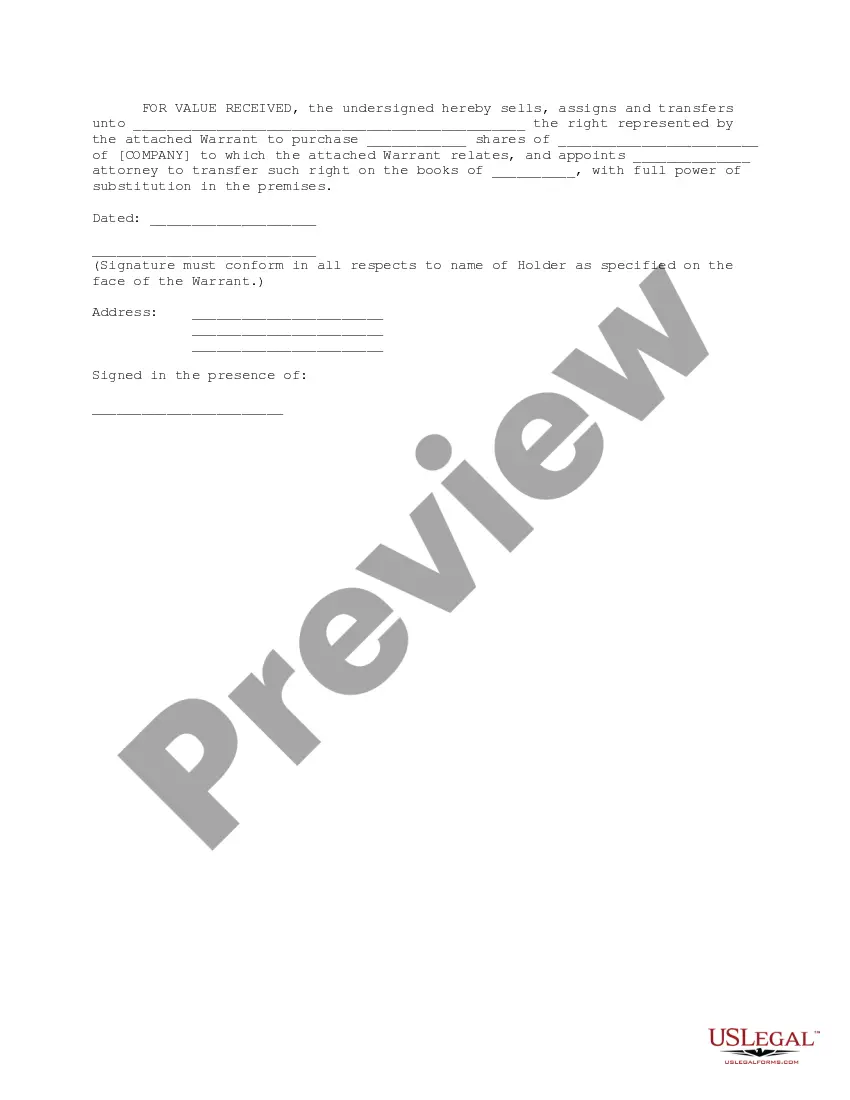

This Warrant is to be used in bridge financing when the bridge investors are making a bridge loan to the company and receiving convertible notes and warrants. The warrant provides for several events subsequent to the bridge financing that fix the number of shares and exercise price for the warrant.

Bridge Financing Warrant

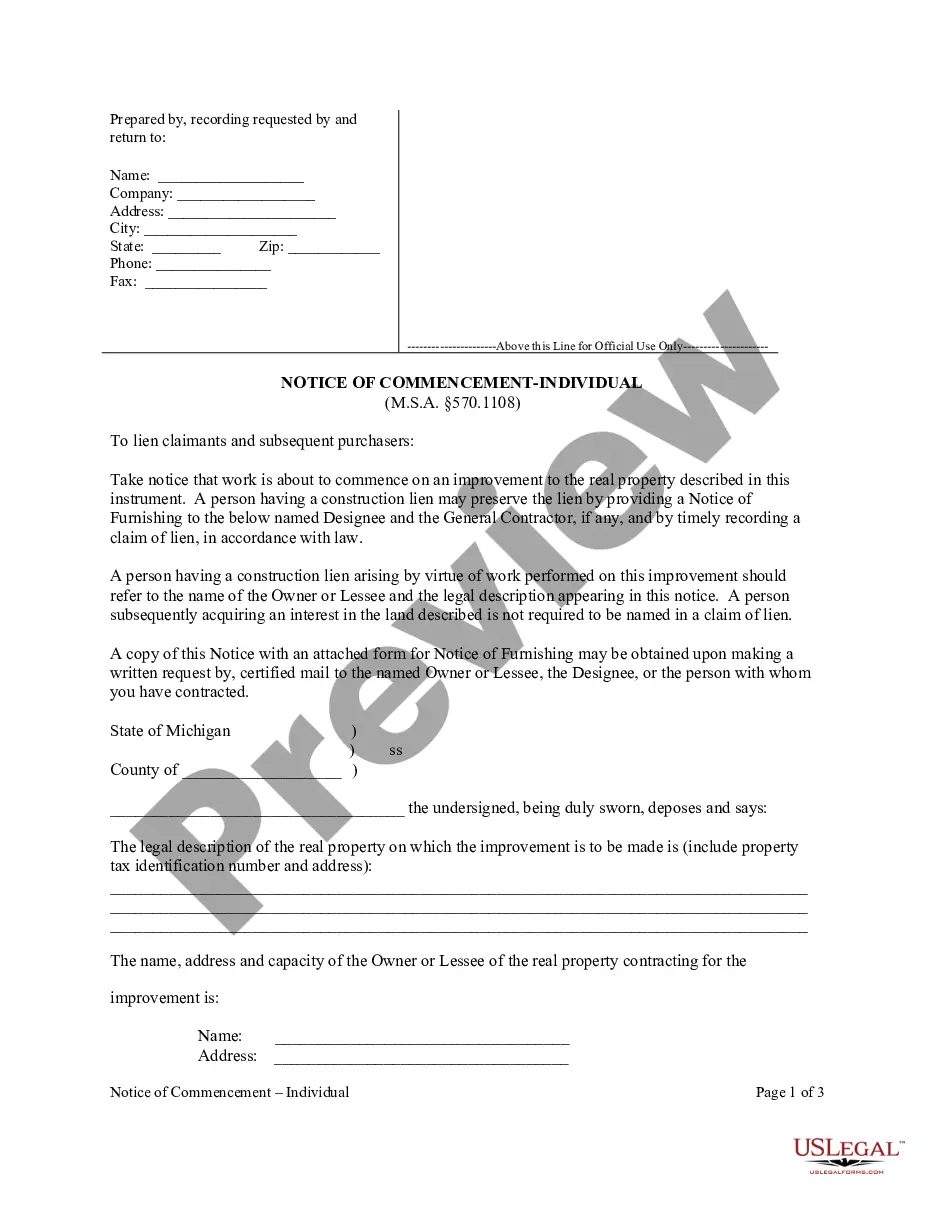

Description

How to fill out Bridge Financing Warrant?

When it comes to drafting a legal form, it’s easier to leave it to the professionals. Nevertheless, that doesn't mean you yourself cannot get a sample to utilize. That doesn't mean you yourself cannot get a template to use, however. Download Bridge Financing Warrant right from the US Legal Forms site. It gives you numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. After you are registered with an account, log in, search for a specific document template, and save it to My Forms or download it to your device.

To make things easier, we’ve included an 8-step how-to guide for finding and downloading Bridge Financing Warrant fast:

- Be sure the form meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Select the suitable subscription to suit your needs.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

After the Bridge Financing Warrant is downloaded you may fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Melanie Bien at mortgage broker Private Finance says bridging finance has its uses, but adds that if you don't have a realistic exit strategy, such as a buyer lined up for your own property, "bridging is extremely risky and should be avoided at all costs".

PRO Avoid Moving Twice. PRO Access equity quickly without selling. PRO Present a stronger purchase offer. PRO Receive bridge loan approval after being denied by banks. PRO Attain a bridge loan against currently listed real estate. PRO Income documentation not required. CON Higher interest rates.

Drawbacks of a bridge loan More expensive than other types of loans: the first major drawback with a bridge loan is that they are costly. Most of the expenses comes from the high amount of fees that they charge. Home-equity loans are generally much cheaper than a bridge loan.

Bridge financing "bridges" the gap between the time when a company's money is set to run out and when it can expect to receive an infusion of funds later on. This type of financing is most normally used to fulfill a company's short-term working capital needs.

A bridge loan is essentially a short term loan taken out by a borrower against their current property to finance the purchase of a new property. Also known as a swing loan, gap financing, or interim financing, a bridge loan is typically good for a six month period, but can extend up to 12 months.

High interest rates: Since lenders have less time to make money on a bridge loan because of their shorter terms, they tend to charge higher interest rates for this type of short-term financing than for conventional loans. Origination fees: Lenders typically charge fees to originate a loan.

Bridge Warrant means the common stock purchase warrant issued on the date hereof to the Bridge Investors to purchase a number of shares of Parent Common Stock equal to the Bridge Warrant Share Number.

However, if the borrower's home does not sell within the brief loan term, they will be responsible for making payments on their first mortgage, the mortgage on their new home and the bridge loan. This makes bridge loans a risky option for homeowners who aren't likely to sell their home in a very short amount of time.

Melanie Bien at mortgage broker Private Finance says bridging finance has its uses, but adds that if you don't have a realistic exit strategy, such as a buyer lined up for your own property, "bridging is extremely risky and should be avoided at all costs".