Small Business Resource Guide to Financial Opportunities with a state government is a comprehensive list of resources and financial assistance that is available to small businesses in a particular state. It includes information on grants, loan programs, tax incentives, financial counseling, and other programs and services that can help businesses succeed. The guide is designed to help businesses navigate the complexities of state finance regulations, find access to capital, and develop a successful strategy for growth. The guide may include the following types of financial assistance: grants, loans, tax incentives, economic development programs, venture capital, angel investing, and crowdfunding. The guide will provide an overview of each type of assistance, including eligibility requirements, application processes, and repayment terms. Additionally, it will provide contact information for state agencies and organizations that can provide additional assistance. The guide can also provide information about business counseling and other services offered by the state. These services can include help with business plan development, marketing, and market research. The guide can also provide links to helpful websites, free webinars, and other resources to help small business owners succeed. The Small Business Resource Guide to Financial Opportunities with a state government is an invaluable resource for small business owners looking to access capital, find assistance, and develop their business. It can provide the information they need to make informed decisions and ensure their business’s long-term success.

Small Business Resource Guide to Financial Opportunities with a state government

Description

How to fill out Small Business Resource Guide To Financial Opportunities With A State Government?

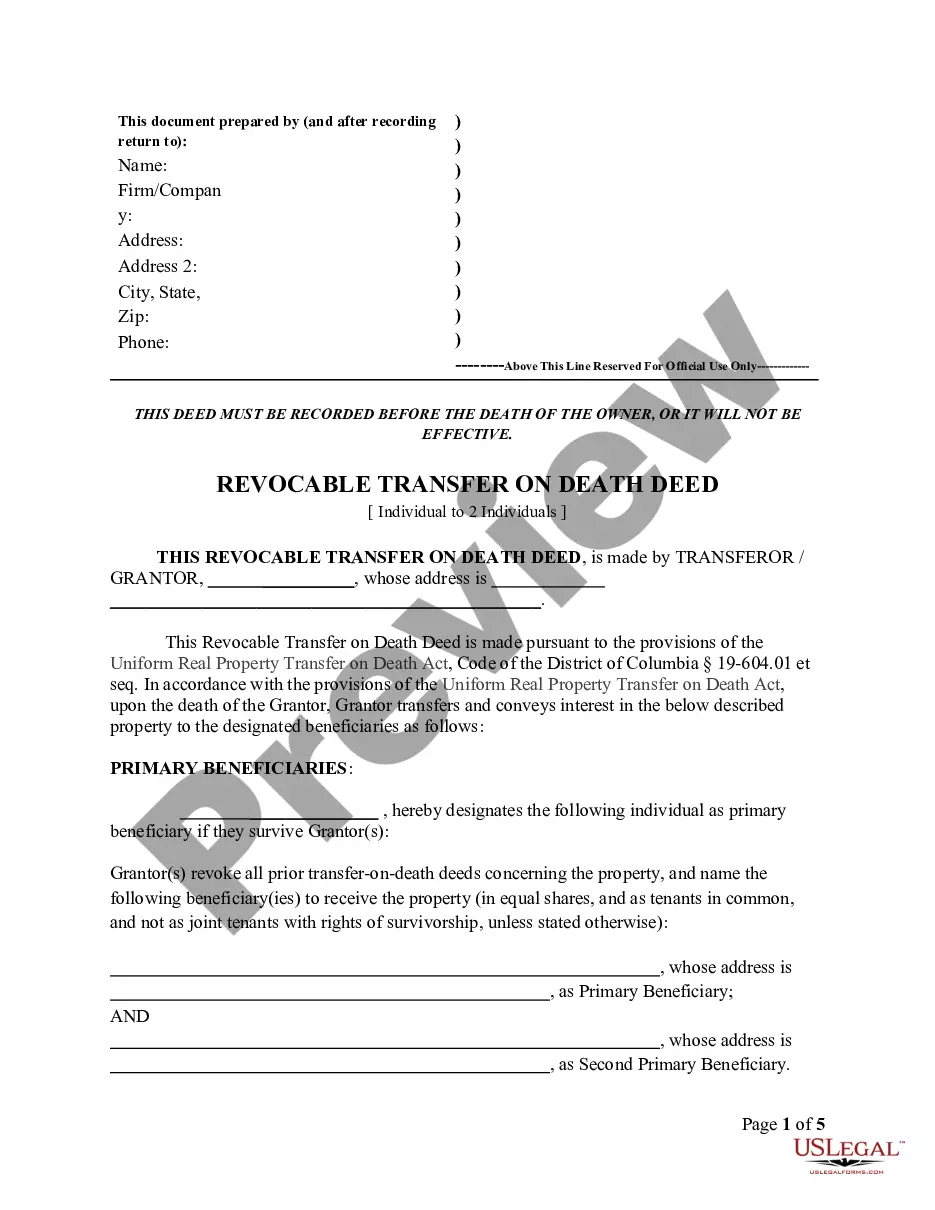

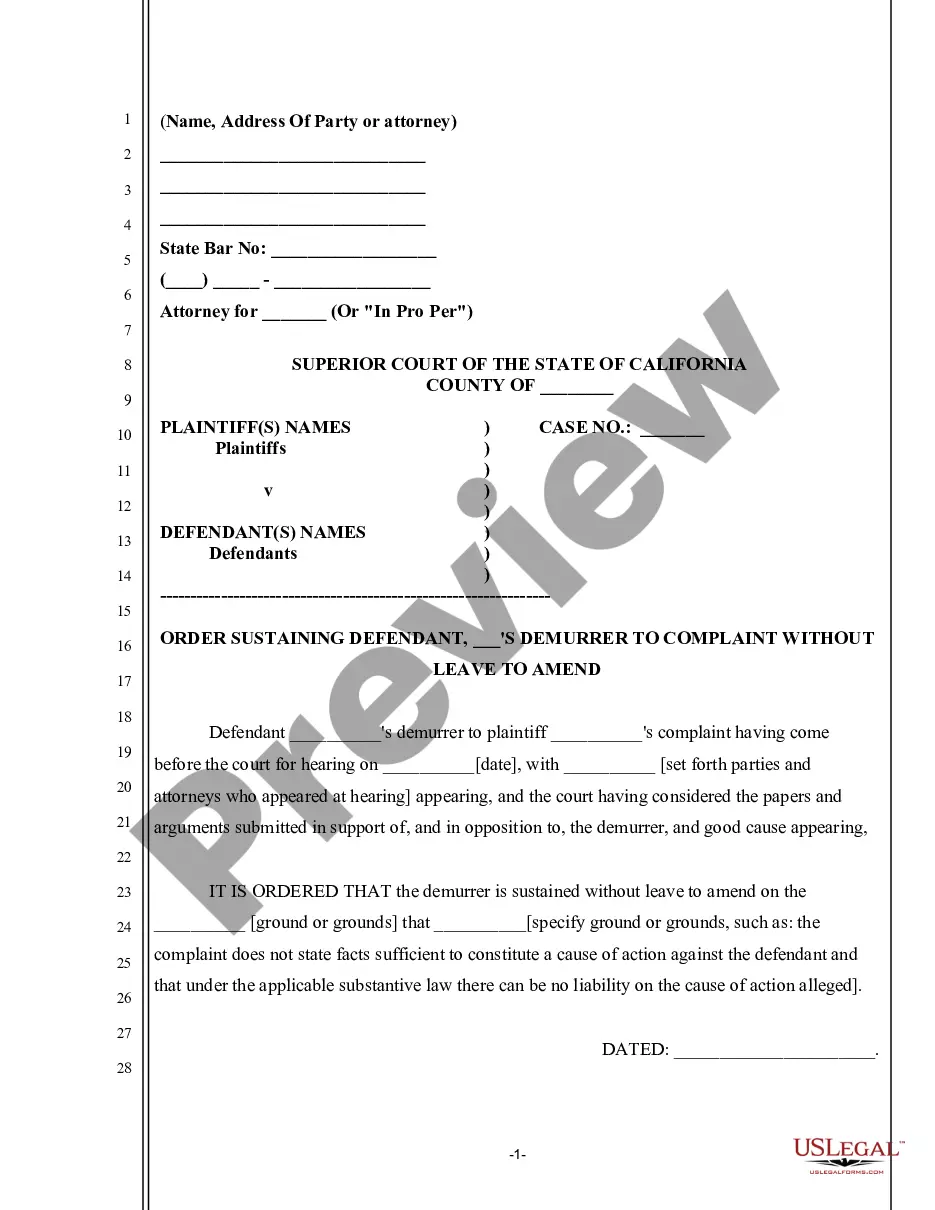

Dealing with official documentation requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Small Business Resource Guide to Financial Opportunities with a state government template from our service, you can be certain it meets federal and state laws.

Working with our service is easy and fast. To obtain the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your Small Business Resource Guide to Financial Opportunities with a state government within minutes:

- Remember to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Small Business Resource Guide to Financial Opportunities with a state government in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Small Business Resource Guide to Financial Opportunities with a state government you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

SBA was created in 1953 as an independent agency of the federal government to aid, counsel, assist and protect the interests of small business concerns; preserve free competitive enterprise; and maintain and strengthen the overall economy of our nation.

You can find small-business grants at government agencies, state organizations and private corporations. A few good places to start your search include the government database Grants.gov, your local Small Business Development Center and nonprofits such as the Local Initiatives Support Corp.

This letter is in response to your inquiry to the U.S. Small Business Administration (SBA) that your identity was used, without your knowledge or permission, to obtain a COVID-19 Economic Injury Disaster Loan (EIDL) for which you never received any of the loan proceeds.

Small business resources Pilot IRS. Pilot IRS Brochure. FinCEN Innovation Hours. Project REACh ? Information on program. Project REACh. SBA Small Business Resources. Entrepreneurial Development. SBA Capital Access.

The U.S. Small Business Administration (SBA) helps Americans start, grow, and build resilient businesses.