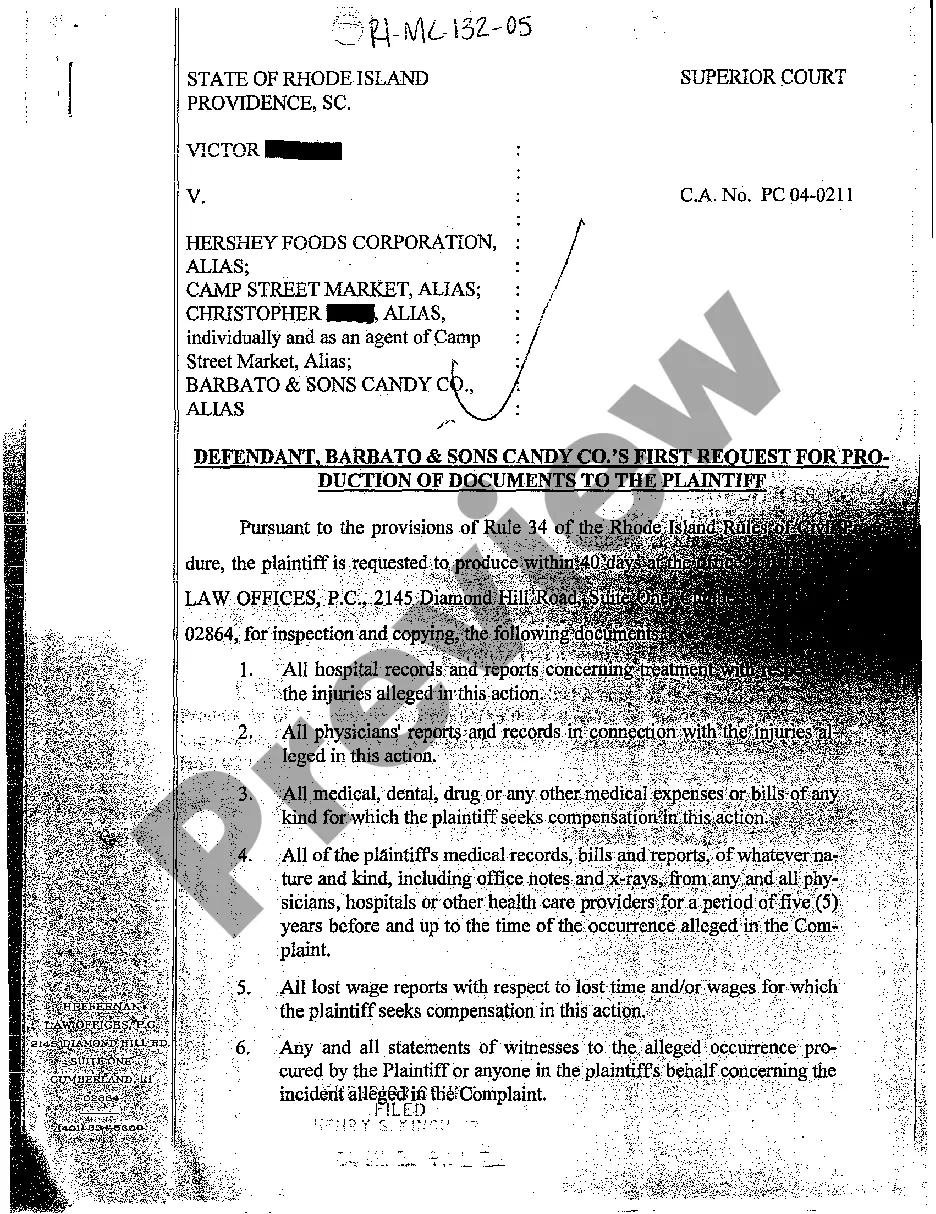

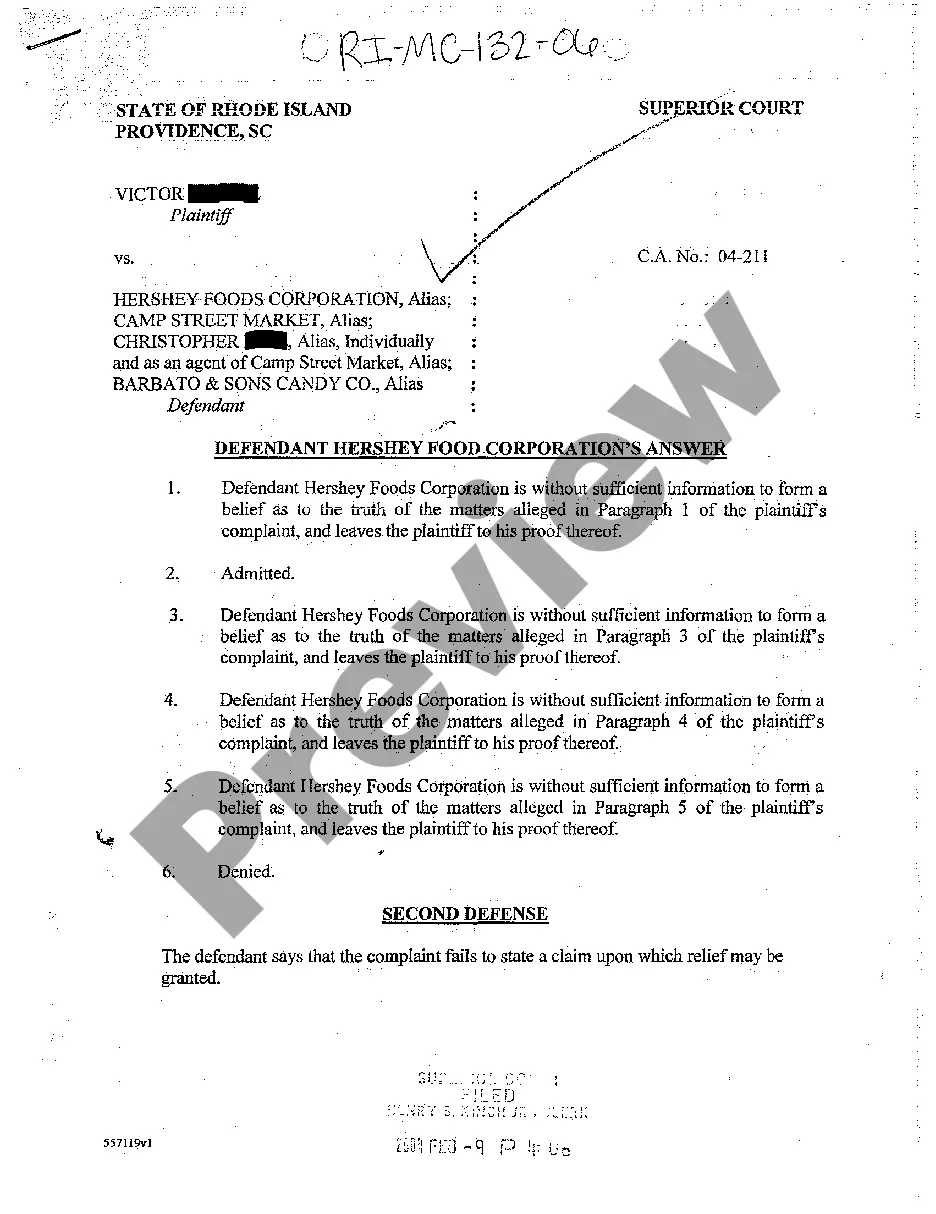

A Survey Affidavit- Refinance is a document that is used to affirm the accuracy of the survey and title documents for a refinancing transaction. It is typically signed by a professional surveyor, and it states that the survey accurately reflects the boundaries of the property and the title is valid. The Survey Affidavit- Refinance is often required by lenders or other third parties to ensure that the land is properly described and that the title is valid. There are two main types of Survey Affidavit- Refinance: 1) a residential survey affidavit, which states that the survey and title documents accurately reflect the boundaries of the residential property; and 2) a commercial survey affidavit, which states that the survey and title documents accurately reflect the boundaries of the commercial property. Both types of affidavits are typically signed by a professional surveyor.

Survey Affidavit- Refinance

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Survey Affidavit- Refinance?

If you’re searching for a way to appropriately prepare the Survey Affidavit- Refinance without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business situation. Every piece of paperwork you find on our web service is drafted in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these straightforward instructions on how to obtain the ready-to-use Survey Affidavit- Refinance:

- Ensure the document you see on the page meets your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the list to locate another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to save your Survey Affidavit- Refinance and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

There are roughly 100 to 150 pages in a standard set of loan documents that need signatures, initials, and dates made in the appropriate locations. A loan signing agent knows exactly where the borrower needs to sign, date and initial on those loan documents.

LEARN LOAN DOCUMENTS: SAMPLE HELOC CLOSINGYouTube Start of suggested clip End of suggested clip Before we start signing. This way it helps them not feel rushed. And they don't have to take theirMoreBefore we start signing. This way it helps them not feel rushed. And they don't have to take their time. And really read through every document.

Understand primary documents within a loan package The Deed of Trust is the security instrument, it places a lien on the home to protects the bank. It gets recorded with the county.

A promissory note provides the financial details of the loan's repayment, such as the interest rate and method of payment. A mortgage specifies the procedure that will be followed if the borrower doesn't repay the loan.

There are usually 125 ? 200 pages involved in a purchase if there is a loan.

Acceptable primary forms of identification are: Valid Driver's License. Valid State issued ID card (must include photo) Military ID. Social Security Card.

The Notary Signing Agent will present each closing document to a signer in conformance with a signing presentation guidelines authorized by the contracting company, and by naming and stating the general purpose of the document, specifying the number of pages and indicating where signatures, dates or initials are to be

These signing are usually around 20-30 pages and pay less than a traditional refinance or purchase signing, but they usually take half the time.