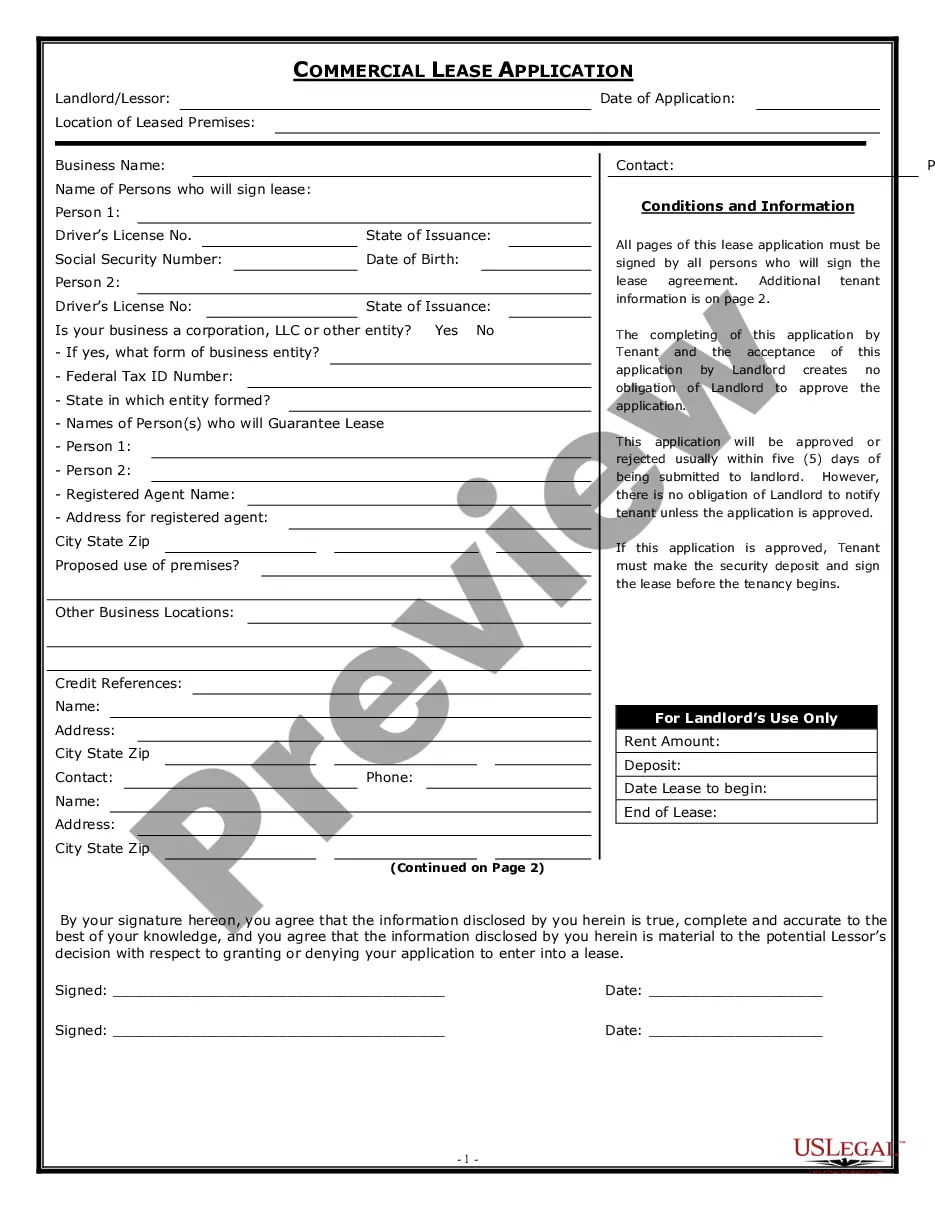

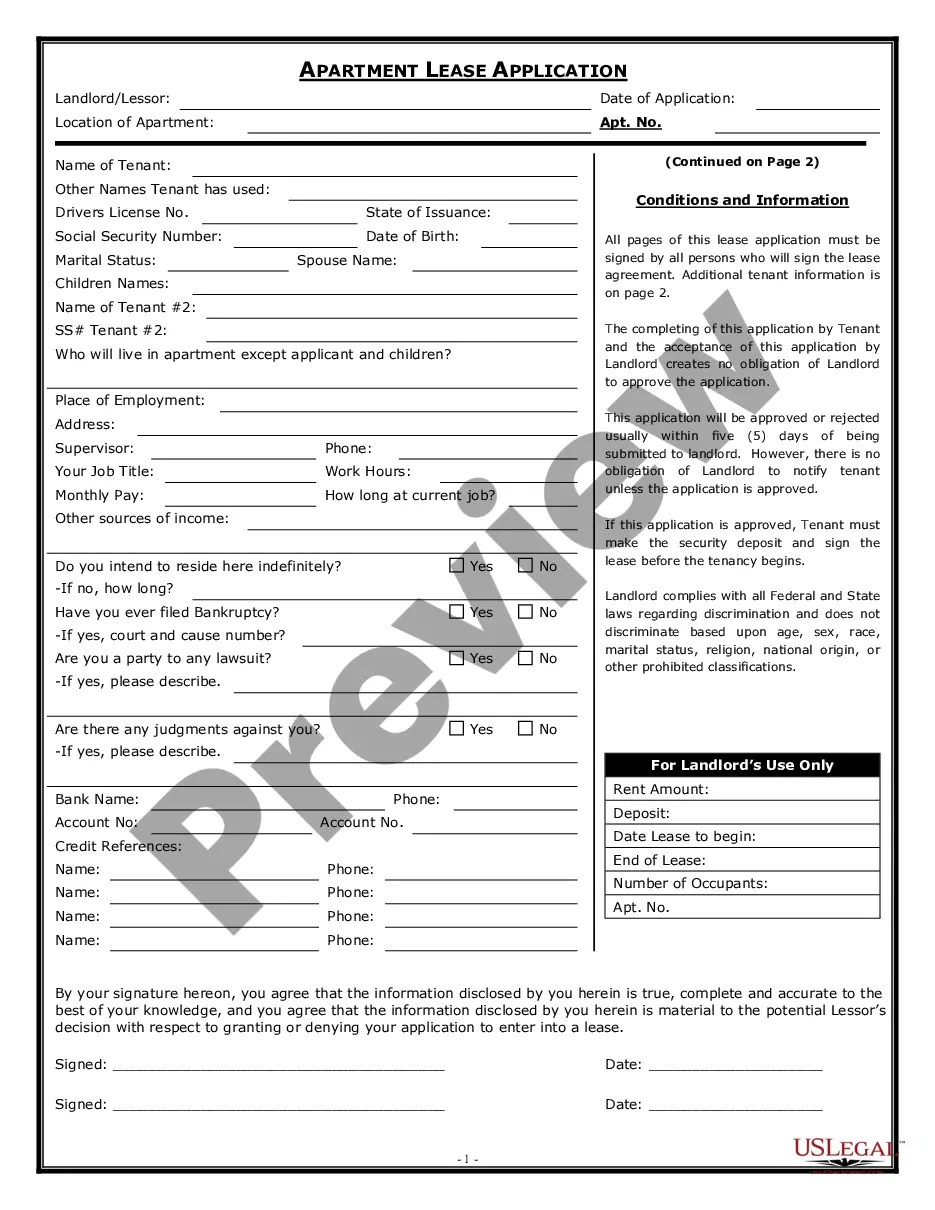

It covers such issues as rental agreements, security deposits, prepaid rent, eviction, installment contracts, credit card interest rates, automobile leases, mortgage interest rates, mortgage foreclosure, civil judicial proceedings, and income tax payments.