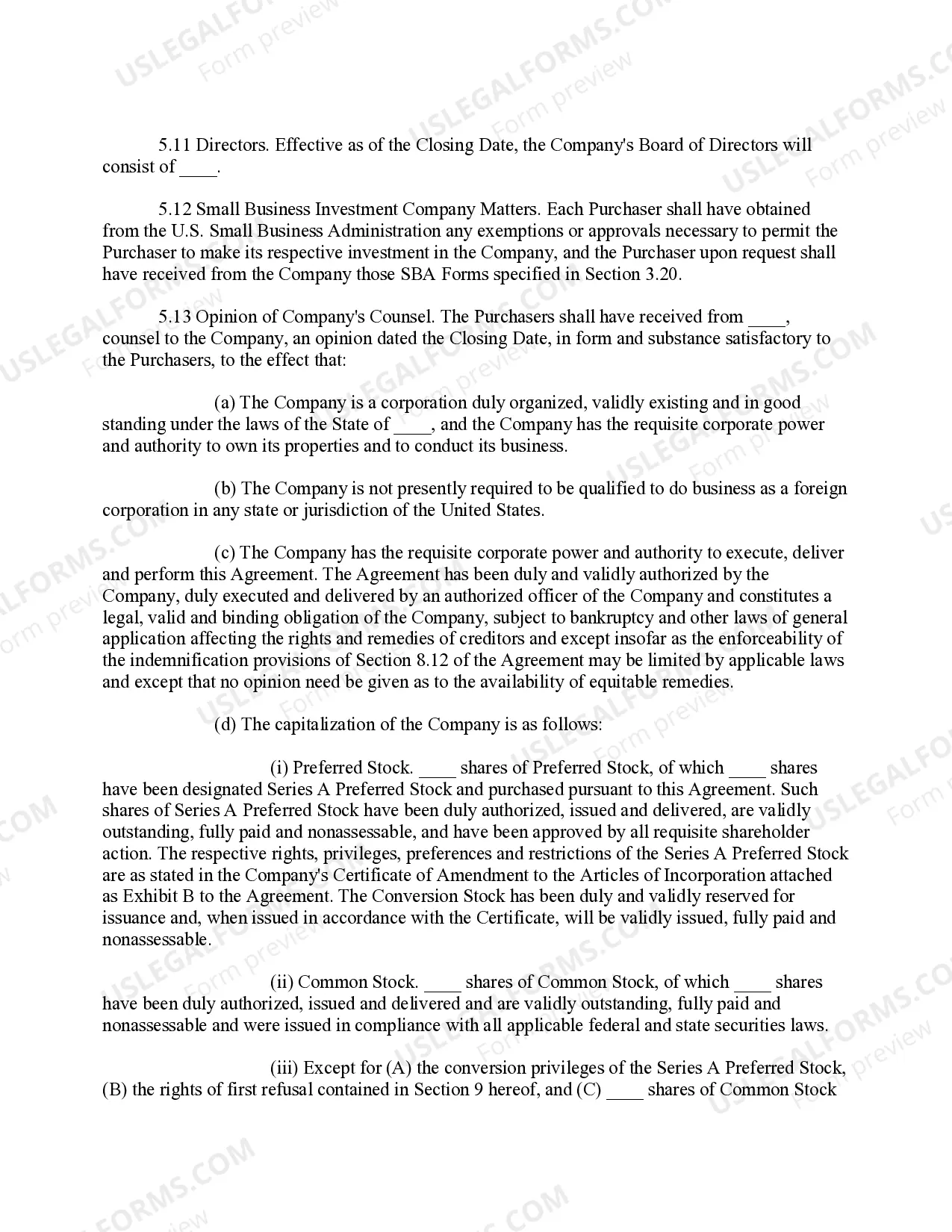

This is a Preferred Stock Purchase Agreement between a startup company and venture capital investors. This form is oriented for investors and contains the agreement to sell and purchase, the closing, delivery and payment options, representations and warranties, and the schedule of purchasers, among other things.

Investor Stock Purchase Agreement

Description

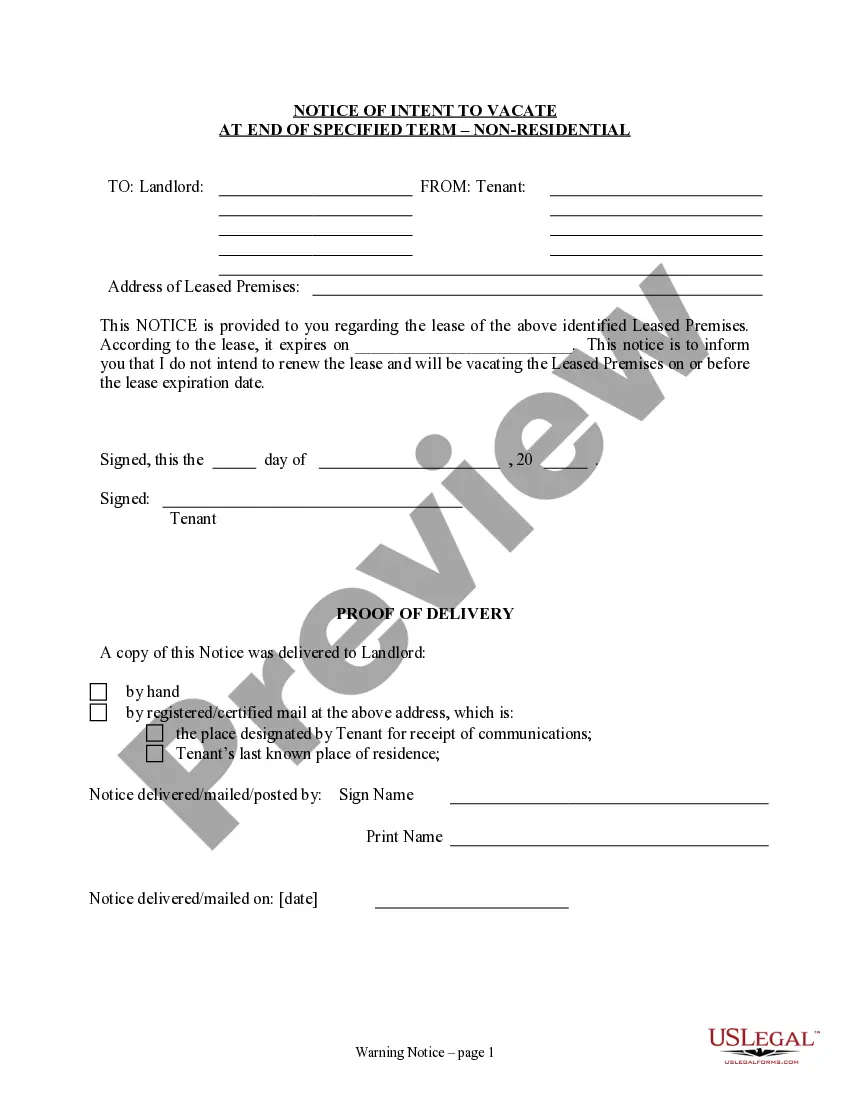

How to fill out Investor Stock Purchase Agreement?

Use US Legal Forms to obtain a printable Investor Stock Purchase Agreement. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms catalogue online and offers reasonably priced and accurate samples for consumers and lawyers, and SMBs. The documents are grouped into state-based categories and a number of them can be previewed prior to being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to quickly find and download Investor Stock Purchase Agreement:

- Check to make sure you have the correct template in relation to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Hit Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Make use of the Search field if you need to find another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Investor Stock Purchase Agreement. More than three million users already have utilized our service successfully. Select your subscription plan and have high-quality forms within a few clicks.

Form popularity

FAQ

The share purchase agreement is the main document. It is normally drafted by the buyer although it is common for the seller to produce the first draft on an auction sale. Note. On an auction sale, the first draft of the share purchase agreement is generally prepared by the seller.

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.

Name of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser. Possible employee issues such as benefits and bonuses. How many shares are being sold. Where and when the transaction takes place.

A stock purchase agreement is a contract to transfer ownership of stocks from the seller to the purchaser. The key provisions of a stock purchase agreement have to do with the transaction itself, such as the date of the transaction, the number of stock certificates, and the price per share.

There are three types of investors: pre-investor, passive investor, and active investor.

An investor is any person or other entity (such as a firm or mutual fund) who commits capital with the expectation of receiving financial returns.Investors can analyze opportunities from different angles, and generally prefer to minimize risk while maximizing returns.

Some pay income in the form of interest or dividends, while others offer the potential for capital appreciation. Still, others offer tax advantages in addition to current income or capital gains. All of these factors together comprise the total return of an investment.

Most investors take a percentage of ownership in your company in exchange for providing capital. Angel investors typically want from 20 to 25 percent return on the money they invest in your company.Invariably, an investor will ask for equity in your company so they're with you until you sell the business.