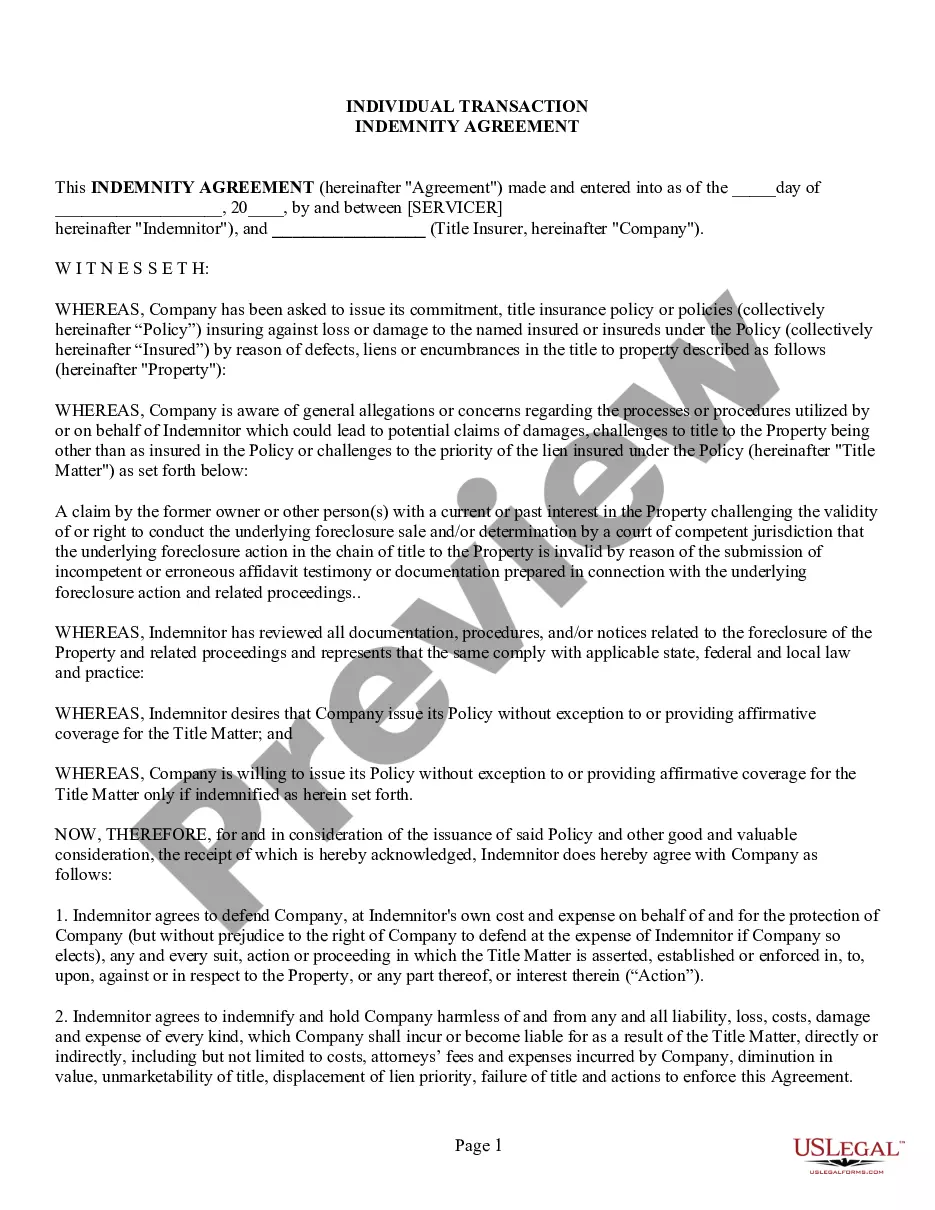

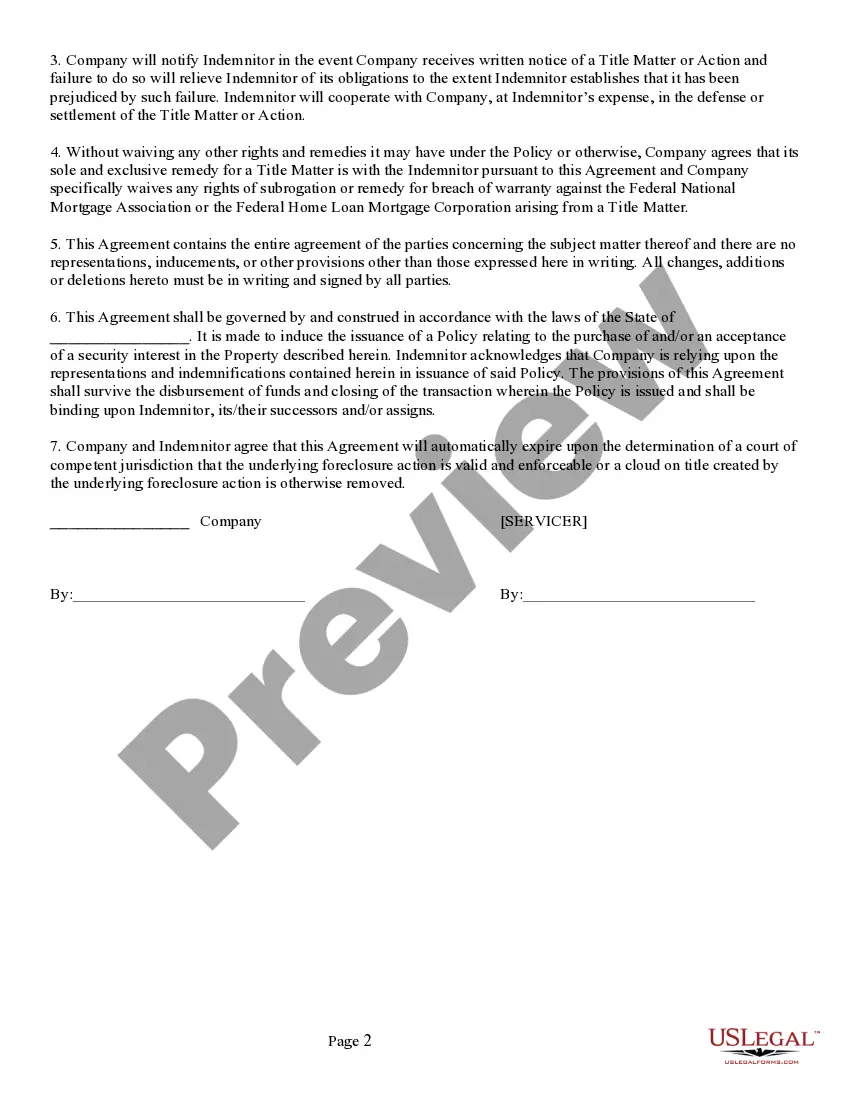

An Individual Transaction Indemnity Agreement is a contract between two or more parties that provides a mutual indemnity in the event of a breach of the terms and conditions of a specific transaction. This type of agreement is usually used to protect all parties involved in a transaction from any financial losses that may result from a breach of the terms and conditions of the transaction. There are two main types of Individual Transaction Indemnity Agreements: 1. Proportional Indemnity Agreement: This agreement requires each of the parties involved in a transaction to agree to bear an equal share of any losses that may be incurred due to a breach of the terms and conditions of the transaction. 2. Non-Proportional Indemnity Agreement: This agreement requires one party to bear the entirety of any losses that may be incurred due to a breach of the terms and conditions of the transaction. The other party will typically receive a monetary benefit in exchange for agreeing to this type of indemnity agreement.

An Individual Transaction Indemnity Agreement is a contract between two or more parties that provides a mutual indemnity in the event of a breach of the terms and conditions of a specific transaction. This type of agreement is usually used to protect all parties involved in a transaction from any financial losses that may result from a breach of the terms and conditions of the transaction. There are two main types of Individual Transaction Indemnity Agreements: 1. Proportional Indemnity Agreement: This agreement requires each of the parties involved in a transaction to agree to bear an equal share of any losses that may be incurred due to a breach of the terms and conditions of the transaction. 2. Non-Proportional Indemnity Agreement: This agreement requires one party to bear the entirety of any losses that may be incurred due to a breach of the terms and conditions of the transaction. The other party will typically receive a monetary benefit in exchange for agreeing to this type of indemnity agreement.