This document is for use in a bridge financing in whci the bridge investors are loaning money to the company on a loan basis, rather than on a repayment on demand basis. The form of the note can be changed to be secured or unsecured, and the optional provisions for security are included in the form.

Bridge Financing Promissory Note

Description

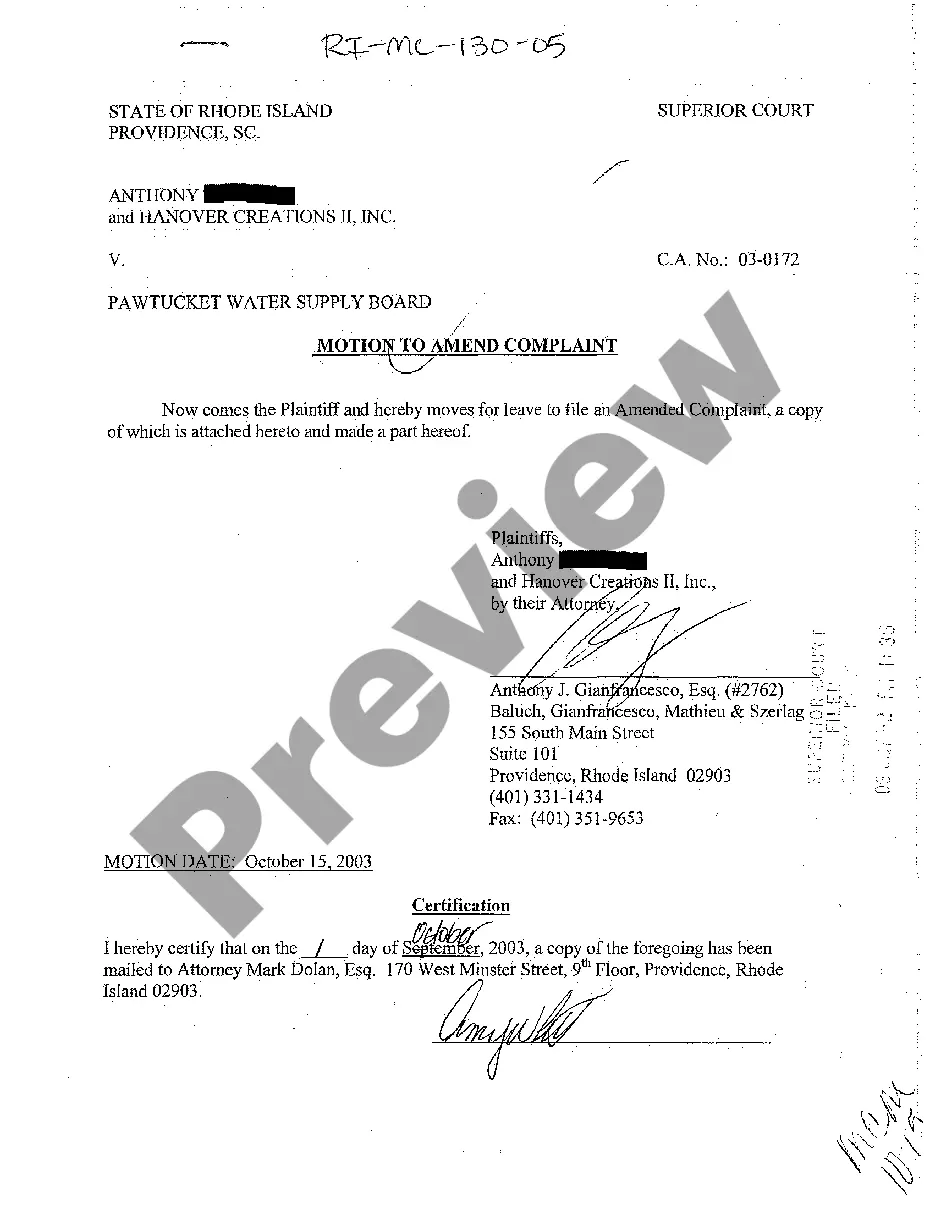

How to fill out Bridge Financing Promissory Note?

When it comes to drafting a legal form, it’s better to leave it to the experts. Nevertheless, that doesn't mean you yourself can not find a template to use. That doesn't mean you yourself can not find a sample to use, however. Download Bridge Financing Promissory Note right from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. When you’re signed up with an account, log in, find a specific document template, and save it to My Forms or download it to your device.

To make things easier, we have incorporated an 8-step how-to guide for finding and downloading Bridge Financing Promissory Note quickly:

- Make sure the document meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the suitable subscription for your requirements.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Bridge Financing Promissory Note is downloaded you are able to fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

A bridge loan is a type of short-term loan that may be used in real estate transactions when the buyer lacks the funds to finance the purchase of the new property without the prior sale of the first property.

Bridge loans typically have interest rates between 8.5% and 10.5%, making them more expensive than traditional, long-term financing options. However, the application and underwriting process for bridge loans is generally faster than for traditional loans.

Typically, the cost for bridge financing is between $1,000 and $2,000.

Melanie Bien at mortgage broker Private Finance says bridging finance has its uses, but adds that if you don't have a realistic exit strategy, such as a buyer lined up for your own property, "bridging is extremely risky and should be avoided at all costs".

A bridge loan is a temporary financing option designed to help homeowners bridge the gap between the time your existing home is sold and your new property is purchased. It enables you to use the equity in your current home to pay the down payment on your next home, while you wait for your existing home to sell.

To determine the amount of a bridge loan, take the purchase price of the new house, then subtract the value of the mortgage and the initial deposit. The leftover amount is the sum that will need to be financed until a sale is complete.

They could range from around 0.4% to 2%. Unlike a mortgage, bridge loans don't last very long. They're essentially meant to 'tide you over' for a few weeks or months. As they are short term, bridging loans usually charge monthly interest rates rather than an annual percentage rate (APR).

It is usually issued by an investment bank or venture capital firm. Equity financing (equity-for-capital swap) can also be an option for those seeking bridge financing. In all cases, bridge loans are expensive because lenders bear a significant portion of default risk loaning the funds for a short period.