Employment Agreement with President Coupled with a Stock Option Grant

Description

How to fill out Employment Agreement With President Coupled With A Stock Option Grant?

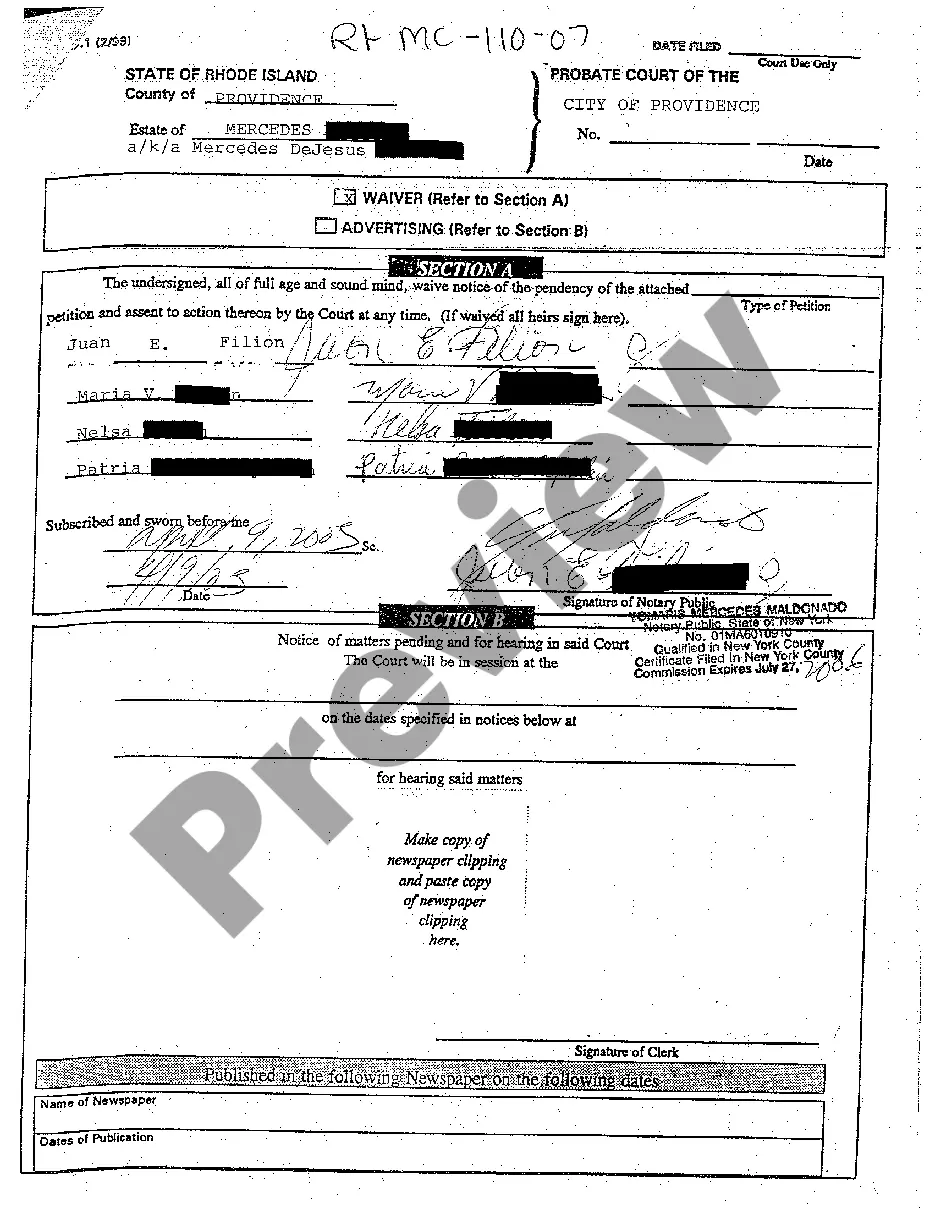

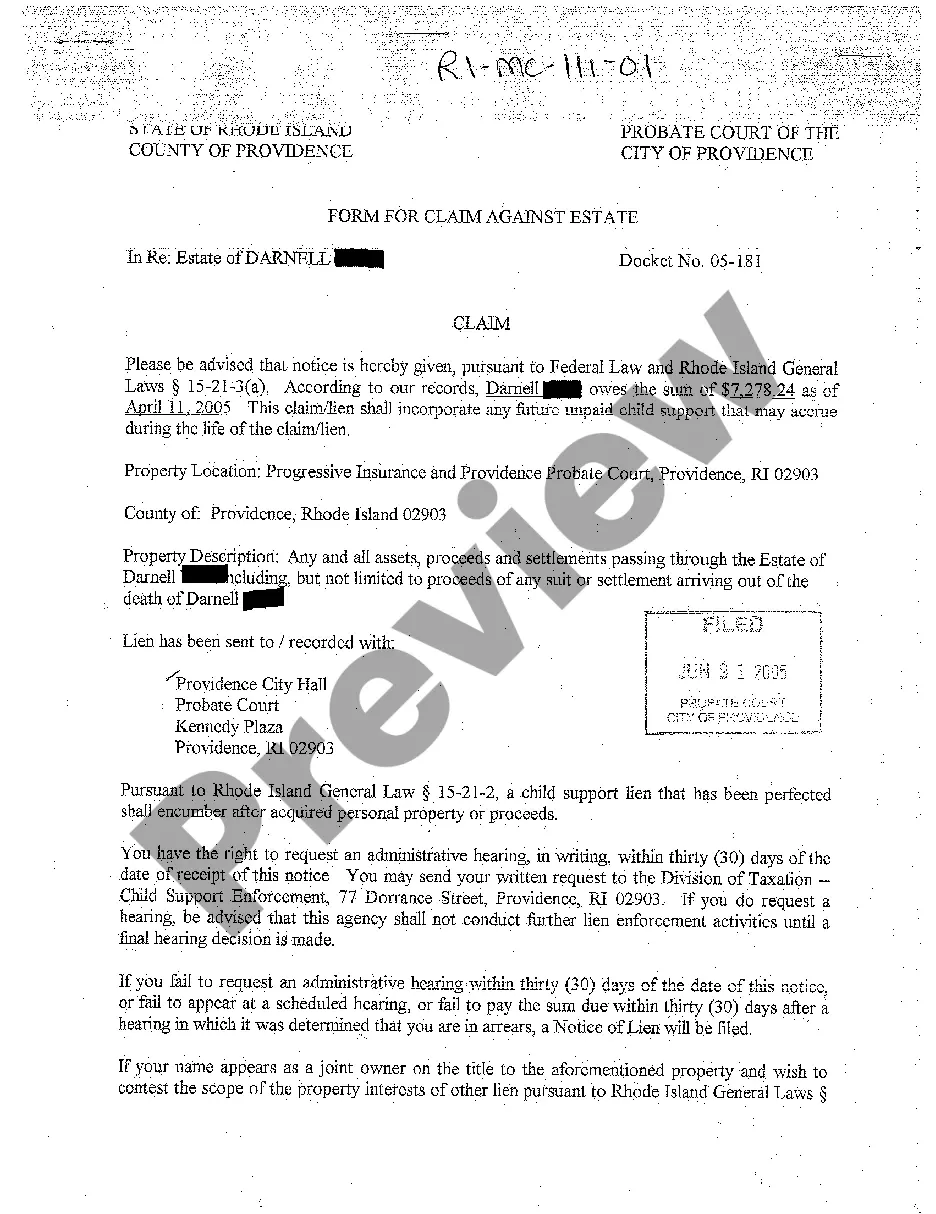

Use US Legal Forms to obtain a printable Employment Agreement with President Coupled with a Stock Option Grant. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms library online and provides reasonably priced and accurate templates for consumers and attorneys, and SMBs. The documents are grouped into state-based categories and many of them might be previewed before being downloaded.

To download templates, users must have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to easily find and download Employment Agreement with President Coupled with a Stock Option Grant:

- Check out to make sure you have the correct form with regards to the state it’s needed in.

- Review the document by reading the description and using the Preview feature.

- Hit Buy Now if it is the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Make use of the Search field if you want to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Employment Agreement with President Coupled with a Stock Option Grant. Above three million users already have utilized our service successfully. Choose your subscription plan and have high-quality documents in just a few clicks.

Form popularity

FAQ

About Stock Option Agreements When a company offers employees stock options, they do so through a special contract called a stock option agreement.The option agreement dictates all the terms of the offer -- including vesting schedule, time limits for exercise once vested and any other special conditions.

It may sound complicated, but accepting your stock grant should be a no-brainer for anyone who's starting at a new company. It's low-risk and can provide measurable benefits down the road. To get started on the ins and outs of stock options, check out part 1 of our series Equity 101: Startup Employee Stock Options.

Determine the market compensation for the role (e.g. $100k/year). Determine how much you can/want to pay in cash (e.g. $80k/year). Determine for how long this gap should be covered. Determine the value and strike price of the stock options. Determine the number of stock options to be granted.

A stock option gives an employee the ability to buy shares of company stock at a certain price, within a certain period of time.Employees who exercise their options and sell their shares when the company's stock is trading significantly higher than the grant price have the potential to make a lot of money.

Stock option agreement Stock option grants are how your company awards stock options. This document usually includes details like the type of stock options you get, how many shares you get, your strike price, and your vesting schedule (we'll get to this in the vesting section).

If an employee is getting a market level salary with employee stock options, they should certainly accept the deal. In that way, you have possibly less chance to lose anything. But if you are accepting stock options in exchange for a lower salary, make sure you have a good understanding with the company.

An option grant is a right to acquire a set number of shares of stock of a company at a set price.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy or exercise a set number of shares of the company stock at a pre-set price, also known as the grant price.

If you have been given the opportunity to purchase stock options, you may want to take advantage of them if you can afford to do so. But you should not go into debt to purchase stock options.You should also only purchase stock options if you are confident that the company is going to continue to grow and profit.