Term Sheet for Venture Capital Investment

Description Term Sheet Example

How to fill out Term Sheet For Venture Capital Investment?

Use US Legal Forms to obtain a printable Term Sheet for Venture Capital Investment. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms catalogue on the internet and offers reasonably priced and accurate samples for consumers and attorneys, and SMBs. The documents are grouped into state-based categories and some of them might be previewed before being downloaded.

To download templates, users must have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to quickly find and download Term Sheet for Venture Capital Investment:

- Check out to make sure you get the correct template with regards to the state it is needed in.

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it is the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search field if you need to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Term Sheet for Venture Capital Investment. More than three million users already have utilized our service successfully. Select your subscription plan and get high-quality documents within a few clicks.

Form popularity

FAQ

The two- to six- week time between the signing of the term sheet and closing is venture limbo. At this point, entrepreneurs know who they're going to be working with and along what structure, but the deal isn't done yet2026including wiring of the funds!

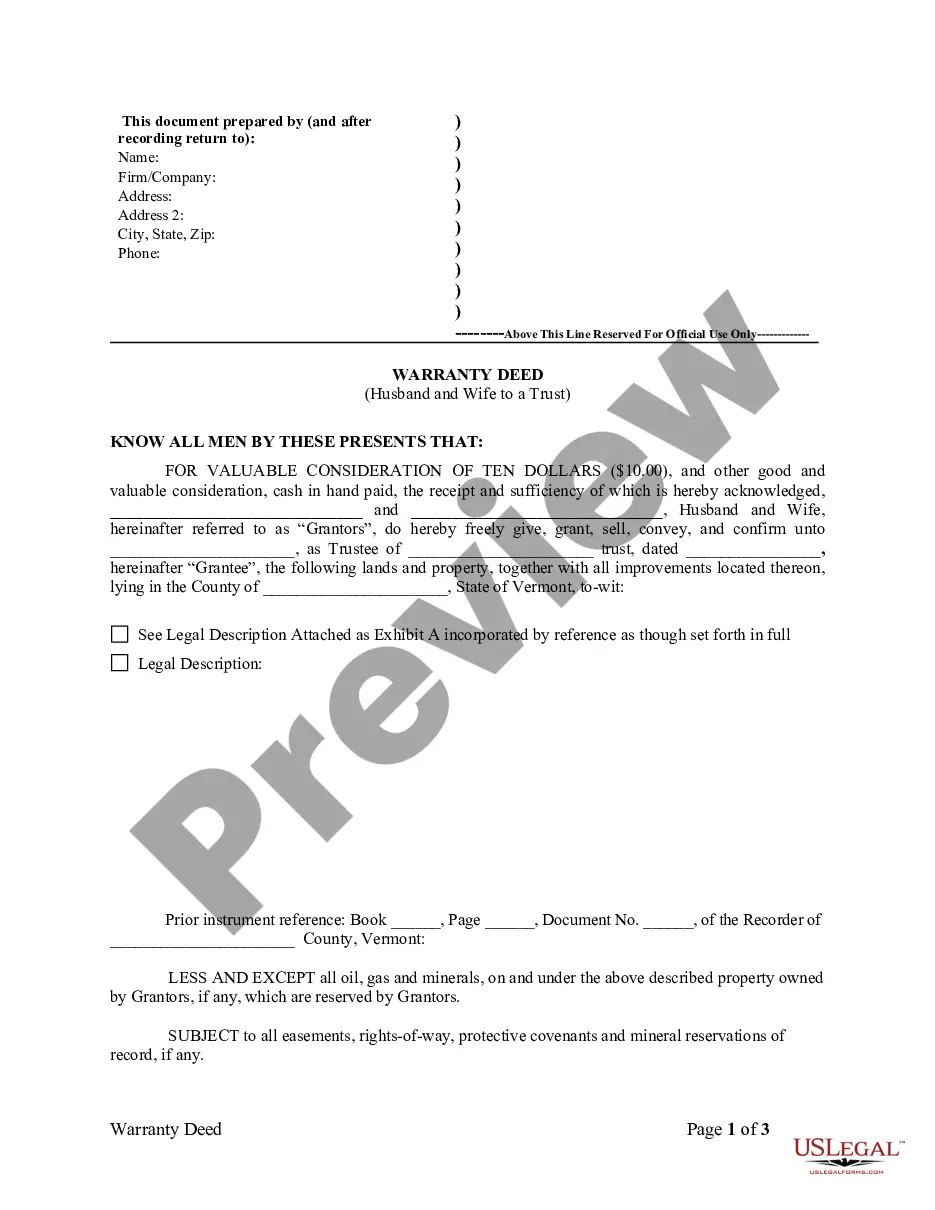

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

How much money is expected from the VC, or venture capitalist, to the founder of the startup, A detailed overview of the financial side of the investment, and. The power and controls given to the VCs.

Investors: Those who are investing money into the business. Amount Raised: Total amount raised to date. Price Per Share: Price of each share. Pre-Money Valuation: Value of the company before investment. Capitalization: Company's shares multiplied by share price.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with startups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

A term sheet is designed to help the parties to the loan to set out clearly and in advance, the terms on which the loan will be made. It serves as a non-binding letter of intent which summarises all the important financial and legal terms as well as quantifying the amount of the loan and its repayment.

A term sheet is a written document the parties exchange containing the important terms and conditions of the deal. The document summarizes the main points of the deal agreements and sorts out the differences before actually executing the legal agreements and starting off with the time-consuming due diligence.

The term sheet is usually a non-binding agreement that contains all the essential points related to the investment like capitalization and valuation, stake to be acquired, conversion rights, asset sale, etc.A term sheet is the first step of the transaction between the Private Equity fund & the Target Company.