Stock Option Agreement

Description

How to fill out Stock Option Agreement?

Use US Legal Forms to obtain a printable Stock Option Agreement. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue on the web and offers reasonably priced and accurate templates for consumers and lawyers, and SMBs. The templates are categorized into state-based categories and a number of them might be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to easily find and download Stock Option Agreement:

- Check to make sure you have the correct form in relation to the state it’s needed in.

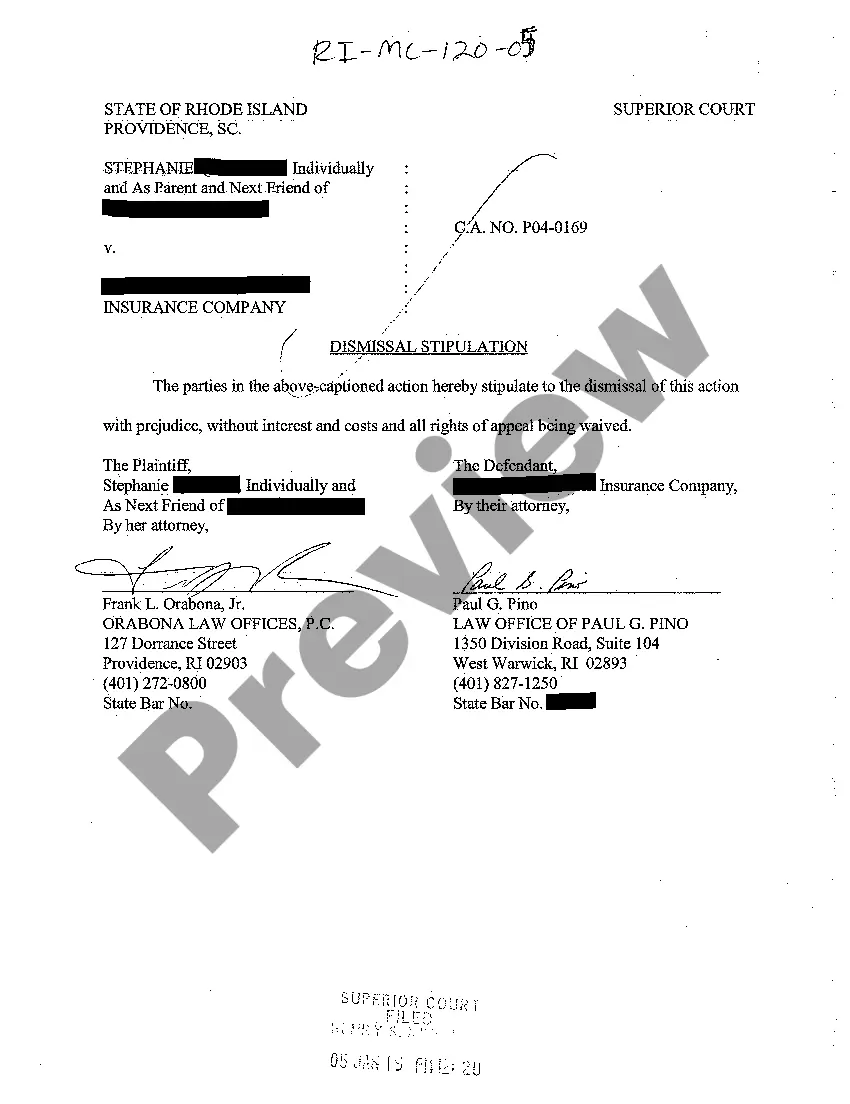

- Review the form by looking through the description and using the Preview feature.

- Press Buy Now if it’s the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Stock Option Agreement. Above three million users already have used our service successfully. Choose your subscription plan and obtain high-quality forms within a few clicks.

Form popularity

FAQ

Oftentimes, stock-based compensation is redeemable at the employee's or employer's option. Stock-based compensation that is redeemable at the employee's option is a considered an employer obligation, and thus a liability while awards that are redeemable at the employer's option are classified as equity.

The quick way of calculating the value of your options is to take the value of the company as given by the TechCrunch announcement of its latest funding round, divide by the number of outstanding shares and multiply by the number of options you have.

Stock Option Journal Entries Year 1 The stock option compensation is an expense of the business and is represented by the debit to the expense account in the income statement. The other side of the entry is to the additional paid in capital account (APIC) which is part of the total equity of the business.

About Stock Option Agreements When a company offers employees stock options, they do so through a special contract called a stock option agreement.The option agreement dictates all the terms of the offer -- including vesting schedule, time limits for exercise once vested and any other special conditions.

Stock options may be considered a form of compensation which gives the employee the right to buy an amount of company stock at a set price during a certain time period. Under U.S. accounting methods, stock options are expensed according to the stock options' fair value.

What is a Stock Option? A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed upon price and date. There are two types of options: puts, which is a bet that a stock will fall, or calls, which is a bet that a stock will rise.

Employee stock options (ESOs) are a type of equity compensation granted by companies to their employees and executives.Typically, ESOs are issued by the company and cannot be sold, unlike standard listed or exchange-traded options.

The stock option compensation is an expense of the business and is represented by the debit to the expense account in the income statement. The other side of the entry is to the additional paid in capital account (APIC) which is part of the total equity of the business.

These options, which are contracts, give an employee the right to buy or exercise a set number of shares of the company stock at a pre-set price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.