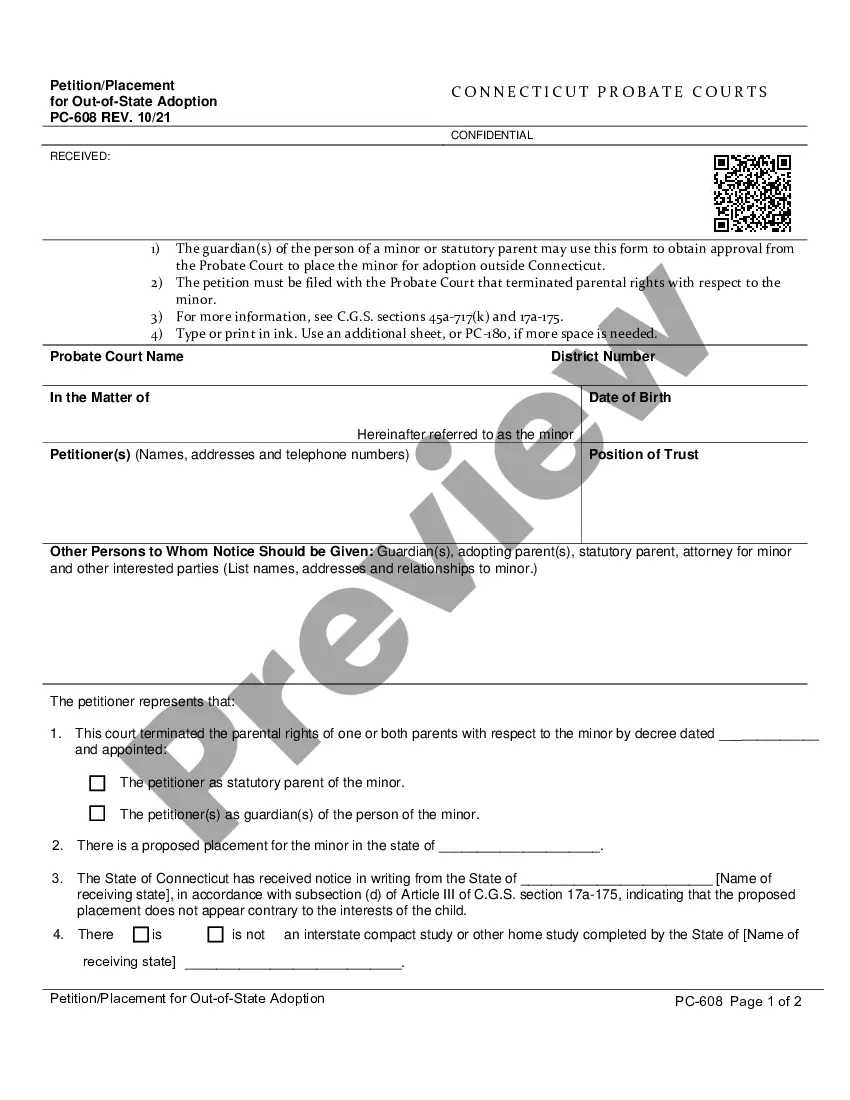

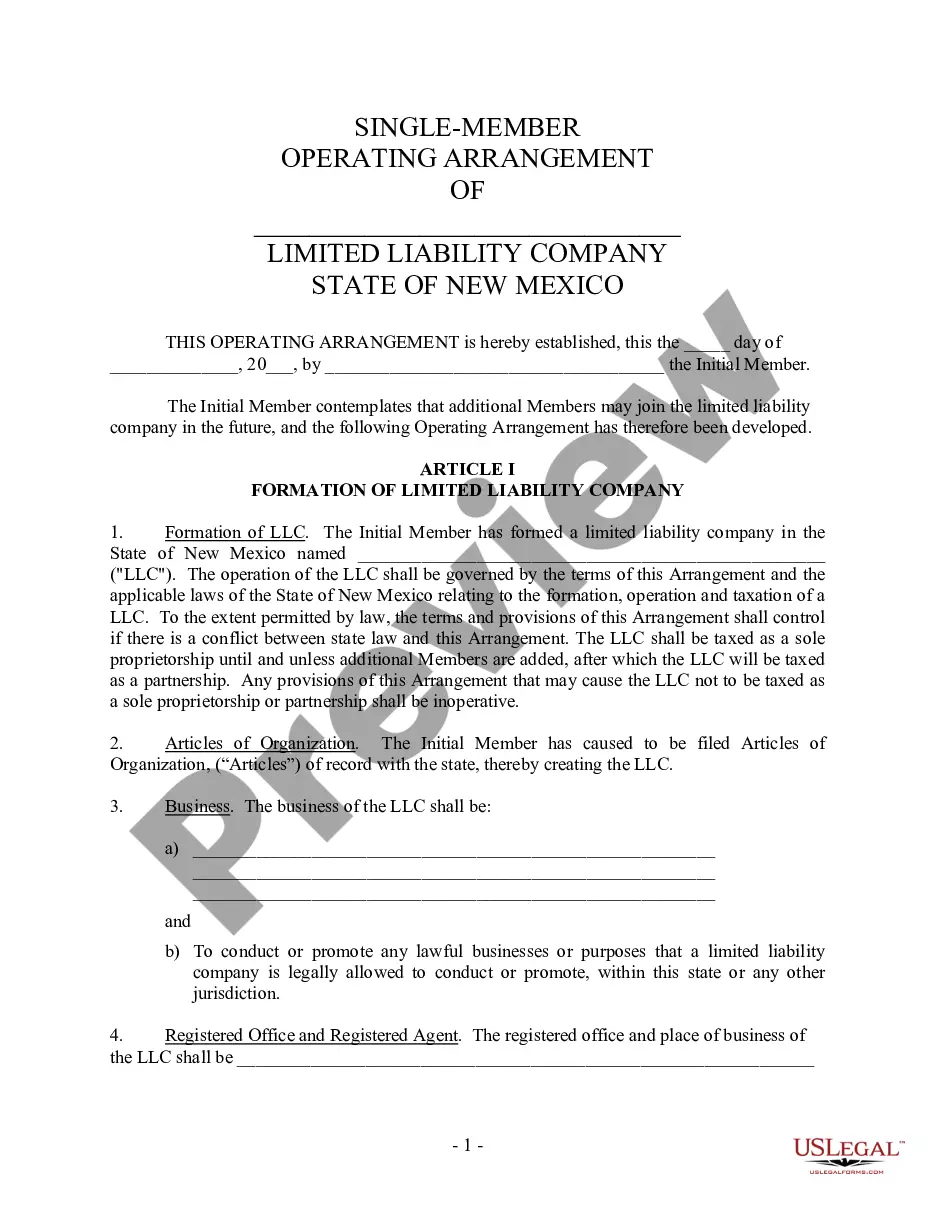

A Petition (Simplified Form) is a written document addressed to a government agency, court, or other authority, requesting a specific action. It is usually signed by many people, and is often done in order to bring attention to a particular issue or cause. There are two main types of Petition (Simplified Form): formal petitions and informal petitions. Formal petitions are often written and submitted to a court or government agency as part of a legal process. They usually have certain requirements, such as specific language and formatting, that must be followed in order to be considered valid. Informal petitions, on the other hand, are typically written and submitted to a politician or other person in a position of power in order to influence a decision. These petitions may be less formal in nature but can still be effective in advocating for a particular cause.

Petition (Simplified Form)

Description Petition Form Fill

How to fill out Petition (Simplified Form)?

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state laws and are verified by our experts. So if you need to prepare Petition (Simplified Form), our service is the perfect place to download it.

Obtaining your Petition (Simplified Form) from our library is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they locate the correct template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance check. You should attentively examine the content of the form you want and make sure whether it suits your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable template, and click Buy Now once you see the one you want.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Petition (Simplified Form) and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

To protect yourself against an unagreed assessment of tax or collection action, you should file a petition within the period set forth in the notice. You may also wish to contact the IRS about the status of your case.

If you do not come to court for the calendar call or at the date and time set for trial and you have not been otherwise excused by the Tax Court, your case may be dismissed for failure to prosecute and a decision may be entered against you.

The IRS, in turn, will have either 60 days from the date of service of your petition to file an answer to the petition, or 45 days from the date of service to file a related motion, such as a motion to dismiss. More than 98% of cases filed in the tax court end in a settlement of some sort.

IRS Form 5564 is included when the federal tax agency sends the IRS Notice CP3219A. The form is known as a Notice of Deficiency-Waiver, and it is used when the taxpayer has no objection to the IRS proposal. If the taxpayer agrees with the IRS proposal, they are required to sign the waiver and mail it to the IRS.

In deficiency cases, a petitioner may move to withdraw the petition without prejudice. If the Tax Court dismisses the case on a ground other than lack of jurisdiction, section 7459(d) requires that the Tax Court enter a decision deciding that the deficiency is the amount determined by the Secretary.

The notice of appeal must be filed with the Tax Court within 90 days after the decision is entered, or 120 days if the IRS appeals first. The cost for filing a notice of appeal depends on the Federal Circuit Court to which the appeal is being made but generally costs $500-$505.

More than 50% of all petitions filed in tax court bring some tax reduction. In cases under $50,000 (called small cases), 47% of all taxpayers win at least partial victories. In cases involving $50,000 or more (called regular cases), 60% come out ahead.

Once you receive your notice, you have 90 days (150 days if the notice is addressed to a person who is outside the country) from the date of the notice to file a petition with the Tax Court, if you want to challenge the tax we proposed.