Stock Option Plan

Description

How to fill out Stock Option Plan?

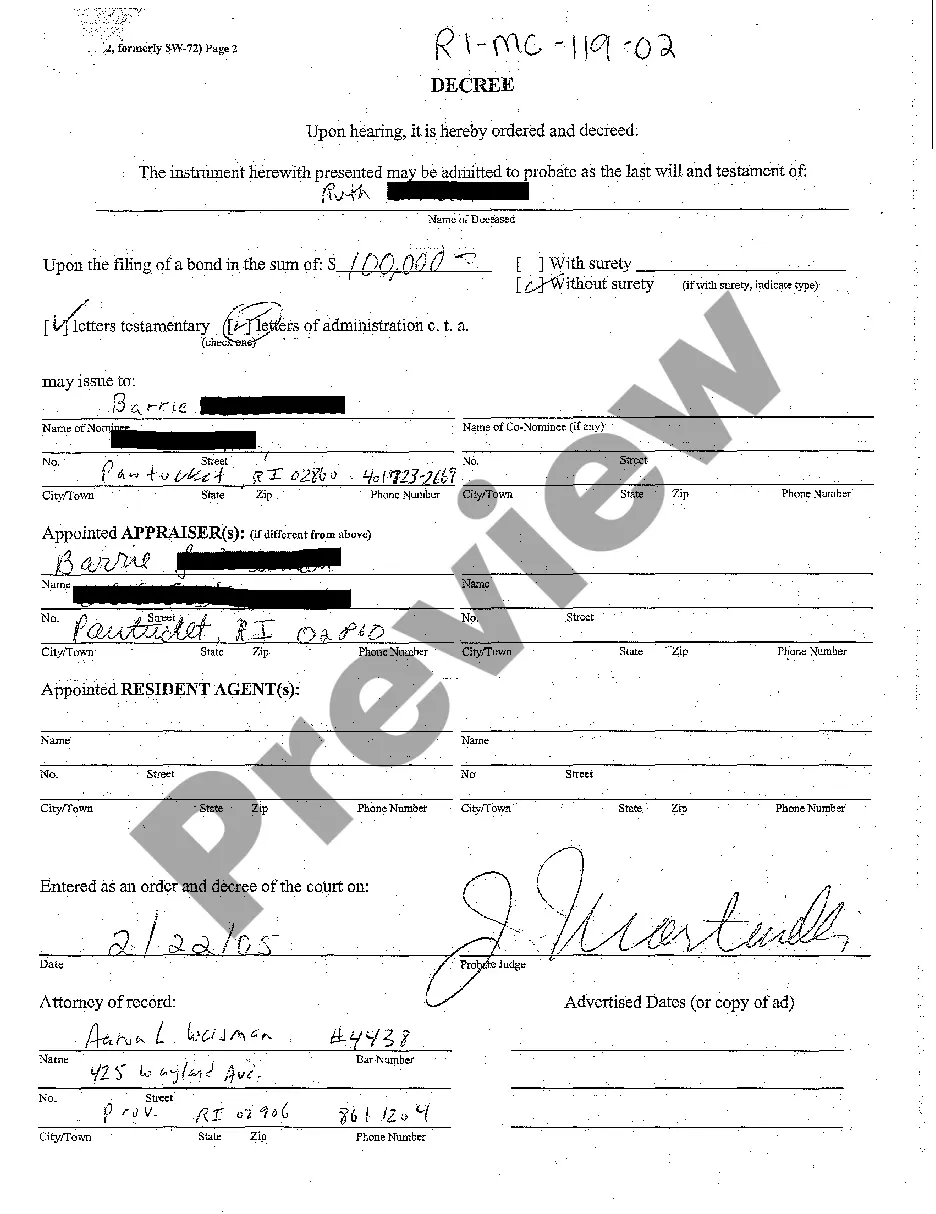

Use US Legal Forms to obtain a printable Stock Option Plan. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue on the web and offers reasonably priced and accurate templates for consumers and lawyers, and SMBs. The templates are categorized into state-based categories and a number of them might be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to easily find and download Stock Option Plan:

- Check to make sure you have the correct form in relation to the state it’s needed in.

- Review the form by looking through the description and using the Preview feature.

- Press Buy Now if it’s the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Stock Option Plan. Above three million users already have used our service successfully. Choose your subscription plan and obtain high-quality forms within a few clicks.

Form popularity

FAQ

There can be huge financial benefits that come from employee stock options. Higher-level employees can often convert their options into six-figure and seven-figure profits.In some companies, key employees can receive options over many years, and even throughout their careers.

Before you understand the taxation of ESOPs and RSUs, here are some key terms you must know: ESOP or Employee Stock Option Plan allows an employee to own equity shares of the employer company over a certain period of time. The terms are agreed upon between the employer and employee.

Develop your philosophy. Your stock option plan is an expression of your company philosophy. Paper it. Adopt your stock plan and option agreements and get board and stockholder approval. Make it official. Work with your lawyers to obtain all relevant state permits for your option plan.

Under fixed intrinsic value accounting, the "spread" of a stock option (i.e., the amount by which the fair market value of the stock at the time of grant exceeds the exercise price) must be expensed over the vesting period of the stock option. If the spread is zero, no expense needs to be recognized.

The benefit of a stock option is the ability to buy shares in the future at a fixed price, even if the market value is higher than that amount when you make your purchase.

In an ESOP, a company sets up a trust fund, into which it contributes new shares of its own stock or cash to buy existing shares. Alternatively, the ESOP can borrow money to buy new or existing shares, with the company making cash contributions to the plan to enable it to repay the loan.

Develop your philosophy. Your stock option plan is an expression of your company philosophy. Paper it. Adopt your stock plan and option agreements and get board and stockholder approval. Make it official. Work with your lawyers to obtain all relevant state permits for your option plan.

An employee stock option is the right given to you by your employer to buy ("exercise") a certain number of shares of company stock at a pre-set price (the "grant," "strike" or "exercise" price) over a certain period of time (the "exercise period").

With an employee stock option plan, you are offered the right to buy a specific number of shares of company stock, at a specified price called the grant price (also called the exercise price or strike price), within a specified number of years.