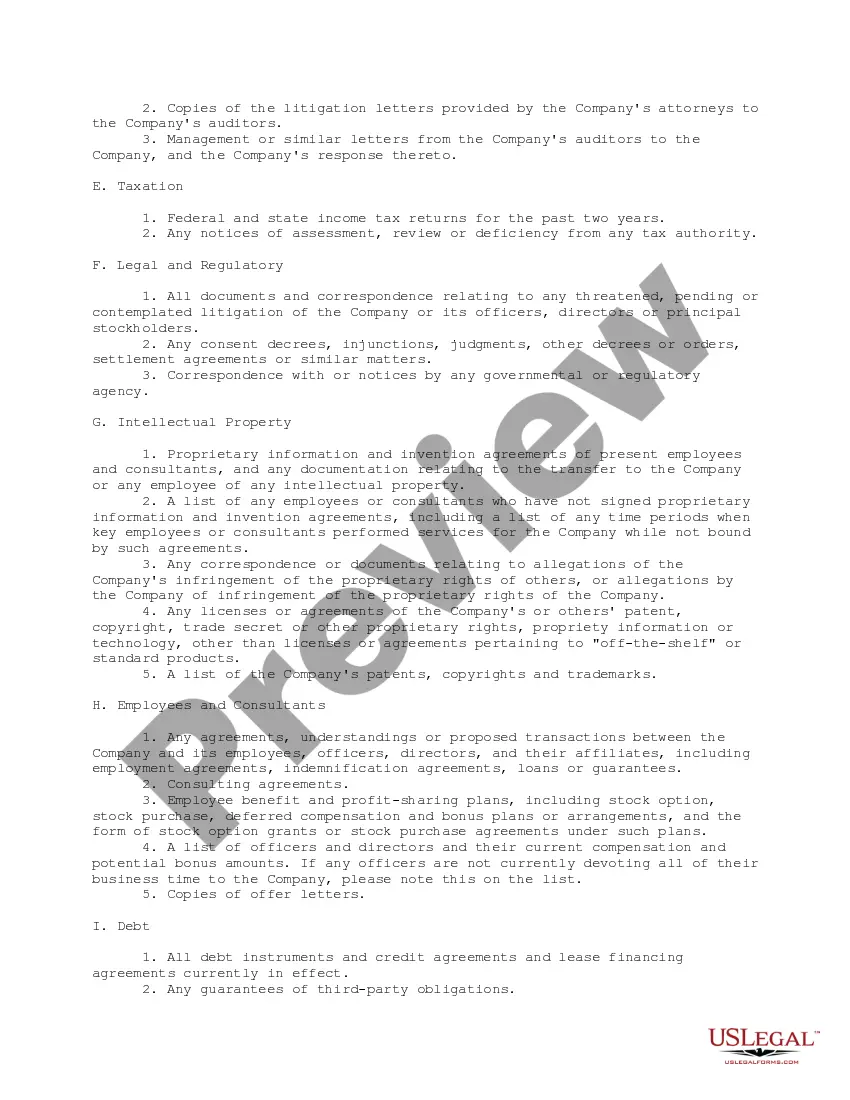

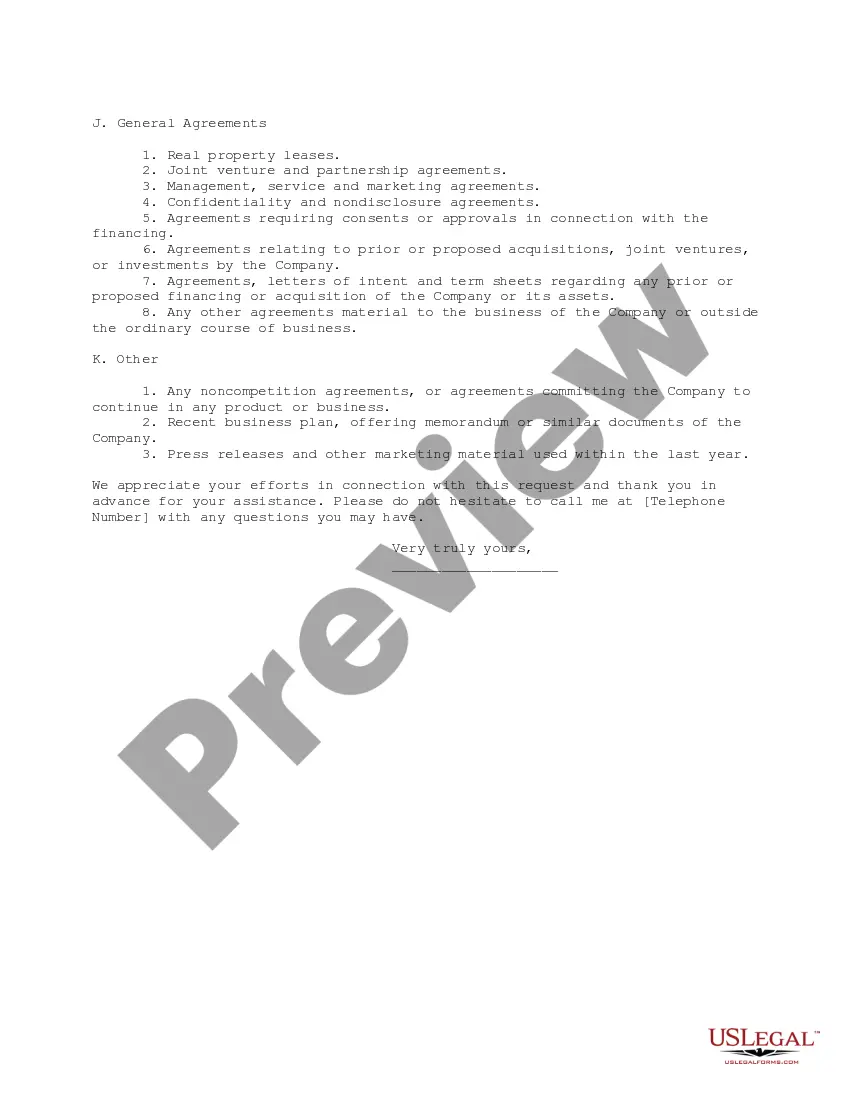

Due Diligence Request

Description

How to fill out Due Diligence Request?

Use US Legal Forms to obtain a printable Due Diligence Request. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms library on the internet and offers affordable and accurate templates for consumers and legal professionals, and SMBs. The templates are categorized into state-based categories and a number of them can be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to quickly find and download Due Diligence Request:

- Check to make sure you get the correct template with regards to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Press Buy Now if it is the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Use the Search field if you need to get another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Due Diligence Request. Over three million users have used our service successfully. Select your subscription plan and obtain high-quality documents in a few clicks.

Form popularity

FAQ

The due diligence fee is a negotiated sum of money, typically between $500 and $2000, depending on the home's price point and a number of other factors. As a buyer, you want a smaller fee because it means less money at stake should you back out of the purchase.

10 Day Due Diligence Period A due diligence period is the first ten days, and the spends the other 20 days securing the mortgage. Having said that, some sales can close in as little as ten days. In order to close a deal in such a short period, the buyer usually removes two important contingencies of the contract.

Due diligence money is given to the seller by the buyer to put a home for sale under contract for the buyer. It is considered compensation to the seller for potentially missing out on another interested buyer while the home is under contract.

While the due diligence period is non-refundable, except in the event a seller breaches the contract, the due diligence fee is typically credited to the buyer at closing.As long as you do not default, the money is yours and will be used for closing costs or your down payment at closing.

During the due diligence process, an investor will request information about your company that will inform their investment decision moving forward. In addition to asking questions of you and key members of your management team during meetings or phone calls, they will provide you with a request list.

Due diligence money is non-refundable The good news is the money is typically credited towards the purchase of the home at closing.If the seller is unable to fulfill the contract the buyer will get the earnest money back. If the buyer is unable to fulfill the contract the seller can keep the earnest money.

Short answer: no, the seller can't back out after an inspection. However, the seller may be able to get the buyer to walk away from the transaction based on a negative inspection report.

The due diligence period gives the homebuyer the opportunity to identify any potential issues or problems with the home that could compromise the purchase. It also gives the buyer the chance to back out of the transaction if certain contingencies aren't met.

A normal due diligence period maybe 10 or 30 days depending on how you define it.10-day periods usually only include inspections, but you probably still need 30 days to close with a mortgage. 30-day periods usually include the mortgage process as well. In this case due diligence and under contract are synonymous.