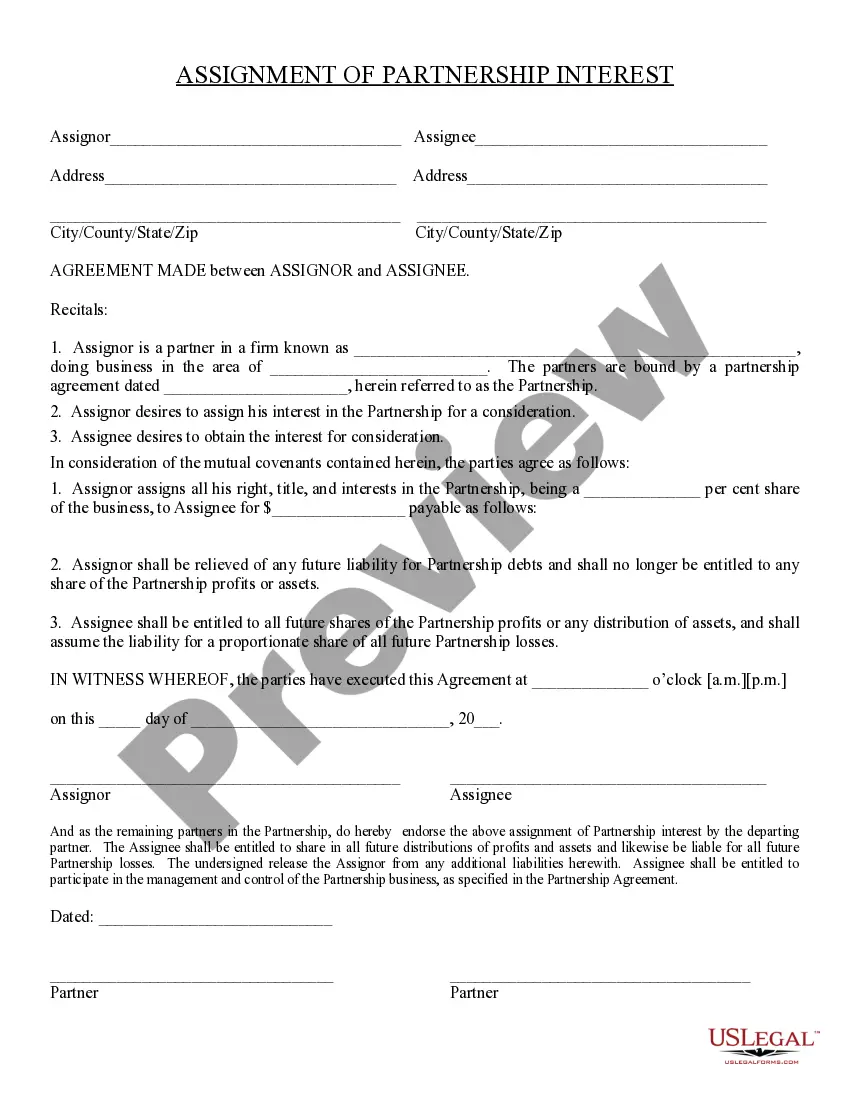

Partnership Interest

Description

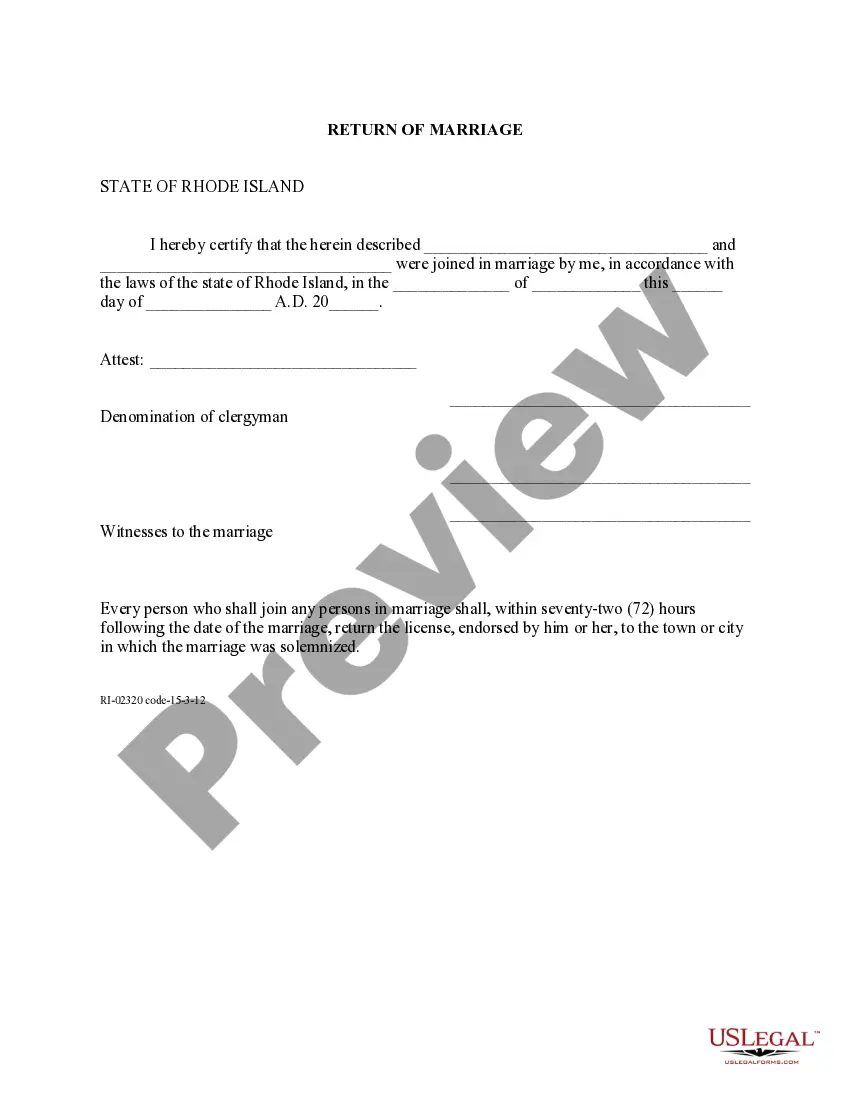

How to fill out Partnership Interest?

When it comes to drafting a legal form, it’s easier to leave it to the experts. Nevertheless, that doesn't mean you yourself can’t get a sample to utilize. That doesn't mean you yourself cannot get a sample to use, however. Download Partnership Interest right from the US Legal Forms site. It provides a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. As soon as you are registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your device.

To make things easier, we’ve incorporated an 8-step how-to guide for finding and downloading Partnership Interest fast:

- Be sure the form meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Select the appropriate subscription to suit your needs.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

When the Partnership Interest is downloaded you can fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

A transfer of partnership interest happens when a business partner relinquishes their ownership rights and responsibilities to another individual or company.

The securities laws define security to include an investment contract and general partnership interest could be considered an investment contract.

Transfer of interest or we can say ownership is possible in case of business as you can transfer your business to any other person with some legal formalities, if applicable. On the other hand, in case of profession, you can not transfer your professional certificate to someone else.

If a partner's entire interest in a partnership is liquidated or redeemed, he or she recognizes gain to the extent any money or marketable securities received exceeds his or her basis in the partnership interest immediately before the distribution ( Code Sec.

A partner's interest in a partnership is considered personal property that may be assigned to other persons. In addition, an assignment of the partner's interest does not give the assignee any right to participate in the management of the partnership.

The federal income tax rules for partnership payments to buy out an exiting partner's interest are tricky, but they also open up tax planning opportunities. Payments made by a partnership to liquidate (or buy out) an exiting partner's entire interest are covered by Section 736 of the Internal Revenue Code.

A partner can transfer his interest so as to substitute the transferee in his place as the partner, without the consent of all the other partners; a member of company cannot transfer his share to any one he likes.

The gift of a partnership interest generally does not result in the recognition of gain or loss by the donor or the donee. A gift is, however, subject to gift tax unless the gift qualifies for the annual gift tax exclusion or reduces the donor's lifetime gift tax applicable exclusion amount.